Yesterday's signs were not activated, as there was no bearish value activity at $10,894.

The present BTC/USD Signals

Hazard 0.75% for each exchange.

Exchanges may just be taken before 5pm Tokyo time, throughout the following 24-hour duration.

Long Trade

Go long after a bullish value activity inversion on the H1 time span following the following touch of $10,481.

Place the stop misfortune 1 pip underneath the nearby swing low.

Move the stop misfortune to make back the initial investment once the exchange is $200 in benefit by cost.

Expel half of the situation as benefit when the exchange is $200 in benefit by cost and leave the rest of the situation to run.

Short Trade

Go short after a bearish value activity inversion on the H1 time period following the following touch of $11,191.

Place the stop misfortune 1 pip over the neighborhood swing high.

Move the stop misfortune to earn back the original investment once the exchange is $200 in benefit by cost.

Evacuate half of the situation as benefit when the exchange is $200 in benefit by cost and leave the rest of the situation to run.

The best technique to distinguish a great "value activity inversion" is for a hourly flame to close, for example, a stick bar, a doji, an outside or even only an overwhelming light with a higher close. You can abuse these levels or zones by watching the value activity that happens at the given levels.

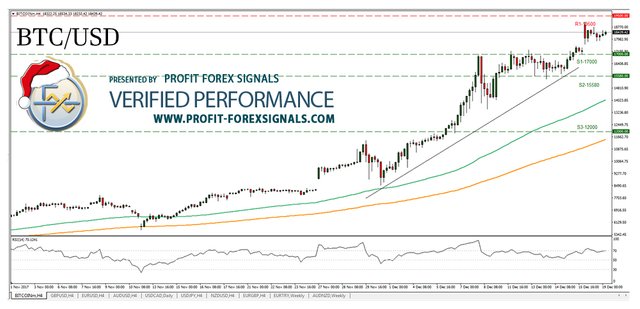

BTC/USD Analysis

Recently I took a bullish inclination because of the capable breakout from a bearish wedge design, yet I noticed a zone of protection at about $11,000 which may stop the progress. This ended up being a right approach, as the value kept on rising, discrediting the main protection level, yet turning bearish at the round number. On its way up, the cost cut out another self-evident, higher help level at $10,480 which has just been hit however may hold again for another ricochet. I am as yet bullish, given the value stays above $10,481, however I note there is currently a slipping pattern line which can associate the two swing highs which coordinates a lower drift line to frame a symmetrical bearish channel, so the cost is probably going to be inside a wide bearish channel now. A separate above $11,191 is far-fetched however would be an extremely bullish sign

Regarding the USD, there will be a release of Preliminary GDP data at 1:30pm London time, followed by Crude Oil Inventories at 3:30pm.

Hey @tuhin2017, great post! I enjoyed your content. Keep up the good work! It's always nice to see good content here on Steemit! Cheers :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wonderful btc amazing work in steemit life

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 0.39 % upvote from @booster thanks to: @tuhin2017.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit