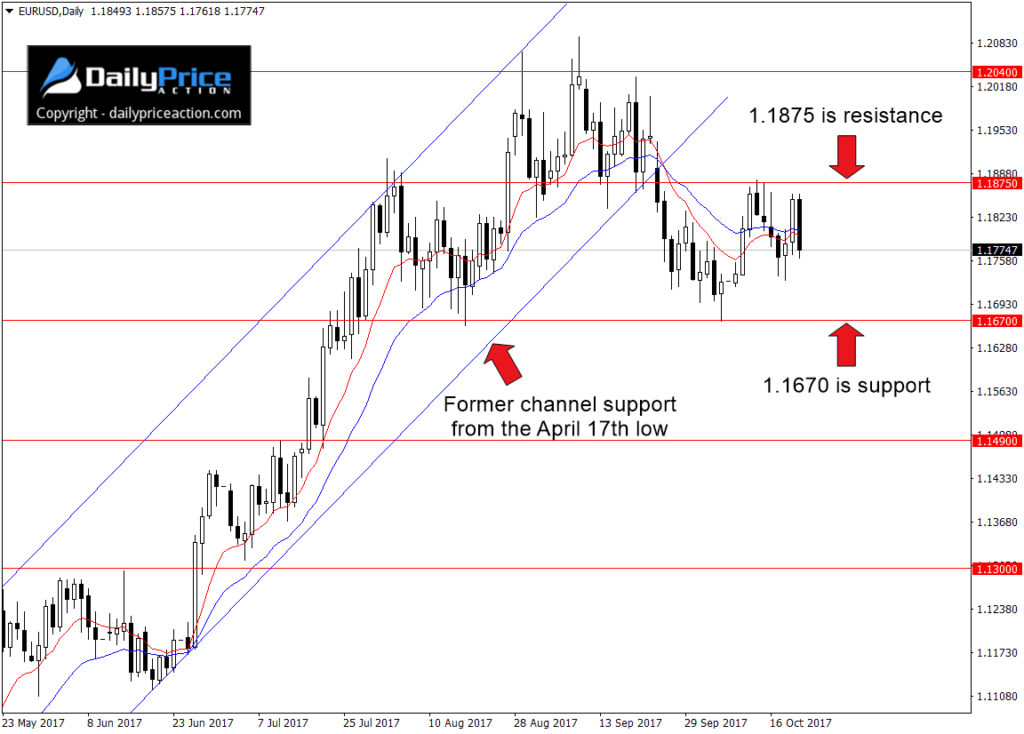

There’s no shortage of recent EURUSD commentary on this site. Just last Friday we discussed the importance of the 1.1875 resistance level. We also reviewed what could be a three-month head and shoulders pattern forming on the daily time frame.

If you missed these recent posts, I suggest you review the commentary from the 3rd of October. It sums up why I turned relatively bearish here in mid-September.

As long as 1.1875 resistance holds on a daily closing basis (5 pm EST), I will maintain a (slightly) bearish bias. Only a daily close above this level would negate the bearish outlook.

I do anticipate an influx of buying pressure if the pair moves to retest 1.1670 support. But if sellers manage a daily close below 1.1670, it would open up a whole new list of downside targets.

The first on that list is 1.1490. A close below 1.1670 would also open up the measured objective just below the 1.1300 handle. That’s a sizeable 480 pips from Friday’s close.

All of that sounds promising for bears, but keep in mind that nothing is confirmed just yet. A market is range bound until it isn’t. So until the EURUSD closes above 1.1875 or below 1.1670, I expect more range bound price action.