Intro

I just joined Steemit and despite seeing its compelling coolness had resigned myself to likely just being a commenter and curator on the platform. My days are already pretty full, being partially disabled with rheumatoid arthritis, and a mum of two who also owns a printing business ( http://www.ticketprinters.co.uk ) and with an unhealthy obsession with cryptocurrency to take care of.

But as I typed another long answer to a question asked on Facebook, whilst simultaneously knowing that my reply would be read to the end by no more than one person (at the most), it occurred to me... I already blog... I just don't get paid for it and none of the people on my friends list have any knowledge of or interest in any of the topics that interest me - economics, anti-authoritarianism in health and politics and crypto.

Where has all the money gone?

So here is my reply to my friend's question 'Where has all the money gone?' that they posted in response to this article https://www.theguardian.com/education/2017/may/23/homeless-teachers-ashamed-housing-crisis-professionals?CMP=fb_gu .

(Please feel free to comment and point out any errors. I live in the UK, so my blog post below is slanted towards UK politics as we've got a general election coming up in a couple of weeks' time.)

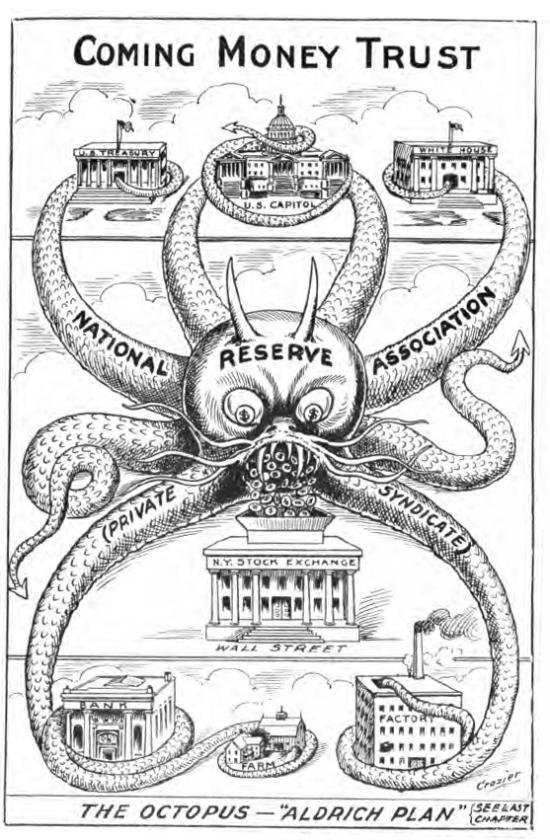

"So the problem begins with the fact that our system of money is debt based, which means that new money is created more or less entirely via the creation of loans - loans to buy houses and cars etc. When the loan is created the interest needed to pay the loan is NOT also created. Thus, our banking system (and by extension our economy) requires our debt load to grow ever bigger and bigger in order that the money supply doesn't start to shrink. A shrinking of the money supply through repayment of loans instantly reveals the bankruptcy of our banking system, because no-one will then have the money to keep paying the interest on the loans, thus rendering the loans themselves worthless liabilities instead of assets.

This is what happened in 2008. So many 'liars loans' were lent out at such a pace that people were defaulting left, right and centre, which had the effect of shrinking the money supply. When a loan is paid off (or the keys for a house handed back) the money that was created when the loan was issued is then destroyed. If this happens enough times over in quick succession it reveals the bankruptcy at the heart of the banking system. Those mortgage loans that they had on their books that gave the banks a big market cap are suddenly marked as worthless liabilities and a loss of confidence occurs. Markets begin to short the banks and share prices plummet. Everyone panics.

At this point the banks all got very self-righteous and told the governments to hand over the shortfall in mortgage payments that they had been counting on, thus keeping their balance sheet intact, or else they'd plunge the world into financial chaos. The government were backed into a corner (see the rules of Monopoly - the bank never goes bankrupt, they just create new money by writing on bits of paper).

In order to hand over this cash, the governments had to resort to QE, commonly known as money printing. This meant issuing bonds and allowing the banks to trade in the worthless mortgage debt at their full face value in return for the safest investment possible, government bonds (i.e. the promise of yours and my tax receipts for the next 10, 20 and 30 years).

In order to make sure this strategy didn't bankrupt the governments they also had to lower interest rates to near zero and keep them there...forever. Even a mild reversion to the mean, say of 4-6% interest would instantly bankrupt our governments overnight.This happened all across the world, so now all the world's governments are up to their ears in debt and no-one can tolerate a rise in interest rates without turning into Venezuela overnight.

So the net effect of zero percent interest rates and quadrupling the money supply is that there is too much money chasing the same amount of goods, so inflation begins to rise in real assets, such as houses, food, energy etc. And money has steadily lost its value at an even faster rate than it usually does. Just look at how much its value has crashed against bitcoin, for instance. It's harder to see the devaluation occurring against other countries currencies because they're all madly devaluing their currencies as well. They're more or less taking it in turns to devalue. At the moment it's the US's turn. It was us last year.

One thing governments don't tell you when they talk about paying down the deficit is that if the government in any way lowers the public debt burden, that there has to be an equal rise in the debt burden in the private sector - i.e. we have to take out more loans to prevent the banks from collapsing in on themselves. So whenever the Tories talk about austerity and reducing the deficit, what they're actually saying is that as the government owes less, the people of the UK must owe the same amount more to make up for it.

So they sell off all our income producing assets, such as the railways, energy, BT, post office, etc - all the things we've spent generations building up with our effort and taxes, and 'lower' the deficit, whilst simultaneously depriving us of those income producing assets, enriching their mates, and forcing us to take on even higher debt levels to prevent systemic collapse.

The other end product of zero percent interest rate policy is that the money is cheapest the nearer you get to the money spigot. So those in the banking sector get to borrow and use money at zero cost, whilst the further away you are from the money spigot, the higher the borrowing costs become (https://www.theguardian.com/global-development/2017/jan/16/worlds-eight-richest-people-have-same-wealth-as-poorest-50). So teachers and nurses and students still have to pay exorbitant interest rates, whilst banks pay nothing and can use money to make more money.

And at the same time, house prices continue to soar because of course it's in banks' interests to have house prices as high as possible. After all, they pay virtually nothing to create loans and then get the loans paid back with interest. And whilst interest rates are at an all time low, they need the cost of the homes to be as high as possible to maintain their margins.

Also, pensioners, and pension companies and those forced to put money into safe assets such as the bond market are getting little to no returns on their money. Yet another way in which savings are now treated as worthless. And of course the government being as desperate for money as they are after devaluing the pound and keeping interest rates artificially low for a couple of decades, would now like to claw back the increased value of your homes from the house price bubble they inflated by repossessing the equity in homes after we pass away.

So, is all this inevitable? Yes, is the short answer. In a debt based system of money this happens over and over. Countries run up the debt until they hit the buffers and then there is a currency reset. It has happened over and over in history and is happening again now, right under our noses as we speak. This time around, however, we have created a different kind of monetary system, cryptocurrency, where money is created on a mathematical schedule by various forms of work - either mining (hashing) for new coins, or in the case of a currency called Steem via creation and curation of content. A paradigm shift is in progress, and value is moving from the old system to the new. To see it happening in real time go to www.fiatleak.com. The benefits of cryptocurrency are that no government can control the issuance of this currency (so no more QE or devaluation is possible), and no government can cut off users from using this currency, thus levelling the playing field and getting rid of the notion of being unbanked. Peer to peer loans will also be possible, making the cost of borrowing more reasonable and preventing the interest apartheid situation we have currently.

My advice would be to buy a little crypto, preferably bitcoin as it's the safest option currently, and watch as all the money flows from the old financial system into the new one. The government won't tell you this is happening, but it is, and quite quickly too. Currencies tend to run into the buffers every forty years or so, and our current monetary system is way overdue a reset. Sorry that was so long, but it's complex but also terribly important."

Welcome to Steemit @spacehoppa - I'm glad to see that you've found a place where you can blog and there are readers that will appreciate your interests.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to the jungle!!! but it is a beauty and good jungle

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome! Well thought out. Followed you :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice intro!! Welcome!! Followed you!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nice post you have !

And very importent topic you chose.

Welcome to society of open minded people =]

Will follow for more !

=]

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much! I'll follow you back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

An unhealthy obsession with crypto - what can be further from the truth. If you are not obsessed with crypto then I would say you are not all there.

Welcome to Steemit and enjoy the ride. The community is great and all very helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

LOL, right on!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit. Think your going to fit in well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome on Steemit ;) Nice to have you here :) Great article! i think you are right: the debt based system is oldschool. I'm looking foreward to read more and I follow you ^^

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for the intelligent and thoughtful post. You are describing many things that I already know to be trust in a very clear and logical manner. Thanks for helping us wake up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fed is owned by a few families , their names never come on any media or news... the manuplation is decided in pvt. meeting like bilderberg. They have made us a slave, and masses are ok with it due to constant brainwashing by the media.

Cryptos and precious metals are the best investments. However iv been watching online about the total collapse of all economies since 2014, but it hasnt happened yet, almost everyday there is a new video on youtube that on this day the dollar will collapse, but never happens. we all know it will, so the best thing to do is wait and play safe and keep a close watch on whats happening geopolitacally..

By the way welcome to steemit, started following you and upvoted you.. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Veerall, I agree that the system has staggered on for longer than any of us watching thought possible.

I'm beginning to think that rather than a collapse, we're going to have a transition from the old fiat monetary system to the new cryptographic system of money instead. No doubt that will be a scary ride too and is fraught with possible unforeseen dangers, though it may look less like a collapse and more like a tsunami style shift from one paradigm to another. But who knows really. The best we can do is to protect ourselves by hedging our bets and taking a position in both systems and then hoping for the best. Thanks for the welcome and I followed you back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upped and followed 👍One of the most interesting introductions I have read. I believe in the crypto too.

Steem on!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very thoughtful and Welcome! I think a lot of us here on Steemit, including myself, know the system is broken. My only concern about crypto currencies are they they will follow the same route as Wall Street, with the Big Boys playing the market in relation to their wealth and we will end up with simply a different shadow of the old system. Somehow, I feel we need to move to a system based on each other. I know..that sounds vague and utopian, but any currency is still just a symbol whose value is obtained by general agreement. Any thoughts?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree wholeheartedly. I too worry that the banks will come in like a tidal wave and grab many of the crypto tokens and be as in control of the new system as they were of the last system. I'm hoping that the decentralised nature of the new system will itself prevent this from happening, but the future is too hard to predict right now. All I do know is that there is a huge paradigm shift happening and most of my friends on Facebook have absolutely no idea its underway and it's our job to make them at least just a little bit aware, even just to the extent that they get a little bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Paradigm Shift is right! I want to maintain my wholehearted excitement about this and not get to bogged down in how it might not work. Amazing times!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

& don't forget the "Social Engineering" post... a little too long to watch though.

"Money" & the U.S $ was meant to rob people of their wealth. What they didn't count on was getting caught holding the bag ,

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have a post on "Money" that explains it all.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @spacehoppa! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

obsessed with crypto is a good thing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to steemit!

Please pour in your comments and upvote https://steemit.com/sleep/@digitaldollar/is-it-sleep-paralysis-or-demon-attack

Follow me @digitaldollar

Upvoted and will follow you as well!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @spacehoppa! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article. I really enjoyed reading. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

woah girl. this is amazing and helpful as heck! welcome to steemit!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to steemit @spacehoppa. You will do great here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome and great post! Steemit is an amazing platform and its great to have you here! If you are ever hungry... dont go to my page! hahah :P Alla x

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit @spacehoppa!

Hope you enjoy the community and find a lot awesome stuff here!

Cheers and Steem on!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit. I'll upvote, resteem and following you. I'm sick as well and know posting such good post takes lot of energy. Congrats. Feel free to follow me if you want. In the future, I hope I'll have the energy to concentrate on a good introduction. Take care.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Aww thanks Dimtrya123. Yes, I agree when you're sick you have to choose between activities and introducing yourself on Steemit isn't necessarily high on the priority list when you're chronically fatigued. I've followed you back and will be interested to read your first post when you're well enough to write it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit. We appreciate you joining the commuter. Cheers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit Ruth! Enjoy the ride here. See you around! :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome! I wish more people would talk about money creation!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What a great introductory post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Beautiful and welcome to SteeMit...

Good luck @spacehoppa

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! I can't quite believe anyone is reading my nonsense. I am delighted :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We welcome you here warmly. ^_^

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

meep

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@spacehoppa

I appreciate your well written and articulate post about your views on economy and currency. I think you have a lot to contribute to this community in a positive way!

I welcome you to Steemit and thanks for being part of something really great!

Just followed you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the generous welcome! I'm sure I can do a lot better than this...I am new to blogging but have been keeping a video blog on youtube about health topics for about seven years now. I just need to figure out how to organise my thoughts on paper better. I am excited to be here with you all!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's awesome, @spacehoppa

I blog and vlog about health quite a bit and so I would look forward to hearing your insights and research! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fantastic, thank you! I research mostly autoimmunity, metabolism and general physiology. I'll get onto it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's terrific! Looking forward to it! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome post - welcome to Steemit. I think people are slowly waking up to the fact that the current monetary and banking system does not really make sense.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the welcome! Steemit seems like a really welcoming, lovely place with a lot of kindred spirits who have strayed off the mainstream path. I feel instantly at home here. I'll try to make subsequent posts much shorter, lol!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Lol I have been trying that since I started here but they keep getting long again!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post, welcome to Steemit! Followed

@gmuxx

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome sapcehoppa. Great article that should hopefully open a few more minds to the real world. Look forward to seeing what else you have to say in future! Thanks for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are a onderful content creator! I'm into garden seeds, silver, and cryptocurrency as alternatives to fiat currency.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I only think your analysis misses two key factors:

The significant effect of inflation and interest rate manipulation in distorting the economic signals market actors use to inform their decision-making, resulting in malinvestment and a boom/bust business cycle

The incredible economic burdens imposed by arbitrary taxation and regulation to restrict the productive economy while protecting crony corporations.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I absolutely agree @jacobtothe. Thank you for those two great additions! As a small business owner, I am competing against megacorps daily... My largest competitor is a Microsoft owned business. Competing with big money has been one of our biggest headaches these past 7 or 8 years, and here in the UK regulations come thick and fast and, as you say, serve as a barrier to entry whilst preserving non-taxing paying mulitnationals' monopoly position.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome post. Thanks a lot for joining us on steemit. I am sure you will have a great time here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. So glad to see this on steemit! Followed!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for the long intro. Please follow in kind upvoted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to the community! Follow me at https://steemit.com/@bitgeek

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome and many Steemian Blessings!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Ruth, Great article. I really enjoyed reading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Maneco! Your upvote means a lot to me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great Post..Very good points. I agree with your point of view.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to Steemit, and your article was resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Eye opening post. Thanks for sharing. Welcome new steemer.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Spacehoppa, you seem to have your finger on the pulse of the market and they're wise words my dear. Followed! ;-D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

welcome to the club and enjoy life. Here you will not only get paid for your blogs but also come across beautiful souls. Followed you. stay blessed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome, great first post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome @spacehoppa and hope to hear more from your well thought and presented articles

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted Welcome to steem looking forward on seeing you steem things up stop by my last post and help spread the steem!

https://steemit.com/life/@adriansky/blue-angels-of-san-francisco-video-and-film-series

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome post! Welcome to Steemit :)

Follow me @xredsoulless

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome I share some of those views on economy and currency. Voted and followed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Right, with the problems we had with fiat currency in the physical world, time to engage with crypto, buy it and keep it for a long time, a decade or so, and see how amazingly it could change our lives.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Totally agree. followed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow, that was your first post? Can't wait to see more from you, followed and upvoted, welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post! I'm completely agree. Welcome to Steemit @spacehoppa!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The federal reserve creates money without gold backing it.

It gives it to the bank, the bank lends it to the gov't, the gov't gives bank interest. @spacehoppa

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @spacehoppa! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit