Article By: OFIR BEIGEL

About every other Bitcoin question I get is “should I invest in cloud mining?”

I’ve talked a lot about Bitcoin investments in the past. One of the things I always tell people who ask me about cloud mining is that I think 99.99% of the companies who offer cloud mining services are probably scams.

Meaning, they don’t actually mine Bitcoins with the money you give them, they only use it to pay out other users until the owners run out of money and vanish. However there is 0.01% of companies who actually do run mining hardware and mine Bitcoins for you. Genesis Mining is one of them.

Genesis mining was founded in 2013 an is one of the oldest Bitcoin companies around. It’s definitely one of the most well known companies when it comes to cloud mining. Genesis has a publicly known mining farm set up in Iceland.

The miners on the farm are able to mine Bitcoin, Ethereum, Dash, Monero, Litecoin and Zcash. However all of the information I brought in this post up until know is somewhat general knowledge. Today I want to dig in deeper into the cloud mining business model and try to answer the question – is it profitable to cloud mine Bitcoins?

Since there are six different currencies that can be mined I want to focus only on Bitcoin cloud mining for the moment since I believe it’s the most popular product on Genesis Mining. Before I begin I just want to mention that I did a previous write up on this matter almost 2 years ago.

How does Genesis Cloud Mining work?

The idea of cloud mining is very simple. Instead of spending thousands of dollars on Bitcoin mining hardware, you can pay someone to lease their hardware and keep the profits to yourself. The company that rents out the miners takes care of the maintenance and all of the hassle of setting them up.

However, you are required to pay a fee for their service but we’ll get to that in a minute. To begin with, I wanted to determine what’s the difference in the ROI (Return Over Investment) between cloud mining and “normal” Bitcoin mining.

At the moment I have 1.19 TH/s with Genesis mining which would cost a new customer around $170 (0.139BTC at today’s exchange rate). This mining capacity generates around 0.00035BTC a day after maintenances are is removed. So at the current BTC price it will take me around 400 days to break even.

In the screenshot below you will see different BTC earnings from different contracts. It took me a while and several emails to the company’s support to understand exactly how revenues are calculated and displayed. I would appreciate it though if the fees were mentioned as well so I would be able to see how big they are in relation to the actual payouts.

The Bitcoin cloud mining contract on Genesis mining is “Open Ended” meaning it will run until it stops being profitable. If you take a look at their customer service page you find the exact definition for it:

In the event of a contract becoming unprofitable (i.e. the payout can’t cover the maintenance fee), the resulting daily payout will be zero. After that, the contract will continue to mine for 60 days. This means that we will take care of the maintenance fee in the hope that your contract becomes profitable again. This may happen if the mining network difficulty decreases and/or Bitcoin price increases. If the contract does not return to profitability in this period it will be terminated because the mining machines are consuming resources (electricity, cooling, hosting, servicing, etc.) which cannot be paid with their generated payouts.

I.E. the contract will run as long as it can cover maintenance fees which include electricity, cooling, maintenance work and hosting services. And I think this is the thing most people miss.

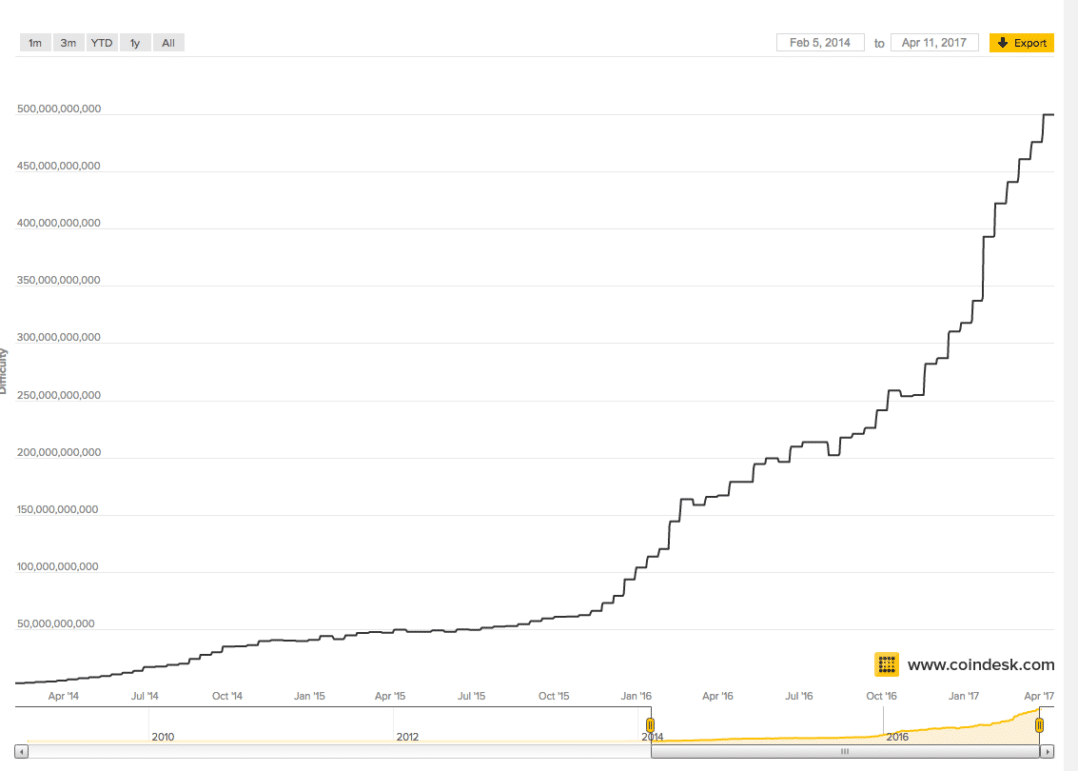

Bitcoin’s difficulty has been more than doubling itself every year for the past 3 years or so. In fact, between 2016 and 2017 it tripled. This means that if you buy a certain package expecting a certain reward, in a year or so you’ll probably be getting anywhere between 33%-50% of that reward. In my case I’ll probably be making 0.00014BTC per day a year from now.

So my previous calculation of how much time it will take to recover my initial investment is actually wrong. It would take a lot more than a year, and that’s just to break even. There’s a fair chance my contract will stop becoming profitable before I earn any profits, or that the profits I earn will be very minimal.

Of course you could say that there’s the chance that Bitcoin’s price will explode during the next couple of month and then you’ll be profitable way faster. If for example the price goes up to $10,000 I will be able to get my initial $170 in a few months right?

Not so sure about that..

If price goes up so does difficulty since more people start mining. This means that the Bitcoins you’re making will be worth more but you’ll be making less of them. That’s exactly what happened in 2016 and why the difficulty more than tripled. Here’s the change in price vs difficulty for the past 3 years:

2014-2015 Bitcoin difficulty vs. price

Bitcoin price: down 2.45x

Bitcoin difficulty: up 34x

2015-2016 Bitcoin difficulty vs. price

Bitcoin price: up 1.36x

Bitcoin difficulty: up 2.5x

2016-2017 Bitcoin difficulty vs. price

Bitcoin price: up 2.29x

Bitcoin difficulty: up 3.05x

As you can see the difficulty is always going up, no matter what’s happening with the price. And for the past 3 years it’s been going up more than what the price itself has.

So should I mine Bitcoins at home instead?

If you mine at home with the same hash rate at today’s difficulty you’d be making twice as much (according to our Bitcoin mining calculator). However, you will be paying for the hardware, cooling and maintenance for yourself. So it’s not safe to say that mining at home would be profitable as well.

In the past I’ve written a very detailed post that discusses Bitcoin mining profitability. For now let’s just say that if you don’t have any access to cheap electricity and cooling systems I suggest to avoid mining in general and just buy coins instead.

What other users are saying?

As part of my research for this review I tried to find as many user reviews as possible to get different perspectives. Most, if not all, of the positive reviews I found were accompanied by a promo code. Promo code reviews are questionable in my opinion since the user reviewing gets a commission if you sign up with his promo code, so they have an incentive to write a positive review.

One interesting review was from a guy who actually used Genesis Mining to buy Ethereum. He states as follows:

I bought a 1 year contract for 1MH/s ETH mining. I’ve paid 0.11BTC for it (equivalent of 45$ at the time). In one year, Genesis gave me back 2.38ETH (equivalent of 69$ now), so you could say that I’ve made a profit. But you would be wrong!!! That’s just because the price of ETH is high now (29$ versus 12.5$ one year ago).

If I would have kept my 0.11BTC, now it would be worth 135$.

If I would have bought ETH with the 0.11BTC back then (I would have gotten 3.66ETH, that’s 1.3ETH more than what they gave me back), now it would be worth 106$.

So even though he could have made a better deal by not investing in Genesis Mining he still made a profit. Please keep in mind that his profit was with Ethereum mining and not Bitcoin mining. In this post I concentrate mostly on Bitcoin mining. Some other altcoins may still be profitable to mine, but I will review them in a different post.

There are also several BitcoinTalk posts about the company. It seems that most people claim that you can’t make a profit with their contracts however few supply evidence of actually trying. Bittrust shows some positive reviews but I will let you judge for yourselves on their legitimacy.

Genesis Mining – The bottom line

Finishing up my review about Genesis Mining all I can say is this – The company seems legit but I doubt if it’s a good investment. Seems like I would be much better off just using my money to buy Bitcoins instead of using it for cloud mining contracts. If Bitcoin’s price goes up – I would be making more money, and if it went down, I would be losing less.

The one thing that really bothered me though is that Genesis Mining doesn’t seem to share a lot of info regarding my mining performance. I’d except a company that is serious about making money for their investors to supply additional information such as:

Cloud mining calculators

Service fee statements

Which blocks were mined and how much was earned on each block (including mining fees)

One might suspect that these pieces of information aren’t supplied in order to keep the questionable profitability of cloud mining obscure. If you are invested in Genesis Mining I urge you to contact their support and try to get answers for this (they answer fast from my experience).

On a final note, this review is about Genesis Mining but I think you can probably copy and paste its characteristics to most legit cloud mining companies out there. The not so legit mining companies will probably show greater profits because they usually hold stop paying at some point.

Keep in mind that this review was made especially for mining Bitcoins, other currencies may still be profitable in these cloud mining schemes.

Article By OFIR BEIGEL

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://99bitcoins.com/genesis-cloud-mining-review-scam-legit-investment/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit