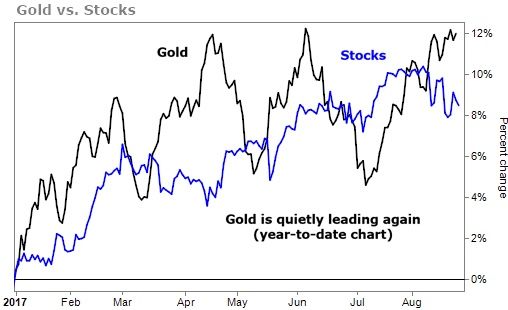

Gold is on pace to beat the S&P 500 for the first time in years. Gold made news last week as it had a significant breakout over the psychological resistance level of $1300/ounce. Overall, gold is quietly having a great year. As you can see below, it's on pace to beat the broad market for the first time in six years.

Gold is up 12.4%, compared with just 9.2% in the S&P 500. The last time gold beat out the S&P 500 was during the last great gold bull market in 2011. But what's interesting is that gold isn't just beating stocks this year...

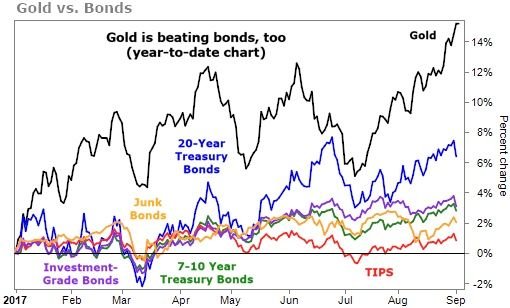

The yellow metal is also beating out bonds. Not just one particular corner of the bond market... VIRTUALLY ALL OF THEM!

Gold is beating investment-grade corporate bonds, high-yield junk corporate bonds, long-term Treasury bonds, 10-year Treasury notes, and even Treasury Inflation-Protected Securities aka "TIPS".

This also hasn't happened since gold's last bull market ended 6 years ago. This is undoubtedly a bullish sign for the precious metal. Gold's recent outperformance compared to long-term Treasury bonds should have investors taking note. Since the start of 2017, the U.S. dollar index has been in a straight uninterrupted downtrend. The recent geopolitical tensions have also not caused investors to rush back into the greenback. It's often accepted that on a general basis, the U.S. dollar and gold go in opposite directions. After a tumultuous six years, this data implies that gold is finally reclaiming its status as a "safe haven" asset once again.

Congratulations @daytrader96! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit