.jpeg)

Over the last year, the performance of gold has been lackluster to say the best. This has led many investors to be exasperated and just be fed up and throw into the well. It's also led many financial pundits to be able to run victory laps and declare that gold is dead, especially in light of what the regular equity markets have just done over the last year and especially assets like bitcoin have done over the last couple of years, just these massive mind blowing returns. So today we're not going to look at sentiment, we're not going to look at opinions, we're just going to look at some numbers so that we can answer the question, is gold dead? Ready, let's dive in.

In today's day and age, it is becoming increasingly difficult to accurately categorize gold because with most assets you're either expecting how your are going to make money or you're going to lose money. This is true if you're selecting stocks, this is also definitive true if you are holding on to dollars because you're virtually guaranteed to lose purchasing power over time, and these two dynamics have led a lot of people to invest in highly speculative highly volatile assets like bitcoin that have had mind boggling returns over the last couple of years. So where does gold land in this mess, increasingly, especially over the last year, many have been placing in the camp of fear, just slowly lose money over time. The problem is, public perception, doesn't exactly line up with hard data

let's look at some numbers, both long term and short term to show that gold is still doing its job and that job by the way, is savings.

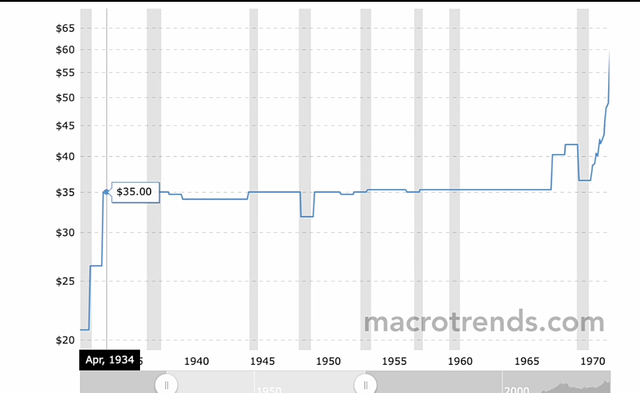

- So first, let's look at Gold versus the dollar.

Gold carry the legal price of $35 an ounce from 1934 all the way through 1971 When Nixon closed the gold window, and the free market was able to determine the price of gold once again, as of today, the gold price is $1,760 per ounce, this is a total return of 4,900% over those last 50 years. So over the last 50 years gold has outperformed the dollar by 4,900%. Pretty good start but you will see nobody over that time frame, especially is comparing gold to the dollar seriously in saying that it would have been better to hold dollars that whole time, what they're really looking at is something probably like the s&p 500 which is an asset that makes you money over time. Right, well okay, over that same period of time the last 50 years.

- Let's compare gold to the s&p 500.

if you would have had the choice to invest in the s&p 500 or in gold. Many people would tell you that you would have been far better off by investing in the s&p 500 than gold. let's look at the last 20 years.

.jpeg)

Gold has had a total return of 560% since then. And would you look at that, this is over, double the return of the s&p 500 over the same period of time, which is 265% Total Return since then. So is this still cherry picking? Yes, of course it is.

So let's look at another date, let's look at the last three years and see how they've compared

Gold has returned a total of 48% versus the s&p 500, total of 55% So is this still cherry picking? Yes, it is, but it shatters the perception that gold is dead, that gold is a shiny pet rock that does nothing goes nowhere has no place in a portfolio, especially in light of the dogmatic religion of index investing, we are not even saying gold is an investment, it's not it's money, they're different, but if you can find periods of time both long term and short term20 years, or in 3 years, where money severely outperforms or matches the return of something that's supposed to be the best investment ever, you've got a problem. What this really means is that inflation numbers are probably understated and that most returns that we're seeing in the stock market are simply inflation. Now this also means that stocks are in decent inflation edge because they've kept up on pace with gold, so you've preserved your purchasing power, but they've done just about as good as gold over the long term. It also means, it hasn't made you rich, you've maintained your purchasing power, which is also great

- Now instead of comparing gold which is money against a popular investing vehicle, an asset like the stock market, let's compare it against inflation to see how well it's done his job over the years.

.png)

so how much purchasing power has the dollar lost over the last three years, well obviously depends on who you ask, And we are using the last three years specifically because most people agree that gold has held up pretty well

if you look at 20 years or 50 years it's had some fantastic returns, most people even acknowledge that gold holds up for inflation, if you look back 1000s of years, because you can look at things that aren't affected by technology, like the wages for rotten army captain, are the same as wage for Roman centurion, when you measure it in gold and something like a custom three piece suit would cost you the same today in gold as it did a couple 100 years ago in gold so things that are not affected by technology, typically will cost the same over time. When priced in gold, but especially recently, in light of the emergence of cryptocurrencies especially Bitcoin, and the alleged manipulation in the gold and precious metal markets like especially silver as well. Lots of allegations of manipulation there. Many are saying it's not even worth it because it can't keep up and do its job, just look at inflation.

So we're going to look at three different measures of inflation.

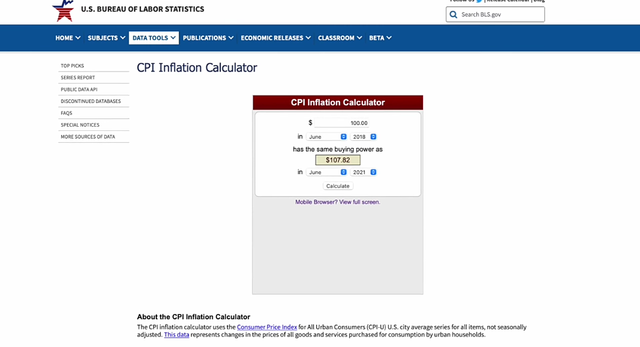

The first one is obviously we got to look at the official numbers, if you go to the BLS the Bureau of Labor Statistics official website

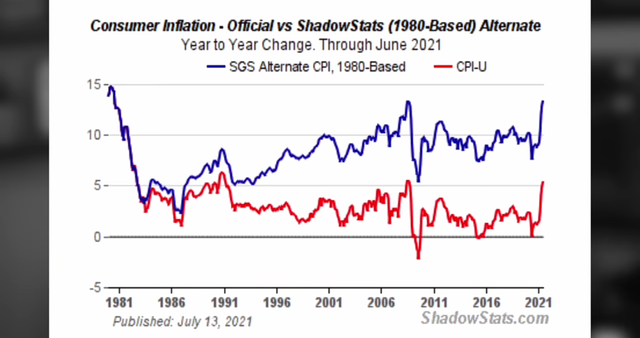

you can see what they report for the CPI, and you can see that for the last three years the reporting of the cumulative inflation has been 7.82%, cumulative for all three years, if you look at private statistics on the opposite end of the extreme the highest estimation, You see that the last three years is approximately 39%.

From shadow stats in this use the same metrics that were officially used in the 1980s before there are a bunch of slimy changes made to how inflation was measured now these are likely two extremes that are both almost certainly incorrect at the far end of the extremes 7.2% cumulative inflation over the last three years versus 39% cumulative inflation over the last three years, likely, the truth is somewhere in between, and, as pointed out by Linode and this is partly because there's kind of a cap on what inflation can be and that cap is going to be the broad money supply growth.

%20-%202021-09-29T200137.666.jpeg)

HOW HAS GOLD HELD UP AGAINST INFLATION

How has it held up as a store of value because remember gold is savings, the point of gold is to make sure that you can still buy the same amount of things regardless of how much time goes on, regardless of whether there's inflation or deflation, it's a store of value, it's a savings vehicle that's its gold at its point, that's why you would buy it so if gold has held its own against inflation, it would need if the official numbers are true, we need to ever turn at least 8% cumulatively, over the last three years, and if the worst estimates of inflation are true, we need to return 39% Over the last three years, and do you remember what gold has returned over the last three years. That's right 45% So, even if the highest possible inflation numbers from private estimates are true. Gold has still done its job, despite the last year of the price drifting downward, and this is why it's important to remember that the point of savings is to retain your purchasing power, if everything doubles in price, this is inflation, golden follow up, but if the stock market drops by 50% and real estate drops by 50% and you wake up tomorrow and Gold is trading at $900 An ounce. Did gold do its job?

Yes, because it's there to make sure you can still buy the same amount of stuff, savings doesn't make you rich savings retains your purchasing power, real savings provides you with a some that you can use to make a purchase, regardless of inflation or deflation. Now contrast this with fiat, which actively dwindles in purchasing power over time, when you have inflation which we always do, and if there's ever deflation you'd get a spike in purchasing power, this is not a store of value theory isn't savings, it's much closer to a speculation, when you look at how it responds how your purchasing power responds to what goes on in the markets, now there's still room for some in a portfolio that is not a store of value and either is Bitcoin, yet there's still room for Bitcoin in a portfolio but gold is still the pristine savings vehicle, it's still a functioning store of value, so just like Mark Twain, the report of gold's debt has been greatly exaggerated.

And finally, if you'd like to buy gold and you just have no idea where to get started, I'll be enlightening you on the best and most comfortable way to purchase gold.

Introducing to you, the Digital gold Platform

This platform provides you a tokenized form of gold. A GOLD TOKEN backed up by 100% physical gold.

%20-%202021-09-29T194927.379.jpeg)

No extra expenses, no storage fee, no personal details required, you can even buy as low as 0.1grams of gold.

Most investors would say that physical gold is the the best form of gold to Invest in. How about a cryptocurrency backed up by 100% pure physical gold - just like the time of the gold standard, only that this time the gold is not stored in the federal reserve of the united States but in a heavily fortified secure vault in Singapore, BULLION STAR VAULT.

This cryptocurrency currency is known as GOLD TOKEN created by the digital gold platform. This is the easiest way to invest in Gold. Check out the token here https://gold.storage

.jpeg)

THE DIGITAL GOLD PLATFORM

The aim of the Digital Gold project is to is to tokenize and digitize physical gold asset exploring the amazing features of the blockchain technology. Thus, allowing people to easily purchase physical gold with the digital Gold token.

The Digital Gold platform give clients the opportunity to diversify their portfolios in a safe state since cryptocurrency price is volatile in the market.

The Digital Gold coin offers an even more comprehensive solution. This token not only provides all the advantages of stablecoins, but also earns you an additional profit, since it constantly grows in value relative to all fiat-pegged stablecoins. This happens since the GOLD token is pegged to gold, and the price of gold relative to fiat currencies continuously increases

MARKET PLACE FOR DIGITAL GOLD COIN

The Digital Gold Platform creates this marketplace for an easy, effective and efficient purchase of Gold with the Digital Gold token

Here is the link to the Digital Gold marketplace: https://gold.storage/market

For more information, visit the below links

Exchange: https://cryptex.net/trade/GOLDUSD

Website: https://gold.storage/

Facebook: https://facebook.com/golderc20

Twitter: https://twitter.com/gold_erc20/

Telegram: https://t.me/digitalgoldcoin

Medium: https://medium.com/@digitalgoldcoin

Reddit: https://www.reddit.com/r/golderc20/

Whitepapper: https://gold.storage/wp.pdf

ANN: https://bitcointalk.org/index.php?topic=5161544.0

Bounty: https://bitcointalk.org/index.php?topic=5164058.0

MY PROFILE

BITCOINTALK UNSERNAME: LEON331300

BITCOINTALK URL: https://bitcointalk.org/index.php?action=profile;u=2215507;sa=summary

Eth Address:0x601D68c1800384C799E8Ac55f4F57Acf93C3fAAF

Telegram: @Leon3313000

I followed and up votes you. please up votes back https://steemit.com/scorpionfinance/@huanmv/scorpion-finance-one-stop-solution-for-portfolio-and-nft-tracker-swapping-gaming-and-the-payment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit