Gold is already in a bull market, but it is well below its historical averages.

Since currencies became irredeemable for a fixed gold amount in 1971, gold’s free market price has risen from $35 then to $1,300 today. In this current boom cycle, we’re notching up 23%, from $1,053 to today’s $1,295.

But, to me, the price of gold is only the starter, not the main course. In this cycle, within two years or less, Portfolio Wealth Global forecasts $1,704 per ounce and roughly $32 silver, but this is peanuts compared with the mining shares expected performance.

In my investing career, I’ve yet to experience such a disparity between gold and the underlying junior mining stocks.

The reason for this anomaly is the outstanding performance of the S&P 500, for when it comes to corporate profits – why would a fund manager buy Barrick Gold when he can buy Google?

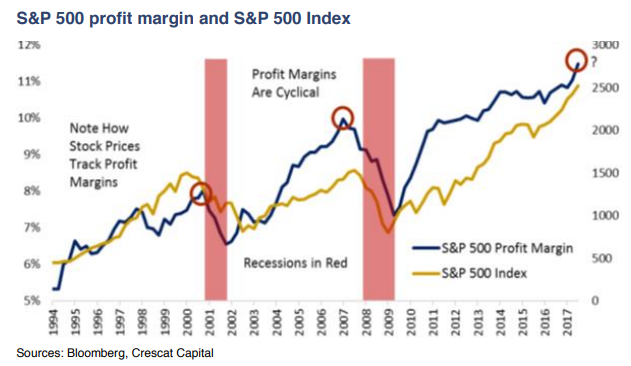

That is true until it isn’t… Take a look:

Courtesy: Incrementum AG

When I began investing in the late 1990s, the most celebrated fund manager was Peter Lynch, who managed to book a 29.7% annual return for 13 consecutive years.

No one has eclipsed that track record until today. Peter’s main philosophy was that profits matter most in the long-term, and as you can see, they do.

Now that the conventional market is topping in profit margins, the commodities sector, with its various problems and challenges, which have caused it to drop so bad that it looks like the reputation of Bernie Madoff’s fund, will now stage a major comeback.

Gold prices are already ticking up and what has kept the mining shares from joining them is the fact that money could be made with better businesses that are less cyclical and less unpredictable.

Those days are coming to an end, though – profit margins are peaking, if not today, then in a few months, and if the market continues higher despite this fact, it means it’s a bubble, and there is no reason that mining shares won’t join that type of “everything bubble.” Put differently, whether the market goes up or down from now, once profits flatten out, mining shares will become the better choice.

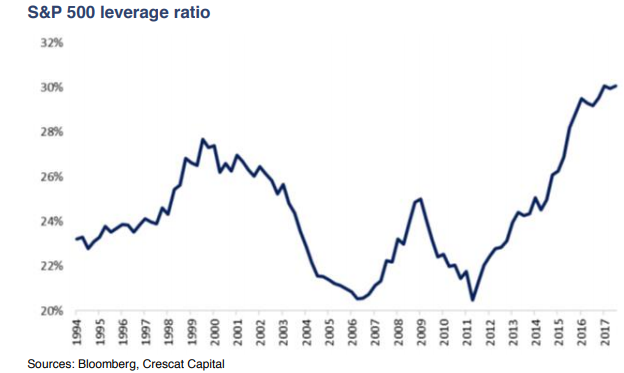

Courtesy: Incrementum AG

It’s not only profit margins that are set to peak; the leverage ratio has never been this high.

As interest rates stabilize with additional hikes, CEOs will buy back fewer shares, profit margins will come down, and common sense will prevail.

The only tech sector, which will be on the rise, along with mining and cannabis, will be Artificial Intelligence, as we see it.

It’s simple – profits have reached their cyclical top, making other industries more likely to grow, going forward.

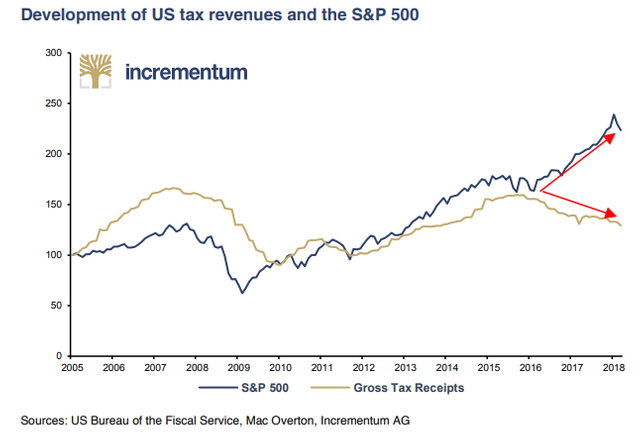

Courtesy: Incrementum AG

As tax revenues depart from the performance of the S&P 500, as the chart clearly shows, deficits will increase, causing inflation to become a burning issue.

The lows for the mining shares are in – any sell-off from here is considered the last shakeout.

If you can tolerate those final hiccups, you’ve set yourself up for some wild gains.

Someone's sitting in the shade today because someone planted a tree a long time ago.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.portfoliowealthglobal.com/gold-1704-rally-the-troops/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @portfolioglobal! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @portfolioglobal! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit