Telegram’s Gram is the most anticipated coin. Numerous exchanges and crypto shops are trying to catch the hype and offer their clients so-called Gram futures. Buying unhedged futures is very risky. Why so? There are three reasons for that.

1. You may never get your profits or money back.

Let’s draw a simple example.

A futures contract is a legal agreement to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future.

Investopedia.

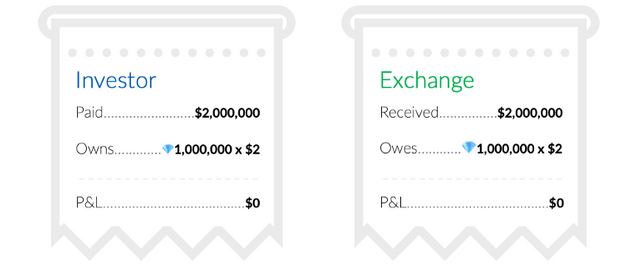

Assume that an exchange sells 1 million contracts at $2 per Gram:

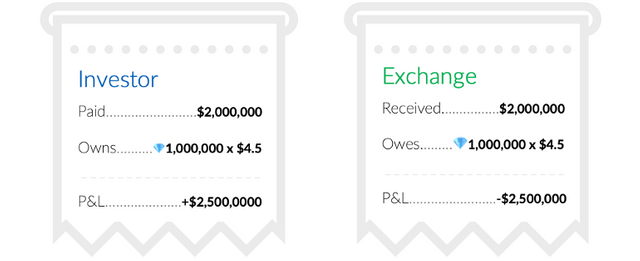

Upon the launch of TON and the actual trading of real Grams, the true price of Grams will be determined. If the price hits $4.5 per Gram, investors would see paper profits. Yet it is an open question whether investors would be able to cash out:

For the investors to see their profits, the exchange would have to find somewhere 1 mln of Grams, now worth $4,500,000. If these futures are backed by real Grams, there is no issue. Still, it’s a known fact that original investors in TON are prohibited from selling their stakes before the TON goes live.

This means, that the majority of the exchanges are selling naked futures and will have to buy Grams in the open market to pay the investors. In this case, exchanges are at a loss and have to find the money elsewhere. In our view, taking the credit risk of the exchange is too risky.

If the fact that you may never see the profits from the questionable deal is not convincing, here is a couple of additional issues with Gram futures.

2. The transaction might be illegal.

Futures are considered to be financial instruments in most jurisdictions. Given the fact that the majority of shops selling and trading the futures are not regulated, this may raise issues with the regulators. This problem is even more important for those exchanges who sell the futures to the US investors in a clear violation of SEC rulings.

Should there be probes from the regulators, this could result in a run on the exchange with a detrimental effect on the price of the exchange-listed futures.

3. The price might be artificial.

Trading on these exchanges usually has a very low volume. Low depth of the market means that the price might be manipulated even by relatively small orders. This could also result in extraordinary price behavior like in the screenshot below. The price increased 4-fold and plummeted as low as $0.12 in a short period amid near-zero trading:

Another interesting pattern is the stickiness of price to $2. It’s worth noting that in June and July all trading activity evaporated completely.

Given the fact that all futures are not tokens and could not be transferred to another exchange, there is no way for the arbitrageurs to profit on price discrepancies.

Conclusion

Indeed, Gram is going to make a big bang when TON goes live. It might be compelling to get exposure to Grams rather sooner than later, but it’s not worth the risk. The potential risks to investors are as follows:

- No backing by real Grams;

- No compliance with regulations;

- No liquidity.

As a result, investors at best may not see their profits or lose all the money in the worst-case scenario. Patience pays off. Stay tuned for the news and wait for real Grams to be listed on trustworthy exchanges.

Original - https://news.blackmooncrypto.com/dont-buy-grams-before-ton-goes-live-f912f9d92367

Source

Copying/Pasting full or partial texts without adding anything original is frowned upon by the community. Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.blackmooncrypto.com/dont-buy-grams-before-ton-goes-live-f912f9d92367

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit