Reading back on my previous blog, I mentioned that most cryptocurrencies are in their introduction phases. When cryptocyrrencies reach their growth phase, they will encounter a new set of problems that they are currently not experiencing soo far. Two of these problems I will list below.

Market stability

Possibly the hardest one, since this requires the market itself with the help of the company that controls the cryptocurrency. Currently, a few things are going on in the crypto-world. Currencies are trying to find ways to solve the problems that they were intended for (Haran 2017). For example Reddcoin for social media and Wagerr for betting, are being used to solve the problems within their respective industries. However, these coins are not necessarily now used for their intended purposes, but used by short term investors (hence the extreme price fluctuation every ~4 days average).

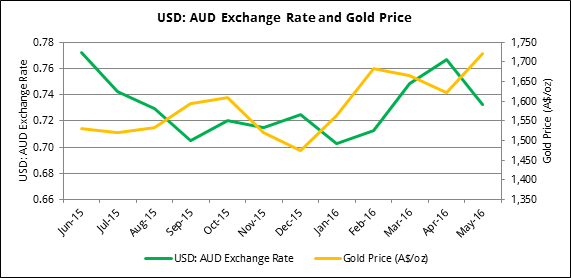

What needs to happen, is for these currencies to have a reliable price range, at least, over a one year range for people to trust it. If businesses used cryptocurrencies now, it would wreak havoc with their pricing and costs, where purchasing stock may be worth one value one day, and half that value in four days. For example, the USD/AUD exchange rate can be trusted and reliable. Even though there are movements, shown in Figure 1, these movements are not substantial (refer to the Y-axis). If a buyer and seller needs to buy or sell a good or service to someone else across these currencies, they can be sure that the price would remain around a certain level,a d would not be a certain value one day, and double that value a week after.

Figure 1

Source: goldendragoncapital.com, n.d..

Secondly, to prevent the large fluctuation from occurring, there needs to be some control over the cryptocurrency (Haran 2017). The control would have to act similar to the central bank, by stopping inflation and deflation of the currency in order to make the currency workable for businesses. This would involve a lot of trust from the business community towards companies that manage these currencies such as Ripple. All these currencies need to be controlled adequately for people to trust them as, at best, an income stream.

Security of funds

One of the major issues with a cryptocurrency like Bitcoin is if payment is made to a wrong address, those coins could be lost forever. Similarly, if coins are stored on cold storage, then if that storage device is lost, destroyed or damage, an individual may never get their currency back.

No company or person, in my opinion, would outright use a cryptocurrency if there was not some safety net in an event of a hack or destruction of funds. People trust fiat currencies such as the AUD or EURO because there is guaranteed protection from the institutions that manage them.

For example, compare Ether and Bitcoin. In 2016, an Ether account was hacked that had around $60 million worth of Ether stolen (Hayes 2016). This transaction was able to be reversed by setting back the system to a day before the hack, and the original owners were able to retrieve their Ether back with help of Ethereum (Ore 2016). Compare that to another event in 2016, where $72M bitcoin was hacked from a Hong Kong exchange. Given there is no one who controls bitcoin, unless the perpetrators are caught, those investors will never get their money back.

This highlights a difficult dilemma with those who are wanting to invest into cryptocurrencies. Unless people want to support a fully decentralized currency where the only thing stopping a hacker and bitcoin is the person who owns the bitcoin, I believe most people, for mainstream adoption to work, will want some overarching security for their funds. The same type of security that will protect them if their funds are stolen from their bank account. This is why people will always trust fiat currencies, as they are backed up by government institutions and laws that try to protect the currency.

Have a nice day

Sources

Goldendragoncapital n.d., 'Figure 5 - USD AUD Exchange Rate and Gold Price', Goldendragoncapital, accessed 18 June 2017, http://www.goldendragoncapital.com/figure-5-usd-aud-exchange-rate-and-gold-price/

Haran, N 2017, 'What's keeping cryptocurrencies from mass adoption?', techcrunch, retrieved 18 June 2017, https://techcrunch.com/2017/04/20/whats-keeping-cryptocurrencies-from-mass-adoption/

Hayes, A 2016, DAO Hacker Donates Stolen Funds to Ethereum Classic Dev Team, Investopedia, retrieved 18 June 2017, http://www.investopedia.com/news/dao-hacker-donates-stolen-funds-ethereum-classic-dev-team/

Ore, J 2016, 'How $64M hack changed the fate of Ethereum', CBC, retrieved 18 June 2017, http://www.cbc.ca/news/technology/ethereum-hack-blockchain-fork-bitcoin-1.3719009

I agree with your view on this - there will need to be more security in order for mainstream adoption to occur. It will be interesting to see how this is achieved - some form of underwriter may come in to play - or maybe some new concept not yet thought of at this stage.

Followed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you :) I agree it will be interesting it see what happens. However, this something that needs to be solved before the mainstream moms and dad will ever touch it or trust it with their life savings.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit