Unlocking the Potential of Real Asset Tokenisation

In the ever-evolving landscape of investment, the tokenisation of real-world assets (RWAs) stands as a beacon of innovation and opportunity. From gold to real estate, the concept of digitising tangible assets on the blockchain is gaining traction, offering investors newfound liquidity, accessibility, and flexibility. Let's delve into the key findings from the webpage and explore the burgeoning realm of Real Asset Tokenisation (RWA).

Real Asset (RWA) Relevance: Opening Doors to New Opportunities

Tokenisation of RWAs is revolutionising the investment landscape, rendering previously illiquid assets more accessible to a broader range of investors. Traditionally, investing in assets like real estate or commodities required significant capital and often involved complex processes. However, with the advent of blockchain technology, these barriers are being dismantled. The tokenisation of RWAs increases their liquidity, availability, and flexibility, making them more attractive investment options.

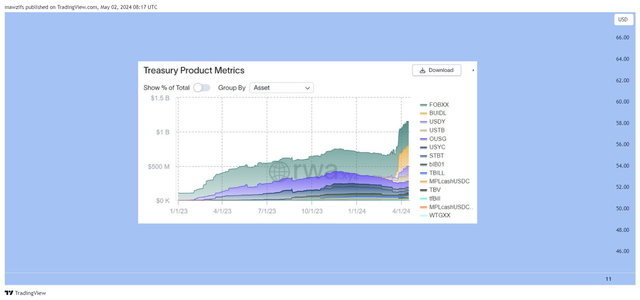

Growth in the Overall Value of RWAs: A Testament to Rising Interest

Despite market fluctuations, the total value locked in various RWA protocols has witnessed a significant uptick. This surge underscores the growing interest and confidence in the potential of tokenised assets. As more investors recognise the benefits of RWA tokenisation, the market continues to expand, offering a diverse array of investment opportunities.

BlackRock Enters RWA: Pioneering the Future of Asset Management

BlackRock, the world's largest asset manager, made waves by announcing the tokenisation of its staggering $10 trillion in assets. This landmark move signals a paradigm shift in traditional asset management and underscores the transformative power of RWA tokenisation. As industry giants like BlackRock embrace this technology, it paves the way for widespread adoption and integration across diverse sectors.

RWA Subcategories: Exploring the Diverse Landscape

Within the RWA sector, numerous subcategories offer distinct avenues for investment and innovation. From DeFi to real estate tokenisation networks, each subcategory plays a crucial role in shaping the future of asset tokenisation. Let's delve into some of the key subcategories and their significance:

DeFi RWA: Bridging Traditional and Decentralised Finance

DeFi RWA aims to bridge the gap between traditional finance and decentralised finance by leveraging blockchain solutions for real estate, securities, agriculture, and financial services. This convergence of traditional and innovative finance holds immense potential for disrupting established norms and unlocking new opportunities for investors.

Onchain RWA Treasury: Enhancing Liquidity and Accessibility

Onchain RWA Treasury facilitates the tokenisation and management of real assets on the blockchain, enhancing their liquidity, fractionalisation, and availability. By digitising tangible assets, Onchain RWA Treasury opens doors to a global network of investors, transforming how assets are traded and managed.

RWA Tokenisation Process: From Concept to Reality

The RWA tokenisation process involves three fundamental steps: off-net formalisation, blockchain compatibility, and decentralised management. This streamlined process ensures the seamless transition of tangible assets onto the blockchain, unlocking their full potential for investors worldwide.

Benefits of RWA Tokenisation: Transforming the Investment Landscape

RWA tokenisation offers a myriad of benefits that transcend traditional investment paradigms. By digitising real-world assets, tokenisation broadens the investment landscape, lowers barriers to entry, increases transparency, accessibility, and efficiency. Let's explore some of the key advantages:

- Increased Liquidity: Tokenisation enhances the liquidity of traditionally illiquid assets, enabling investors to buy, sell, and trade with ease.

- Enhanced Accessibility: By fractionalising assets, tokenisation allows investors to access high-value assets with smaller capital contributions.

- Greater Transparency: Blockchain technology ensures transparency and immutability, providing investors with real-time insights into asset ownership and transactions.

- Efficiency and Security: The decentralised nature of blockchain platforms enhances security and efficiency, mitigating risks associated with centralised systems.

RWA Tokenisation Networks: Powering the Future of Asset Management

RWA tokenisation networks serve as the backbone of asset tokenisation, providing platforms for creating, trading, and managing tokenised assets. These networks offer increased liquidity, availability, transparency, and security, revolutionising how assets are managed and exchanged.

Examples of RWA Tokenisation Networks: Leading the Charge

MANTRA, Polymesh, and Ondo stand out as leading players in the RWA sector, offering unique asset tokenisation solutions. These platforms leverage cutting-edge technology to streamline the tokenisation process and empower investors with unparalleled opportunities.

AI in RWAs: Driving Efficiency and Security

Artificial Intelligence (AI) plays a pivotal role in enhancing the efficiency and security of RWA platforms. By leveraging AI-driven algorithms, these platforms can automate processes, detect anomalies, and mitigate risks, making them more attractive to investors.

Future of the RWA Sector: A Glimpse into Tomorrow's Investments

The RWA sector is poised for exponential growth, with the potential to become a cornerstone of the broader cryptocurrency ecosystem. As blockchain technology continues to evolve and mature, RWA tokenisation will unlock new investment opportunities, bridging the gap between traditional finance and the decentralised world of cryptocurrencies.

Conclusion: Embracing the Future of Finance

In conclusion, Real Asset Tokenisation represents a paradigm shift in the world of finance, offering unprecedented opportunities for investors. From increased liquidity to enhanced transparency, the benefits of RWA tokenisation are manifold. As the sector continues to evolve and expand, embracing innovation and leveraging technology will be key to unlocking its full potential.