Use DSLA to hedge against Uniswap Rug Pulls

Dear DSLA champions and cryptocurrency community, the DSLA core development team is proud to announce that we will be adding AMM Pool Ownership Agreements to DSLA Protocol’s list available DSLA contract types! 🎉

Pool Ownership Agreements are a new type of DSLA contracts that enables core development teams to build trust with their community by provably enforcing timely liquidity ownership requirements for their Uniswap pool, and being held accountable when they don’t meet these requirements.

Until now, core development teams were resorting to liquidity lock mechanisms to achieve a similar goal of being perceived as worthy of their community’s trust.

But at a time where Ethereum’s dominance as the most attractive EVM-compatible blockchain network is being challenged, we strongly believe that locking your Uniswap liquidity would be a strategic mistake.

With this addition, DSLA Protocol is poised to become a better way for core development teams to reduce their holders exposure to rug pulls without limiting their migration options and agility on the super hot cryptocurrency market.

DEX and Risk: What are Rug Pulls?

A rug pull is an infamously common type of Uniswap scam that consists in:

When liquidity is removed after an explosive rally of the token, the scammer’s share of the Uniswap liquidity pool is worth much more ETH than it was before.

DSLA Protocol fixes this

By signing a DSLA contract, a core development team and their asset holders agree on sanctioning unhealthy liquidity management practices, and on rewarding good practices, for a set period of time.

To activate an agreement, both parties need to put money when their mouth is, by staking DSLA, USDC or DAI to the DSLA contract liquidity pool.

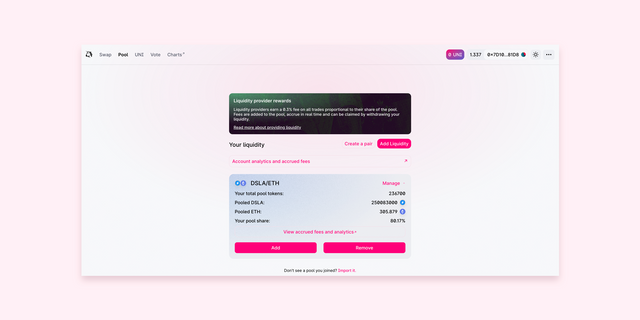

When a AMM Pool Ownership Agreement is active, DSLA Protocol monitors the core development team’s share of the Uniswap pool.

If their share stays within the thresholds of the agreement, core development teams earn the right to claim a reward, by depleting the coverage stake of asset holders.

Conversely, whenever an agreement is violated, asset holders earn the right to claim a compensation, by depleting the upfront commitment of the team.

Our share of the Uniswap DSLA/ETH pool is sitting at ~80%, at the time of writing.

Join the conversation on Telegram!

About DSLA Protocol

DSLA Protocol is a risk management framework that enables infrastructure operators and developers to reduce their users exposure to service delays, interruptions and financial losses, using self-executing service level agreements and bonus-malus insurance policies.

Its flagship use case is to offset the financial losses of proof-of-stake delegators and DeFi users, while incentivizing the good performance and reliability of staking pool operators and DeFi service providers such as Uniswap (AMM) and OpenSea (NFT).

To learn more about DSLA Protocol, please visit stacktical.com, browse our official blog, and follow @stacktical on Twitter.