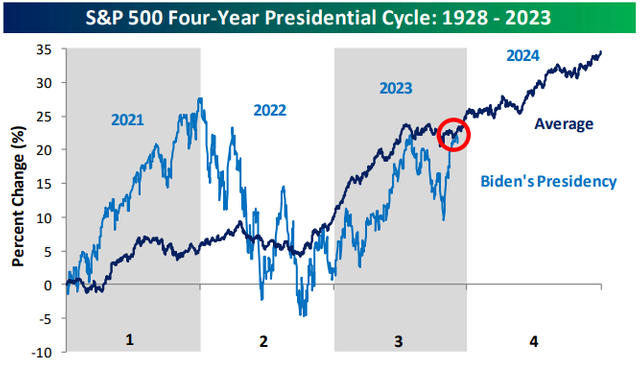

The average performance of the last year in the 4y presidential cycle is bullish. However, it's less bullisher than the 3rd year. When it comes to this quant investment idea, this year would be bullish.

As you know, spot BTC(Bitcoin) ETF(Exchange-Traded Fund)s were approved few days ago. So, the BTC price will be affected by the 🇺🇸 stock markets, which means it's gonna be coupling with the 🇺🇸 stock markets.

The 🇺🇸 labor market is still strong. And, the CPI(Consumer Price Index) recently increased. But, it's not much a risky level yet. So, I'd say the next recession is likely not coming this year. Therefore, this year, the 🇺🇸 stock indicies would break the 2021's ATH(All Time High). Dow Jones index already broke it. But, S&P 500 is about to break it, and NASDAQ is still floundering.

After breaking 2021's ATH, the BTC price will follow the trend. I expect that the BTC price will break 2021's ATH the end of this year.

This comment is for rewarding my analysis activities. Upvoting will be proceeded by @h4lab

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow nice post.. i love bitcoin 🤝🤝

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

说得好

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit