Hello friends and readers, welcome to my blog once again and I am so glad to have you here. I attended the Steemit Crypto Academy lecture presented by professor @reminiscence01 and it was really enlightening and educating so I have decided to attempt the homework task given in order to test my knowledge of the class. I hope I am able to do justice to the assignment.

Introduction

Before I begin answering the first question, I will like to give a little insight into what a chart is.

A trading chart is a graph depicting the price movement of an asset in form of line, bar, Japanese candlestick, lines and figures, and so on. Financial traders make use of charts a lot, they use charts to study the movement of prices, it is through the proper understanding of financial charts that traders are able to identify a possible move in the price of financial assets such as stocks, bonds, options, commodities, forex, and cryptocurrencies.

Now that we have an idea of what a chart is, I will like to move ahead to answering the first question.

Explain the Japanese Candlestick Chart (Chart screenshot required).

The development of the Japanese Candlestick dates far back to the 17th century by a Japanese Rice trader whose name is Munehisa Homma, he came about this the Japanese Candlestick when he discovered that the price of rice in the market was a complete effect on the emotional behavior of traders so he came up with an idea to use candlesticks as a form of representation that displayed the pattern with which the price of rice was moving at the time.

Since he was able to understand financial terms, he was able to dominate the rice market and he became highly renowned for the discovery of the Candlestick method of the chart. The Japanese stock market started in the 1870s and a local technical analyst decided to incorporate Munehisa’s Candlestick idea into the process of trading. The idea of Japanese Candlestick was also presented to the western world when Steve Nison wrote extensively about it in a book he titled ‘’Japanese Candlestick Charting Technique’’ and this financial technique is now widely used in various financial sectors to understand the market.

The Japanese Candlestick is widely acceptable in the financial market because it clearly displays the movement of price, it shows the highs and lows in the market for a given period. The Candlestick chart can as well be used to analyze if there is going to be a bull or a bear market.

Explaining the Features of the Japanese Candlestick.

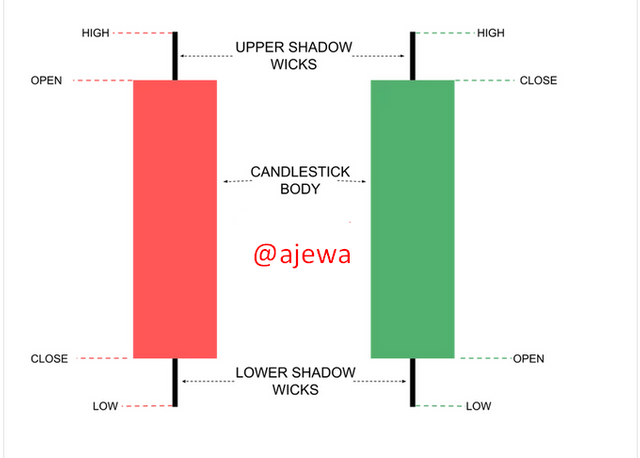

A Japanese Candlestick consists of;

- Opening price

- Highest point reached.

- Lowest point reached.

- Closing price.

- Shadow/Wick

The colors of the candlestick are usually red and green. The green color represents the bullish market where there is more demand in the market and the price increases, while the red color signifies the bearish market, with more selling pressure. The longer the length of the candlestick (i.e) the distance between the high and the low, the wider the price range of that session will be. The tiny line above, below, or on both ends of the candlestick is known as Wick/Shadow.

When there is a long train of higher highs and higher lows, it is an uptrend and the candlestick for the buying process are green candles, it signifies that there is pressure from buyers to continue to have a price increase while the long train of red candles signifies that there is a lot of selling action going on in the market.

The shadow and the real body are also parts of a candlestick which signifies the movement in price but no closed deal. The wick of the candlestick is used to identify the rate of the volatility of the market, if there is a low wick it indicates a low volatile market and if the wick is high, it indicates a highly volatile market. There are basically three types of candlestick patterns and they are: Single, Double, and Triple.

Describe any other two types of charts (Screenshot required).

Line Charts.

Line charts show the historical price of assets, the graph of a line chart displays various time frame and the time frame can be adjusted according to the displayed preference of the trader which could either be according to minutes, hours, days, weeks, months or even years depending on the display preference of the trader.

Line charts can also be viewed as either a linear chart or a logarithmic chart. A linear chart can be used to identify how fast price changes while a logarithmic chart, on the other hand, can be used to identify how easy it is to identify a trend. Line charts are actually very simple but contain less information, plotting on a line graph is very easy as it entails the mere display of a straight line from one point to another.

Bar chart.

A bar chart also known as OHLC charts (open-high-low-close charts) displays more details compared with the line chart, it also comes with a friendly and easily understandable interface. A bar chart displays to traders the point of support/resistance, it also helps traders understand better when to enter and when to exit the market. The bars are displayed in either a green or red color, the red color signifies when the market is oversold and the green bar signifies when the market is overbought. The bar charts are plotted on a graph where the open, close, high, and low prices of an asset is indicated in a bar.

In your own words, explain why the Japanese Candlestick chart is mostly used by traders.

Every trader likes a point of convenience, they want a chart that displays a wide range of information in just one simple glance and that is the option that the Japanese Candlestick chart offers above other trading charts. Placing great focus on the open and close options and providing a complete overview of price, trend, and other things just by a quick glance. I see no reason why anyone would not find it as a great option to use. Candlestick chart provides the details of multiple data into one single price bar. Once the chart of a Candlestick is complete, it is easy for the prediction of price to occur.

Candlestick charts have proven to be a long-time historical trading instrument that can be used to predict the direction of the market correctly. The Japanese candlestick also shows traders the possibility of the market giving a market reversal, displaying the price of the market in a specific and easily understandable manner.

With the reasons stated above, we can come to a conclusion that the Japanese Candlestick Chart offers a wide range of information and good trading options and for these reasons, traders definitely find it as a better option for chart studying.

Benefits of a Japanese Candlestick Charts.

By simply understanding the shape and color of the candlestick, it is very easy for traders to realize if the displayed chart signifies a bullish or a bearish trend.

Easy to understand and comprehend on a first look while giving a better chance to give efficient analysis.

The Japanese candlestick chart shows not only trends, but also helps in showing the forces underpinning the move.

With a simple glance at the candlestick, traders can easily view the length of the candlestick and then have an understanding of if the market is getting towards a bullish or a bearish direction.

The Japanese Candlestick Chart also has a special feature of displaying a reversal pattern of a specific bullish or bearish trend which cannot be easily found through other charts.

Describe a bullish candle and a bearish candle identifying its anatomy? (Screenshot is required).

Bullish Candle.

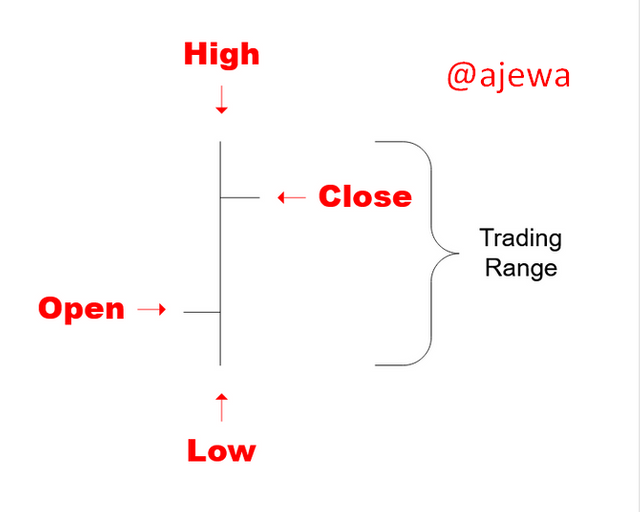

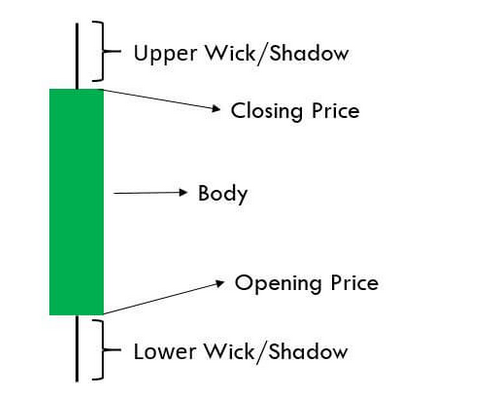

A bullish candle is found whenever there is an increase in the price of an asset, this occurs whenever the market closes higher than its point of opening. A bullish trend is said to occur whenever there is a continual increase in the price of an asset and the candlestick that represents this usually has four sections which are:

source

- Open: This shows the first price or the entry price of an asset within a specific time frame and in this case of a bullish candlestick, it will be found at the bottom of the candlestick.

- Close: This shows the final price of an asset within a particular set time frame and it can be found at the top of the bullish candlestick.

- High: This shows the highest point of a transaction within a particular time frame.

- Low: This shows the lowest point of a transaction within a given time frame.

Bearish Candle.

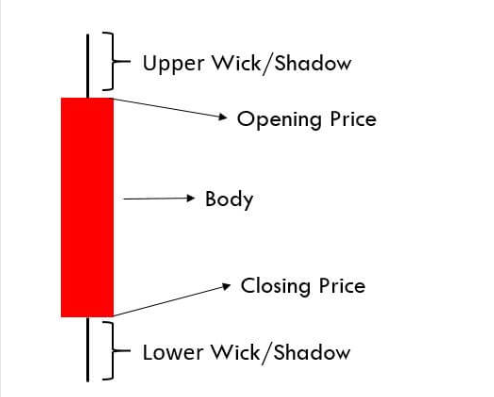

A bearish candle is seen whenever there is a reduction in the price of an asset, this occurs whenever the market closes lower than its opening point. A bearish trend is said to occur whenever there is a continual decrease in the price of an asset and the candlestick that represents this usually has four sections.

sourrce

Open: This indicates the entry price or first price of an asset within a particular set time frame and in this case it will be found at the top of the bearish candlestick.

Close: This indicates the closing or final price of an asset within a particular set time frame and in this case, it can be found at the bottom of the bearish candlestick.

High: This indicates the highest transaction point of an asset within a particular time frame.

Low: This indicates the lowest point of an asset within a particular time frame.

Conclusion.

This is definitely an extensive study in the world of charts and every trader needs to gain adequate knowledge in the world of charts in order to have a smooth trading experience. Personally, I will conclude that the Japanese Candlestick chart offers a wide range of advantages over other charts and it provides good and extensive information about the market, no doubt it is one of the most used trading charts available.

I appreciate the entire Steemit body in charge of this academy for providing us with the opportunity of expanding our crypto knowledge again this session and I greatly appreciate professor @reminiscence01 for the class and task. Thank you for reading.

Hello @ajewa, I’m glad you participated in the 2nd week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit