INTRODUCTION

Crypto trading is very easy with the help of numerous tools, charts( like candlestick), as well as indicators. All these mentioned are the basic things used when performing technical analysis of any given coins. However, one of the basic thing traders needs to ride on the market is to predict and identify trends.

Therefore, ADX is one of the possible indicator that helps traders to detect the strength of a trend since trading in a market direction of strong trend results to maximize profits, as such minimize losses.

What is the ADX indicator?

Generally, the main focus of every crypto trader is to identify trends most especially where the market direction shows a strong trend, and to detect trend reversal (market reversal). And in the crypto ecosystem, we have hundreds of indicators, but one of which a trader can use to identify the strength of trends is known as the ADX indicator.

The ADX is among the numerous indicators that enable crypto traders to measure the strength of market trends, which was created by Welles Wilder and he realized this dream in the year 1978 which was later elevated by several technical analysts to know the strength of market trends of crypto assets.

However, it is very relevant to understand the full meaning of ADX. So let's check it out.

Full Meaning of ADX

✓ ADX = Average Directional Index.

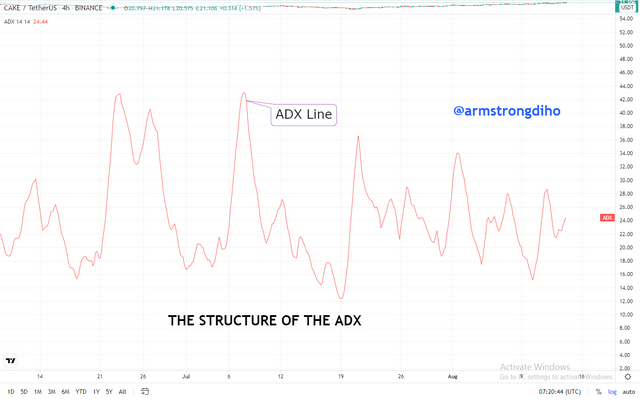

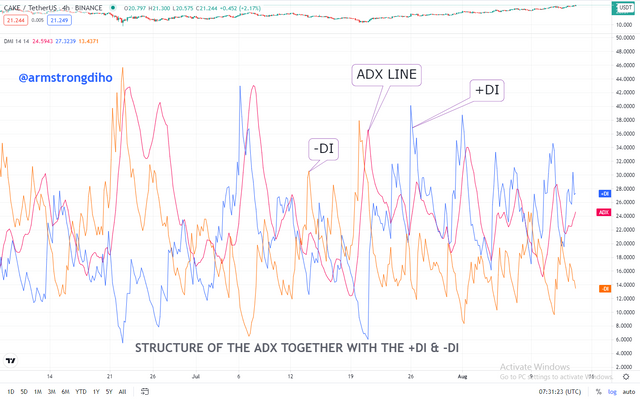

Basically, we have three types of market trends which are uptrend, downtrend, and neutral trend, and we can use the ADX to identify all these trends since the ADX is characterized by a major lines called the ADX line also in conjunction with the two minor accompanying lines called negative (-DI) and the positive (+DI).

Furthermore, these three separate lines; ADX line, positive (+DI), and negative (-DI) are the lines that pass the message to the trader on when to place an entry (buy or sell) on an asset at any given timeframe and in most case when not to enter the trade at all. Hence, once the trader understands and interpret these lines, instantly, they ride on the market.

Once the trader measures the strength of the market trend at any given timeframe, the trader instantly rides in the market. With this effect, we can say that the ADX is an important oscillator that shows the strength of the trends, and can be useful to determine the market if it's experiencing a strong or weak trend, though it depends on the ADX values that are high ADX value signifies strong trend and low ADX value signifies weak trend.

Moreover, the ADX line should be plotted with values of 0 to 100. As such, the positive (+DI), and negative (-DI) which are the two-directional indicators (DMI) lines are plotted together with the major ADX line in the same sequence to obtain a better result. It very necessary to note that the ADX majorly shows the strength of a market trend be it uptrend or downtrend, and doesn't rely on the direction which is why some literature refers to it as non-directional.

The market trend is said to be strong when ADX reading is above 25, while the market trend experience weak or trendless when the ADX reading is below 25.

| ADX Reading | Strength Of Market Trends |

|---|---|

| The range of 0 and 25 | indicates Weak or Trendless |

| The range of 25 and 50 | indicates Strong Trend |

| The range of 50 and 75 | indicates Very Strong Trend |

| The range of 75 and 100 | indicates Extremely Strong Trend |

So from the table, it is observed that obtaining profitable results requires the trader to understand and interpret the ADX lines in conjunction with the positive (+DI) and negative (-DI) directional indicator since they shows when there is trend or not.

CALCULATION OF THE ADX INDICATOR

To calculate the ADX indicator is a bit complex but has a perfect way to obtain it which I will present below.

To calculate ADX, it requires the user to calculate for the DIs which is the positive (+DI) and negative (-DI) first in order to achieve a better result. Let's check it

Obtain the inform on the swing highs and lows of each period and the closing information of each period.

To calculate the positive (+DI) is by taking the Current high - previous high.

- DI= CURRENT HIGH - PREVIOUS HIGH

Perphas, the negative (-DI) is by taking the current low - previous low.

- DI = PREVIOUS LOW - CURRENT LOW

CALCULATE TRUE RANGE (TR):

Obtaining the true range gives you a better advantage to calculate the ADX indicator so let's check out how to obtain the true range.

We can obtain the true range of a crypto asset, by

✓calculating the Current high minus Current low

✓Current high minus Previous close

✓Previous close minus Current low.

where,

TR = True Range

A = Current high minus Current low

B = current high - price of the day

C = Previous close - Current low.

The equation below will clarify us better.

TR = [ (ABC)]

The highest number among in these data serves a the true range

Now, to get the positive (+DI) is by dividing it with the TR of any selected given periods

(+DI)/ True range

To get the negative (-DI) by dividing it with the TR of any selected given periods

(-DM))/True range

Now, to get the ADX which is the basic one we needed. I will be using 7 periods to demonstrate this from here.

D7=100 * [(+DI 7) - (-DI 7)) / ((+DI 7) + (-DI 7)]

Now, to get ADX we take the average of D7

ADX 7= Sum of n [((DI +) - (DI-)) / ((DI +) + (DI-))] / n

This is not only the means to get the ADX , other way is by using EMA

The formula is ready and we need to use some values to input into the formula for proper clarification.

Suppose we have 52 as the Current high of a crypto asset, and 30 for the Current low. Also from the chart, we have observed that the market price of that given timeframe is at the rate of 50. From the previous high and low, we have 46 a d 42 respectively and the previous close is around 38.

Soln

current high =52

current low=42

price of the day=50

previous high=46

previous low =42

Previous close-38

- DI= CURRENT HIGH - PREVIOUS HIGH

+DI = 52 - 46 = 6

- DI = PREVIOUS LOW - CURRENT LOW

-DI = 42 - 30 = 12

Therefore, we have

+DI = 6

-DI = 12

TRUE RANGE

Recall,

A = Current high - Current low

B = B = current high - price of the day

C = Current low - Previous close

The equation below will clarify us better.

TR = [ (ABC)]

A. B. C.

TR = (52 - 42), (52 - 50), (42 - 38) = 10, 2, 4

Now we got 10, 2, 4

Frome these values, 10 is the TR since it's the value with the highest number and from figure 10 is the highest.

TRUE RANGE =7(HIGHEST VALUE FROM ABOVE)

current high =52

current low=42

price of the day=50

previous high=46

previous low =42

Previous close-38

Recall,

+DI = 6

++-DI = 12

(+DI)/ True range= 6/10 = 0.6

(-DI)/ True range= 12/10 = 2.1

D7=100 * [(+DI 7 ) - (-DI 7)) / ((+DI 7) + (-DI 7)]

D7=100 * [(0.6 ) - (2.1 )) / ((0.6 ) + (2.1)]=100

Finally, The ADX is obtained by checking out 3 periods. That's we already have 100, so I'm going to add another two which is 50 and 49.

ADX=Sum of n [((DI +) - (DI-)) / ((DI +) +

Where, n= number of the periods. Which is 3

(DI-))] / n=(100+50+30)/3=180/3= 60

Therefore, the ADX is 60 which signifies very strong trend.

How to add ADX, DI+ and DI- on the chart

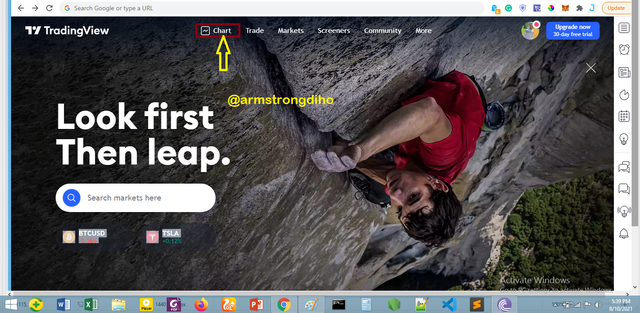

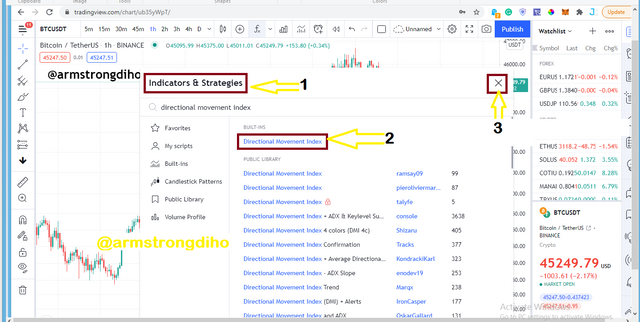

Visit the website https://.tradingview.com/

On the landing page, click on "Chart"

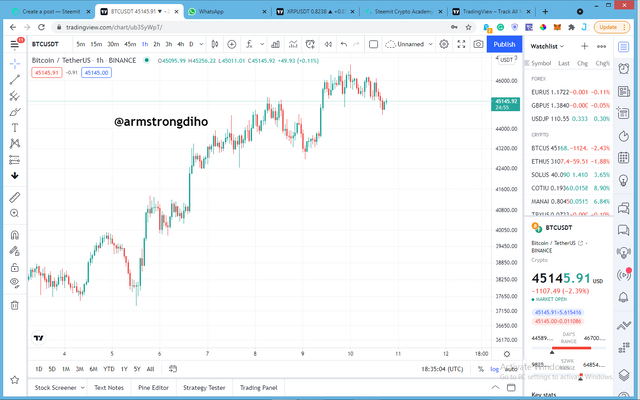

- Now, you can see the crypto chart of BTC/USDT pair

- Click on the "fx" to add the ADX indicator

- Here, I decided to search on the directional movement index to make it more easier as you can seen below. Instantly, it appears then I selected on the directional movement index.

- Here on the chart you can see the indicator have been added automatically.

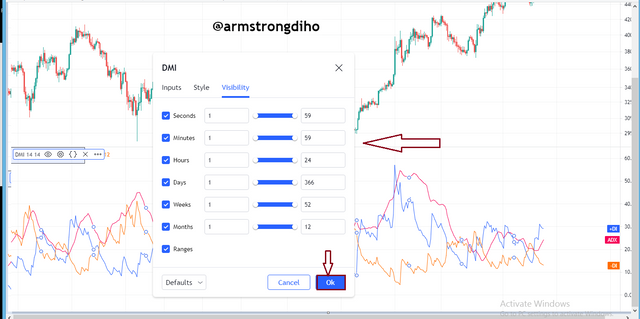

- Since I have added the indicator on my chart, I have to set it up based on my choice. now, I will being by clicking on the setting button just as seen on the chart, then you will seen the 3 sessions and I will start with the style phases. Select the colour you desired but I prefer the default colour which red for ADX, blue for +DI and orange for -DI. The the chart below will explain better.

- Now, is to set up the input. here will have to set up the desired length and period but on the chart, its on default. It can change depend on your on your trading style. As you can see on the chart, the 14 periods which means the read value will be for the last 14 candles on the asset price.

- Here is the last session of the set up where we can select timeframes but here is on default.

BEST SETTINGS FOR THE ADX INDICATOR

To me, the best settings depend on a trader strategy since no indicator can offer 100% reliable signals to the crypto trader. Though a crypto trader has different best Settings with different trading style, but what really matters is the profitable result derived from it.

However, ADX indicator settings by default are 14 period which different technical analyst has refined as they use short timeframe and long timeframe of 7 periods and 30 periods respectively. So, for proper understanding, I will present low and high periods on a chart. Let's check it out one of the other.

USING LOW SETTINGS AS 7 PERIODS

SCREENSHOT OF MR. WILLIAMS SHOWING 7 PERIODS OF ADX

Just as I said different trader has various styles and best settings so let's assume Mr. Williams a crypto trader prefer short timeframe of 7 periods, let's check out how effective it will offer to him.

Mr. Williams set his chart as 7 periods that's 7 periods signifies 7seconds, 7 minutes, 7 days, and 7 months. Based on the Screenshot of the crypto chart above, the ADX responds more quickly to price movement as such made the price movements of the asset to be altered due to the high price volatile of the asset.

Thus, has caused Mr. Williams to generate more false signals. With this effect, low Settings is less reliable regardless of its nature to respond very quickly just as we have seen how it disappointed Mr. Williams to place a trade that results in high losses due to the false signal it gave to him.

Things to note when using high periods is that,

✓ It facilitates false or wrong signals as such is less reliable

✓ It responds more quickly to price movement than the high Settings but offers false signals.

Since we have checked out low period, let's check out high period.

USING HIGH SETTINGS AS 38 PERIODS

Here, we have another trader Mrs. VIVIAN whose style and the best setting are 38 periods that's 38 periods signifies 38 seconds, 38 minutes, 38 days, and 38 months. Let's check out how effective it will offer to her.

Mrs. Vivian set her chart as 38 periods, based on the Screenshot of crypto chart below, the ADX responded more slowly to price movement as such made Mrs. Vivian generate a good signal after a large part of the trend is missed. That's high periods provide less frequent signals to Mrs. Vivian which made her to minimize false signals Mr. Williams encountered.

Thus, high Settings is more reliable regardless of it's nature to respond very slowly to price movement but gives good signals just as we have seen how it provide to Mrs. Vivian. Things to note when using high periods is that,

✓ It minimizes false or wrong signals as such is more reliable than the low

✓ It will also take a long time before it provides good signals which makes the trader to missed out a large part of the trend that would have to bring false signals.

SCREENSHOT OF MRS. VIVIAN SHOWING 38 PERIODS OF ADX

Now, we have seen the effect of low and high periods respectively used by two different traders, but I will say it depends on how the trader understand and interpret any of the ADX Settings (low or high periods). With this effect, I believe there is no best Settings provided every trader has different trading styles.

However, to be in a safer side, other indicators like the RSI or MACD should be used along with the ADX to obtain more reliable signals.

Do you need to add DI+ and DI- indicators to be able to trade with ADX? How can we take advantage of this indicator?

The ADX is an important oscillating line and it's function is to measure and identify the strength of the current market trends on the range of 0-100 but doesn't detect the direction of the trend. Hence, the addition of DI+ and DI- indicators is not a must since the ADX line only is to measure the strength of the trends. In fact, it well noted that strong trend is when the ADX value is above 25 mark.

However, a trader who fully understand this will enjoy the indicator in conjunction with the positive (+DI) and negative (-DI) directional indicator and

other suitable indicators like the RSI, MACD, etc. since the information provided by the ADX is only on the strength of the trend as such can not enough when making trade decision.

Basically, to enjoy this indicator is to understand and interpret it. Hence, the trader will ride on the trend once a they identify the strength of trend, and use other suitable indicators like the RSI, MACD, Ichimoku, etc. that will suit their trading strategy to identify the direction of the trends. If possible use the trader can also studied the candles together with the indicator as a reliable means to confirm your entry and exit strategy.

TAKING ADVANTAGE OF THE DI+ AND DI-

There is always advantage when using two things, and in the case of using the positive (+DI), and negative (-DI) together with the ADX lines gives a trader lots of advantages when making trade decision. Just as I stated that the ADX only focus on the strength of the trend and doesn't show the directions of the trend, but together with the positive (+DI), and negative (-DI) shows the market directions.

With this effect, the trend directions and crossing over when used together with positive (+DI), and negative (-DI) makes the trader to have an advantage to ride on the market. Remember, the function of the directional indicators is to measure the swing highs and swing lows of a price movement that occurs over any of the period used by the trader but by default it's 14 periods.

However, when the positive (+DI) rallies over the negative (-DI) signifies an uptrend strength, and when the negative (-DI) rallies over the positive (+DI) signifies a downtrend strength. Hence, to obtain the strength of the range between 0-100 using the DIs and ADX line is by plotting the DIs with the ADX line. Always note that the DIs respond very quickly to price movements change.

From the chart, we can see how the positive (+DI) rallies and the negative (-DI) rallies over each other signifying how the market experience an uptrend and downtrend respectively.

Based on the overview of what I have discussed, always understand that the rallies over of the positive (+DI) and the negative (-DI) respectively is not recommended or shouldn't be seen as an entry signals. As such, to make a trade decision whether to place a buy or sell entry shouldn't be based on the rallies of the DIs because they respond very fast to price movement change which makes them sometimes provide signals that are not significant within a given timeframe.

TRENDS DETECTED BY THE ADX

The ADX has a scale range from 0- 100, and scales passes a message to traders regarding the strength of the market trend. Moreover, the strength of the trend can be weak, neutral or trendless, strong trend, and very(extremely) strong. Remember, these trends depends on the ADX values. For more clarification let's check them out.

NEUTRAL/ WEAK/ TRENDLESS

The strength of a trend can be called weak or neutral trend when the ADX value on the scale is plotted at the range of 0-25. Once the ADX line is between the range 0-25, instantly signifies weak or neutral trend. Based on this I could say the price at that given timeframe is heading towards consolidation.

Moreover, based in the strength measured or derived from the ADX, it is ideal to wait for the market to observe a strong or very strong trend before making any trade decision.

STRONG TREND

Strong trend is another trend detected by the ADX, and it is observed when the ADX value on the scale is plotted at the range of 25-50. Once the ADX line is between the range 25-50, instantly signifies strong trends.

VERY STRONG TREND

Very strong trend is differ from the strong trend. Very strong trend is observed when the strength of a trend is above the range of 50, and will not exceed 75. That's between the range of 50-75, the market trend is said to be called very strong. Let's check out the crypto chart below;

EXTREMELY STRONG TREND

This is usually observe when the strength of the trend is at the range of 75 down to 100. That's when the market is at the range of 75-100 on the ADX line. When extremely strong trend is observed in a market, it means there is a high pump or pressure from the buyers most especially the brokers which will lead to big candles as a result of higher volumes, instantly the ADX will tend to respond to the market at that given time.

We normally experience this during bullish season indicating a very high price volatility, and is very rare. Let's check out the crypto chart.

HOW TO FILTER OUT FALSE SIGNALS WITH THE ADX

To filter out false signals using the ADX involves the following.

USING SUITABLE PERIODS

Using a proper periods gives a trader an advantage to filter out false signals. By default, the indicator is set as 14 periods, but not a must that a trader must make use of it when trading. It's very important for a trader to identify a proper periods that suit their trading strategy but the question should be is it producing a good results.

When I explained about the best Settings, I could remember vividly I said low periods like 7 reacts very quickly to price movement and tends to produce false signals. And I also made mention regarding high period using 38 periods as an example that there is delay in signals but tend to produce reliable signals better than the low periods. Remember, the high periods has an issue when it comes to how it reacts to price action change. It's reacts very slow to the price action change as such trader might have missed some signals which they should have trade on.

However,, with all these explained, we can now agree with me that periods plays a vital role when filtering false signals to some point. Hence, it all depends on the trader to choose a suitable period, and understand it very well in order to filter false signals.

USING THE RALLIES OF THE DIs

Another possible means a trader can filter false signals is through the rallies of the positive (+DI) and the negative (-DI). In some case, it has really worked out that once the positive (+DI) rallies over the negative (-DI) signifies signals to long the trade, and also once the negative (-DI) rallies over the positive (+DI) signifies signals to short the trade which most trader have strong mindset on but forgot it can give false signals sometimes.

Moreover, once will observe in the market that the positive (+DI) rallies over the negative (-DI) below the range of 25 shows a false signal. From this we can see the ADX together with the DIs how it can help filter false signals.

What is Breakout and how to use ADX indicator to filter valid breakouts?

Basically, break is when price of an asset break the previous Support and resistance zones in which the price action can continues in its direction. However, in the crypto ecosystem, we can experience breakout both in a bullish trend and in a bearish trends. Most at times once we noticed breakout, it signifies that the price is about to trend either upward or downward.

For instance, in a bullish movement, once the buyers keep on pumping in the market resulting to high volume, instantly the price will rise in such a way that it will breakout from the last resistance level and continue an upward movement. Note that the previous resistance instantly becomes support once the price retest.

The same also occur when there is a bearish trend, the price will drastically move downward as a result of high pressure from the sellers in such a way that the the price will breakout the previous Support and continue its downward move. Note that the previous Support instantly becomes resistance once the price retest.

How to use ADX to filter valid breakouts

The ADX is to measure the strength of a market trends, hence understanding this will enable a user to notice a valid breakout. With the strength measured by the ADX, we can detect between the buyer and seller who is dominating the market at a given timeframe.

It is ideal not to place a trade when observed the ADX is below 25 because any breakout observed is not a valid one. Perphas, when the ADX is above 25 shows a strong trend and the breakout observed at that time is valid and user can place a trade.

Looking at this chart below, we can see another role the ADX offers to trader as to avoid a false breakout which I believe most trader might have fallen into the such false breakout.

Difference between using ADX for scalping and swing trading

In the crypto ecosystem, there are different types of trader but here I will be discussing on two Scalping and Swing Trading. Let's check out how we can use the ADX in Scalping and swing trading.

Using ADX For Scalping

In the crypto ecosystem, scalping trading means a short-term trade. And a trader who demonstrates this is called a "Scalper". For more clarification, this is a trader who doesn't hold the position for a long time and doesn't focus on big timeframes like 4h or A day instead it concentrates on small timeframes like 5,10, or 15 minutes and most at times 1h. One unique about scalping trading strategy is all market is very favorable to them.

Using the ADX for Scalping is very possible but it all lies on the support and resistance levels. Since the timeframe mostly used in Scalping is 1M or 5M, high period Settings for the ADX is recommended in order to get rid of some disruption in the market trends.

However, the ADX line together with the positive (+DI) and negative (-DI) can be used to determine the strength and direction of trends at a given timeframe.

Also one peculiar about using ADX for Scalping is that any other indicators like the RSI, ICHIMOKU, etc. And the period is configured to 100 so as to identify trend within a time frame.

Using ADX For Swing Trading

When we talk about the swing trading, it has to do with traders who holds position for daily timeframe. Hence, using the ADX indicator, in this aspect of trading will be beneficial in confirming entry points. Although, using it with other indicators like the Pivot Points, is recommended but the user have to be careful to avoid be confused.

However, swing trading only requires selecting two indicators like the Pivot point and Ichimoku in order to see the productiveness of the ADX. And the ideal period shouldn't be above 30. Hence, it all depends on the choice of the trader but shouldn't be above 30.

Furthermore, I will choose the swing trading since it has lesser indicators to be added because much indicator might lead to confusion. Also one tbi g that sweet me in swing is the longer timeframe used, I bel6 a scalper needs patience because watching the time frequently might not be easy for me, so I like longer time frame where I will not focus much if my time in the chart. Moreover, the ADX together with other indicator can be used as a means of guiding me on my trade decision since the ADX function more effectively in swing trading.

CONCLUSION

The ADX is an important indicator which should be recommended to traders used since it can be used to measure the strength of the trends. Based on what I have acquired in the course of this assignment, it's ideal not to place a trade when the ADX is below 25, but above 25 is ideal. Moreover, above 25 which shows the strong trend gives a trader better advantage on the market.

From the course of the studied, low periods tends to react very quick to price movements but offers false signals while high periods tends to react very slowly to the price movement hence, offer more reliable than that of the low.

Lastly, this indicator could be reliable only when the user identify a proper periods, understand it, and interpret it very well. Also, other indicators like the RSI, Ichimoku, etc. should be used in conjunction with the ADX for more confirmation.

**

Unfortunately @armstrongdiho, this week's submission time has expired.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Prof. kouba01 for your reply. I submitted it around 23:57 using Nigeria time.

Although, it's really painful after passing through some stress to prepare this post. Nevertheless, I appreciate maybe next I will learn from my mistake.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit