A trader just bought a coin, he is relatively new to the crypto world. As unfortunate as it sounds, the coin starts experiencing a decline in value. Now the trader has three choices, (1) wait it out, (2) act quickly and sell his positions, or (3) buy more in an attempt to reduce his losses.

The Trading Trap

Now, out of the three options, the newbie trader would most likely choose number two and three. Even though he has scoured through several crypto forums, groups, and pages on the internet. He would still end up picking the last two options. Why?

This is because it is one thing to learn about cryptocurrencies and it is another to implement what you have learnt. The trader is still new to the feeling of watching his investment lose value. He is still new to the emotions associated with loss: the sad feeling of loss.

This feeling can turn into accepting defeat and giving up his positions. Or turn into rage and anger that leads to buying more, like some sort of revenge.

Even though he has learnt a lot about crypto, there's something he still hasn't learnt. Something no one can teach him. Something he has to learn on his own. He has to learn about himself. He has to get to know himself like the professor adviced.

My reaction to a sudden dump in BTC price from 62k

Screenshot from tradingview.com

What I would have done before this class

Given that I'm not new to crypto, I would most likely wait it out. I have made some mistakes in the past that have taught me a lot about my self.

What I will do now

After this class, I will do two things;

1. Don't sell in a hurry, study the chart

Screenshot from tradingview.com

In the chart above, I have went ahead to draw a line at the bottom of the graph called the support level.

From that little adjustment I made in the chart, I can see that Bitcoin price is still within a reasonable price since it hasn't touched the support level. Things would only get serious if Bitcoin had fallen below the support level.

2. Set a stop loss

While patience is an essential virtue in the crypto space, it has a down side. After reading the professor's post, I realized that I have been missing an essential ingredient in my trade recipe: setting a stop loss.

Don't get me wrong. I know about stop loss, but I never really paid it much attention. However, this week's homework post got me wondering; what if a bear market happens right before our very eyes? Without stop loss my loss would be unimaginable.

Even if Bitcoin doesn't dump to 3k, it can probably go down to 10k or 20k. Imagine what will happen to the altcoin's market when Bitcoin dumps to those levels.

I have been in the crypto ecosystem for the past five years, and four out of that five have been bear market. This is, of course, the longest bull-run ever. What happens when the bull stops running?

On that note, I seriously need to insulate myself with stop loss. That is what I will do now. I wish I had down this on an earlier trade. Keep on reading to find out my mistake!

My experience when it comes to making mistakes in trading

"No matter how much knowledge you acquire about crypto, it will still find a way to embarrass you." Those were the words I told a friend few weeks ago. It wasn’t the first I've felt that way. And I don't think it will be the last. Sometimes, our emotions just get the best of us.

Either that or we simply lose ourselves to the hype of a boom.

Mistakes I have made when trading

Crypto is all about wins and losses. Sometimes, the wins make the losses worth it. I have made a handful of mistakes. Either by missing out on a really good trade or making an absolutely wrong buy. I will just share my last mistake.

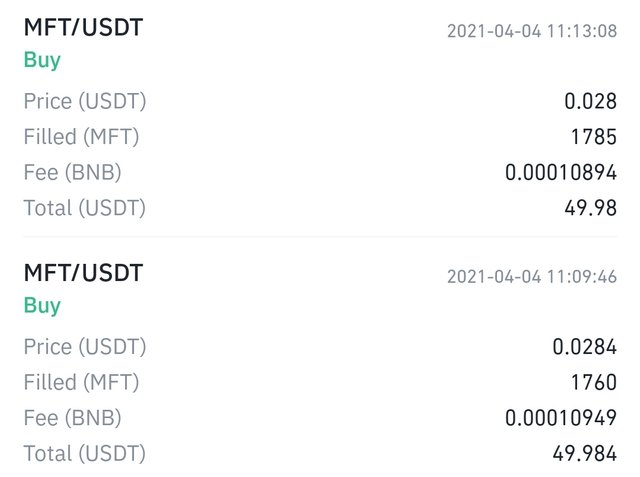

On April 4th 2021, I spent $100 buying MFT. I convinced my self that this decision wasn't a mistake because most people in my Telegram group believed it would do a 5x. They've been right a couple of times about other trades, but not this time.

A few days later, my $100 investment in MFT turned to $35. I had lost 65% of my investment. After reading the professor's post, I can see that I made three mistakes:

- I had FOMO (Fear Of Missing Out)

- I did not set a stop loss

- I invested money I wasn't willing to lose

I have learnt my lessons though.

What did I learn from this mistake?

I have learnt three things;

Avoid FOMO

It is often best to make a planned trade instead of making one in a hurry. Nothing good ever comes from rushing to do something. Since the prices of coins are always fluctuating, one should enter a trade when the price is relatively low and not when the coin's price is in an all-time-high.

Set a stop loss

I should have set a stop loss of at least 20% change in price in order to mitigate my risk, especially since I bought at an all time high. Stop loss would have protected me from losing $75. The most I would have lost with a 20% stop loss is $20.

Invest what I can lose

Investing what you can lose will protect you from high blood pressure. Although, I did not have an urgent need for the money I invested in MFT, I was not willing to lose that money because it was all the USDT remaining in my wallet. I could have split the money in two and invested in another coin to earn some profits.

The strategy I find most useful

Get to know yourself

I consider "getting to know yourself" as the foundation of all strategies. This is because understanding myself will help me to identify my weaknesses. And then make active effort to correct those weaknesses.

Control your emotions

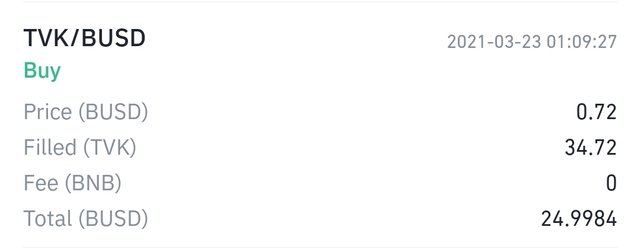

Personally, my weakness is revenge trading. I tend to buy more when my trade is going bad. For example, I bought TVK at $0.72.

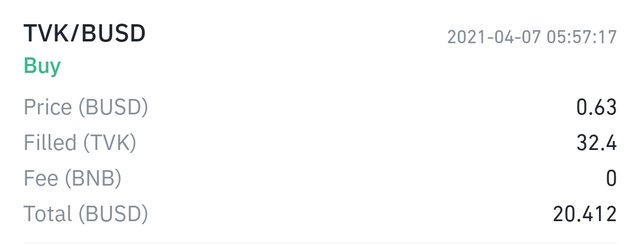

When it dropped to $0.63 I bought some more.

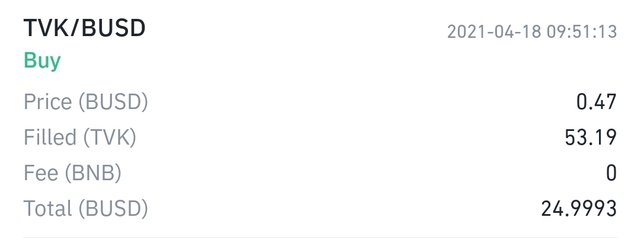

It then dropped to $0.47 and I still bought more.

If this isn't revenge trading then I don't know what is. Buying more exposed me to more risk. Unfortunately, this coin kept dropping. It went to as low as $0.24.

I have learnt to control my emotions.

My reaction when I see a tweet like like this

Screenshot from Twitter

What I would have done before this class

Before this class, I would buy the coin because there is a good chance its price will increase. I used to have a slogan: "I see Elon's tweet, I buy."

What I would do now

Now, I will still buy. However, here's what I will do before I buy;

1. Observe the changes in price

I will not buy in a hurry. Instead I will acquire some positions when the price goes down a little.

2. Set a stop loss

In addition, I will set a stop loss of 10% drop in price. By setting a stop, I will not be exposed to the risk of losing more than half of my investment.

3. Invest what I am willing lose

Since this trade is a risky one, it makes sense to only invest what I can lose. That way, I wouldn't fall sick when the trade goes bad.

Also, by investing what I am willing to lose, I won't be in a difficult situation. Imagine I invest my feeding money. Doing that would only make me desperate to see the price go up, which means that I will be investing my emotions also. Sadly, emotions and trading don't mix.

Final Words

I have read the professor's homework and I learnt a lot from it. As crypto traders, we are all looking to make profit but we can't do that successfully if we get our emotions involved. Overtrading and revenge trading are practices we should avoid. It is also important to set a stop loss. Thanks @fendit, for the class.

Thank you for being part of my lecture and completing the task!

My comments:

That's way too painful to even think about it!!

Also, careful about those Telegram chats... sometimes, the people that's promoting certain coin just want to make everyone get into it so that the price goes up and they can sell their position. I have seen it several times...

Aside from that, I still remember your work from my previous class... and this one as well as simply amazing. I love how you write and how you get to express your ideas in a very clear and precise way.

Congrats on this beautiful work!!!!

Overall score:

10/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! Thank you @fendit for appreciating my efforts. You don't use confusing jargons in your class. I like that, and I try to write that way too.

I thought I was the only one thinking about this. I agree with you. I won't be deceived anymore, I've learnt my lesson.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit