1.State in your own words what you understand about the Perfect Entry Strategy (Put at least 2 examples on crypto assets)?

Consistent with the idea of good entry, although the professor explained it in school is extremely simple, it is only an understanding of the precise objective where there is a high chance for the market to reverse or show the current trend. This strategy of good entry is achieved with the feature of Associate in Nursing indicator called Random Indicator.

With the help of indicators combined with price action on charts and moving averages, good chances of trading orders with high success can be achieved.

The right entry strategy takes into account 3 specific elements. The primary issue is that you have clear price action from the market structure and price reconciliation at a specific time.

The second part that has to be considered is that the 200 moving average indicator which helps in filtering the market structure as well as market trends at the same time and finally, the good random indicator is a part of its additional elements .

This indicator helps the US to prove that although oversold or overbought and plus is that if oversold, there is a higher trend that the price may flip optimistically and if overbought, then also a pessimistic movement is around the corner. it happens.

Now for a lot of clarity, let's take a look at the detailed steps to be followed to carry out a good entry strategy.

Steps to Ending a Good Entry Strategy

As mentioned above, there are 3 important elements of square measure to be used for correct admission criteria. These criteria are justified in the steps given below.

- Determining Market Trend: In a good entry strategy, and indeed, in any commerce strategy, the primary issue is to try to find the market bias or the current major trend. Thus during this strategy it is often the case when the 200-MA (200-MA) comes into play. We are going to use two hundred moving averages to look at the trend, noting that once price is trading above the moving average, the market is in an optimistic trend and once price is below the MA, the trend is is pessimistic. , Throughout this strategy, trend determination is not only based on two hundred MAs, the strategy also uses price action information of market structure and price harmony to visualize the market trend. In this case, we are able to trace the current bias established by each MA and the market structure.

For greater clarity, an image showing an illustration of step one is uploaded below.

- Candle Holder Confluence with 200 MA: Once the market trend is set and we have bound the square measure whenever the price moves, looking for future moves "reference candle or trigger candle" Is. , The trigger candle is the candle holder that tells the US the validity of a good entry strategy. This is a small candle holder with a little body and a light or shadow at the top and bottom. So, however, does this trigger candle make sense? We spot this candle by the perceptible candle holder which is formed when the price approaches the moving average line.

For example, if once our first move is to the top, we determine that the trend is gaining a pessimistic direction. Then the price trades below the two hundred moving average, and then the value retraces to make a lower high and so reaches the two hundred moving average as if it wanted to touch it, and so at this point if a candle like As mentioned above, each aspect body and candle shows that we already have our "trigger candle". The formation of a trigger candle shows that the strength of the consumers is weak which the consumers could not push the market upwards this time. Just as we have for the pessimistic trend, we are also able to make a consistent case for the optimistic trend.

For more understanding, pictures specifying step two are uploaded below.

- Random Generator Signals: The last step in executing the correct entry strategy is the Random Generator signal. This is often important because the signal from the random generator must match the phase one and phase two speeds. Otherwise, we drop it and expect another. For this to be currently valid, the random generator must additionally offer the continuous problem we see in step one and a pair.

For example, to show that the trend is pessimistic, that {value | price | Price} is an action and therefore price reconciliation is additionally in line with the trend as ensured by the market structure, plus the price trades below the moving average. In addition to waiting for the price to reach the two hundred MA to ignite the trigger candle, indicating that there is currently not much strength for short buys, the random generator should additionally give an overbought signal, this In the course of the case, the random generator should vary up to a hundred. For the flip side of this, the random generator should vary from zero to twenty which signifies overselling.

2. Explain in your own words what candlestick pattern we should expect to execute a market entry using the Perfect Entry Strategy.

This strategy is expected to be executed in an extreme market that is trending up or down. This strategy generates a trend reversal signal and thus traders are ready to switch to the full method by adopting the then important professionalism options.

That candle is also called Doji candle. A doji candle can be a candle on a candlestick chart that is shown in a trending market, but once it appears on the chart, it is expected that the trend will reverse.

Traders make important professionalism choices once the Doji candle is shown on the bar chart. Doji coin shows that the trend is over and currently the market may move to the other side. If there is an uptrend and the Doji candle is kind, it indicates that the uptrend has ended here and the market may currently move in a downward direction. Thus traders must sell the coins and can exit the market.

When the market is in a downtrend and therefore the Doji candle is kind, traders should understand that the downtrend reverses into an uptrend and they should enter the market by buying coins.

However, the doji measures certain conditions after the candle is gone after the market starts. This may be an area where the market does not follow a certain trend, although it moves sideways. Still we see that the market stops moving in its previous direction at the time of Doji candle.

3. Explain the trading entry and exit criteria for buy and sell positions in any cryptocurrency of your choice (Share your own screenshots)

1- We should always analyze the beginning of the market. We should always get or sell coins without doing proper analysis and study. All the conditions that we mention above in order to create a position to place a buy or sell order within the crypto world must be met. Should the market participate, the 200 moving average around the market and the random generator should be taken into account when placing orders to take the term profit.

2- If there is a condition that is not being fulfilled on the spot, we should always wait until all 3 conditions are met. It is our tendency not to make hasty changes and not to commercialize in haste. {we need We must always} until a view satisfies all the conditions, then enter the market.

3- Once all the conditions are met, traders will verify that the quality price can move anywhere and should do what is currently in the market. They use the signals produced by the 3 positions and choose professionalism. If all the signals show the same output, which means the exit or entry signals are produced by all 3 elements, then we should always order.

4- For a sell order position, the MA acts as resistance to be positive and the random generator lines should cross each other in the overbought area, and a downtrend is currently anticipated so that we should always sell the asset And the market will exit. We all know that once an associate in an uptrend, there is a downtrend. Thus once the random generator shows a reading over the k lines below eighty, it shows that the trend reverses downward. Thus we should always exit the market in the present. Always enter or exit the market after there is a clear trend. If the market is trending, traders should not choose professionalism.

5- To place an order, the MA should act there as a support for the candlesticks. If the market was in a downtrend or overbought zone and hence the random indicator readings are getting below twenty. Although allies in nursing are once a sector, more buying movement is expected in the allies market in nursing. We should always enter the market as a partner in a nursing uptrend once the downtrend has reversed.

6- To place an order, ensure a stop loss and take profit price at the beginning. Investors are vague about profit and stop loss prices usually cannot end profitably. Thus, it is often necessary to be clear about the take profit and stop loss rate. We should always set each of these values initially. The stop loss and take profit volume ratio should be 1:2 or 1:3. Always take profit from stop loss.

4.Trade 2 demo account trades using the “Perfect Entry” strategy for both a “Bullish” and “Bearish” scenario. Please use a shorter period of time to execute your entries. Important you must run your entries in a demo account to be properly evaluated.

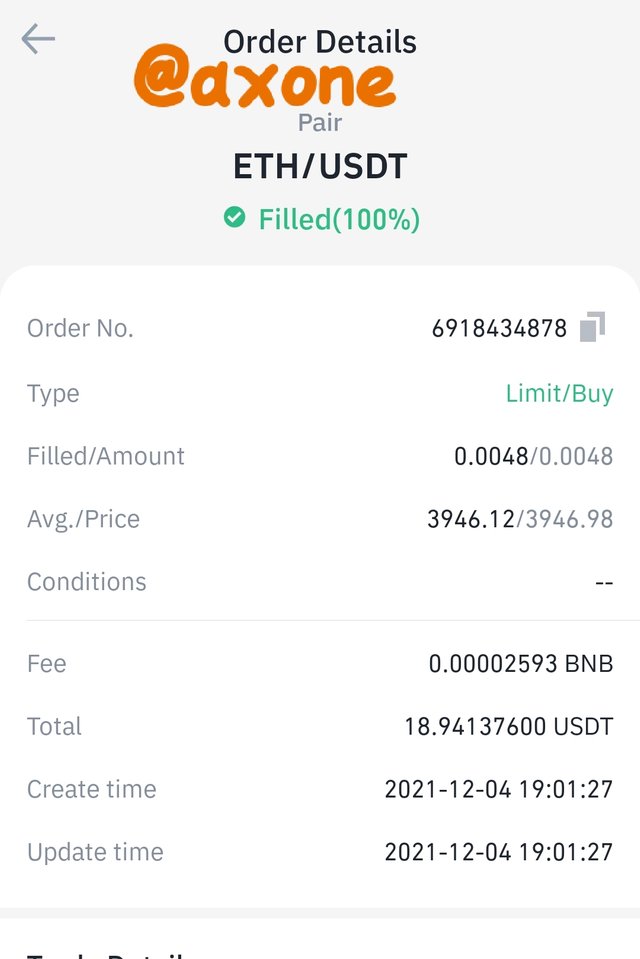

I have used EthUSDT charts. Below the chart, all conditions are met. The moving average is close to the smaller candle. Market is in trending part. The market is in a downtrend. The Random Generator indicator is indicating that the market is in oversold territory. All the conditions are being fulfilled. Thus I ordered to get one here. I bought some super. It is often an excellent entry point. I use the right entry strategy to enter the market. Once all the conditions are in mind, I placed my order and bought Super.

Even more screen wants EthUSDT coin. Here we see that we will keep the entry obtained as a result of fulfilling all the conditions. The market is in a downtrend. The Random Generator indicator is indicating that the market is in oversold territory. All the conditions have to be met so I bought the coin.

More than that purchase order description. For the time being, all the conditions for the sale of the coin must once again be exhausted.

Conclusion:-

The correct entry strategy can be eliminated by mixing the 3 positions. Once the 3 condition is met, it thinks about the most effective time to enter the market. The primary among them is the position that the segment should have in the market.

Then the price should be at the point of the two hundred moving average. The random generator uses aggregate which verifies whether the market is in an overbought zone or an overbought zone. It facilitates finding the most efficient entry and exit points. By exploiting all 3 parts, traders get proper entry points.