An unlock token, in the context of cryptocurrency and blockchain projects, is a digital asset that typically represents a share of ownership or utility within a decentralized network or platform. These tokens are often associated with blockchain- based projects, including cryptocurrencies, decentralized applications(DApps), or blockchain protocols. They serve colorful purposes within the ecosystem, similar as enabling users to access specific features, participate in governance decisions, or act as a medium of exchange.

One common practice in blockchain projects is to lock a certain quantity of these tokens for specific periods. This locking mechanism is implemented for several reasons, reflecting the project's goals and strategies.

Token locking can be a strategic move to incentivize long- term commitment and prevent rapid-fire sell- offs. When tokens are locked, it discourages early investors or participants from immediately selling their holdings, which could lead to price volatility or destabilization of the project.

Token locking often aligns with the project's roadmap and development milestones. By locking tokens, brigades can ensure that resources are available for ongoing project development, maintenance, and expansion. It also serves as a commitment to the project's long- term success.

locking tokens can foster a sense of community and shared ownership. Token holders are more likely to participate actively in the project's ecosystem, similar as voting on proposals, contributing to development, or using tokens for intended purposes when they've a vested interest through locked tokens.

In my opinion, the decision to lock tokens is a strategic one, aiming to strike a balance between maintaining stability and encouraging active participation in the project. It reflects a project's vision for sustainability and growth while fostering a pious and engaged user base. However, it's pivotal for projects to transparently communicate their token locking mechanisms and ensure they align with the stylish interests of the community and the project's long- term success.

Tokens are locked and released through colorful methods in blockchain projects, and the choice of method depends on the project's design and goals. Here, we'll explore some common methods for locking and releasing tokens

1. Smart Contracts This is one of the most common methods. Smart contracts, self- executing law on the blockchain, can include locking mechanisms. Tokens are often locked in a smart contract, and their release is governed by predefined conditions. These conditions could be based on time(e.g., releasing a percentage of tokens every month), events(e.g., achieving certain milestones), or a combination of both.

2. Vesting Schedules Vesting schedules are agreements between parties that outline when and how tokens will be released. For example, founders and team members of a project may have a vesting schedule that unlocks tokens gradually over a specified period, promoting their commitment to the project over the long term.

3. Governance Decisions Some projects implement token locking and releasing through on- chain governance. Token holders vote on proffers that determine when and how tokens are uncorked. This method allows for decentralized decision- making by the community.

4. Staking Mechanisms In Proof- of- Stake( PoS) and Delegated Proof- of- Stake( DPoS) blockchains, token holders often stake their tokens to share in network activities or earn rewards. Staked tokens are temporarily locked, and they're released when the staking period ends.

5. Time- Locked Wallets Token holders may use time- locked wallets where tokens are inapproachable until a specific date or condition is met. This method is often used for particular fiscal planning, similar as long- term savings.

The release of locked tokens typically follows the rules established during the locking process. This can involve automated smart contracts executing according to predetermined conditions, homemade approval for governance- based releases, or the expiration of a specified time period for time- locked wallets.

Token locking and release mechanisms are essential for maintaining the stability and sustainability of blockchain projects while commitment and responsible token management. Clear communication and transparency regarding these mechanisms are pivotal to building trust within the community.

Unlock tokens can have a significant impact on the price of a cryptocurrency, and monitoring this impact is essential for both investors and project teams. Let's delve into the impact and monitoring of unlock tokens with an example

Impact on Price When a substantial quantity of tokens is unlocked and becomes available for trading or selling, it often exerts downcast pressure on the token's price. This is because an increased supply of commemoratives without an original increase in demand can lead to a decrease in token value. Investors anticipating these unlock events may sell their holdings before the tokens are released to avoid implicit price declines. Conversely, when tokens are locked and unapproachable for trading, it can create scarcity, potentially driving up demand and prices.

Monitoring Monitoring the impact of unlock tokens involves tracking several crucial factors

Unlock Schedule The timing and frequency of token unlocks are pivotal. Investors and dealers closely follow the project's published unlock schedule to anticipate supply changes.

Trading Volume A surge in trading volume around unlock events can signal market activity related to unlocked tokens. High trading volume may suggest increased price volatility.

Price Movements Monitoring price fluctuations around unlock events helps investors gauge the immediate market sentiment. Sharp price drops may indicate a bearish response to token releases, while price increases may suggest bullish sentiment.

Example Let's consider the example of a blockchain project XYZ that has locked a significant portion of its tokens to incentivize long- term commitment. After a 12- month lock-up period, a substantial number of tokens are set to unlock. In the weeks leading up to the unlock event, there is a conspicuous increase in trading volume as investors prepare for the release. As the unlock date approaches, the token's price gests fluctuations. On the day of the unlock, the price initially drops due to the unforeseen increase in token supply, causing some investors to sell. However, if the project is strong and the unlocked commemoratives are used for productive purposes, the price may stabilize or even recover in the long run.

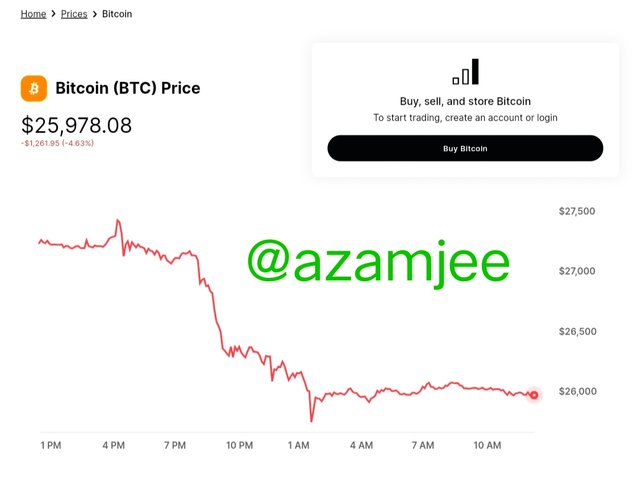

Screen shot

In summary, monitoring the impact of unlock tokens involves assessing the timing, trading volume, and price movements around unlock events, helping market participants make informed decisions and project teams manage their token economics effectively.

Not all cryptocurrency ecosystems have implemented token lock mechanisms, and the decision to do so varies from project to project. Steem Inc. which is associated with the Steem blockchain, has had its own approach to token locking in the past. It's essential to note that my knowledge is up to September 2021, and the specific strategies of blockchain projects may have evolved since then.

Steem, a blockchain- based social media and happy platform, did incorporate a form of token locking through a mechanism called" Powering Up." Users could convert their liquid STEEM tokens into Steem Power( SP), which were locked for a specific period. The further SP a user held, the further influence they had on the platform, including voting power and rewards. The idea was to incentivize long- term commitment and discourage short- term academic behavior.

The concept of token locking can be beneficial for cryptocurrency ecosystems in several ways

Long- Term Commitment Locking tokens can encourage stakeholders to remain married to the project's success over the long term, as they've a vested interest in its growth.

Reducing Speculation Token lock mechanisms can help reduce short- term price volatility caused by academic trading, creating a more stable environment for users and investors.

Governance and Voting In platforms like Steem, token locking can grant users more significant voting power in governance decisions, promoting active participation in platform governance.

Resource Allocation Projects can use token lockups to allocate resources for development, marketing, or ecosystem growth, ensuring a steady supply of resources.

Trust and Community Building Token lock mechanisms can build trust within the community by demonstrating a commitment to project sustainability and preventing token dumps that could harm the ecosystem.

However, the effectiveness of token lock mechanisms depends on their design andexecution.However, they can discourage liquidity or create barriers for users, If not well- balanced. The key is to strike a balance that aligns with the project's goals and values while still accommodating the needs and preferences of the community.

Whether Steem Inc. or any other cryptocurrency ecosystem should implement or continue using token lock mechanisms depends on their specific goals, stoner base, and community feedback. Careful consideration and transparency in implementation are vital to ensuring the benefits of token locking are realized without causing unintended negative consequences.

Certainly, here's a simple table listing the risks and benefits of unlock tokens:

| Benefits of Unlock Tokens | Risks of Unlock Tokens |

|---|---|

| Encourages Long-Term Commitment | Potential Price Volatility |

| Promotes Stability in Token Value | Short-Term Speculation |

| Aligns Interests with Project Goals | Reduced Liquidity |

| Active Participation in Governance | Lock-In of Investment |

| Resources for Development and Growth | Regulatory Scrutiny |

| Builds Trust in the Community | Token Dumping |

| Reduced Pump-and-Dump Scenarios | Complex Tokenomics |

| Easier Resource Allocation | User Dissatisfaction |

| Prevents Concentration of Power | Barrier to New Investors |

| Incentivizes Community Engagement | Implementation Complexity |

Benefits of Unlock Tokens

Encourages Long- Term Commitment Locking tokens incentivizes users and investors to hold their assets, demonstrating dedication to the project.

Promotes Stability in Token Value Locking can reduce price volatility by discouraging short- term academic trading.

Aligns Interests with Project Goals Locked tokens align the interests of token holders with the long- term success of the project.

Active Participation in Governance Token lock mechanisms can encourage users to actively participate in governance decisions.

Resources for Development and Growth Projects can allocate locked tokens for development, marketing, and ecosystem growth.

Builds Trust in the Community Token locking demonstrates a commitment to the project's sustainability, building trust within the community.

Risks of Unlock Tokens

Implicit Price Volatility Unlocking large quantities of tokens can lead to unforeseen price fluctuations.

Short- Term Speculation Users may be discouraged from participating if they can not easily access their tokens.

Reduced Liquidity Locking tokens can reduce liquidity, making it challenging to buy or sell when needed.

Regulatory Scrutiny Lock mechanisms may attract nonsupervisory attention in some jurisdictions.

Token Dumping When locked tokens are released, users might sell them quickly, causing price drops.

Complex Tokenomics Intricate token lock mechanisms can confuse users.

User Dissatisfaction Locking can lead to user dissatisfaction if they want immediate access to their tokens.

Barrier to New Investors Implicit investors might be deterred by lockup requirements.

While token locking can provide benefits like commitment and stability, it's pivotal to strike a balance to mitigate implicit risks similar as price volatility and reduced liquidity. Projects should carefully design and communicate their lockup mechanisms to ensure they serve their intended purpose effectively.

Very informative guide on what token lock is all about as said when token are lock they increase commitment and reduce sell of which also have it advantage and disadvantages thanks for the share best regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Most at times, tokens drop after unlocking. This is because many investors have the traders mindset, taking profit as soon as possible. However with good projects, those tokens will always bounce back and those that sold off their holdings will regret doing so. Really appreciate your presentation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bravo @azamjee! Your post dissecting token unlocks in The crypto landscape is truly enlightening . your knack for breaking Down intricate subjects & Offering valuable Insights is commendable . Ive gained A deeper Understanding of token Unlocks from your well - structured post. keep Up the fantastic work & I'm Eagerly Looking Forward to More educational content from you! 🌟💡

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unlock tokens it's very essential topic for crypto. And you have enlighten it with your thoughts about this very important topic. And you have described very good methods of Unlocking tokens. And yes , risks and benefits are along with it. Thanks for sharing this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola Azaamjee 😊

Se ve que tienes un solido conocimiento respecto al tema, la investigacion fue bastante completa y todo fue explicado a detalle. A mi particularmente me gusto mucho este tema, me parecio un interesante concepto que es bueno saber.

Exitos

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Es un excelente post muy completo en su contenido. Me gustó la manera de abordar las preguntas del desafío.

El proceso de bloqueo y desbloqueo de un token es una necesidad del ecosistema que busca estabilidad, tranquilidad en los inversionistas a largo plazo.

Gracias por compartir, ¡un gran saludo!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit