Designed by @bilaldar113 Using Post Maker

Hey Everyone!

This is my homework task for @reminiscence01 in which the professor explained confluence trading strategy. I would like to thank him for teaching in a simple and great manner. This strategy can be useful for every trade as it shows how fake signals can be avoided and you can also realize its important by going through my homework post.

Explain Confluence trading. Explain how a trade setup can be enhanced using confluence trading.

Explain Confluence trading. Explain how a trade setup can be enhanced using confluence trading.

Confluence Trading is one of the most renowned methods and the core reason due to which it has gained popularity among traders is that considerable profits can be booked while it minimizes the risk of loss to a great extent. It is done by using multiple tools as a single one can produce a fake signal which often occurs in the crypto market. So, anyone can avoid fake signals through confluence trading as it only helps in finding profitable setups.

Before opening any position, a trader must verify through confluence trading to enhance the setup as it can show whether the predicted result is accurate or not. I can give you a detailed example of how it can enhance the setup from the chart patterns of FTM/USDT.

I have drawn a trendline that shows that price is bullish while you can see that RSI is in a continuous downtrend. So, if I would have relied on RSI, then my stop loss would have been hit because it was signaling a bearish trend while the commodity was bullish.

I also applied EMA which was below the trendline representing a bullish trend. So, with the help of trendline and EMA, I would have deduced that it is wise to long the commodity rather than opening a short position based on the RSI signal. So, bottom line is that the confluence trading method has enhanced my setup assisting me in finding a great trade.

Explain the importance of confluence trading in the crypto market?

Explain the importance of confluence trading in the crypto market?

One can’t simply overlook the importance of confluence trading in the crypto market as it has helped countless traders make a good profit and avoid fake signals. It is said that “Trend is Your Friend” and the best benefit of confluence trading is that it can show the trend of the commodity through multiple tools and the trader can enter accordingly. So, if the trade is opened in the direction of the market, then it will be surely profitable and risk-free.

You might have also noticed that indicators give the fake signal and no one would like to face loss based on such signals. But if 2 or more tools are combined then we can get a much better signal. Suppose that 2 tools are making a bullish signal while 1 is making a bearish signal, you will surely open a long position as the majority of tools are in support of the uptrend. So, confluence trading can give accurate, reliable, and profitable signals.

Another benefit is that sometimes a trader finds a setup but doesn’t have enough confidence to enter it. However, multiple confluence through various tools can assist in predicting perfect outcomes and give unmatched confidence. There are much more benefits of confluence trading to mention and you can easily understand them once you start trading through this method.

Explain 2-level and 3-level confirmation confluence trading using any crypto chart.

Explain 2-level and 3-level confirmation confluence trading using any crypto chart.

The professor has explained in the course that there are 2 types of confluence trading methods that can be used by traders. There’s not much but minor difference and you will get to know all about it through the comprehensive details that I will provide along with examples from the live market.

2-Level Confirmation Confluence Trading

2-Level Confirmation Confluence Trading

In confluence trading, we use several tools based on trader preferences to find the setup that has maximum chances of giving a profit. In this method, we can use 2 tools of personal choice to find a setup with utmost confluence.

The chart of ICP/USDT shows that I have used RSI and EMA as the professor has also taught this method with those indicators and I also trade using them. I have to observe the price action for a bit and see where those indicators are adding confluence so that I can open a position in that direction.

The RSI was between 0 and 30 which is the oversold zone and indicates that it can start a bullish trend. So, one of my indicators showed a bullish signal. My 2nd indicator also represents a bullish state as the candles are above the line. After observing both of my tools, they were adding confluence to the uptrend which means that ICP can be purchased.

3-Level Confirmation Confluence Trading

3-Level Confirmation Confluence Trading

Contrary to 2-level confluence trading, we use around 3 tools for confluence in this method as it gives more detailed information about the commodity and signals like whether it should be bought or sold.

I have mentioned an example of the ALICE/USDT chart in which you can see that price is in an uptrend by forming highs but it broke the structure by making a low which is the sign of break of structure. The candles were trading below the EMA line and RSI was overbought. So, all 3 tools show a bearish trend which is the signal of selling the commodity.

Analyze and Open a demo trade on two crypto asset pairs using confluence trading. The following are expected in this question.

Analyze and Open a demo trade on two crypto asset pairs using confluence trading. The following are expected in this question.

a) Identify the trend.

a) Identify the trend.

b) Explain the strategies/trading tools for your confluence.

b) Explain the strategies/trading tools for your confluence.

c) What are the different signals observed on the chart?

c) What are the different signals observed on the chart?

I will open trade on 2 different crypto assets through the confluence trading method to show you that it truly gives amazing profit and you will also get to know complete details on how you can trade using this method.

1st Demo Trade

1st Demo Trade

I will be making the first demo trade on BNB/USDT chart on tradingview through 2-level confluence trading. The first thing I had to do was identify the trend and I used EMA to do that. The following chart shows that price was above the line so we can say that it is bullish at the time of trading.

As for the strategy and tools, I will be simply using EMA and RSI as one of them gives a trend reversal signal while the other shows the ongoing trend. As mentioned earlier, EMA shows that the commodity is bullish while RSI was in the oversold zone showing trend reversal. Both indicators give a long signal so I opened my position with risk to return ratio of 1:5.

My setup is currently in profit and near to hit the TP.

2nd Demo Trade

2nd Demo Trade

I will be making 2nd demo trade on ALICE/USDT chart through 3-level confluence trading so that I can cover both methods taught by the professor. I started by identifying the trend and it was bullish because the price was trading above the EMA line.

As for the tools, you can see that I applied EMA, RSI, and break of market structure. EMA showed that the price was in an uptrend and RSI was oversold. The commodity also broke the bearish structure and started making a series of highs. So, all tools were making a signal of a long position due to which I bought the asset with a risk to reward ratio of 1:5. The TP was easily hit and the profit was booked.

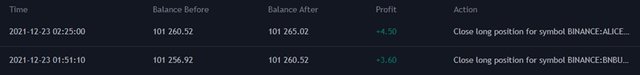

I have attached a picture below that shows that TP of both setups was hit and profit was gained.

Conclusion

Conclusion

The conclusion of my homework is that an expert trader should never rely on a single tool but use the confluence trading method. Several indicators can provide an accurate signal that has lower chances of hitting stop loss. A trader should at least use 2 indicators so that fake breakout can be avoided and maximum profit can be gained.

Thanks For Visiting My Post

Cc: @reminiscence01