.png)

Introduction

Leverage trading refers to a type of trading strategy whereby traders borrow money from brokers, exchange firms, etc, and used it in trading. Leverage trading grants the opportunity for traders to buy huge sums of assets with just a little capital. Leverage trading allows traders to purchase assets multiple times with the small capital they borrow from the exchanges with the aim of earning huge profits.

Traders can purchase assets 2X, 5X, 10X, etc greater than the capital they borrowed from the platform. When leverage trader's prediction goes the right way they earn the huge sums of profit that they targetted, but when the trade goes against their predictions, then they lose their invested capital at the end of the trade. We see to it that from the explanation above, there is high liquidation of the invested capital of a trader in leveraged trading than in non-leveraged trading.

With all the benefits of leveraged trading to a trader in the market, we must also know that leveraged trading is very risky and as such a novice trader shouldn't make a mistake and try to apply that strategy in his trade. I advise that only experienced traders should use this strategy in trading and must know how to manage risk in trading to avoid loss of the invested capital or liquidation.

An example of leverage trading; Let's say I am going to buy or enter a trade with $200, then I decide to leverage 10X, meaning that my trade investment would now be $2000 instead of the initial $200. This additional $1800 that was added to my initial investment capital is being borrowed from the exchange platform or broker which comes with a fee. Similarly, any multiple times you select, it multiplies your initial investment capital by that and then borrows you the additional income needed to perform the trade.

In this section, I would discuss some of the benefits of Leveraged Trading in crypto-assets and they include the following;

Leveraged trading helps traders to earn huge profits with the small invested capital they used in trading. This is when the prediction of the trader goes right then he would smile at the end of the trade and go with a very huge amount of money/profit depending on the leverage he selected.

In leverage trading, traders are provided with the opportunities of high purchase with the small invested capital they entered the market with. These leverages include 2X, 4X, 5X, 10X, 50X, etc of the capital invested initially. This is why leverage traders earn such huge profits when the trade goes in their favor.

Leveraged trading is meant for short-term trading and such a trader does not have to sit back for long waiting to see if the future prediction he placed has gone right or wrong knowing the fluctuations that may occur in the market as it takes longer. Leveraged trading is just targeted for earning huge profits within a short period of time.

Leveraged trading also permits traders to secure positions when they see that the price prediction they gave is correct. This means that they can partially earn a profit when the prediction is going right or partially avoid loss when they see the price prediction going against their prediction. Wow, this is super and it helps to reduce the risk involved in leveraged trading.

In leveraged trading, traders can equally diversify their trades by opening multiple trade positions on two or more assets because of the high purchasing power with the leveraged account. This reduces the risk of liquidation of one's account especially if all invested capital is used to trade one asset and the prediction goes wrong.

In this section, I would be discussing some of the disadvantages of Leverage Trading;

As I said earlier, there is a high risk in leverage trading and one must be an experienced trader before using this strategy. A Wrong prediction can cause the liquidation of the invested capital as well as clear the whole account balance especially when higher leverages are used.

Leverage trading attracts trading fees for holding traders over days, unlike spot trading where there are no extra fees charged for holding a trade overnight. Leverage trading charges extra fees for holding trades because of the borrowed asset used in trading.

Leverage trading as we discussed earlier is very complicated and as such novice traders or naive traders must stay away from this strategy. Leveraged trading is for experienced traders who can manage risk and also use technical analysis to correctly predict the price movement of an asset in the market.

In this section, I would be discussing three different indicators that can be used for Leverage Trading including their importance as well. These three indicators I would be discussing include the following; Exponential Moving Average, RSI Indicator, and the Parabolic SAR indicator. We would first look at the Exponential Moving Average indicator used for leverage trading.

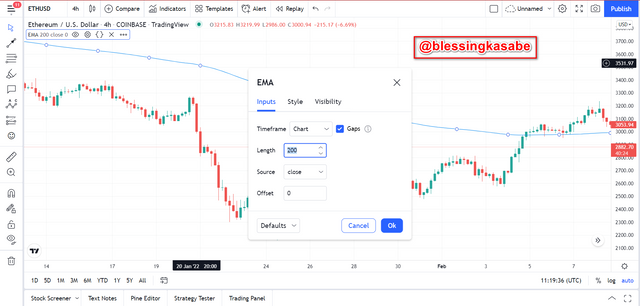

The Exponential Moving Average

The Exponential Moving Average (EMA) indicator is a type of trend indicator that is used by a trader to determine the region of support and resistance levels as well as the price movement of the price of an asset. The EMA looks similar to the Simple Moving Average indicator but differs in its calculation. The EMA is calculated from the most recent price movement of the asset's data.

The EMA is much considered as compared to that of the SMA and this is as a result of how fast it reacts to price movements and trend change or trend reversal. In using the EMA an uptrend is identified or signaled when the price of the asset breaks and stays above the EMA. Similarly, when using the EMA a downtrend is identified or signaled when the price of the asset breaks and stays below the EMA indicator.

The parameters of EMA such as the period must be configured with respect to the type of trading system used and also it depends on the type of trader(Scalpers, Swing traders, and Intra-day traders) going to use it. It is advisable for scalpers and Intra-day traders to utilized lower periods 8, 18, and 21 EMAs whilst swing traders are also advised to use higher periods 50, 100, 200 EMAs.

The Relative Index Strength Indicator

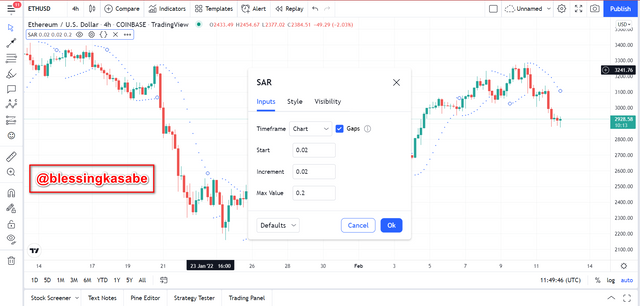

Parabolic SAR indicator is a type of indicator that helps traders to identify the directional bias of the price of an asset and also in determining the entry and exit point in the market. It also helps traders to identify any price change in the movement of an asset's price within a given period. The Parabolic SAR indicator is indicated by dotted lines on crypto charts which are seen either below or above the price trend of an asset. When using the Parabolic SAR indicator, sellers become the controller of the market when the dotted lines are seen above the price movement of the asset. Conversely, buyers become the controller of the market when the dotted lines are seen below the price movement of the asset.

Furthermore, when there is a discontinuation of the dotted lines from one direction and continues in the other direction then we say that trend reversal is signaled. For example, a bearish trend reversal can be indicated by discontinuation of the dotted lines of the Parabolic SAR below the price movement of the asset and a continuation above the price movement of the asset.

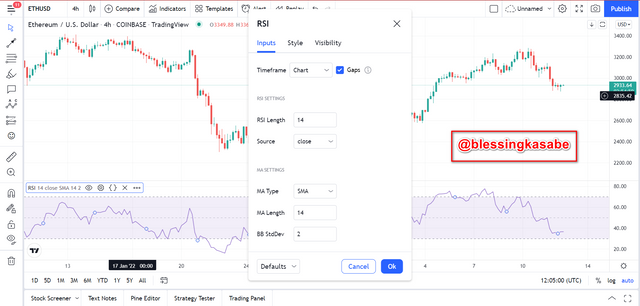

The Relative Strength Index Indicator

The Relative Strength Index indicator is a volume-based indicator that helps traders to identify overbought and oversold regions on crypto charts. It also helps traders to identify support and resistance levels on crypto charts. The RSI indicator is comprised of two levels, i.e. 30 and 70 RSI levels.

In using the RSI indicator, when the price of asset moves below the 30 RSI mark, then it is an indication of an oversold formation and also an indication of a possible bullish reversal in the price movement of the asset. Similarly, when the price of an asset moves above the 70 RSI mark, then it is an indication of an overbought formation and also an indication of a possible bearish reversal in the price movement of the asset.

In this section, I would be using discuss how to perform leverage trading using special trading strategies by using using the EMA and RSI indicators to support my entry and exit points. In leverage trading, to combine different indicators in order to enter or exit a trade, the combined indicators are used with a chart called the Heikin Ashi Chart. It is a way of representing price on charts by using the price data of the asset from the previous candle in order to predict future prices on crypto charts. Now, let's look at taking a buy position using leverage trading.

Leverage trading for Buy Position

When trading leverages for a buy position, the price of the asset must be an uptrend movement whereby consistent higher highs and higher lows are formed. From the different indicators combined we first observe and analyze the EMA indicator to make sure that the price of the asset moves above the EMA indicating a long-term uptrend movement in the price of the asset. Again, we then observe and analyze the Parabolic SAR dotted lines to see if it switches from the above price movement of the asset to below the price of the asset which indicates a price reversal from a bearish trend to a bullish trend.

Lastly, we would then make analysis and observation from the RSI indicator and make sure that the RSI line is seen below the middle market i.e. the 50 level. And when the RSI indicator line further moves below and breaks the 30 mark then it is an indication of an oversold condition and a strong confirmation of the trend reversing from a bearish trend to a bullish trend.

Al the above conditions must be satisfied by the three indicators before a buy order trade can be strongly be confirmed. A good illustration is shown in the chart below.

From the ETHUSD chart shown above, we can clearly see that the three indicators satisfy all the rules mentioned above. We can clearly see that the Parabolic SAR indicator gives a buy signal as well as the EMA 200 indicating a buy signal as we saw that the price of ETHUSD was trending above the EMA 200 showing a buy signal. Also, the RSI indicator also displayed a clear bullish movement in the price of ETH as we saw that the RSI mark was below the 30 level or mark. Stop-loss was placed below the current or recent low and take-profit was placed targeting the high point nearer.

Leverage trading for Sell Position

When trading leverages for a sell position, the price of the asset must be a downtrend movement whereby consistent lower highs and lower lows are formed. From the different indicators combined we first observe and analyze the EMA indicator to make sure that the price of the asset moves below the EMA indicating a long-term downtrend movement in the price of the asset. Again, we then observe and analyze the Parabolic SAR dotted lines to see if it switches from below price movement of the asset to above the price of the asset which indicates a price reversal from a bullish trend to a bearish trend.

Lastly, we would then make analysis and observation from the RSI indicator and make sure that the RSI line is seen above the middle market i.e. the 50 level. And when the RSI indicator line further moves above and breaks the 70 mark then it is an indication of an oversold condition and a strong confirmation of the trend reversing from a bullish trend to a bearish trend.

All the above conditions must be satisfied by the three indicators before a sell order trade can strongly be confirmed. A good illustration is shown in the chart below.

From the ETHUSD chart shown above, we can clearly see that the three indicators satisfy all the rules mentioned above. We can clearly see that the Parabolic SAR indicator gives a sell signal, as well as the EMA 200, indicating a sell signal as we saw that the price of ETHUSD was trending below the EMA 200 showing a sell signal. Also, the RSI indicator also displayed a clear bearish movement in the price of ETH as we saw that the RSI mark was above the 30 level or mark. Stop-loss was placed above the current or recent high and take-profit was placed targeting the low point nearer.

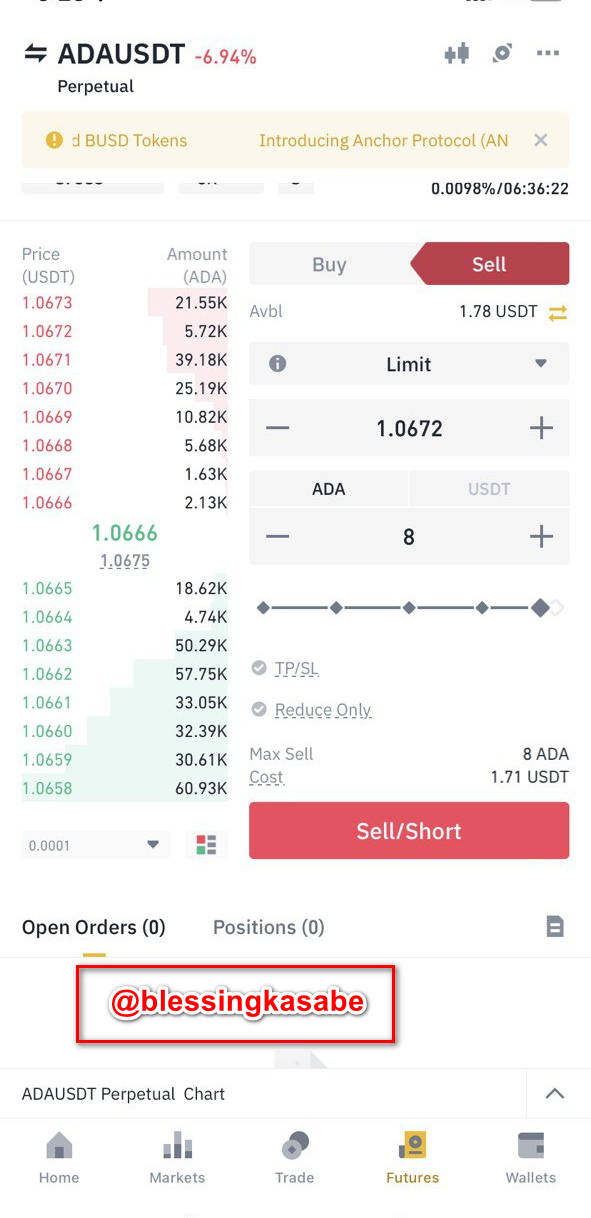

Sell Trade ADAUSDT (5 MINS)

In this section, I would be demonstrating a real trade on ADAUSDT in a 5 minutes timeframe.

Observing the ADAUSDT chart shown below, I observed that the price of ADAUSDT was trading below EMA 200 indicating a bearish current trend. We again observed from the Parabolic SAR indicator that the dotted lines of this indicator started to move above the price movement of the asset confirming the bearish trend.

In addition, we looked at the RSI indicator and we saw that the price of ADAUSDT was above the 50 mark of the RSI which confirmed the bearish trend of the current price.

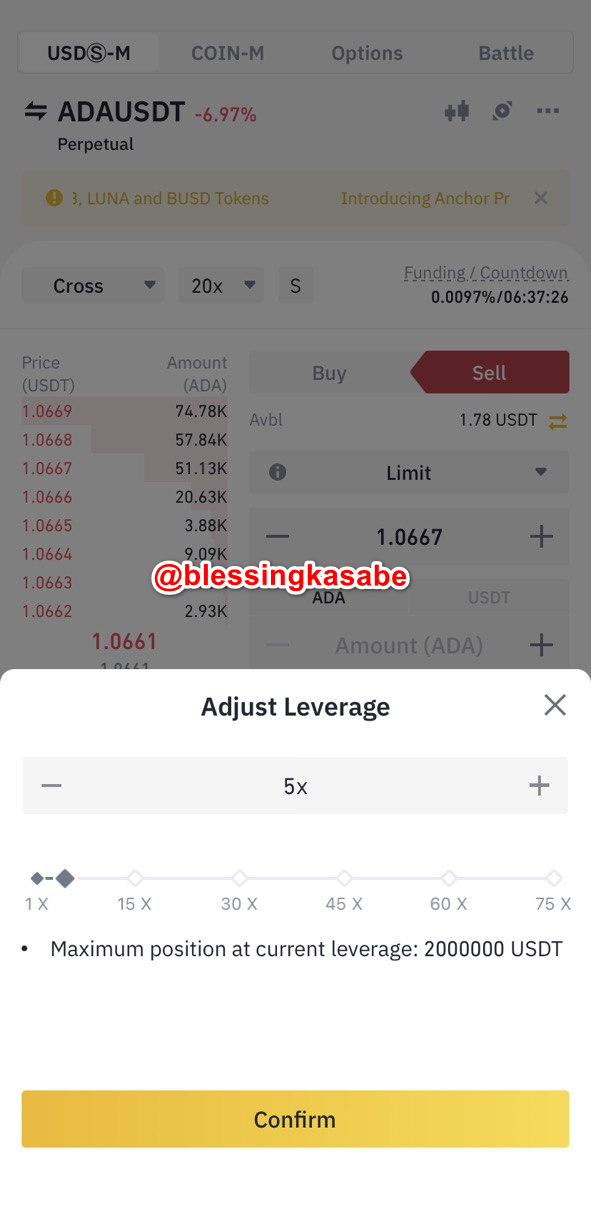

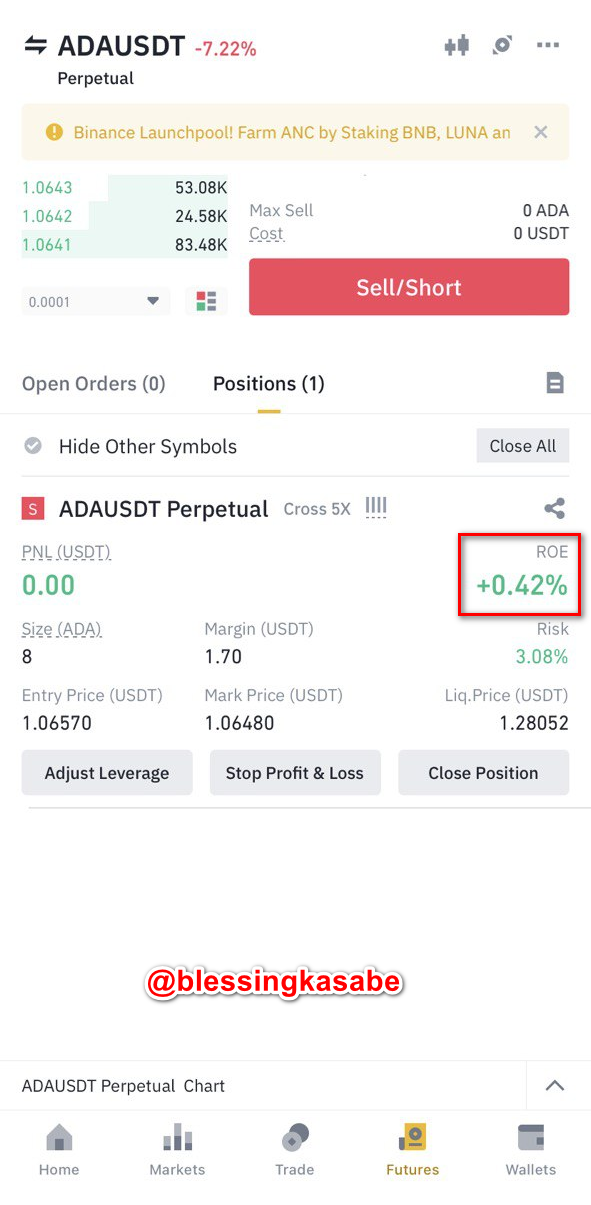

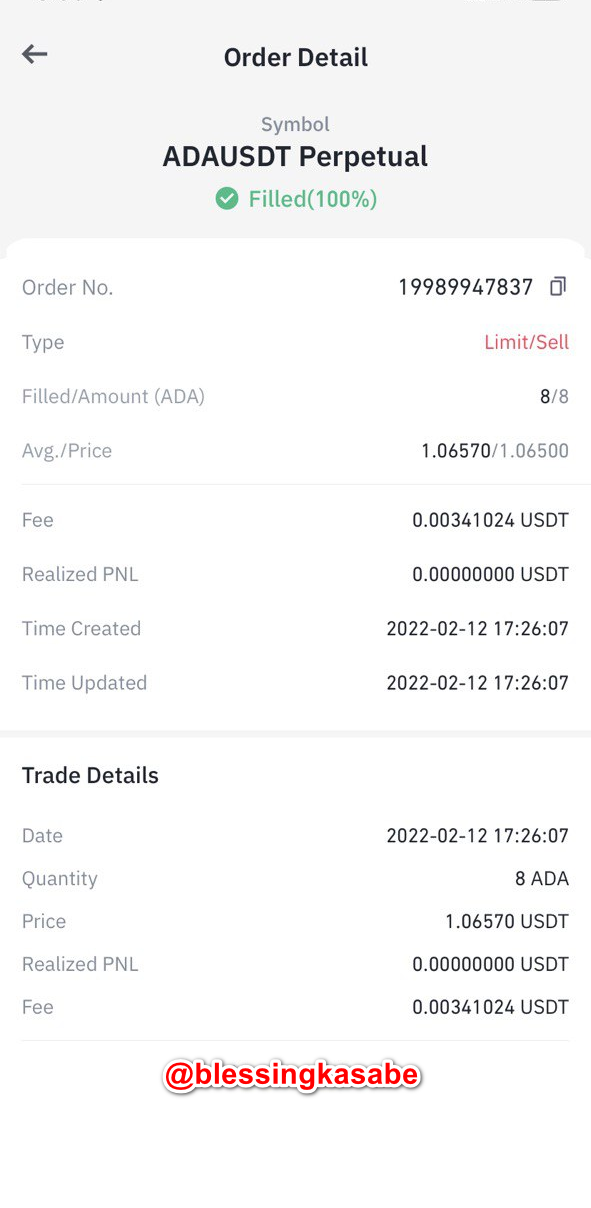

After seeing that all the three conditions were satisfied at the price of the asset, I then executed a sell order trade using the leverage of 5X on my Binance account.

The trade was executed at $1.06570 with stop-loss placed at $1.0780 and take-profit at $1.052.

The risk to reward ratio for the trade was 1.6

I then exited the trade when a percentage profit of +0.42% was obtained on the trade.

Conclusion

To conclude, I would like to summarize what we have done so far in this article. First of all, we discussed the concept of leverage trading in the crypto market. In addition, we discussed the benefits of leverage trading to a trader.

Furthermore, we discussed some of the disadvantages of leverage trading in the crypto market. We also looked at how to use three different indicators with leverage trading to maximize profits.

These three indicators were the RSI indicator, EMA indicator, and Parabolic SAR. Moreover, we also discussed and explained how to perform leverage trading using some trading strategies. Finally, we did a real trade using 5X leverage.

I would like to say a very big thank you to professor @reddileep for this wonderful lecture. I have really understood the concept of "Leverage With Derivatives Trading Using 5 Min Chart".

Thank You.