Edited with imarkup

Greetings to the entire Steemit Ecosystem in general and the Steemit Crypto Academy in particular. I feel elated participating in the Second Week of the Steemit Engagement Challenge. To kick off this week's challenge I will be discussing centralised exchanges and also reviewing my favourite centralised cryptocurrency exchange: the Binance Exchange (which is very likely also going to be the preferred choice of most people).

Discuss briefly Centralized exchanges and its Benefits to crypto users.

Centralised cryptocurrency exchanges are very crucial vehicles that aid transactions with cryptocurrencies which can include the trading of cryptocurrencies, lending and borrowing of cryptocurrencies, staking, liquidity farming, auto-investing and a lot of other activities related to cryptocurrencies. A centralized cryptocurrency exchange can be defined as a platform which is hosted on the internet through which users can perform transactions on cryptocurrencies. Centralised cryptocurrency exchanges have become the most common type of crypto trading platforms adopted by users globally.

Cryptocurrencies are considered to be decentralized. However, centralised exchanges act as third parties or intermediaries between sellers and buyers of cryptocurrencies. Usually, a company is responsible for their control and operation. It is on record that up to 95% of all transactions related to cryptocurrencies are done through centralised exchanges according to KPMG.

They participate directly in the clearing of trades. They operate through the use of digital order books that showcase all the open buy and sell orders as a list. These order books also show the prices and volumes of the assets. They showcase the current price of an asset in the market which is actually the last price it was traded for. Equally, they match up cryptocurrency sellers with buyers for the purpose of transactions.

Centralised exchanges act as middlemen trusted by both buyers and sellers and operate in the manner that banks are set up. They monitor and offer security to the funds made available to them by individuals. They also have to source trading partners for investors. Usually, they are in custody of users' funds and hold the private keys to such wallets where the funds are stored. This may safeguard against investor carelessness if the private keys were to be with investors.

Examples of centralised cryptocurrency exchanges include Binance, Coinbase, Kraken, Gemini, KuCoin, Probit, Hotbit, etc.

Benefits Of Centralised Exchanges To Crypto Users

There are a number of important benefits or advantages centralised cryptocurrency exchanges offer to its users. Some of these benefits include:-

Provision Of Organised Services:- Centralised cryptocurrency exchanges are notable for providing crucial and well organised services to investors or cryptocurrency traders. Sometimes they operate with call centres for their customer service personnel who are usually well trained to communicate and assist investors. Again, they operate a special infrastructure which is necessary for custodian services where digital currencies of investors are stored. In some cases special online hardwares can be provided for the storage of digital coins.

They Give Legitimacy To Trading:- Actually, centralised exchanges perform the important task of making the trading of cryptocurrencies legit and reliable. This is because if they were to be absent then it would be difficult for cryptocurrency traders to have platforms that would enable them to enter and exit cryptocurrency markets. Doing this may come in ways that involve more uncertainty and risk.

Provision Of Fund Insurance:- Centralised cryptocurrency exchanges due to the fact that there are sometimes prone to attacks make efforts to insure the funds that are deposited by users with them. An example is the Binance Exchange which claims to have the availability of a special fund which is meant to cushion the effect that could be experienced by investors in the case of attacks or loss of funds.

Provision Of Special Tools For Investing:- Centralised cryptocurrency exchanges usually offer additional value-added services to their users. One of such is the provision of specialised tools such as charting tools that are helpful for making investing decisions. Such charting tools display the movement of price action of assets as well as other important information that help in making decisions in the trading of cryptocurrencies.

User-friendliness:- Centralised exchanges have been observed to be quite user-friendly with investors who are not very familiar with cryptocurrency trading. Users can simply log into their accounts and easily navigate to whatever features they desire to use. They can easily have access to their account balances and make use of the websites and applications available to conduct several kinds of transactions including even peer-to-peer trades.

What do you look out for when choosing an exchange to trade your crypto assest?

image from pixabay

There are quite a number of things I would usually look out for when making the choice of the cryptocurrency exchange to trade with.

Accessibility

The first time I thought of choosing an exchange for trading I had to ensure that my location could access such an exchange. That was why I had to settle for the Binance exchange which is accessible from Nigeria West Africa where I live. I'm aware that this site is not accessible in the United States and places like China have not allowed citizens to access crypto exchanges in any form.

Security

The next and of course one of the most important things I also look out for is security. To this regard I normally check to know whether such an exchange has any form of insurance for users' funds. The Binance exchange claims to have set aside a certain amount of funds in the case of a hack to refund users. Coinbase has a $255 million worth of insurance policy available.

Liquidity

Whenever I am planning to trade crypto currencies on any exchange I would normally look out to ensure that there is high volume of trades which would be enough to ensure that my holdings remain relatively liquid (that is to say that I should be able to sell them anytime I wish to). The larger exchanges have more liquidity. That is why I settled for Binance. This would ensure that I may not have to sell at a relatively lower price than my preferred price target due to negative slippage.

Fees

The issue of fees is also very important to me when I'm making a selection of a crypto exchange to use for trading. Most times it is believed that when an exchange makes it easier for you to trade then they are likely to charge you more. That is to say, the more the liquidity, the likely higher trading fees are going to be. Nevertheless, I had to settle for the Binance exchange because the fees are relatively lower than other exchanges. Interestingly, when I hold the BNB token in my wallet I am given very huge discounts on my trades.

Review your favorite centralized exchange and explain its unique features

In this section I would be discussing some very important features obtainable on the Binance exchange.

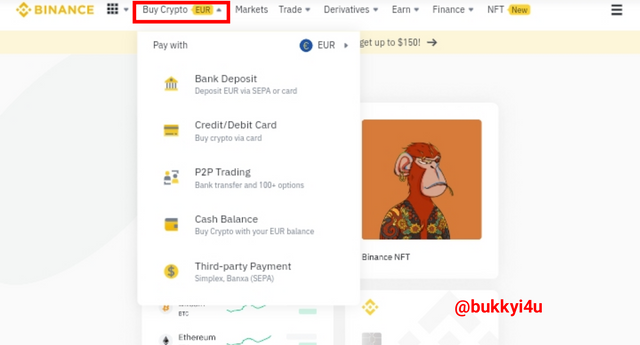

Buy Crypto

Source

This particular feature shown on the site is the gateway through which fiat currencies like the Euro can be used to purchase cryptocurrencies. There are several options for this which include the use of bank deposit, credit or debit card, P2P trading with up to 100 bank transfer options, cash balance where you can buy with your Euro balance on Binance as well as use of third-party sites like Simplex.

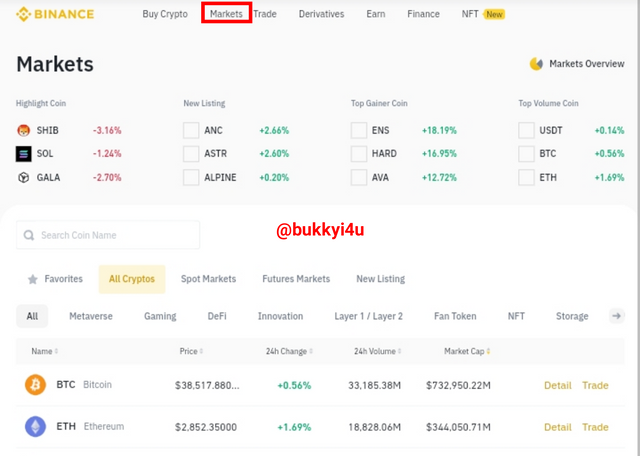

Markets

Source

Under this section you can view the various available cryptocurrencies that can be traded. There are features that highlight coins which are newly listed, the top gainers for the past 24-hours, the top losers and the coins with the highest traded volumes in the past 24 hours. Also, you can filter the coins based on various projects like metaverse, gaming, DeFi, innovation, NFTs, fan token, etc.

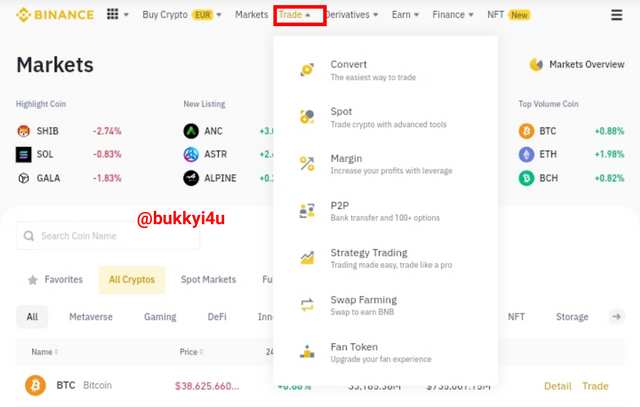

Trade

Source

Under the trade section there are several available actions you can perform. You can convert crypto assets from one to another, spot trade on assets (where you buy low and sell high), trade margins with leverage as well as a few other options like swap farming and holding fan tokens where you have the ability to vote on important issues relating to the club you support.

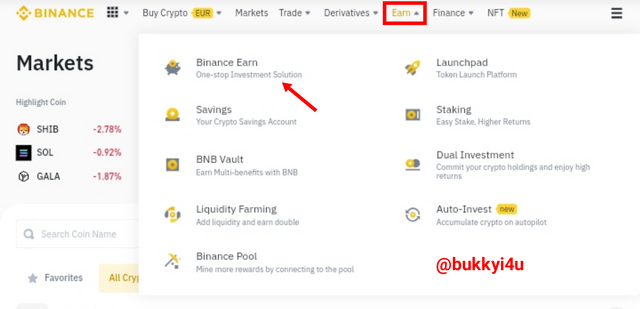

Earn

Source

Through this section you see a lot of various opportunities and options to gain profits on your cryptocurrencies by participating in several mouth-watering ventures in order to earn from such investments. There are options like staking, liquidity farming, connecting to Binance pool, earning from savings and benefiting from the dual investment options which are high-risk high-reward investments. Equally, you can create your own repeated investment plans with the auto-invest.

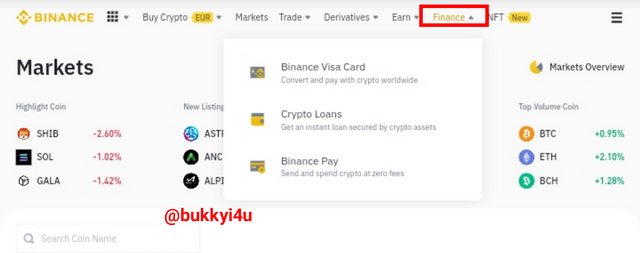

Finance

Source

Under this important section you have the opportunity of carrying out transactions like being able to possess a virtual card with which you can pay for goods and services while earning up to 8% cashback in the form of BNB which would be deposited to your funding wallet directly. Under here you can also obtain cryptocurrency loans and use the Binance pay option to spend cryptos without any fees attached.

Is there anything about your favorite exchange you will like to be changed? Discuss.

Actually, there is little or nothing I would want the Binance team to change on the Binance cryptocurrency exchange. The very first change or improvement I would like to see in the Binance crypto exchange is the removal of the hiccups that usually come in the process of account verification.

As much as the process of facial verification and identity card verification are all acceptable, I did experience a lot of difficulties when going through these processes of verification. I had to change my phone several times in order to successfully capture it. I would love to see this process made a lot easier and reviewed in much less time than it takes currently.

Furthermore, the main Binance exchange is not available in the United States and I wish this could be changed. Even though I may not benefit directly from this as I do not reside in the United States I believe it would be a great achievement if this could be worked on.

Apart from these, I believe every other thing is in order (at least based on the features I am interested in or using now).

What shortcomings do you see on centralized exchanges and how do you think user funds can be protected since we don’t have access to our wallet private keys?

As much as there are quite a number of benefits associated with centralised exchanges, there are some shortcomings I have observed with them some of these include:-

They Have Fewer Options Of Cryptos:- I have observed that sometimes investors just use centralized exchanges for safety rather than trading variety. A typical centralised exchange could offer up to about 50 different types of cryptocurrencies which is actually a small fraction of what is obtainable in the form of available in the entire cryptocurrency world(though Binance has up to 600). They only list the reputable ones but this reduces the options investors have for trading. Decentralized exchanges offer way more options than centralised exchanges.

They Come With Stricter Regulations:- Centralised exchanges are more regulated in a stricter manner by the government due to the fact that they are usually required to be licensed. This makes them have to follow a lot of stringent norms that may include requiring customers to fill forms that make them look like banks due to know your customer (KYC) requirements. Sometimes it is not all customers that would be very comfortable or have the patience of going through all this. Unfortunately, you may not be able to perform some transactions if you are not properly verified through the KYC processes.

High Transaction Fees:- When compared to peer-to-peer transactions or decentralized exchanges, centralized cryptocurrency exchanges come with fees on transactions which are quite high especially for Futures trading contracts. This may especially be due to the fact that they provide additional services meant for the comfort and convenience of their users.

Higher Risk Of Hacking:- The fact that centralised exchanges operate in a manner where the company's actually hold custody of the funds of customers or users in their online vault makes them a target for darknet internet activities. At a time, Mt.Gox used to be the largest cryptocurrency exchange in the world until about 850,000 bitcoins were stolen from it which led to the exchange being suspended.

Just like I have stated earlier the centralized exchanges are usually in custody of the private keys of users wallets. Users only have access to the passwords with which they can enter their accounts and view their balances. There are a few ways by which the exchanges can ensure the safety of users' funds.

The centralized cryptocurrency exchanges should take necessary measures and steps to ensure that their sites are highly protected to prevent hackers from gaining access to the exchanges. They should operate with highly secured vaults where the funds of users would be safely kept to cushion the effect should there be an attack on their exchanges. Nevertheless, there is a lot a user has to do himself in keeping his funds safe.

On the part of users, you should ensure that the centralised exchanges where you trade are compliant with AML and KYC regulatory checks. Exchanges with a feature of regular audits from external sources have the best chance of funds safety. Furthermore, as a user any cryptocurrencies or funds which you are not using for trading should not be left in cryptocurrency exchanges. They should better be stored offline in cold storage wallets to minimise the risk of losing funds to hacking activities.

Again, as a user you should learn to implement very strong passwords to your account to prevent unauthorised persons from gaining access to them. These passwords should be changed regularly. Also, you should enable two-factor authentication (2fa) on your centralised exchanges. Further, you should be careful of phishing attacks which could come from private messages, social media, and emails.

CONCLUSION

Today we discussed centralised cryptocurrency exchanges and I reviewed the Binance Exchange. Centralised exchanges act as intermediaries that hold the fund of users in their custody while facilitating transactions related to cryptocurrencies. They do come with a number of advantages like ease of use but are high targets of darknet internet activities.

In order to increase the security of funds, centralised cryptocurrency exchanges should consider keeping the funds of users in offline storage. This is the case with Coinbase which claims that 98% of funds belonging to its users are kept in offline storage. However, they also have a mechanism to make such funds available when they need to be traded actively.

Equally, it is advisable that users relying on cryptocurrency exchanges that already have a very large user base. This will not only ensure that they would likely get the best services but that they would have high chances of operating in a more secure, safe and organised environment.

Thank you for publishing an article in the Crypto Academy community today. We have accessed your article and we present the result of the assessment below

Comments/Recommendation

Total|8.5/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is wonderful content, well explained.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @wealthmary

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are welcome bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is interesting, I feel like it going through it again, recomended.. I love Binance as an exchange it has alot of features.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes @kingworldline, Binance definitely has a lot of interesting features which time and space may not permit us to fully elaborate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes of course am one there features beneficiary, kudos to them

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice content you have here. I love your explanation of centralized exchanges. I also like your choice of exchange of course, the number one exchange is Binance. I think also that the verification process just as you have said should be made less complex. Nice post once more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @gabikay for reacting. Indeed Binance is the number one exchange globally after Mt.Gox which used to be was compromised

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well articulated sir. Binance is indeed a top notch exchange, will lots of features. You have really ellaborated on this amazing exchange. It was nice reading from you...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Sir @bright-obias

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just like conventional banking institutions that acts intermediaries, centralised exchange also offers those services on their platform without you ever needing to grace the four walls of the exchange.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes Ma @beckie96830, centralized exchanges have brought banking realities to our digital and online experience

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One thing I hate about centralized exchanges which you mentioned are high network fees. I even had to dump one of them because of it. I think decentralized exchanges are the future right now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, indeed decentralized exchanges are way ahead in terms of transaction fees but the lack the needed liquidity. Interestingly, even Binance has launched its own DEX

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit