copyright free image from pixabay

Hello fellow Steemians, I welcome you back to Week 3 of Steemit Crypto Academy season 4. I believe you all enjoyed the courses just like myself. I particularly enjoyed the course on token redenomination presented by professor @wahyunahrul. Here is my entry for this week's homework task.

1). Explain what is Token Redenomination in your personal opinion? What distinguishes it from currency or other assets redenominations?

It is not uncommon to discover that throughout the different stages of a token it could undergo significant changes and adoption that usually represents it's good performance and success in the market. Sometimes the crypto market could become highly volatile such that the price or value of a particular token becomes very high. Consequently, it becomes difficult for the majority of the people to afford such tokens. This usually results in inflation. As a reaction to this, tokens may often undergo redenomination.

Token redenomination refers to a process whereby cryptocurrency assets are recalibrated or the value per coin subdivided to smaller values or digits. Normally, when this happens, the old currency or token would have to be exchanged for new tokens at a rate usually fixed in the market. The reason for this is to break the value of the token into simpler digits in order for more people who do not have so much money to afford it. For two major reasons - the need to increase liquidity and decrease inflation - this process often becomes necessary.

The liquidity of a particular token would usually decrease if the price of the token should become very high. It becoming high makes it difficult for more people to own the asset thereby creating the problem of few users or investors. This comes with a reduced volume of transactions in the market. Consequently, liquidity is highly reduced for the token. So, to capture the public who are unable to afford the high cost, redenomination becomes the solution.

Redenomination of currencies was a reality first observed with fiat currencies. Governments would often have to break the value per coin of their local currencies in order to increase the purchasing power of the population. This helps to ensure that more people, especially the poor masses are able to purchase goods and services. Equally, more services and goods can be gotten with smaller amounts of the fiat currencies.

2). Mention the advantages and disadvantages of Token Redenomination

Of course, there are reasons for the redenomination of tokens. Some of these reasons are actually why it often becomes necessary to do so. Hence, these can be seen as the advantages associated with them. Some of these advantages include:-

- The redenomination of the token makes it possible for more people to afford the coin as a result of it becoming more affordable. This increases the number of investors in the token.

- Redenominating tokens so that more people can participate in market transactions as a result of being able to purchase it helps to increase its liquidity in the market.

- The redenomination can often come with the opportunity to drive significant changes and new projects, including interesting features, into an already existing blockchain or platform.

- Equally, it improves the rate of adoption and "increases market transactions with the tolen*. This is due to the fact that more hands can afford it.

- Also, it often drives in new investors because a lot of people can afford to make investments with smaller amounts of money. This can *increase the market value" of the token.

As much as the redenomination of tokens comes with quite a huge number of advantages, there are a few disadvantages associated with the redenomination of the tokens. Some of these include:

- Sometimes after tokens are redenominated, the old ones would have to be converted to new ones. The different platforms where they would have to be exchanged may charge conversion fees that could be high for the small investors.

- Sometimes the fast or sudden change may take some people aback. This could cause investor fear and panic leading to some exiting.

- Some salient modifications like changes to names of the token may leave some people feeling left out

- Sometimes the fact that voted would often have to be cast to determine whether or not the redenomination should occur could mean that those who lost the polls could exit the market feeling disappointed

3). Do all cryptocurrency projects need to do Token Redenomination? Explain in your personal opinion

Actually, it may not be necessary that all crypto projects should undergo redenomination of tokens. I have two reasons for my assertion.

To start with, the redenomination of the token only becomes necessary if the price per coin or of the token becomes astronomically high so much so that it becomes difficult for a lot of small investors to participate in the ownership and transaction with the token. This leads to an inflation of the token and reduces liquidity. Hence, it becomes necessary to break down the prices of the asset.

If a particular token is not experiencing inflation or low liquidity as a result of the price not being too high for the majority of small investors, then there would be no need for redenomination. This is not to even consider the salient changes that could come with redenomination that would often require time for some people to adapt.

Furthermore, the fact that a lot of crypto coins or tokens which may have come with high-value per token are granulated into smaller affordable digits makes it often unnecessary to redenominate. Bitcoin is granulated into satoshis and Ethereum is granulated into wei. So, the smaller investors can afford the weis and satoshis. Hence, there would be no need for redenomination.

4). Choose a project that has or is currently doing Token Redenomination and show how to convert old tokens into new tokens.

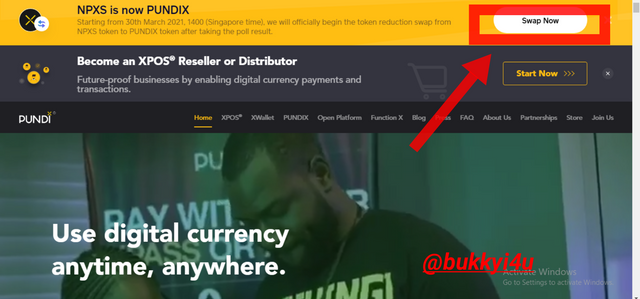

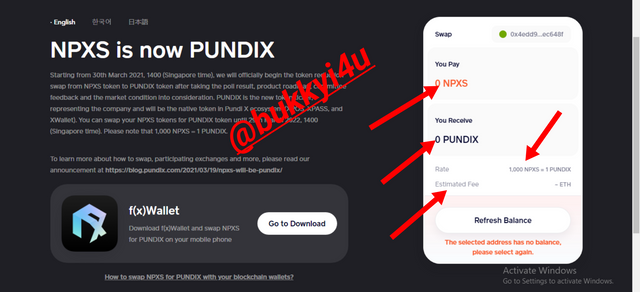

For this section I have chosen one of the more popular tokens that is currently undergoing redenomination. I will be going with the PUNDI X token. The redenomination of the NPXS to PUNDI X which started from the 30th of March 2021 means that for every 1,000 NPXS, 1 PUNDI X will be given.

Swapping the token from the old one to the new one can be done in three ways:

- It could be done on the exchanges where the token is supported in which case you do not have to perform any action or pay any fees as the swap would occur automatically

- Also, the swap will occur automatically for XWallet uses

- The third option is to do it manually (I will be describing the process below)

Swapping PUNDI X Manually

The manual swap can be performed on the PUNDI X official website https://www.pundix.com/

- Once on the site, I clicked the swap now option

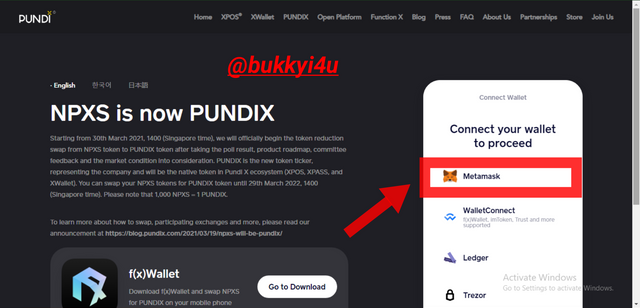

- On the the next page that opens up, I selected metamask to connect my wallet

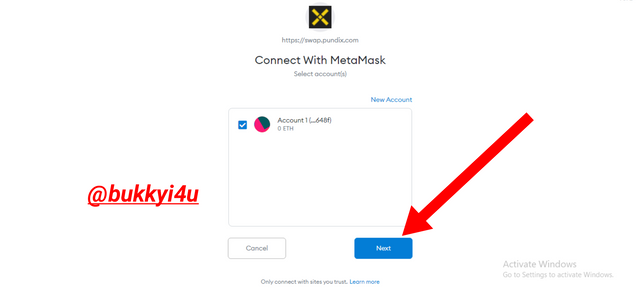

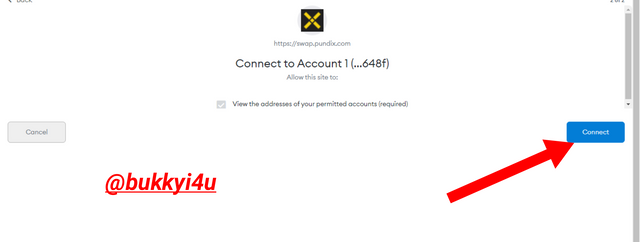

- The next options appears and I click next and, then, connect to give the necessary approval for the wallet

- A new option opens up and I am required to input the number of NPXS I wish to swap. The equivalent PUNDI X I would receive is equally displayed

- Once I make the inputs appropriately, the swap would occur after I have confirmed the transaction and the necessary gas fees would be deducted since the whole transaction is taking place on the Ethereum network.

5). Analyze whether the token from the project you chose in question number 4 is worth investing in.

The PUNDI X is a blockchain that was set up with the intention of developing devices on the blockchain that would help in transforming businesses, especially small businesses with the blockchain-based solutions they offer. The intention is to make it possible for these small or retail businesses to carry out quick and instant transactions on the blockchain.

It's ICO was launched in January 2018 after being founded in 2017. It was the first point-of-sale solution the world had ever known. Due to the success it recorded with its ICO it has launched XPOS, XPASS and XWallet which are products aimed at retail services. Equally, a blockchain phone known as BOB has been launched as the very first.

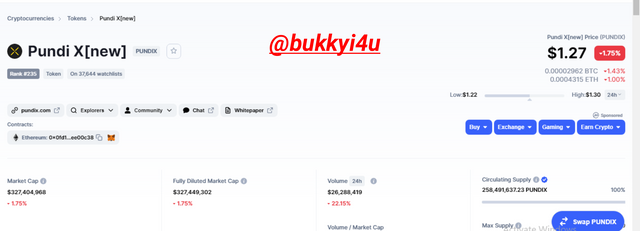

screen from Coinmarketcap

Although it is based in Singapore, it's devices and XPOS solutions have been transported to more than 25 international markets including Spain, United States, Australia, Argentina, Colombia, Taiwan and Korea. It was founded by Zac Cheah together with Pitt Huang and has the intention of making cryptocurrencies usable in everyday activities of life.

So, it's chief aim is to make sure that people and businesses can easily utilise their solutions which are based on the blockchain to quickly carry out buy, sell and other exchange transactions on a day-to-day basis.

That is it concerning the fundamental analysis of the coin. Now over to a few technical analysis.

| Parameter | PUNDI X Statistics |

|---|---|

| Pundi X[new] Price | $1.27 |

| Price Change (24h) | $-0.02102 |

| 24h Low / 24h High | $1.22 /$1.30 |

| Trading Volume (24h) | $26,198,914.17 |

| Volume / Market Cap | 0.07994 |

| Market Dominance | 0.02% |

| Market Rank | #235 |

| Market Cap | $327,734,713.36 |

| Fully Diluted Market Cap | $327,779,092.45 |

Looking at the table shows that this coin falls within the small market cap as it is below $1 billion. For the fact that it has an interesting and potentially widely adopted fundamental analysis means that this coin has a lot of potentials of exploding in value since it is within the small market cap and has room for expansion.

screen from Coinmarketcap

Equally, it's 24 hour price change shows that it has good potential for trading in the cryptocurrency market. From the chart displayed above, its price is currently in a period of low-volatility but the fact that it has an interesting use case and wonderful fundamental analysis means that we should expect a positive upward breakout which would normally follow such a low period of volatility.

CONCLUSION

Token redenomination can be seen as a process whereby the price or value of a token is broken into smaller pieces in order to make it possible for more small investors to participate in its ownership and transactions. It may often become necessary because inability of people to participate in large numbers can lead to lack of liquidity and inflation of the token in the market.

However, it is not every token that needs to undergo redenomination. While the redenomination of a token can come with quite a huge number of advantages - including increasing liquidity and reducing inflation - there could also be some disadvantages which would involve having to adapt to the new features.

Before making any investment into a cryptocurrency token, it is usually necessary to conduct a fundamental analysis on the token. Equally, it would be helpful to look at the historic performance from the price chart. This will help to determine whether such a token would be a potentially profitable investment or not.