Homework

1. Define the Order Book and explain its components with Screenshots from Binance

2. Who are Market Makers and Market Takers?

3. What is a Market Order and a Limit order?

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

5. Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens

(Make sure you are logged in to your wallet).

6. Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

7. Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

8. Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

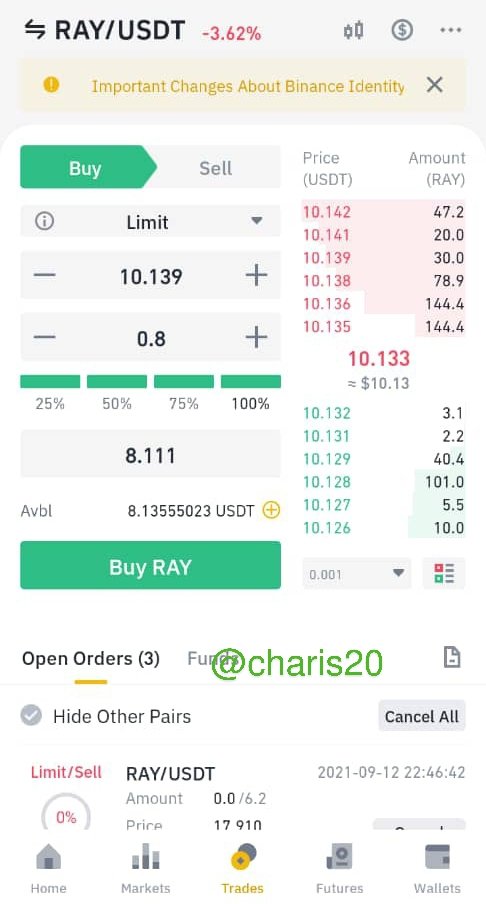

1- Define the Order Book and explain its components with Screenshots from Binance.

The Order Book consists of all the present Buy and Sell orders that has been placed.

|  |

|---|

The image above illustrates the order book placed between RAY/USDT in Binance trading app.

The Orders in green colour shows the buy at a particular price levels and the ones in red illustrates the sell order.

In the screenshot you will notice the buy limit so the trader sets it according to the way he wish as the market plays out it may work as he wish or not work out. Also the sell limit can also be set.

But one thing that should be put in mind is that it is not a signal for trading so therefore it should be used with order trading tools.

The Order Book is important to a trader because it helps to view the traders buy and sell target.

2- Who are Market Makers and Market Takers?

Just as in the open market where there are in existance a buyer and a seller, so also in the cryptocurrency world. But at some instance someone that is selling can also buy depending on his need at that time. You can sell egusi to buy corn, depending on your need at that moment. So also you can sell BTC and buy Steem.

Market Makers

Let me use an illustration to explain this point. I have 600BTC and i place and order to sell 200BTC at the rate of $100 in that way i just made the market and I can be called a market marker and the order will be added to my order book instantly. Both those that buy in buck and those that buy in little fractions can be market makers as long as they place orders and allow it to be filled in a future term.

Marker Takers

They are those that enters the market just to buy and exit the market. As in the first instance i gave using thenopen market, I want to prepare soup i go to the market to buy my ingredients and go home, in this am a market taker , so also in crypto trading, the market takers go to the market and buy at the very market price. They do not have businesswith setting a buy or sell limit. The price they meet in the market is what they buy.

3- What is a Market Order and a Limit order?

Market Order

This is an order that is placed to be excuted instantly that is at the market price prevalent at the given time

Market Limit

This is an order that is place at a particular take limit. In this the trader have his own target that he places so until it reaches the point it will not buy or sell.

4- Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

I will explain in my understanding how the market makers and market takers relate.

Here the market markers places their price according to what they desire to buy a commodity or even sell. They are traders all, so when the market takers enters the market to buy at the current price as their culture is they are now matched with the existing order of the market marker. Now i will say it is the market makers that makes available the liquidity while the market takers accepts or takes the liquidity.

5- Place an order of at least 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

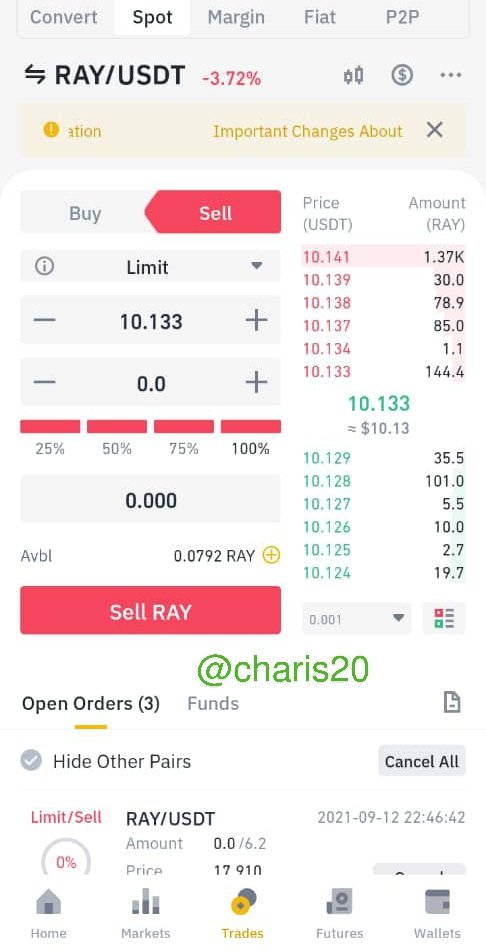

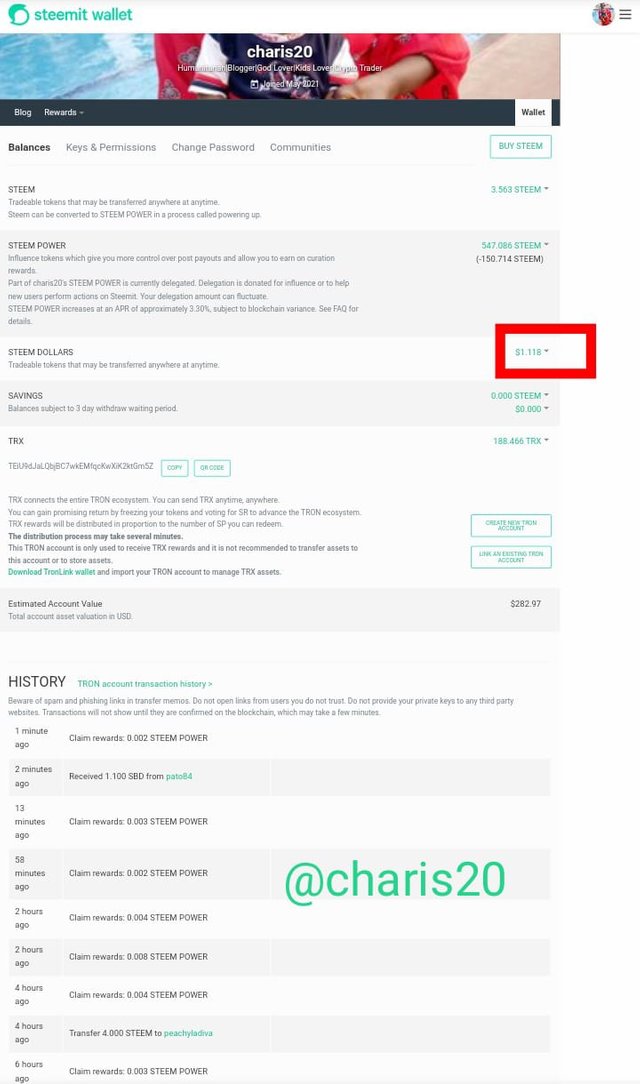

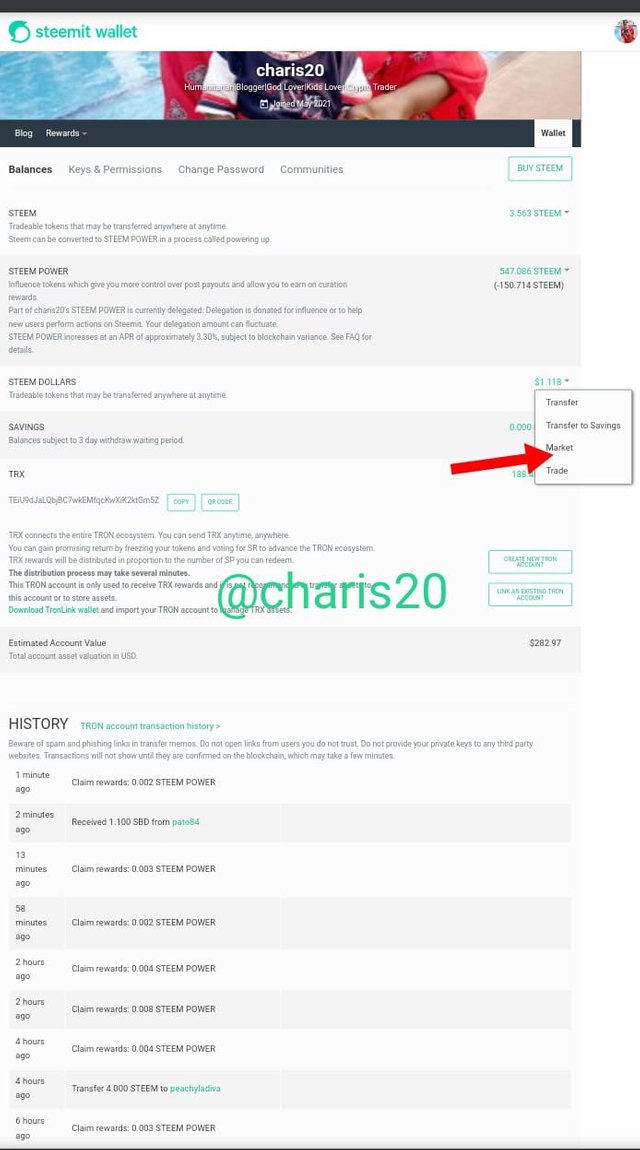

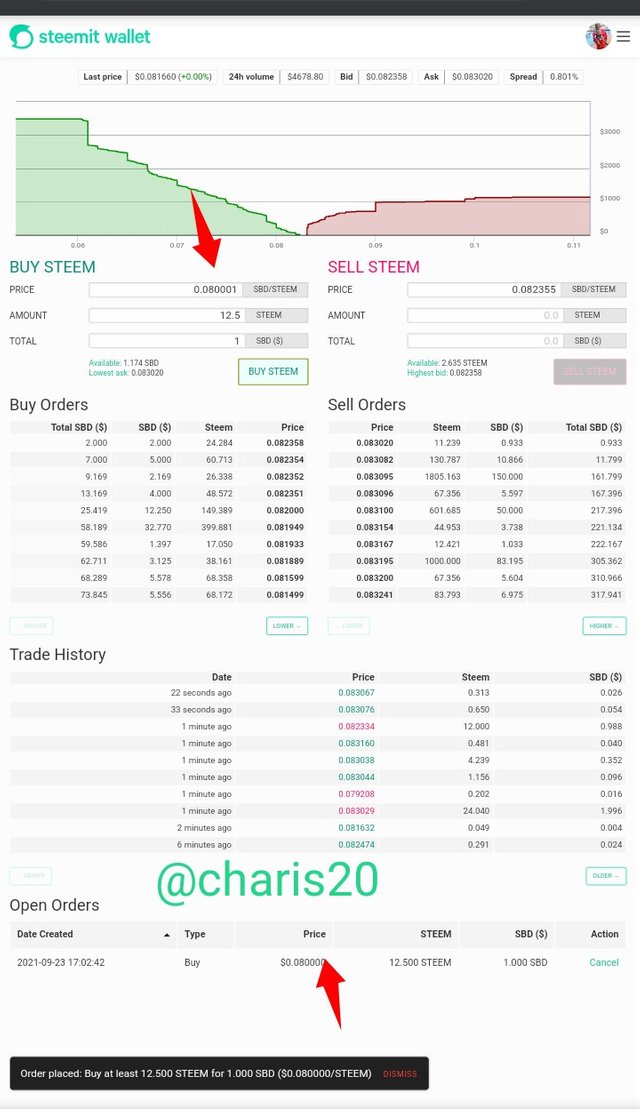

To complete the task first

- I logged into my steemit wallet.

- Went to market

|  |

|---|

By the day of this trade, the market was not so stable so the order was not instant because it kept moving up and down.

- Changing the lowest ask to my choice price. It became worse because it was way below the market price.

6- Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

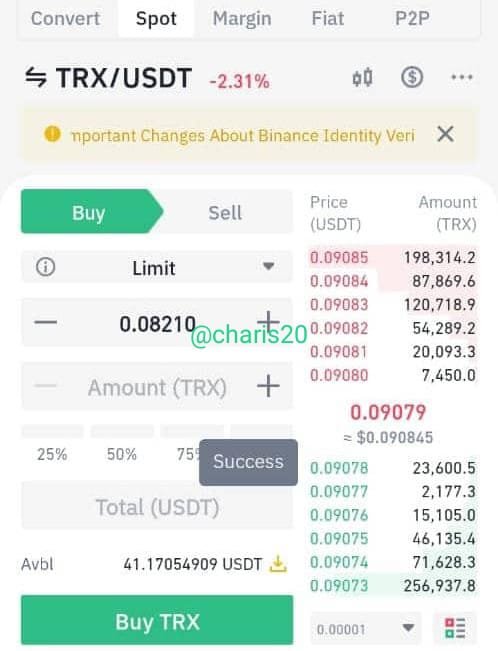

STEPS

- I searched for Trx on the market search button and chose usdt pair.

- I made sure i had about $15 usdt.

- I click on BUY button,

- Then i selected the BUY LIMIT order, I typed to BUY at $0.082,

- I clicked 100% and placed my BUY order

IMPACT

It has no impact yet as the orders where not filled yet. But the main aim is for orders to execute at a Lower price

7- Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

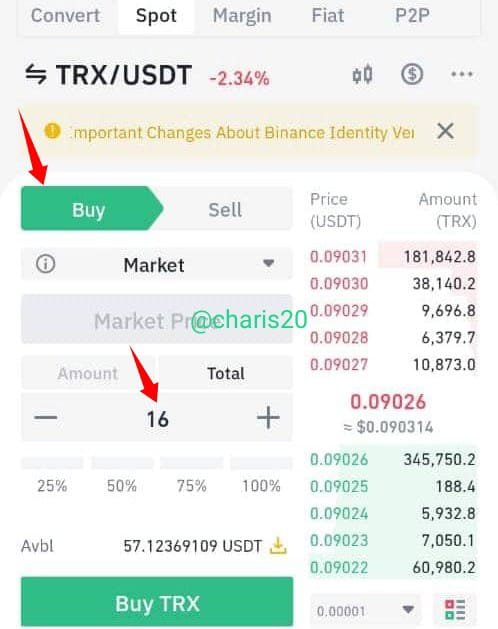

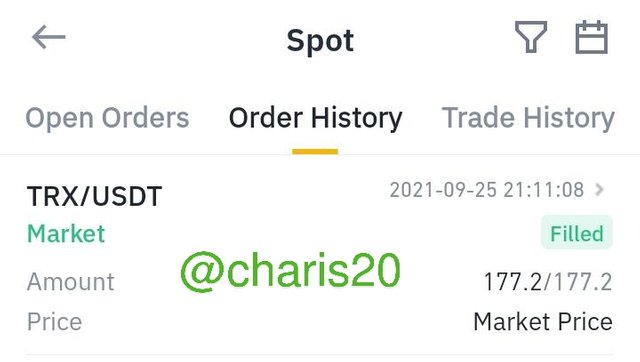

STEPS

- I searched for Trx on the market search button and chose usdt pair.

- I made sure i had about $15 but placed order of $16 usdt.

- I click on BUY button,

- Then i selected the Market order, clicked 100% and placed my Buy order

IMPACT

The impact on on my order is that the market bought a bit higher above the current price

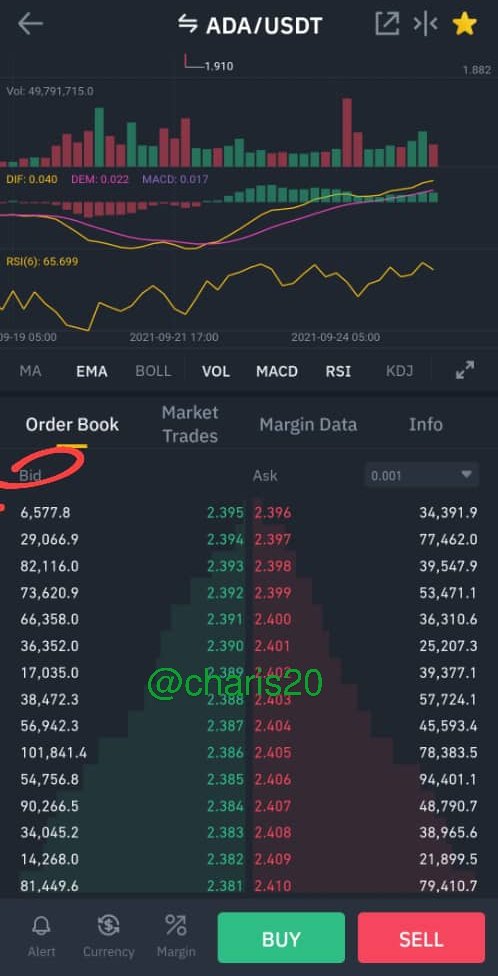

8- Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

a). Highest Bid and Lowest Ask prices here are $2.395 and $2.410

Calculating Bid-Ask %

BUYING $2.395

SELLING $2.410

Bid Spread here is $0.015/$2.410

0.622%

b). Highest Bid + Lowest Ask divide by 2

Mid-Market Price

$2.395+$2.410= 4.805

$4.805/2=$2.4025

$2.4025 is Mid-Market Price

Conclusion

Continuing in this weeks course has helped me to build on my pass knowledge on this course on Aid-Ask Spread thank you so much Professor @awesononso for this amazing course.

Cc: @awesononso

Best Regards

@charis20