Homework Task by Professor @stream4u:

What Is The Meaning Of Support Can Become Resistance & Resistance Become Support, When and Where set Buy trade, Chart Example?

What Is A Technical Indicator? (You can explore it as much as you can, like explain its role, show anyone technical indicator from your chart and name of that Indicator.?)

Provide your view and explore TradingView.

What is 200 Moving Average, how and when we can trade/invest with the help of 200 Moving Average? Show different price reactions towards 200 Moving Average

Source Tradimo

Support VS Resistance

Supports and resistances are some of the most fundamental topics when talking technical analysis of financial assets, especially cryptocurrencies.

They are actually very simple concepts. They are basically levels that prices are unable to break through.

Support can be defined as the floor levels of an asset's price, for example: BTC is trading at 40,000usd and crashes to 30,000usd; then it goes up to 35,000usd, then back to 30,000usd again; no matter how much selling pressure traders put on it, it doesn't go under 30,000usd - that will be considered the floor or the support line.

On the other hand resistance is just the opposite, if the price cannot go past a certain amount but touches it multiple times, that means that's the resistance line. Traders are refusing to buy above that price ceiling.

Supports and Resistances Reversed?

Now, how is that possible? That a resistance can become a support, and vice versa. This happens when a price reversal happens - when an upward trend becomes downward, or a downward trend becomes upward.

The previous support levels are generally the new resistance levels, when they are breached. The same goes for resistance levels, when breached they may become the new support lines.

In regards to trading, figuring out the supports and resistances will help you when buying or selling your cryptocurrencies. Graphs like this IOTA/USDT from Trading View will help:

Source TradingView

I'm using this as an example since, I don't know how to do proper TA on supports and resistance, so getting content elsewhere assure accuracy.

The blue bars indicate resistances, as well as one of the green line. The rising green line is the support - which you can extend theoretically to find future support indicators.

These support and resistance indicators will help you plan your trades by setting your purchases on the support prices, and sells on the resistance prices. Doing so, might minimize risks - since those are the actual trades people have been doing.

Technical Indicators

In trading cryptocurrencies, or actually, any kind of financial assets. Traders use 2 different kinds of analysis. Fundamental analysis and technical analysis. For cryptocurrencies, technical analysis can be done by using technical indicators.

These technical indicators are used to analyze all the available quantitative information like trading volume, buys, sells, demand, graphs.

In fact, earlier in this article, you were already introduced to 2 of the most basic technical indicators used for cryptocurrencies: support and resistance. They are not alone though. There are a lot of indicators that you can use as standalones or in conjunction with each other to analyze cryptocurrencies and make better trades.

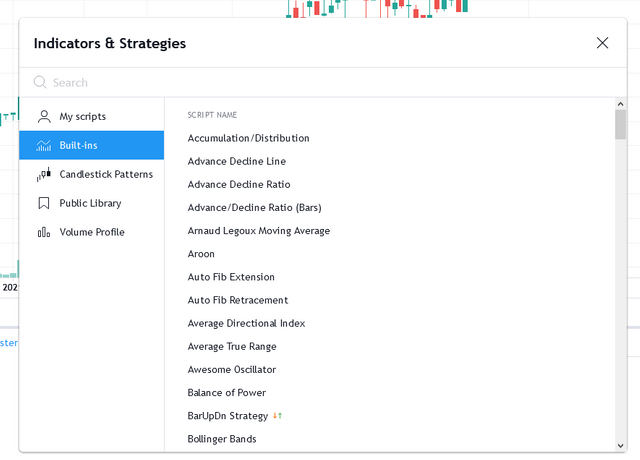

Source Tradingview

In fact, there's tons of technical indicators, so discussing everything here will not be enough, so we're going to give some examples of the best ones.

To start, technical indicators can either be 2 things: a lagging indicator or a leading indicator. Leading indicators are those that attempt to make predictions where the price might be heading while lagging indicators offer historical reports of conditions that have resulted in the current price being where it is. Some examples are:

Trend Indicator - this is a lagging indicator that analyzes if a trend is going upwards or downwards, or sideways over some time.

- Examples: 50 or 200 Moving Average

Mean reversion indicator - this is also one lagging indicator that measure how far prices will go before it gets a correction.

- Example: Bollinger Bands

RSI or relative strength indicators are used to measure the buying and selling pressures of a certain cryptocurrency. This one is a leading indicator.

- Example: Stochastics

Momentum indicators evaluates the speed of price changes over time. This one is leading.

- Example: Moving average convergence divergence (MACD)

Volume indicators are also leading ones that checks the trades and quantifies if the bulls or bears are the ones in control (bulls - buying; bears - selling).

- Example: On-Balance-Volume (OBV)

Trading View

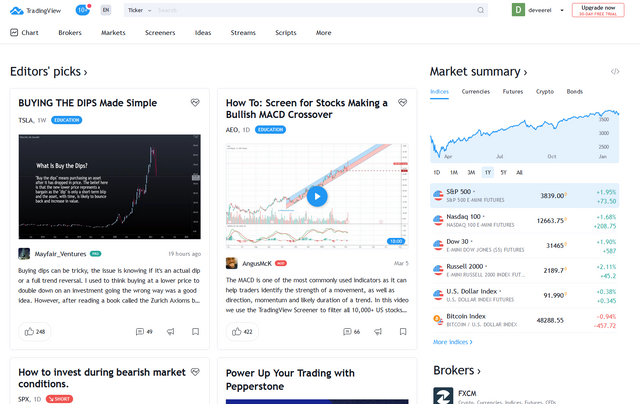

So, you've seen a graph sample and the technical indicators. The screenshots I have above are from a website called Trading View.

Source Tradingview

It is a platform made to get real-time information and market insights on financial products, e.g stocks, cryptocurrencies, etc. It's like the social media platform for traders.

Trading view enables its users to publish trading ideas and get better at trading by seeing what others are doing. Here you can browse technical analysis published by other people, create your own technical analysis with their built-in tools, there are even technical indicators that are created and fine-tuned by actual users. They also have a feature where you can collaborate with others.

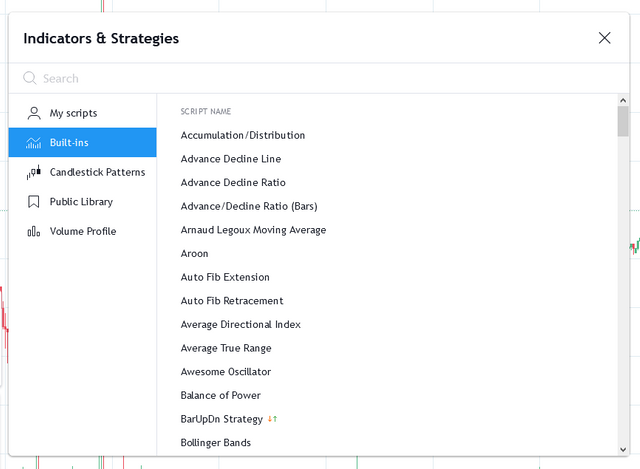

Source Tradingview

TradingView charts is everything you need to make your dream TAs to make sure you trade properly. Charts and TA tools are also available in other places like exchanges (Bittrex, Binance), but Trading View is unique since you are able to publish what you make and study what other people has published.

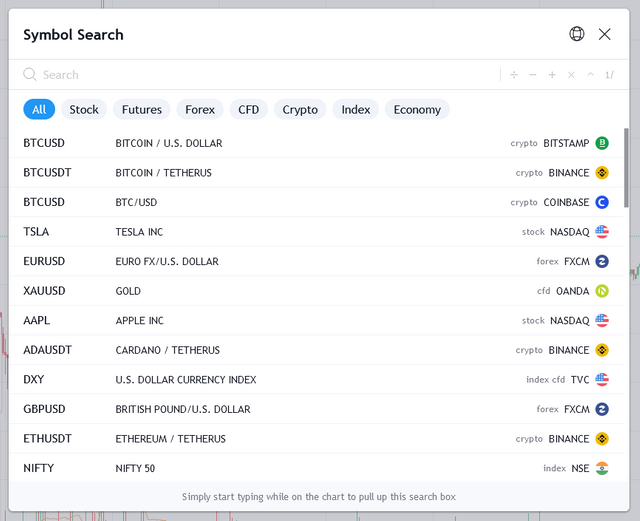

Source Tradingview

Also, unlike exchanges - which are only limited to the assets listed on their own platform, TradingView offers a lot of options and information. Ranging from stocks, futures, forex, CFD, economy, cryptocurrencies, etc.

Source Tradingview

They also have a lot of features that you can use to your advantage and to expand your learning. You can make your own TA tools, check what others have made, or simply use the base tools that the platform provides.

Since this certain technical indicator also came up earlier in this articles, let's discuss this more:

What is 200 Moving Average?

Moving averages are technical indicators that are used to analyze as well as identify long term market/trading trends. Basically, it is a line in the graph that represents average closing prices for a number of days and can be applied to any security like stocks, forex, or even crypto.

200 moving average is based on a 200-day trading period. This is a technical analysis used for checking the long term trend of an asset's price movements. On the contrary, there are other periods used with the same analysis e.g 50 day for medium term, and 10 or 20 day for the short term trends.

This certain technical analysis is often used by traders to determine if a certain cryptocurrency is following a bearish trend or a bullish trend.

In an analysis graph, if the price of the candles are constantly above the moving average line, then this is a bullish price trend - meaning the price is going up. On the other hand, if the prices are below the moving average line, it is showing a bear market - means that prices are going towards the downtrend.

Keep in mind that moving averages are called lagging indicators which means that they rely on past information to show the trend, the moving average line indicator actually has a lag depending on which type of averaging you use and depending on the period. Short term periods will lag less than long term periods (like the 200 day moving average). More or less, this analysis is used by everyone to get signals to help them trade in the near future or help confirm their other technical analysis results by looking at the past.

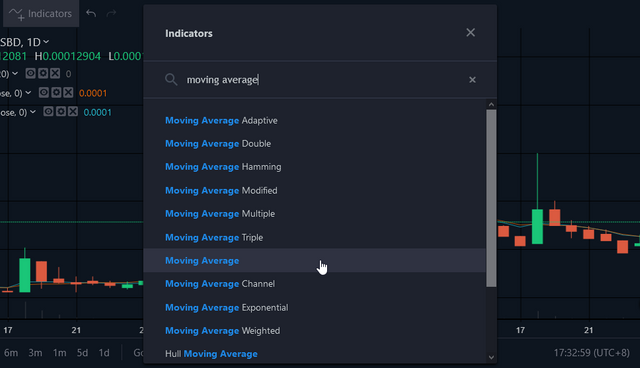

How to Use 200 Moving Average

Using this technical analysis is very simple. Simply head over to an exchange of your choice (like Binance or Bittrex), or a trading guide website (like Trading View), and activate the moving average on the indicators and it will show a line that dances together with your chart's candles. Make sure to click the gear icon, and change the length to "200":

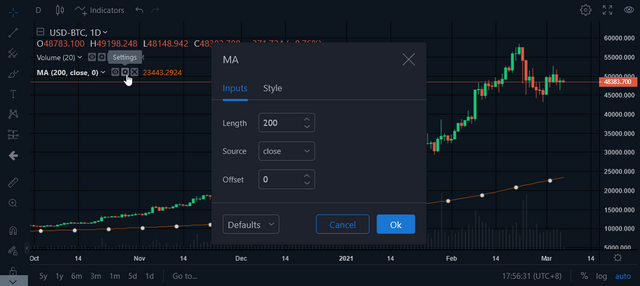

Now, determining when to actually buy or when to sell will have you looking at the proper signals and how the trend is going. I'm using Bittrex and the BTC/USD pair for the purposes of this illustration:

We're looking at a 1 day chart of BTC/USD pair: here we see the candles, a blue line, and a red line. The red line is the moving average, and the blue line is the moving average exponential. They're generally the same, with the difference that simple moving average takes the closing prices, and exponential filters through all the prices (which is helpful for volatile markets with spikes in prices).

Notice how the moving average lines are under the candles when the price is going up, and how they're above the candles when the prices are moving downwards. That's one of the basics that you look at when using moving averages, be it for short or long term (200 moving average).

These highlighted circles above are considered buying points. Buying points happens when the candles in an upward trend touches the support lines (the lines made by the moving average).

On the other hand, these new highlighted circles up top are what we consider selling points. Selling points are when the candles touches the resistance lines when the trend is downward (lines made by the moving average).

As of the moment, based on this graph, pair and moving average results, we can say that the price is still bullish:

What you need to be wary of are trend reversals which can be seen clearly when you use this technical analysis. As you can see here:

The bullish trend was reversed into a bearish trend when the candles and the moving average lines intersected each other and switched places effectively. These are how the prices react when a trend reversal is set in place. If the trending prices suddenly become lower than the 200 day moving average chances are people will be looking to sell, until proper support is reached (shown when the candles and moving average lines meet), and a trend reversal can happen.

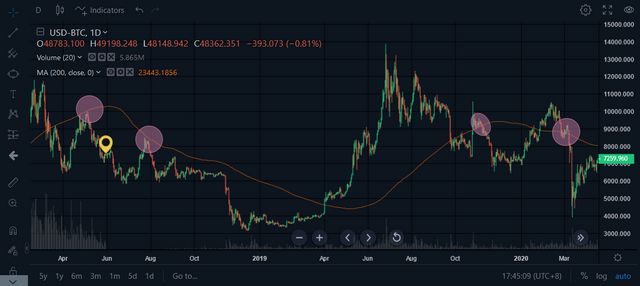

Other Samples:

Here are other samples of the 200 moving average interacting with trading candles and how the prices move.

This one is BTC/ADA on Bittrex. As we can see, the price of Cardano remained on the upward trend when the candles are above the lines. Highlighted in yellow circles are the buy points, where the candles touch the support lines. Highlighted in pink, is a trend reversal - to bearish/ranging.

This next one is BTC/DOGE on Bittrex. The highlighted parts in yellow shows where the trend started. The bullish trend clearly shows the candles above the moving average lines.

Last example will be BTC/SBD on Bittrex. The recent uptrend in Steem Dollars or SBD was shown in the moving average as well. With those candles staying way above the lines, and the pink one shows the reversal.

These are just some of the ways you can use 200 moving average technical analysis to your trading advantages. You can also use it in conjunction with other indicators and TA methods to achieve a more accurate price prediction and confirmations. There are some things that can't be predicted or confirmed with moving average though, since again it's a lagging indicator - so predicting the highs and lows of a trend is something other TA indicators will help you with.

Hi @deveerei

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 4.

Your Homework task 4 verification has been done by @Stream4u, once you updated this existing task with the pending topics, just reply to me here and I will surely review it again.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

OOoooohhhh, I thought those were the previous week's topics, my bad. Thanks for the reminder!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have made the necessary edits and included all the other topics onto my article, I tried to make the flow still seamless and provided an in-depth article for each topic. Please check again, thanks a lot!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @deveerei

Thank you for making the correction.

Your Homework task 4 verification has been done by @Stream4u.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! Well, the main reason I don't add captions to photos is the description is part of the main content already. But that is a nice suggestion, esp when it can be applied.

I do it when needed lol, but I think yeah there are missed opportunities on some photos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @deveerei,

Thank you for that you feel it was a good suggestion.

Yes, 100% I agree that description is part of the main content.

The intention for this suggestion is while Blogging or making a Post if we think about the Reader's point of view, sometimes readers may feel difficult to understand any content so Images and their captions can help them to understand better how it looks like, and accordingly, they can implement it in their own study. Just Like below.

If images are taken from any sources then we can add those sources in captions like hyperlinks.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post

if you don't got the 400 STEEM claim it now, i got last night

it's for limited time get it quickly click Here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit