QUESTION 1

Explain the following stating its advantages and disadvantages: spot trading, margin training, and future trading

A) Spot Trading

The spot trading is a trading type which allows traders being the buyers and the sellers to transact crypto currencies at a price known as the spot price. The spot trading is known to be the simplest type of trading especially in relation to beginners in the world of trading crypto currencies.

With the spot trading, we can purchase an asset and hold it until the value of the asset increases which we can then sell and it gives complete ownership on the asset purchase.

- There is complete ownership of the asset purchased using the spot trading type of trading.

- A trader does not encounter liquidation when using the spot type of trading.

- There is no minimum investment with the spot trading type of trading.

- The first and foremost disadvantage of the spot trading is that the spot trading is that the traders does not take advantage of the bear market, meaning that they can only buy a crypto asset and sold.

- The spot market does guarantee much profits unless an asset is held for a long period.

- Traders can face the risk of purchasing an asset on spot inflated prices caused by the high volatile nature of some crypto currencies.

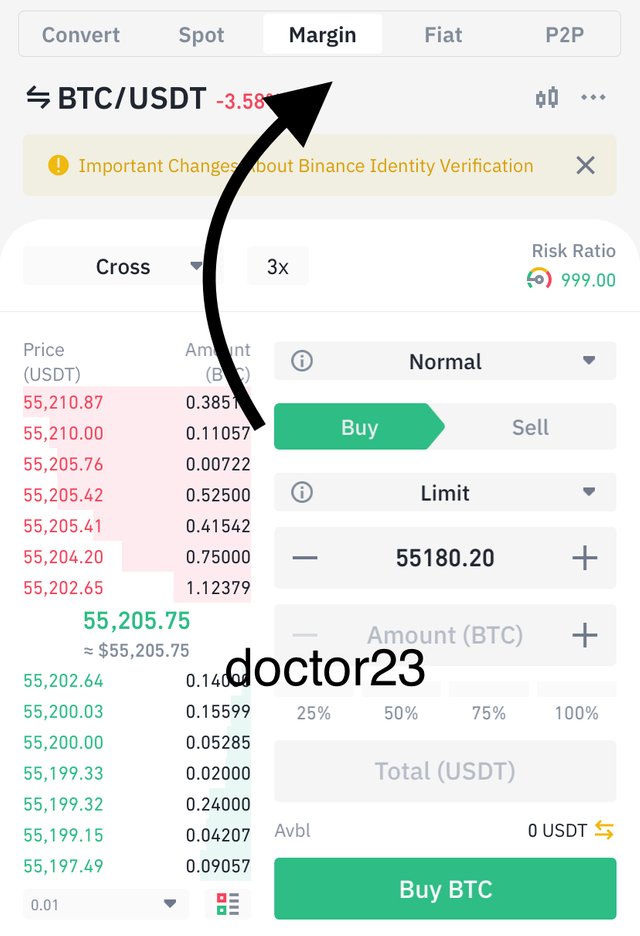

B) Margin Trading

The margin trading is a trading type which allows the traders with the possibility of have more purchasing power when compared with the spot trading. With the margin trading, traders can borrow funds from a third party provider. The borrowed funds from the margin type of trading makes it possible for the traders open positions which are greater than the initial capital of the trader.

The types of leverage in the margin trading include 2X, 5X etc.

- There is higher benefits and returns with the usage of the margin trading. The margin trading with the usage of leverage or the said borrowed capital brings about higher benefits.

- With the aspect of purchasing power, we see that a trader can split up their investments with the opening of different positions which is an aspect of risk management.

- The margin trading trending disadvantage is the fact the traders are exposed to more risk since there will be useless capital and using more leverage to borrow and open positions.

- The margin trading is a trading type which requires a high trading experience. The margin trading cannot normally be used by beginners as they will face the risk of losing all their investment capital.

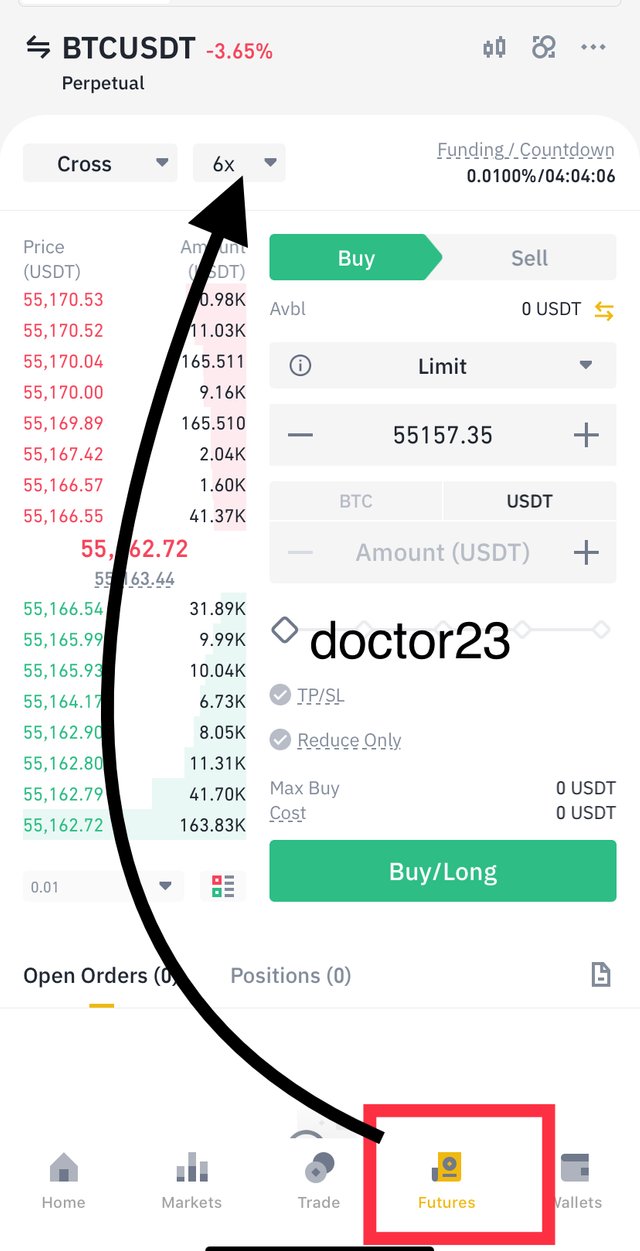

C) Future Trading

This is an advanced type of trading type of the crypto currency. The future trading allows traders to place buy and sell orders which mean they can take advantage of the bearish and bullish movements of the market.

With the future trading, the purchases made are done by purchasing future contracts with the real price being pegged to the real value of the asset.

With proper risk management with the future trading we see that traders can make more profits with the usage of the various multiplication of the initial capital through leverage which include 2X, 5X etc.

- Future traders can make more profits with the advantage of the leverage system of the future trading especially when we compare it to the said spot trading

- The future trading allows the traders to take advantage of the wavelike nature of the market as well as the market structure through the placing of buy and sell orders.

- The future trading is with the huge profits it comes with, also has the same rate of loss in which it comes with as well. The risk level with the future trading can even cause traders to lose everything on the market

- The future trading requires skills before it could be carried out successfully, meaning that beginners should be eliminated in the trading of futures.

QUESTION 2

A) Explain the different types of orders in trading.

B) How can a trader manage risk using an OCO order

Types of Orders in Trading

Market Order

I will begin with the aspect of the market order. The market order is the simplest type of order in trading. It is known to fastest and easiest as beginners can easily take advantage of the movements in the market. The market order when placed purchases an asset instantly at the readily available price in the order book.

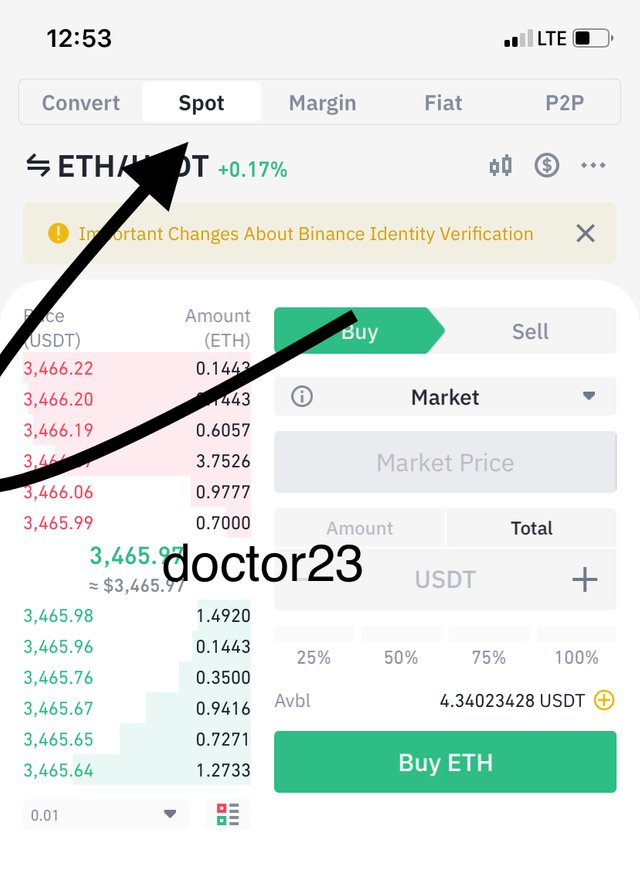

I will illustrate the market order on the screenshot below as I instantly purchase an asset at the best available price.

Pending Orders

Not all traders can take off the time to watch the trade entry positions in which they desired to enter at which is the reason why the pending order comes into play. The pending orders allow traders to enter trades at the believe that the prices will touch a particular level. We a series of pending orders which we will be seeing below.

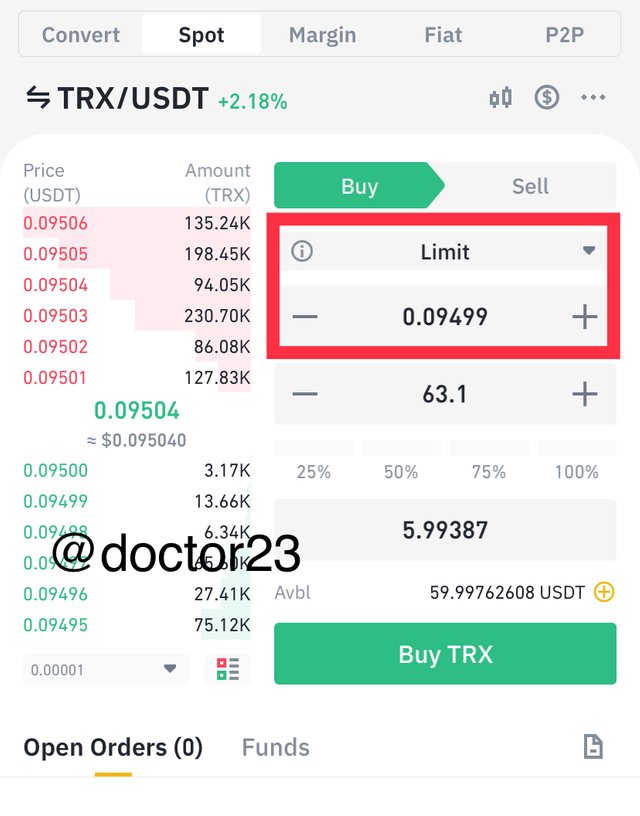

A) Limit Order

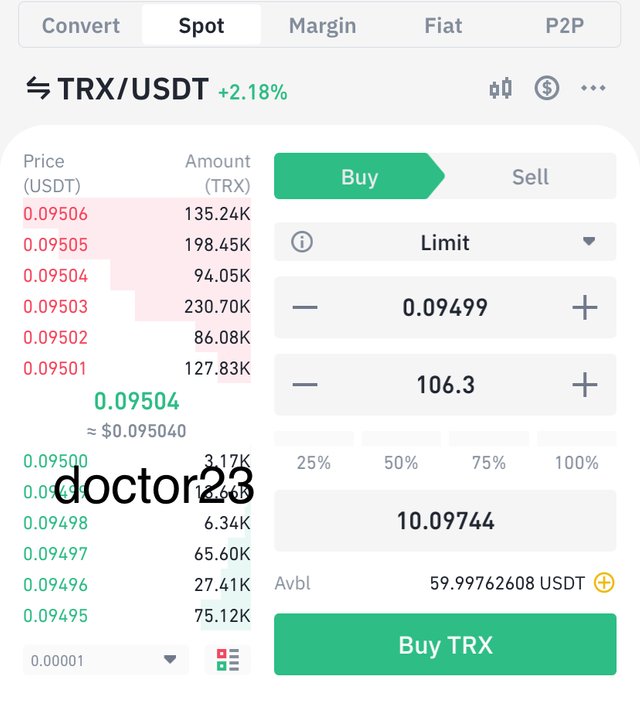

The limit order allows traders to execute trades at specific and desired prices. With the limit order, we normally have buy and sell limit orders. Since we will be demonstrating with the usage of the spot trading in the cryptocurrency, we will be using the buy limit order which is given just as the limit order. It means that we can purchase an asset at a much cheaper price than the initial price of the asset. it is not 100% certain that the trade will get executed after triggered as some take a whole lot of time for those levels to be reached. Unlike in the case of market order which has 100% rate of execution.

We can see a demonstration from the screenshot below.

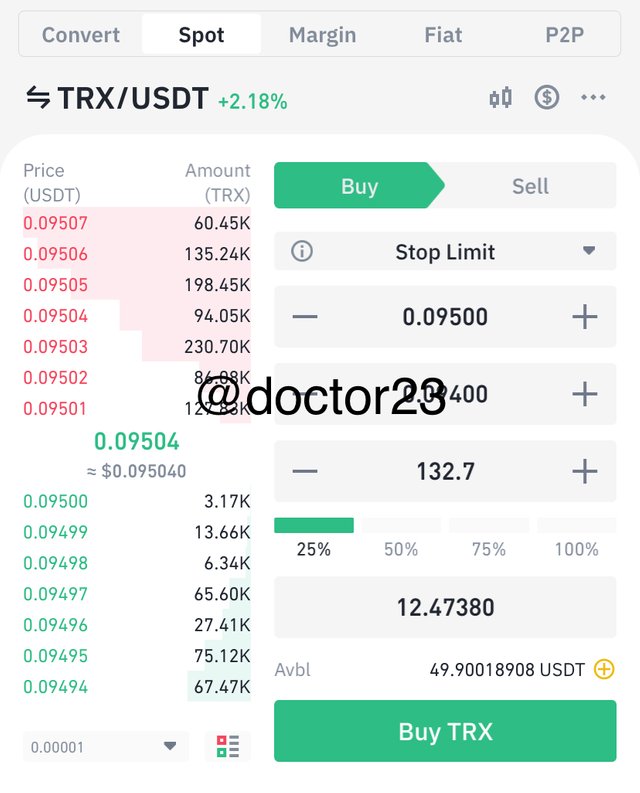

2) Stop limit order

The stop limit order is a type of pending order in which we a trader can place an order specifically a limit order in such a way that when a stop price is hit, the order is being executed.

I will be explaining furthermore on the stop limit graphically to expanciate more.

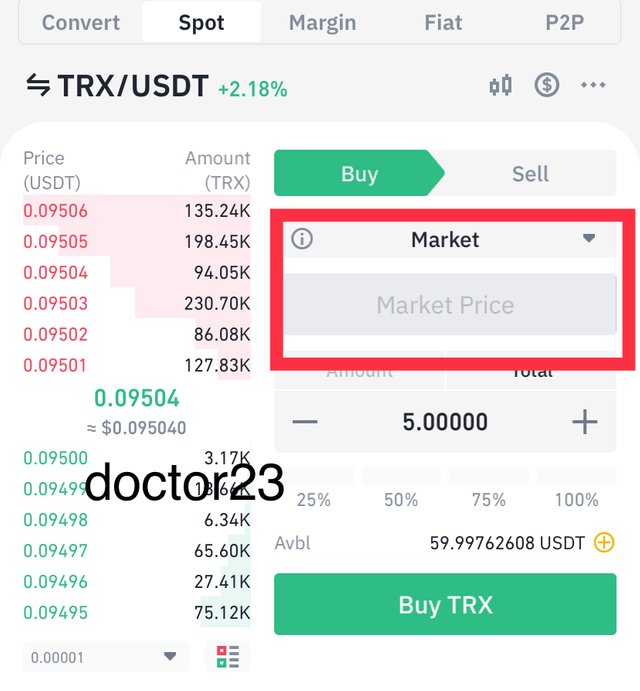

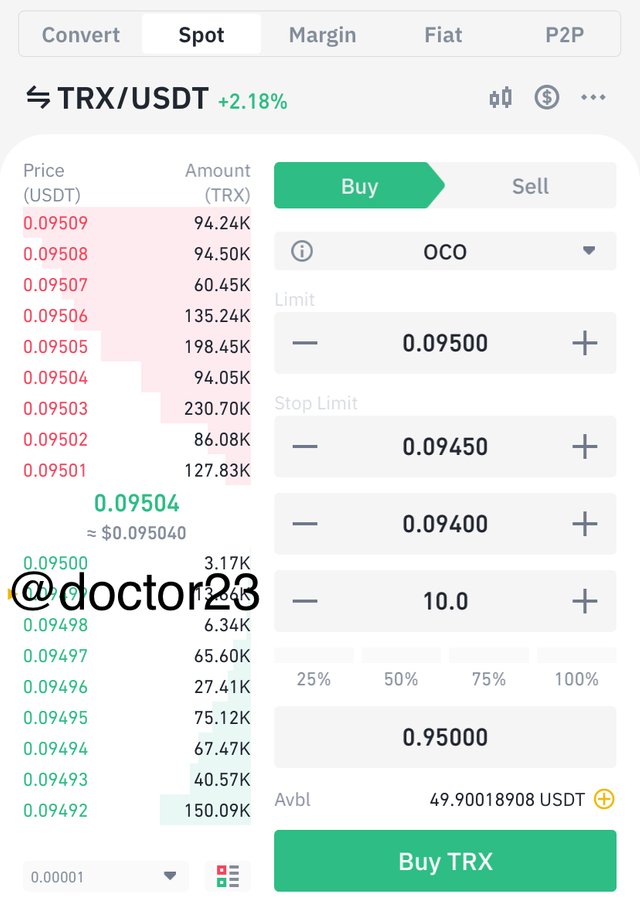

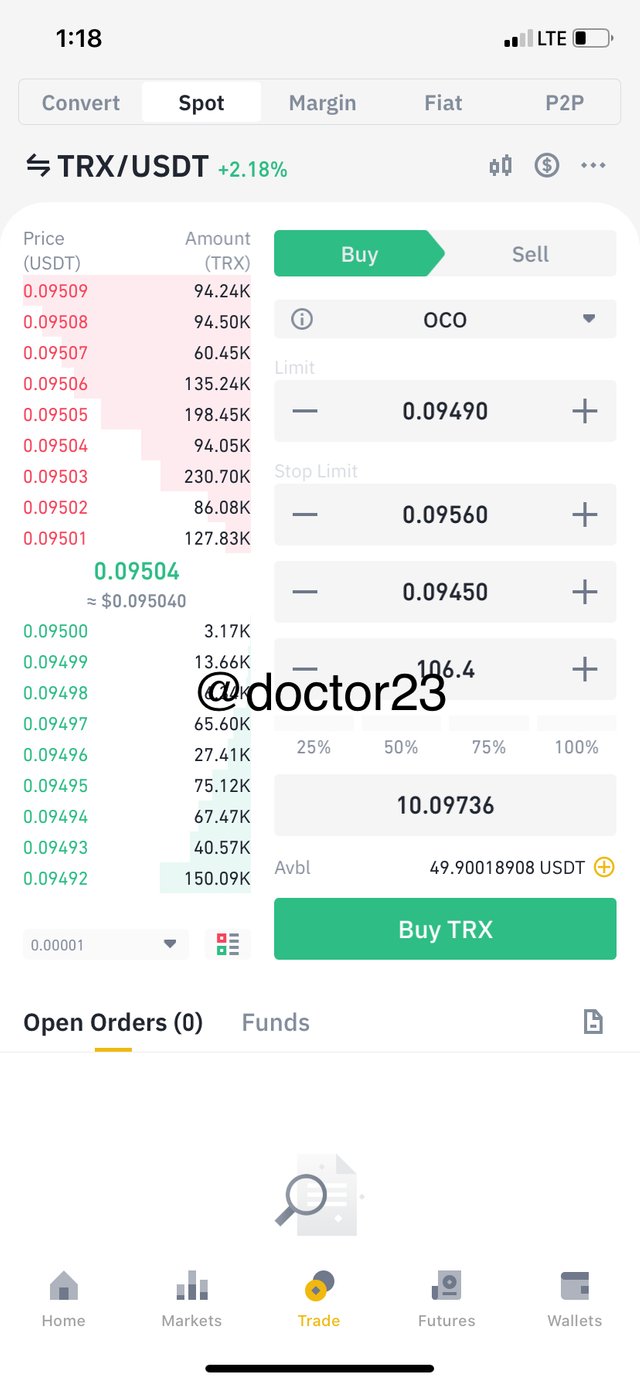

One Cancels the Other order

The next I will be explaining is the OCO which is known as the one cancels the other type of order. It is self-explanatory itself just from the name. This type of order allows a trader to place two entry points at the same time. With this, it could be a view of a resistance and support level and whichever point is first the order get triggered. This OCO order can be made up of stop limit order and a limit order.

We can see a demonstration in the screenshot below.

4) Exit Orders

As a good risk management technic as well money and emotional management it is important that traders should use entry stop loss and take profit levels.

The stop loss level will automatically close a trade in case it goes against as planned initially while the take profit level will accumulate the profit made and close a trade instantly.

How a trader can manage Risk using OCO order

The One Cancels the Other type of order can be particularly used to reduce risk and losses through the usage of stop limit order and limit order.

If prices is dropping rapidly away from the predicted price, which is the limit price, the limit price will help in taking the profit or the sell limit will execute in the case of sell order.

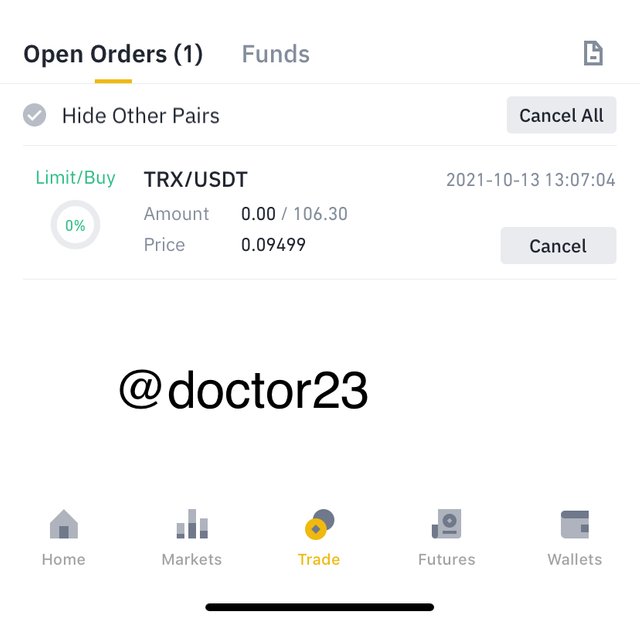

I have practically demonstrated in the trade I carried out by purchasing the trx crypto currency.

My limit and stop limit are set at 0.0949 and 0.0956 respectively. This is shown below.

QUESTION 3

Open a limit order on any crypto asset with a minimum of 5usdt and explain the steps followed.

Opening a limit Order

Step 1

I will be using the Binance Exchange to carry out this trade. Ii begin by logging into the binance exchange and click on spot I select the desired cryptocurrency I wish to trade which will be the trx/usdt crypto pair

Step 2

Next will be the placing of the trade. I will click on the buy tab, and I change market order to limit order. This can be explained further below.

QUESTION 4

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. the following are expected.

i) Why you chose the crypto asset

ii) Why you chose the indicator and how it suits your trading style.

iii) Indicate the exit orders

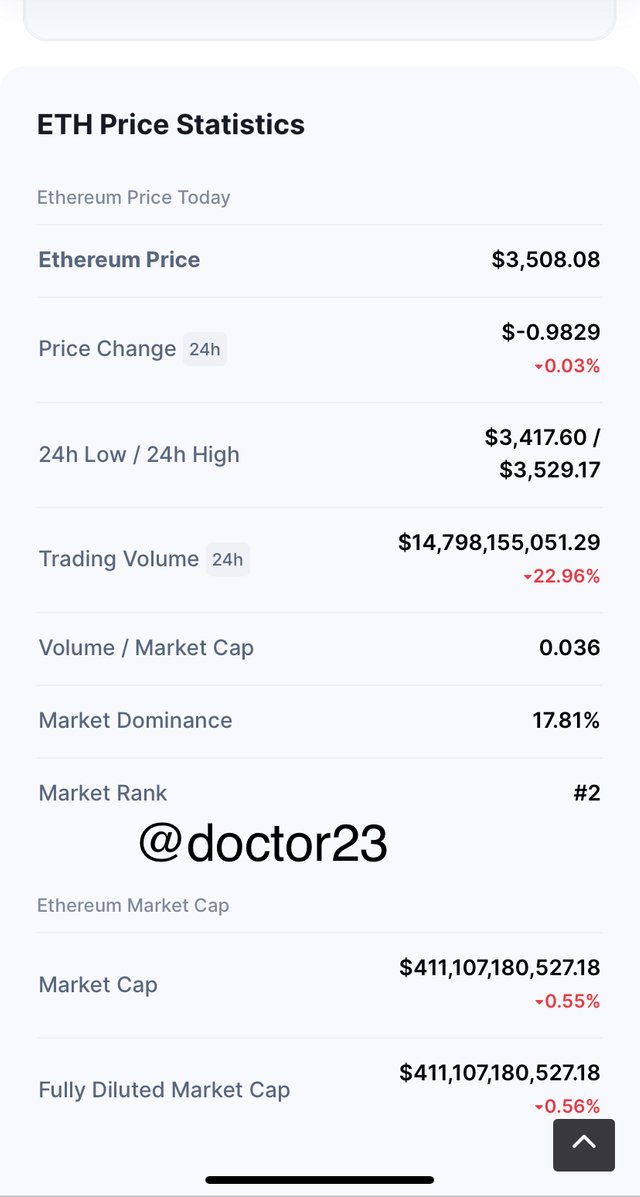

Buying the ETH Cryptocurrency

The ETH with its last dip still trying to reach its all-time high again and currently at a price $4300 should be worth investing in. the Ethereum crypto currency ranked on the 2nd position in the coinmarketcap has known too be very promising. The eth crypto currency with the contract of that of the Ethereum Blockchain, it has a 24 hour trading volume of $14,798,155,051.29 and a market capitalization of $411,107,180,527. with a total supply of 117,911,761 ETH.

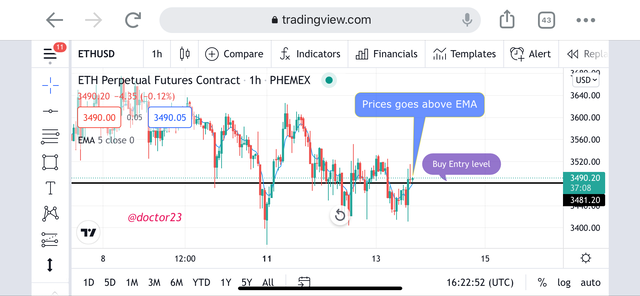

I will be using the Exponential Moving Average indicator. The EMA is a leading indicator and since I am a scalping trader it will just be perfect to suit my trading style. The EMA shows a buy order when the prices just go above the indicator line and a sell order when the price just goes below the indicator line.

Trade Entry

My trade entry will be done just at the level of the price moving above the indicator line. In moving above, I wait for the candlesticks to move a little further to avoid fake outs which I then enter a buy order at the beginning of the next candle,

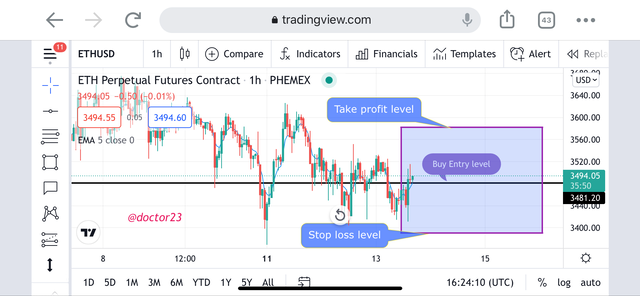

Trade Exit

Trade exit is about setting proper stop loss and take profit levels. I will be setting by take profit level using the stop loss level to a risk reward ratio of 1:2. This is explained vividly in the screenshot below.

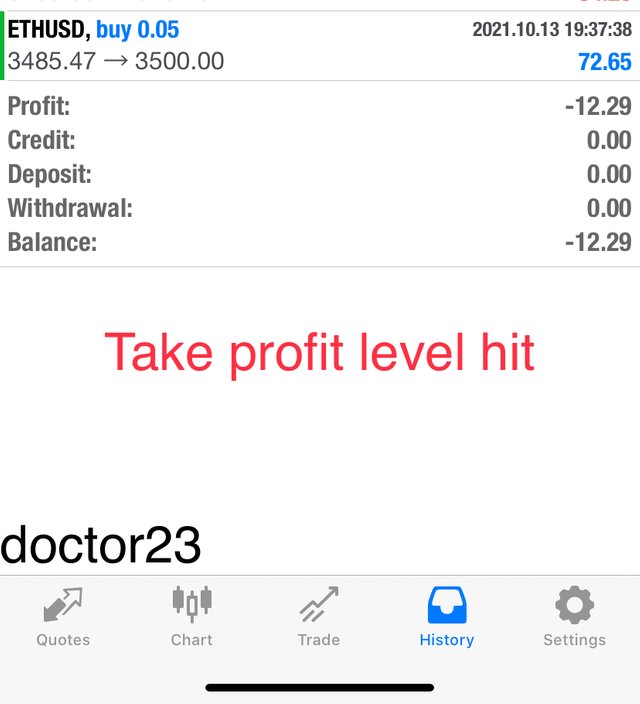

Trade Declaration

Conclusion,

We have series types of others which include the market order which allows purchase of a cryptocurrency at the ready available price in the order book, the limit and the stop limit order, the one cancels the other type of order and the take profit and stop loss which are under the exit orders.

We also have different types of trading which include the spot trading being the easiest type of trading, the margin trading and the future trading which requires an advanced experience to carry out.

Hello @doctor23, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

That's correct. You can still own your assets even when the market is down. You just have to hold.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit