Hello everyone how are you doing I am good, today I am going to participate in another challenge which is really interesting as it will enable me to explore my knowledge about the SEC-S18/W6 | Mastering the Break Retest Break (BRB) Strategy retest and break

Explain in detail the concept of the Break Retest Break (BRB) strategy. How can this strategy be applied specifically to trading the Steem token?

The process of breakout strategy is most commonly adopted for the investors who always has trends to do trading at prior stage of

Price action.

If see deeply the investors and active traders may get maximize profit ration if they do consider proper analysis for risk management and also for the technical analysis, as its particularly useful to knew the risk ratio versus profit in more appropriate ways.

Now why traders look into this trading strategy through this technique as its applicable in any way of trading.

Moreover, as the market price action takes place on daily basis, therefore investors can take advantage of price breaks during in time of day frame.

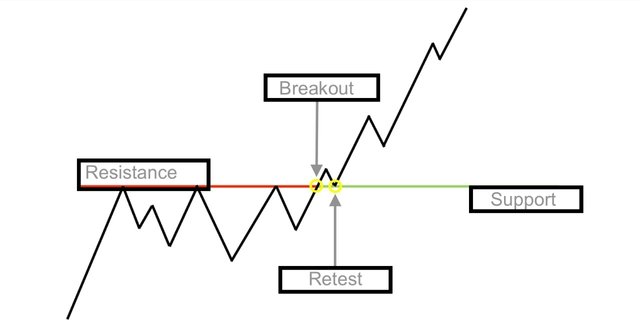

The break and retest are the chief elements of BRB mechanism which are essentially needed in order to maintain the integrity.

The mechanism become evident when the price of any currency reached to its higher level by broke the resistance and support level. Hence the event become more visible when there is high volume of trade.

If we see in chart we may clearly monitor the breakout in bullish or bearish, we can observe the bullish breakout trends when there is Increase in price trends above the resistance level, in case of bearish breakout when the price dropped observed lower than the support level.

The BRB strategies may be effectively used in trading of Steem token. In this process we have to carefully observed the when the steem breakout occurred at the point of resistance level.

Now if we see the price momentum to initial level its the second step who h is retest and if it persistent its the indicator a good for trading.

In next step if we see the consistency of the price exceeded more than the level of resistance here the trader may take a wise decision as its the indicator of another break and the profit margin may be good.

What are the specific entry criteria for a position using the BRB strategy? Include specific technical indicators and market conditions for the Steem token.

While a traders wanted to use BRB trading technique different factors are taken into consideration so that it may leads towards a profitable trade. We have to see in details the technical indicator and different other market factors for trade.

Screenshot from my binance account

In initial step we will identify the level of resistance of steem token, it shows around 0.1980 and then sharp downward trend and might it crossed the support level which is falling around the 0.2000. Its the probably indicator of first break.

In next step we can see there is slight increase in price and its moving above 0.1990 its the indicator of retest of price trend of steem we have to taken considerations of resistance and support too.

In order to continue about trade we have further seen the price is not moving sharply above the 0.1990 while it had the trend of downwards as the market is not showing bullish trending.

So the ideal time for the entry would be around 0.2200 as the price has trend of downwards as market trend showing to reach the tested resistance and had no more upwards trends.

In order to carry a successful trade obviously a investor must taken into consideration break, retest and technical indicator and hence the additional factor might be the moving average

for successful trades Iin volatile condition of market. While BRB is effective in knowing the best entry or exit in trading for steem token.

Describes the exit criteria for a position based on the BRB strategy. What signals or conditions should be present to close a position in profit or loss?

While we are trading through break retest break it should be clear understood when the trades are closed despite we are getting profit or avoud to stop loss.

In any trade we defined profit while seeing the resistance level, and it can be taken from previous data. When we got the profit we have set we can set the dmsrvond level of profit to maximum advantage. Obviously we have to keep an eye watch while adjust the stop loss as its best strategy to avoid loss.

For the exit we have to see whether market is in favor by using relative strength index which clearly shown either its the over buying conditions, its a primary sign to ready for exit from trade.

Another factor which may be very important is the bearish condition or diverge in this the price are showing upwards trending its the indication of reversal.

Hence the candlestick pattern can be used to see the reversal pattern and the sign of bearish market, so whenever the price shown the reversal trend when we perform BRB it perhaps showed the new level for resistance and furthermore it shows there would be more sold conditions, hence candlestick reversal pattern along with the onset of new resistance line snows its time to exit from the trade.

Provide a detailed example of a BRB trade on the Steem token. Include entry points, exit points, and the reasons why you chose these points. Use graphics to illustrate your example.

Here i will show how i can do trade while using BRB techniques.

First of all I will identify the level of resistance which is shown on the graph I have taken from binnance. Its evedieng on 0.2000 and also taken into note the support level which is almost on 0.1980.

Screenshot from my binance account

I have waited for initial breakout which was seen where resistance broke at 0.2000 and reached above 0.2100 it indicated the increase in volume of buying too and also showed steem will move upwards towards 0.2300.

OK next I have to see whether price returned towards downward yeah it reverse and confirm the retest and definitely there is appearance of second resistance, and support at level of 0.1900.

After the retest confirm price will show the rice again and crossed more than 02200 which is indicator of second break.

As my retest is and second break is visible I will enter for trade at the value of 0.2200. Moreover I have set my first profit level at 0.2400 and second 0.2600. Stop loss obviously set to avoid any sudden volatility in market. I have set stop loss at 0.1850 that is below the support level.

Well if the price crossed more or around the 0.2600 I will take my 50% profit and if further crossed towards 0.2800 I will take further profit. Now if I see price returned towards resistance level value 0.2000 I will exit from the trade as I have set my stop loss around 0.1850.

How do you manage risk and capital when using the BRB strategy? Discuss risk techniques and how to set stops and limits for Steem token trades.

When we are using trade through brake retest break we have to follow certain strategies in order to avoid risk for example we have to set stop loss order also calculate position size and management strategies so on.

The stop loss adjustment essentially needed because its the safest to avoid losses, for example when I observed new support while confirm retest, let's suppose I started trade entry at 0.26 after retest at 0.22 I have set my stop loss 0.19 it would be beneficial for me for risk management.

Screenshot from my binance account

When investor do trade risk per trade have t9 keep in mind, normally an investor has to consider 1 to 2 % of risk as per trade. Let's suppose if he invest 100 dollar on trade the risk would be 1 and 2 dollar.

An investor must keep an account about the position size which is particularly based on stop loss distance and also about the risk. For example if I enter at trade at 0.26 and stop loss ratio at 0.19 We are at 0.06 token at risk, let's supposed I do trade of 100 dollar my position size would be 100÷0.06= 1666 token.

We can manage risk during a successful trade by following stop loss, and calculating position size which would proved useful in order to avoid any losses.

Its all about my today's post.

I would like to invite @m-fdo, @jannat12 and @sualeha to take part in the challenge.

In this BRB strategy, we must at least determine the right entry time and also form a pattern such as the paramid triangle pattern. This technique involves identifying breakouts of support and resistance levels and waiting for a retest before entering the market. A retest provides confirmation that the breakout is valid and indicates an opportunity to enter the market at a better price.

Determining a stop loss is also required because it can be automatically closed when the trend direction reverses against us and can minimize existing losses.

Thank you for presenting a useful publication, I wish you success in this contest, dear 🤗🥰...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you dear friend for precious time to read my post and leave valuable comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

🤗🥰

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Break retest break is essential for a profitable trade and also how important it is for a trader to know support resistance and anti points. Thanks a lot for participating and sharing the post. Nice to see you here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for kind feed back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You explained clear about Retest Break Strategy especially entry and exit point. I guess the one who underatand support and resistance and can able to find them on a price chart, he can properly apply the Retest Break Strategy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Creo que lo más difícil para mí por ahora es identificar bien los patrones de las gráficas, son tantas diferentes que se vuelve un rompecabezas. Este método simplifica muchas cosas pero tienes sus aristas, las rupturas falsas son las malas de esta película. Son pocos los indicadores o argumentos para detectarla correctamente, hay que escudriñar a veces una vela que te revela el secreto.

Gracias por compartir, saludos y éxitos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for you kind feedback

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Breakout Retest Breakout (BRB) strategy you described here offers a strategic approach for traders, emphasizing the importance of identifying key resistance and support levels. Your analysis underscores the need for thorough risk management and technical analysis, which is critical to maximizing profit margins.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit