Hello friends, hope you are all doing well. Today I am writing a homework task for professor @pelon53 which is about "LUNA Blockchain"

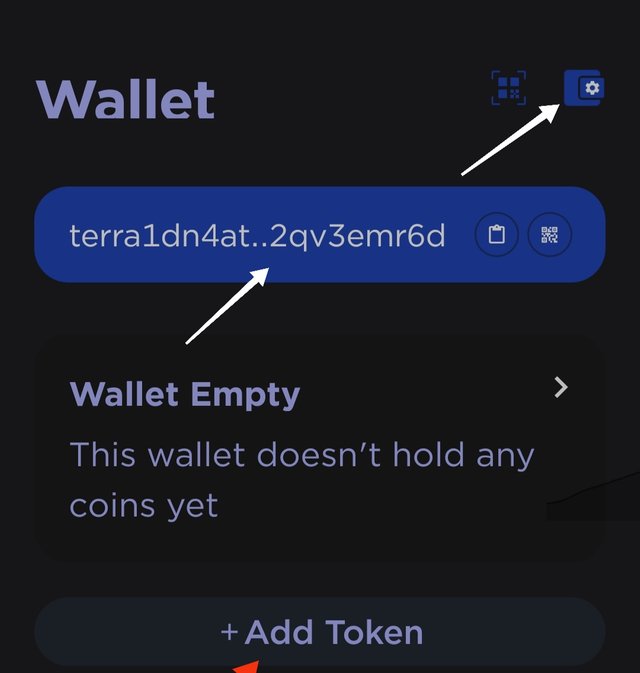

What is Terra Station? Explore the application, Download the wallet and connect the wallet to Terra Station. Screenshots required.

Terra station is an official wallet of Terra blockchain. It allows users to interact with Terra ecosystem with ease. Terra station is available as chrome and ledger extension besides being downloadable for Android and iOS users as well. It allows storage of Terra blockchain tokens like LUNA and UST and facilitates their utility in different use cases of Terra ecosystem. It is a security gateway as it secures our assets and seeks permission everytime we wish to utilize the stored assets.

Terra station Explore

On the main page of the wallet, we get to see all the token balances and details that we hold. We also have option to add token. At top right corner, we have settings like export wallet and change password etc. At the top of main page is wallet address which is used for deposition of tokens into the wallet.

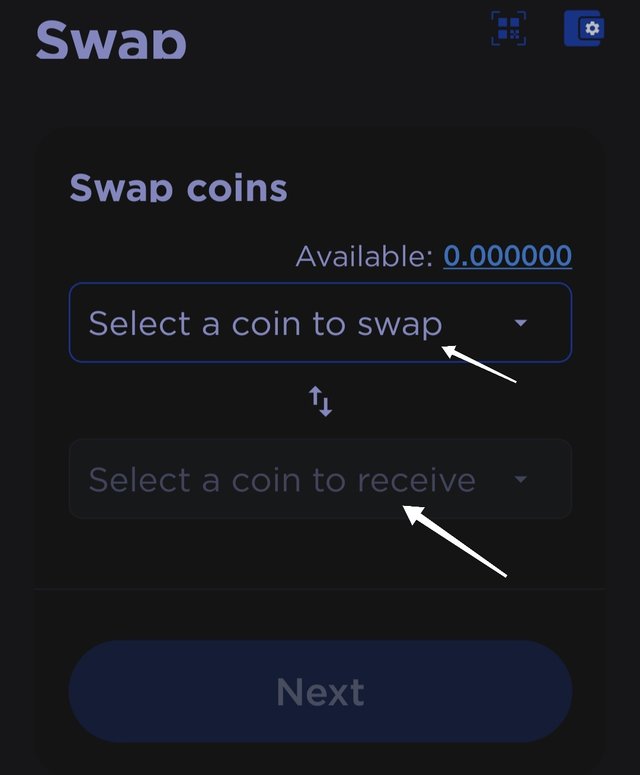

Swapping

We can swap different tokens for each other by a single click. We have to select token that we have and token we wish to receive.

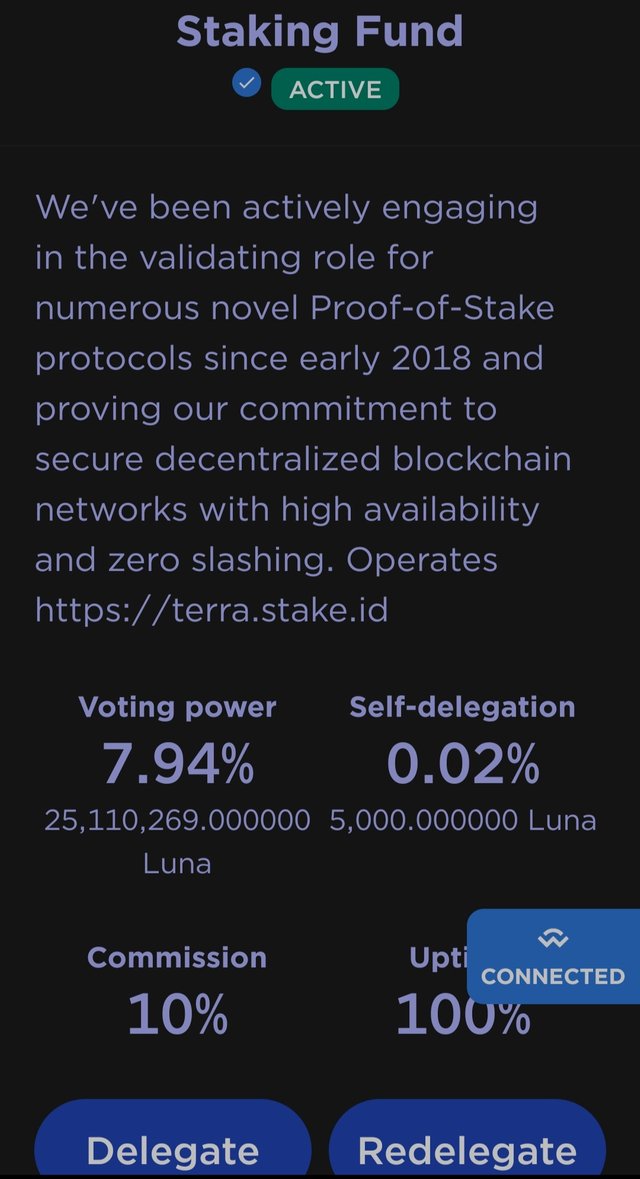

Staking

Here we can lock our tokens for specified periods and earn passive income at defnite rates.

wallet connect to Terra station

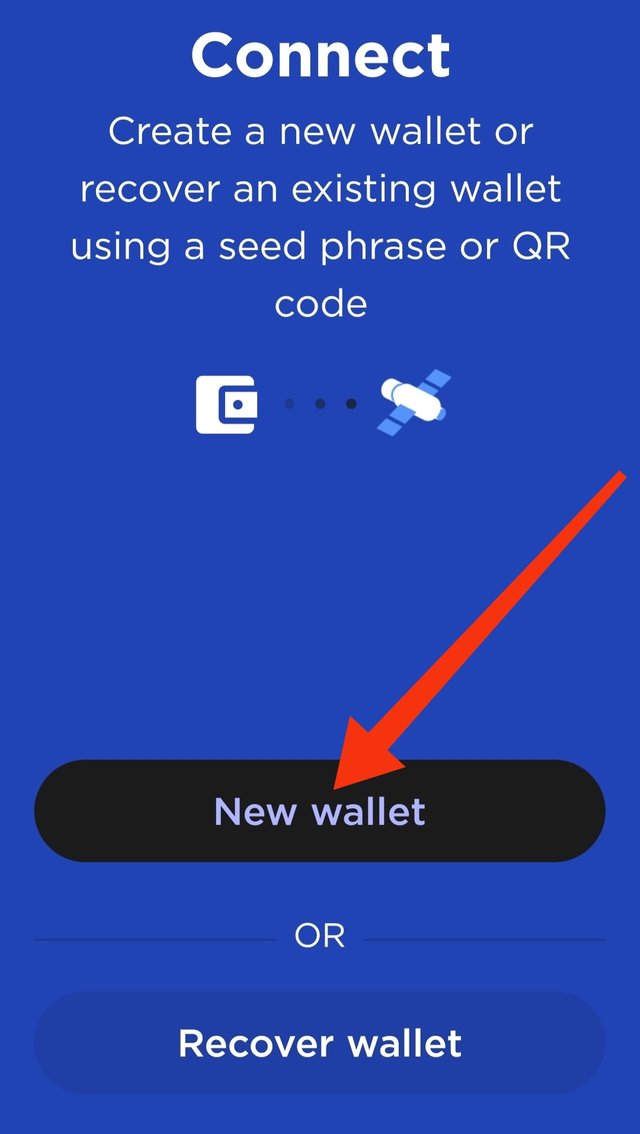

For the sake of demonstrating linking of wallet to Terra station, the simplest way for me and for majority of users is to connect it from smart phones. First we need to download the app from app store of our device.

Launch the app, and we have two options to choose. One is new wallet creation and another is recover wallet. Let's choose create new wallet.

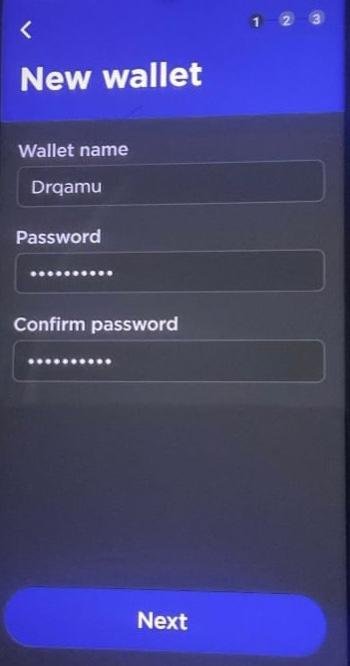

Next we have to choose Wallet name and set password and confirm password. Password has to be atleast 10 characters long. Than click on next.

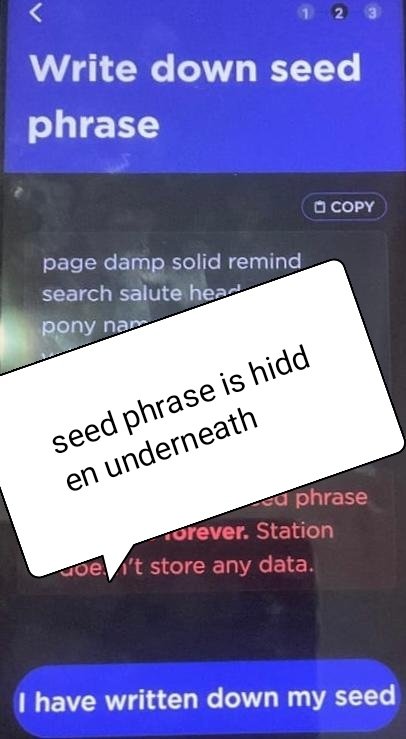

Write down the seed phrase in the same order in which it is provided. It is important to store seed phase securely because restoration of wallet anytime may require this phrase. Terra station doesn't store any data. Once written click on " I have written down my seed" .

To confirm seed phrase , it will ask you to enter two random words like 7th and 24th etc. Once done click on confirm and finish.

Wallet is created and Terra will welcome you aboard on Terra Station.

Explain Anchor Protocol, explore the app and connect the Terra Station wallet. Show screenshots.

With the boom in decentralized finance in recent years, different use cases of DeFi are coming to lime light ranging from diverrse number of exchanges fostering ease of DeFi utilization. The worth mentioning features of DeFi are staking and yield farming that are evolving as a means of better utilization of funds to maximize profit. Staking being a bit older than its new variant and that is yield farming. The point to put more rocus on yield farming is that, Anchor protocol is related to Yoeld farming.

Yield farming involves supplying tokens to the liquidity pool of the platform and earn interest as passive income. The liquidity pool is used for lending funds, carrying out trades, issuing loans etc to the users and collect interest from them. The earned interest is distributesd to the liquidity providers proportionate to the share of supplied tokens. More the percentages of tokens supplied, more is the yield. On DeFi platforms, Automated Market Maker (AMM) mechanism is in place to facilitate Yield farming via smart contracts. Yield farming is seemingly a fascinating concept but it has some inherent risk factors linked like Impermanent loss, smart contract bugs, scam projects etc . Impermanent loss seems inevitable because volatility is the inherent feature of crypto.

Despite congested DeFi space, Anchor platform is able to establish itself because of principal-protected stablecoin savings product. To put it simply, Anchor platform offers yield farming based on stablecoins. Here a user supplies some stablecoins like UST and earn stable APY. The supplied tokens are utilized by Anchor Protocol for multiple purposes and thereby generatile interest on it and distribute among Liquidity providers. For each supplied UST token, a user receives aUST and at the time of withdrawing supplied token, a user has to pay back aUST tokens. You can also burrow UST by supplying bLUNA (bonded LUNA) as collateral. bLUMA is obtained by minting LUNA for bLUNA.

Features of Anchor protocol.

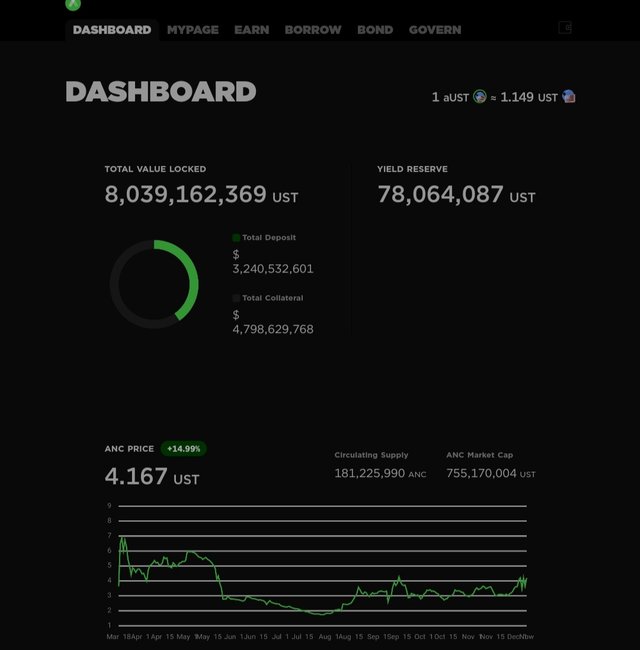

Dashboard

Source

On dashboard one is able to see rhe various details about the platform like Total value locked , Yoeld reserve , ANC details like price, chart, buy back etc.

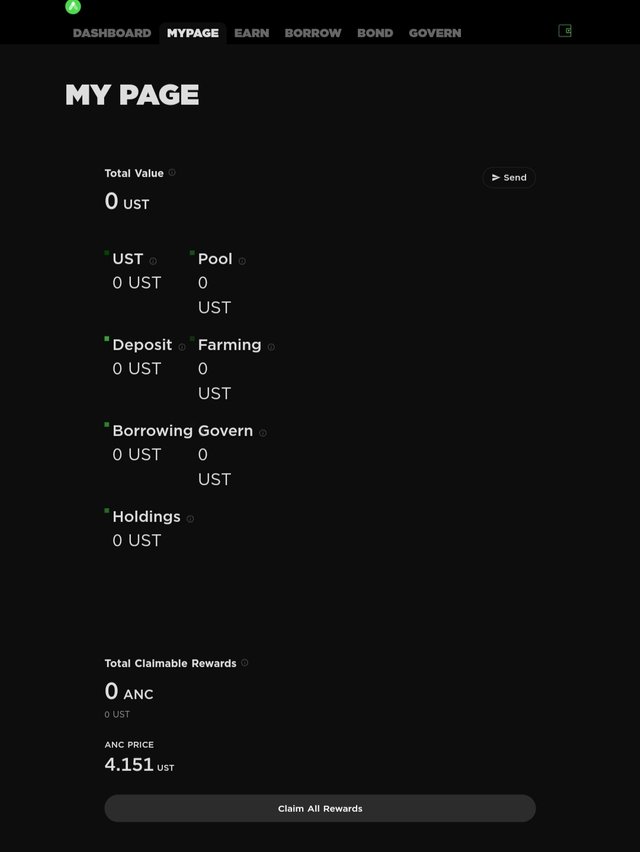

My page

Source

This page shows details of usees holdings, earnings , borrowing, governance etc.

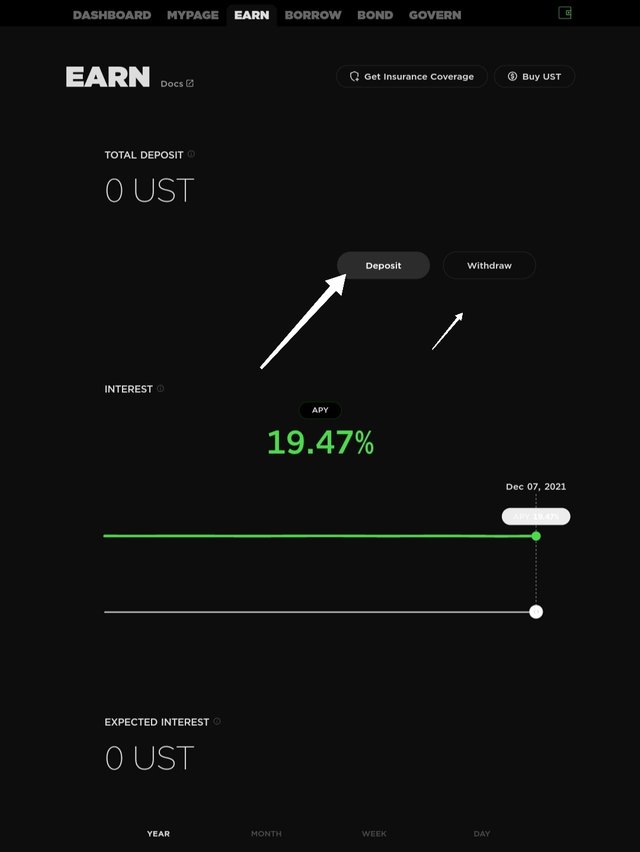

Earn

Source

Here you can check your earnings and can also withdraw your earnings or deposit funds to supply for farming. At the time of writing, APY is 19.47%.

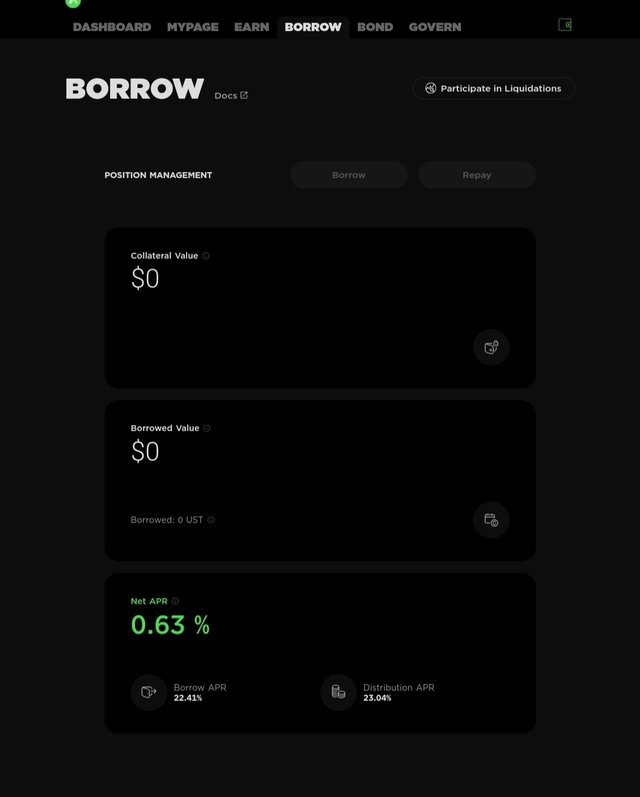

Burrow

Source

Here we can check collateral value, borrowed value and Net APR. Also one can burrow funds by clicking on burrow.

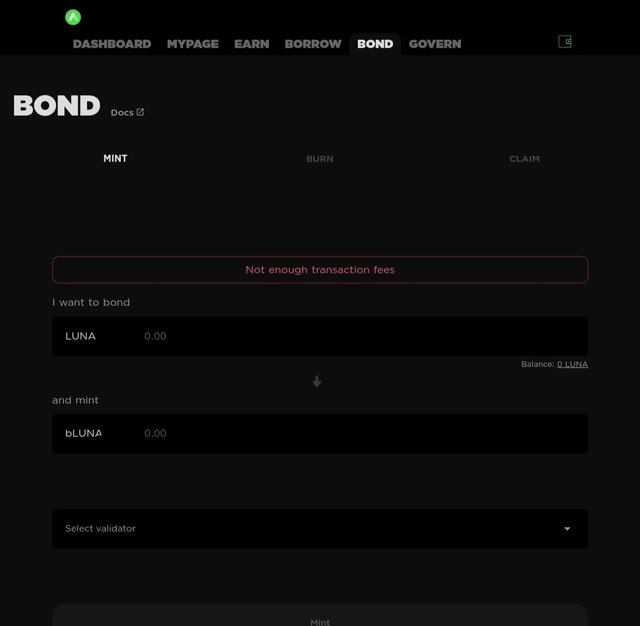

Biond

Source

Bond allows conversion of LUNA to bLUNA which are than supplied for staking etc.

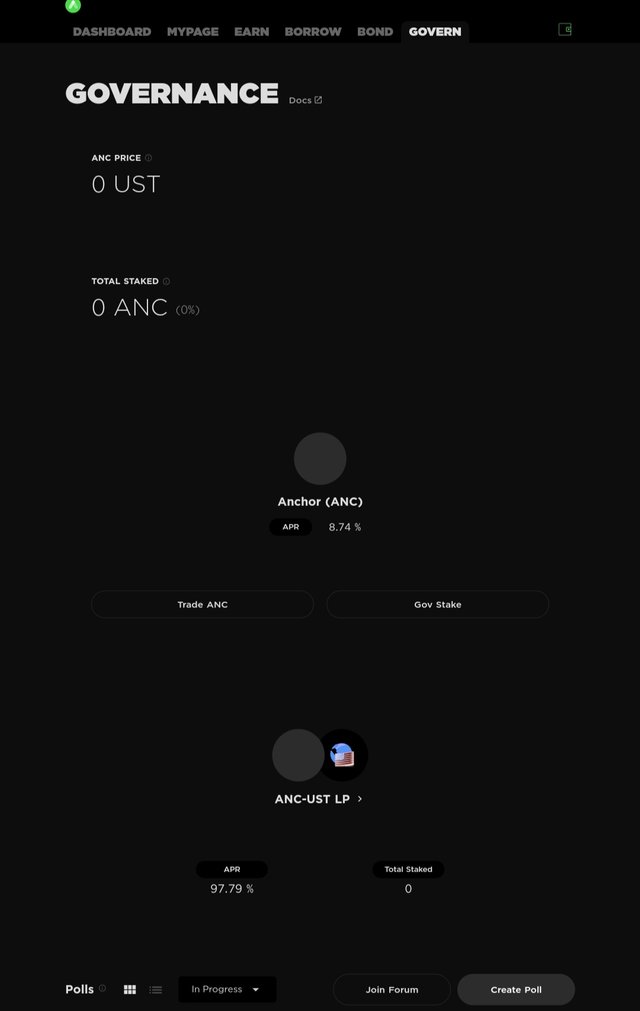

Governance

Source

ANC is the governance token of Anchor protocol. Here users can check ANC token details and can also supply ANC for staking.

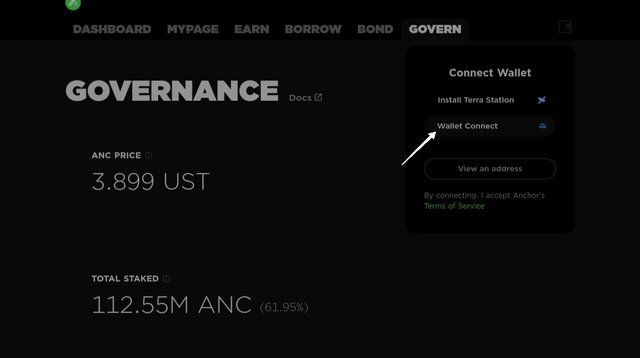

Connect Anchor protocol to Terra station.

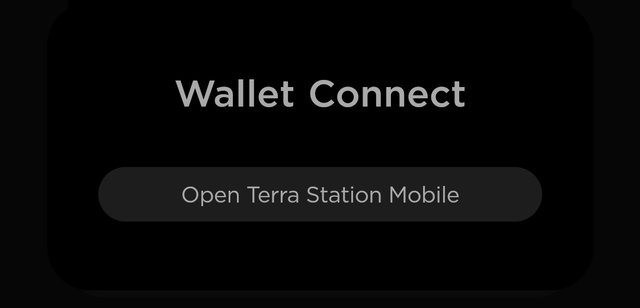

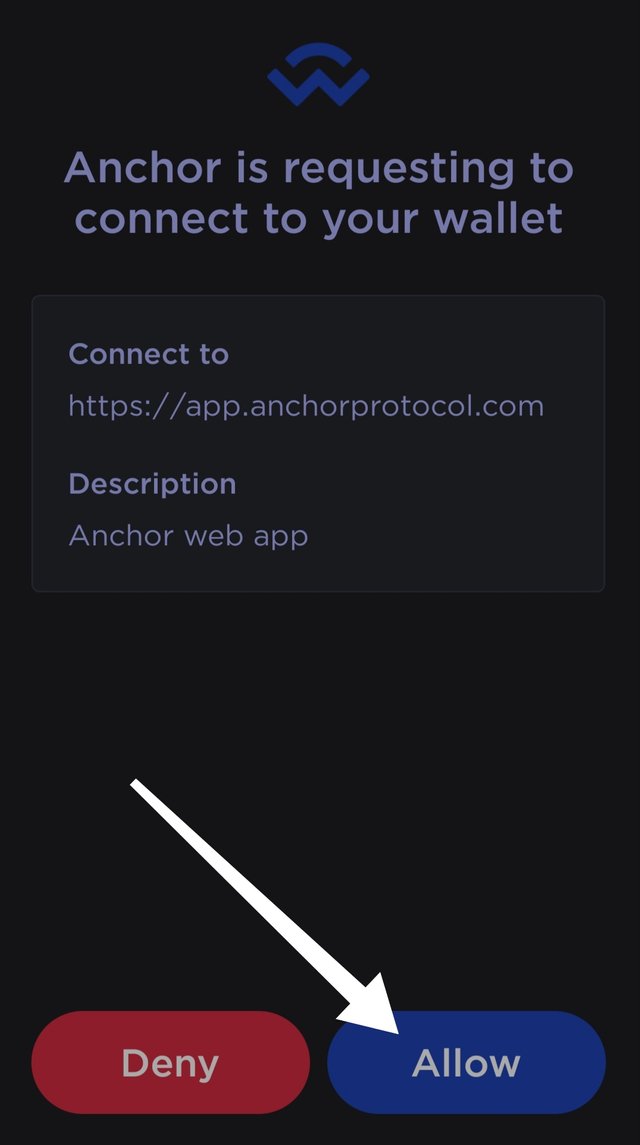

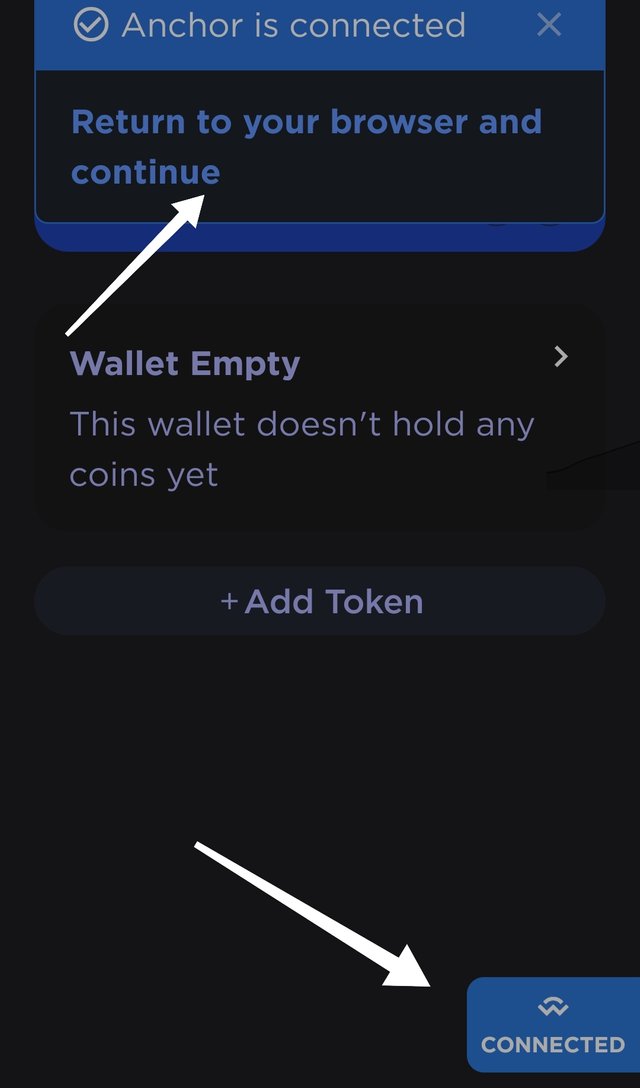

Log in to official website of Anchor protocol . From the main page, click on top right corner where you find connect wallet.

A notification of wallet connect will pop up asking to open Terra Station mobile.

Anchor will request to connect to Terra station. Click on allow.

Wallet is connected. As I have connect Terra station mobile app to Anchor.

Explain Mirror Protocol, connect Terra Station and explore the Mirror Protocol app. Show screenshots.

Mirror protocol is a Terra Blockchain based DeFi protocol that offers traders opportunity to trade Mirrored Assets (mAssets) . So the concept of Mirrored assets has to be understood first. Mirrored Assets are those assets that are not tradable otherwise due to multiple reasons like government regulations or operational barriers due to technical or monetary problems. These mirrored assets are also known as synthetic assets. Examples, mTSLA, mGOOGL, mABNB, mFB etc.

Explore Miirror protocol.

source

Go to official website of Mirror protocol and from the main page of the platform, we have different features to explore like :

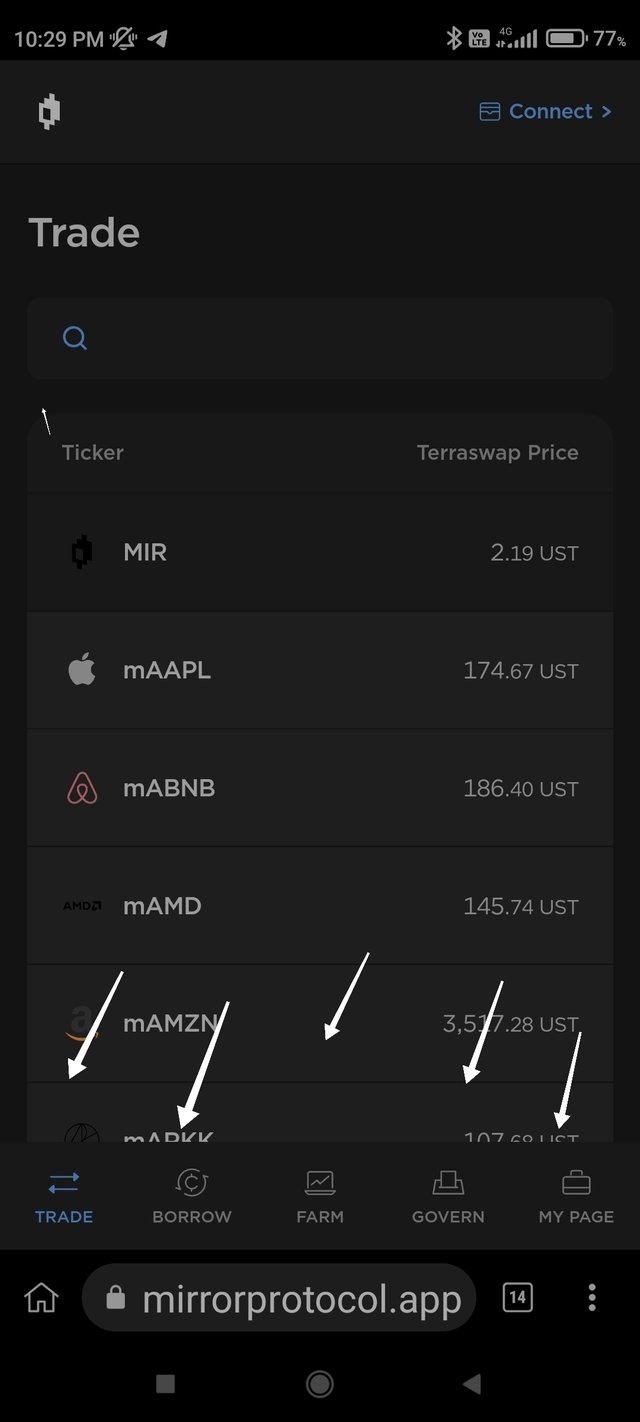

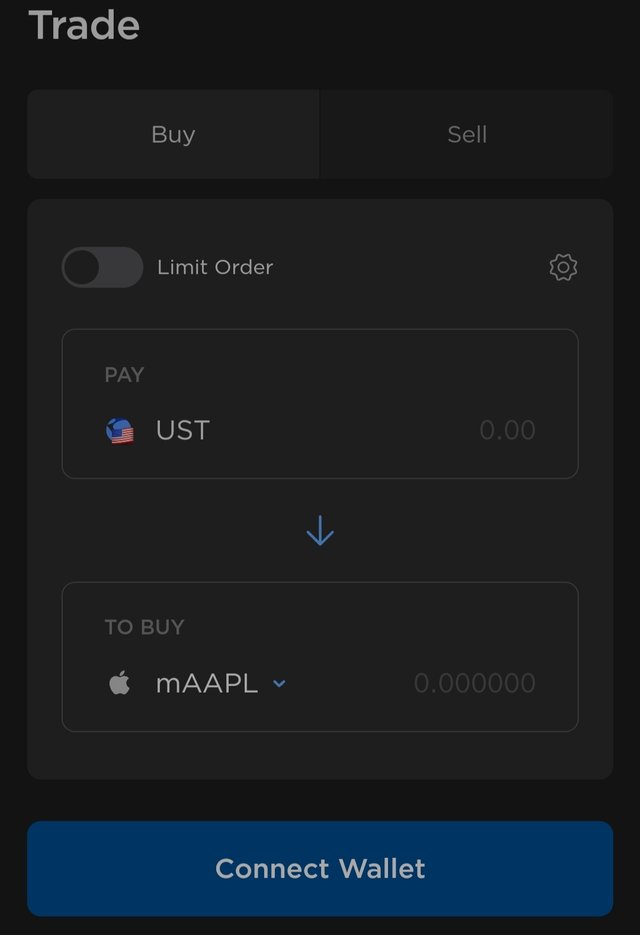

Trade

source

Here we get to purchase different mirrored asset by making use of stablecoin UST . We cal also sell our tokens for UST.

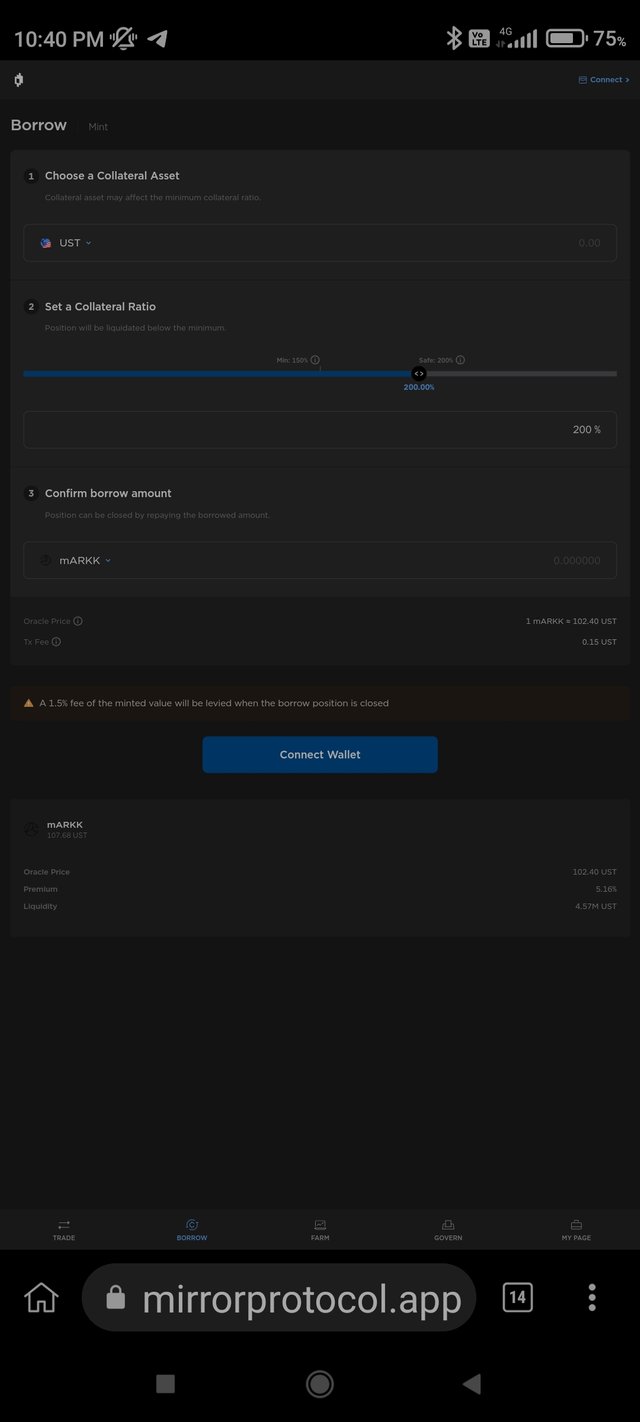

Borrow

source

As the name implies, we can borrow mirrored assets by making use of stable coin like UST or other mirrored assets. A user has to choose collateral ratio and supply collareral assets. More the ratio, more safer is the investment from liquidation.

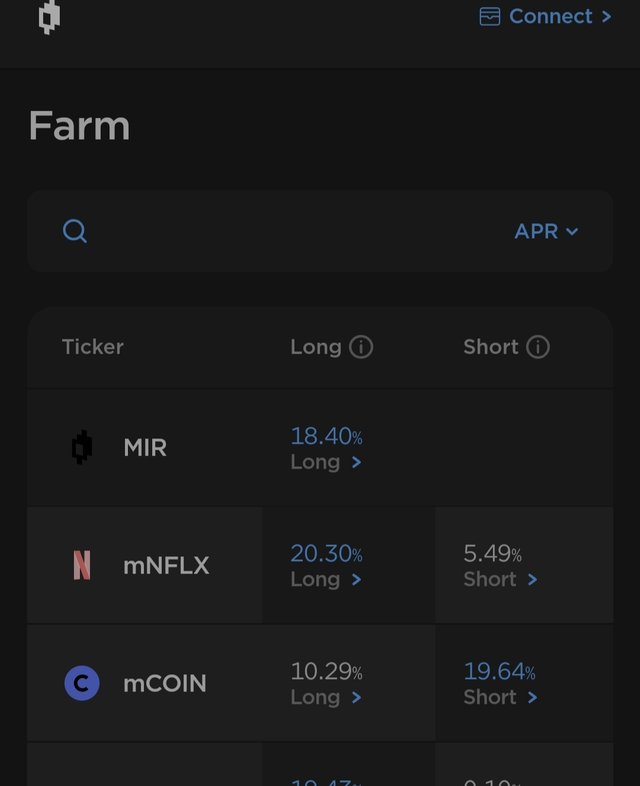

Farm

source

Here Mirror users can stake their mirrored toeken by long/short their position and earn variable APR. Staking rewards are earned in native token of Mirror protocol and that is MIR.

Please note that while withdrawing assets, 1.5% Mirror protocol fee has to be paid.

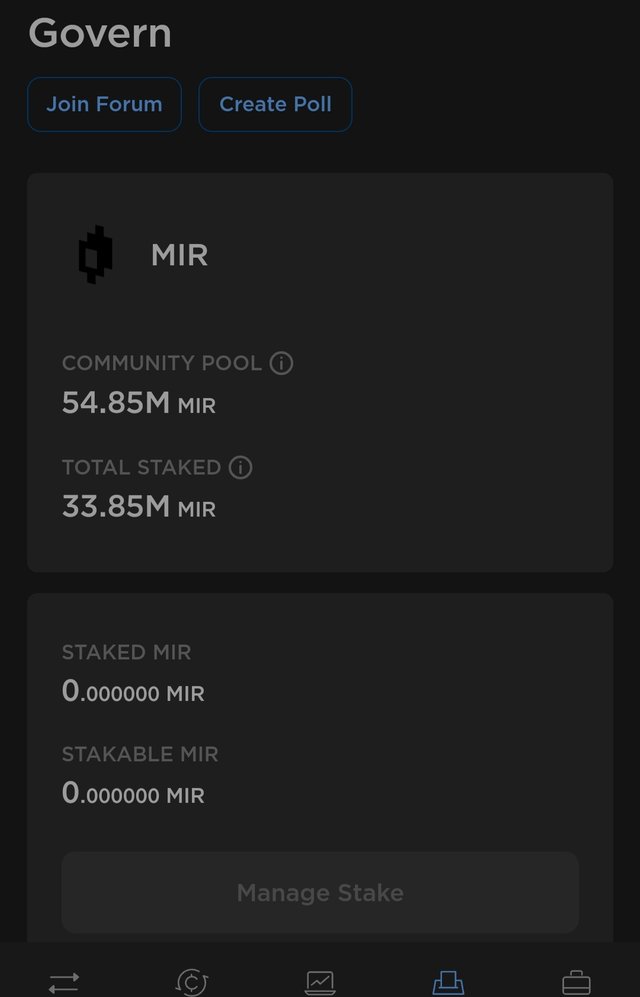

Governance

source

The governance token of Mirror is MIR. Under governance section, a user can check staked and Stakable MIR. It is by virtus of MIR that user can participate in governance of Mirror protocol. In addition to staking, MIR can be used fo4 staking and we also receive MIR as rewards for staking.

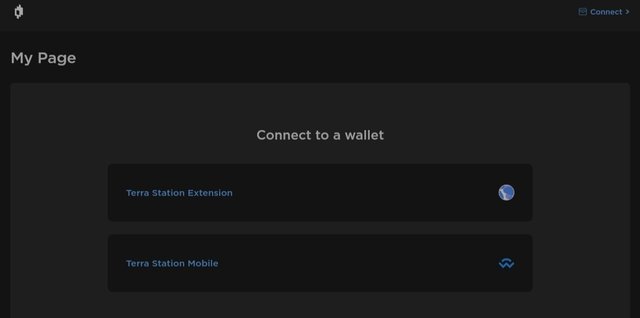

My page

source

Here a user gets all details about his holdings, rewards etc. You can also connect to wallet from this section.

Connect Mirror protocol to Terra station.

Log in to official website of Mirror protocol

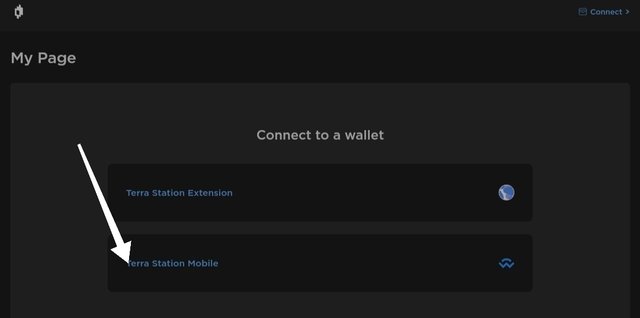

From the main page, click on top right corner where you find connect wallet. Click on it and next we get options to either connect with Terra station extension or Terra station mobile.

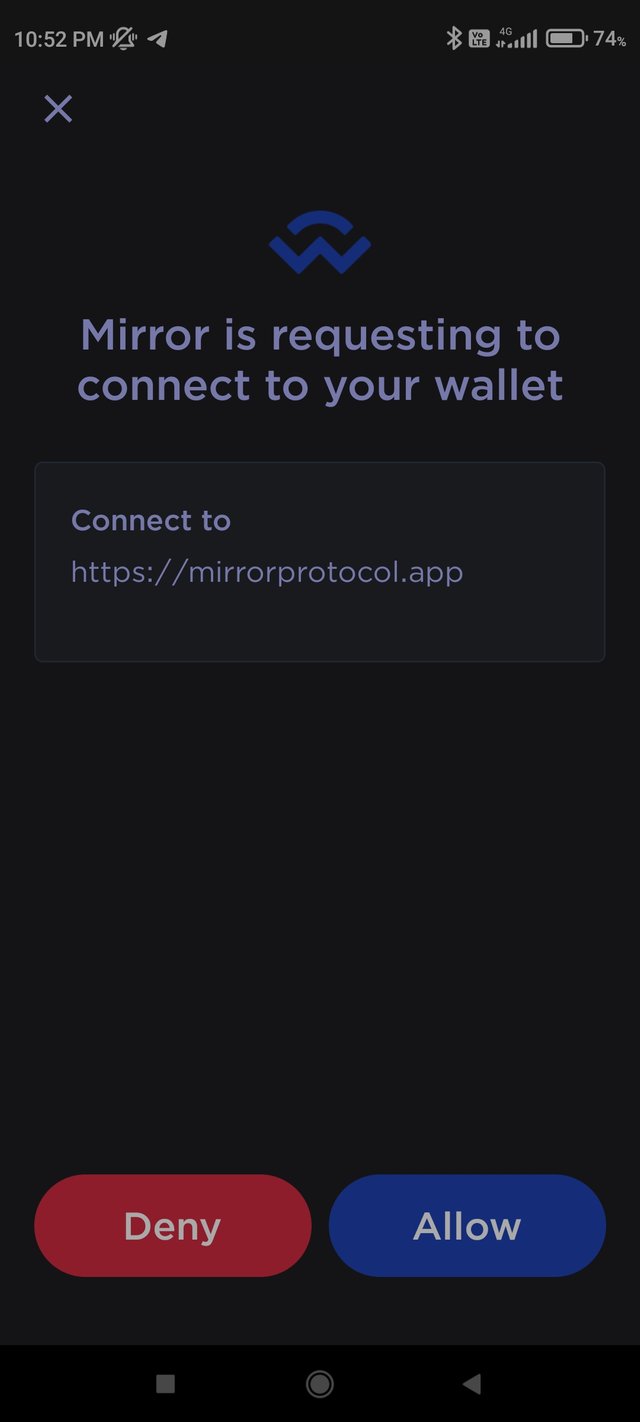

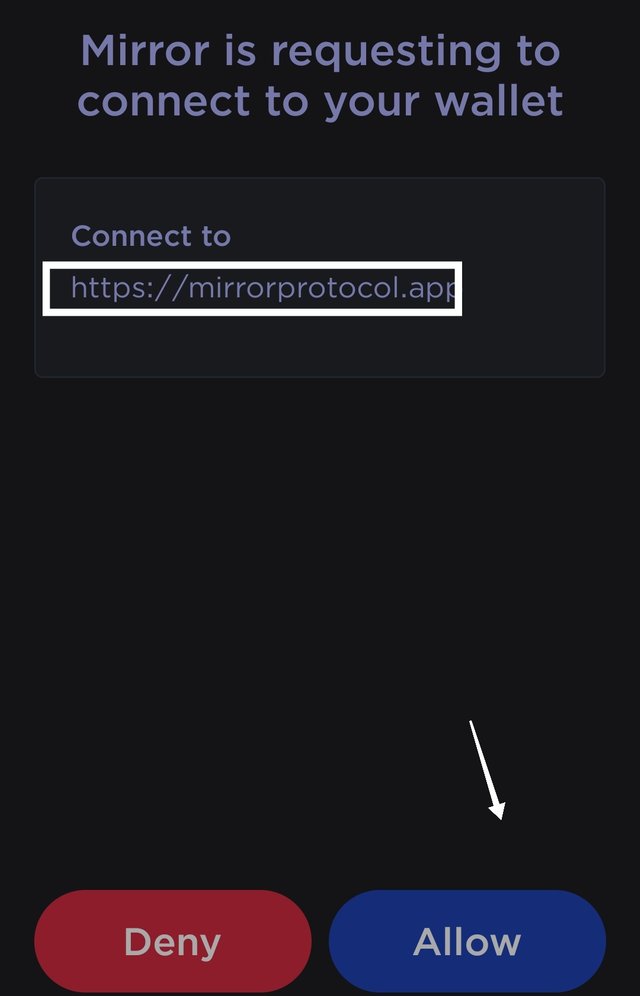

I choose to open Terra Station mobile.

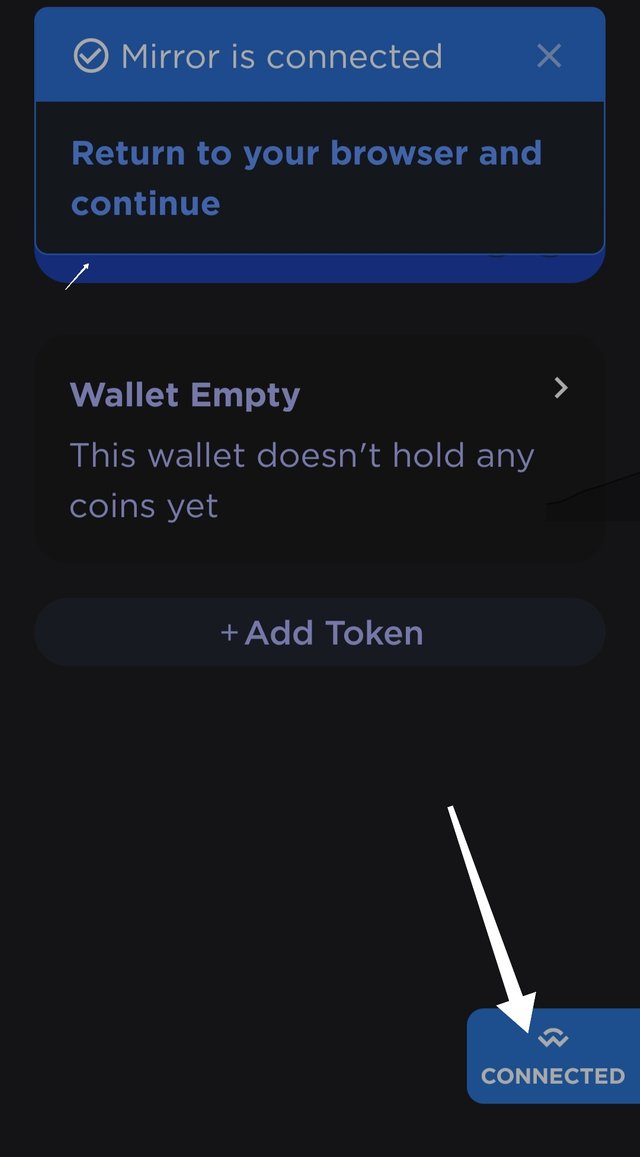

Mirror protocol will request to connect to Terra station. Click on allow.

Wallet is connected. As I have connect Terra station mobile app to Mirror.

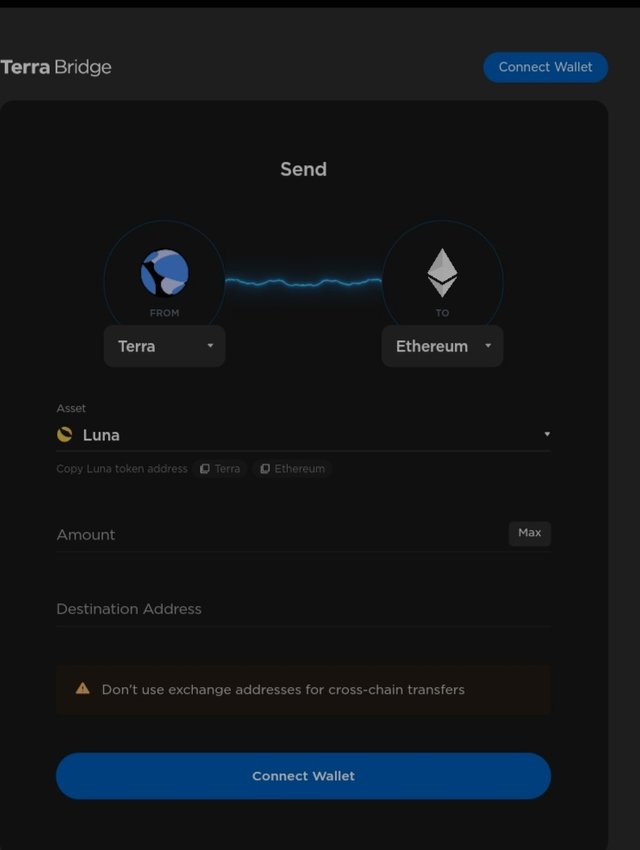

What is the Terra bridge? Explain, show screenshots.. Explain how it works and what Terra Stablecoins are.

As the name implies, Terra bridge acts as a bridge between Terra ecosystem and other blockchains like BSC, Ethereum etc. Majority of the tokens supportes by Terra blockchain are transferred cross chain. The assets include mirrored tokens , native tokens and other supported tokens of Terra blockchain. The Terra bridge charges 0.1% or 1$ as transfer fee. The final settlement is carried out by greater sum of the two among 0.1% or 1$

As for Terra stablecoins are concerned, we know that stablecoims came into being for offering a relatively stable price as compared to other crypto coins that are highly volatile. The two stable coins of Terra ecosystem are UST and LUNA. These stabeclins have been incorporated into Terra ecosystem for multiple purposes like Supplying to LPs to earn APY , supply as collateral amd earn yields from staking and yield farming.

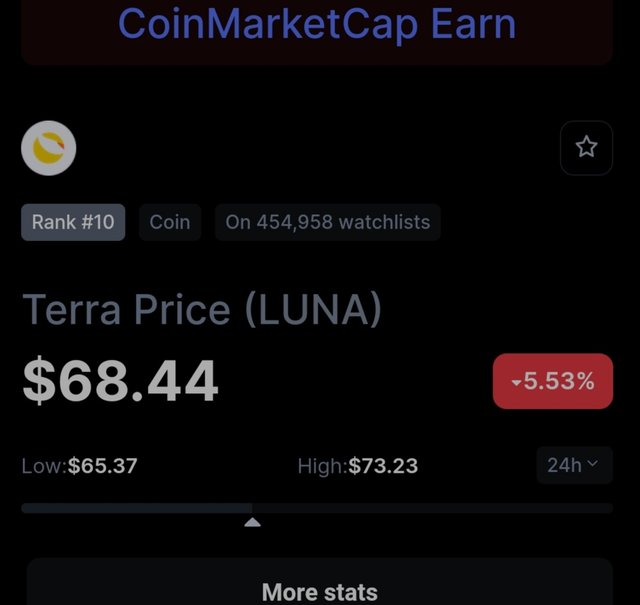

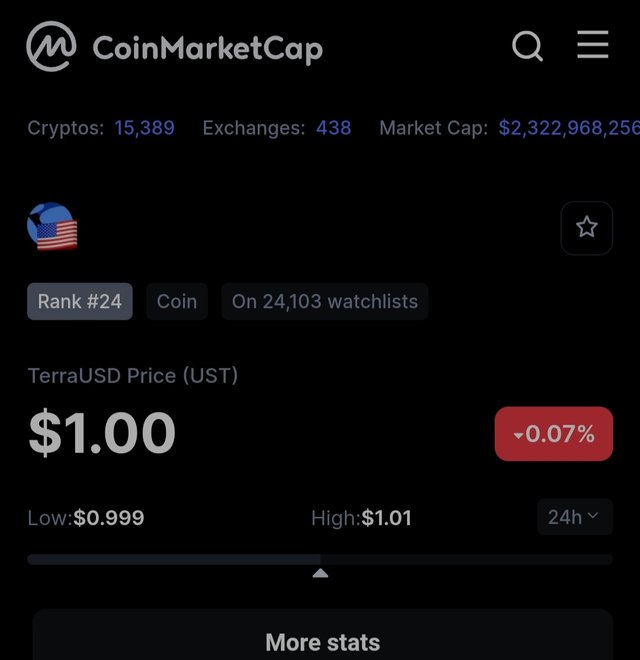

As for stastics from coinmarketcap is concerned, the live TerraUSD price today is $1.00 USD and rank is 24 . The 24-hour trading volume of $16,46,15,368 USD and market cap of $8,39,90,64,122 USD.

As for stastics from coinmarketcap is concerned, the live LuNA price is $68.44 USD and rank is 10. The 24-hour trading volume of $2 592 958 418. 78 USD and market cap of $26 151 833 332.68 USD.

You have 1,500 USD and you want to transform it into UST. Explain in detail and take the price of the updated LUNA token.

From the stastica given above, we have UST Value = $1

LUNA value = $68.44

We have to invest 1500 USD.

Therefore 1500 USD = 1500 UST (1:1 peg ratio)

Therefore 1500 UST will give us; 1500/68.44= 21.97LUNA tokens.

1500 UST investment would give us 21.97 LUNA tokens.

Now you have that 1,500 USD and you want to make a profit, since 1 UST = 1.07 USD. Explain in detail and take the price of the updated LUNA token.

As given in question above, we presume 1 UST = 1.07 USD. on Investing 1500 USD we will get

$1500 x $1.07 = 1,605 UST which is 105UST tokens more than with that of 1:1 peg ratio.

We have LUNA token= $68.44

1605 UST = (1605 UST68.44) = 23.45 LUNA

So we will get 1.48LUNA more than 1:1 peg ratio

Conclusion

Terra is a DeFi blockchain protocol that was founded in 2018 by Terraform Labs to act as powerful stablecoin based DeFi platform. Later on, Terra widened its usability via different protocols like Anchor protocol, mirror protocol to cover various DeFi use cases like staking, yoeld farming and swap etc. Terra bridge is a innovative functionality of Terra ecosystem to foster interoperability.