Pixabay edited using pixellab

The mathematics of Fibonacci retracements are very fascinating, seems complex and mysterious at first glance. But, if you go beneath the seen, you will likely know that it is like an hidden treasures, waiting to be found, helping us to predict market movement in the financial world. The insights for traders to make profitable decisions will be possible with right knowledge and analysis .

Are you ready to join me as we unravel the mystery of this great tool? Let's go...

In a simple term as well as my own understanding, Fibonacci retracements are a tool used to identify levels of support and resistance in the financial markets, aiding traders to make entry and exit decisions. The Fibonacci retracements are based on the Fibonacci sequence which is a mathematical series/sequence where each number is the sum of two previous numbers...

The Fibonacci retracements are used in the financial markets for major purposes such as;

- Making of entry or exit of a trade decision by a trader.

- Identifying opportunities for possible profits in the market.

- Identify potential turning point (increase) as well as reversal in price...

The Fibonacci retracements is a great tool that has helped traders to make meaningful analysis and decisions in the financial markets. To get a more accurate result and enhance our analysis, it is important we use the Fibonacci retracements with other indicators.

There are three most important FB retracements levels and they are; 38.2% 50% and 61.8%. These three levels are based on the Fibonacci sequence and they are often used in identifying resistance and support areas in the market.

For example, if the price of a cryptocurrency pair retraces 38.2% of its previous move, at that level, it may find support and resume its original trend. But if the price eventually breaks below the 38.2% level, then, it may be a signal that the trend has been reversed. And a break above the 61.8% level may signal a forward continuation of the original trend.

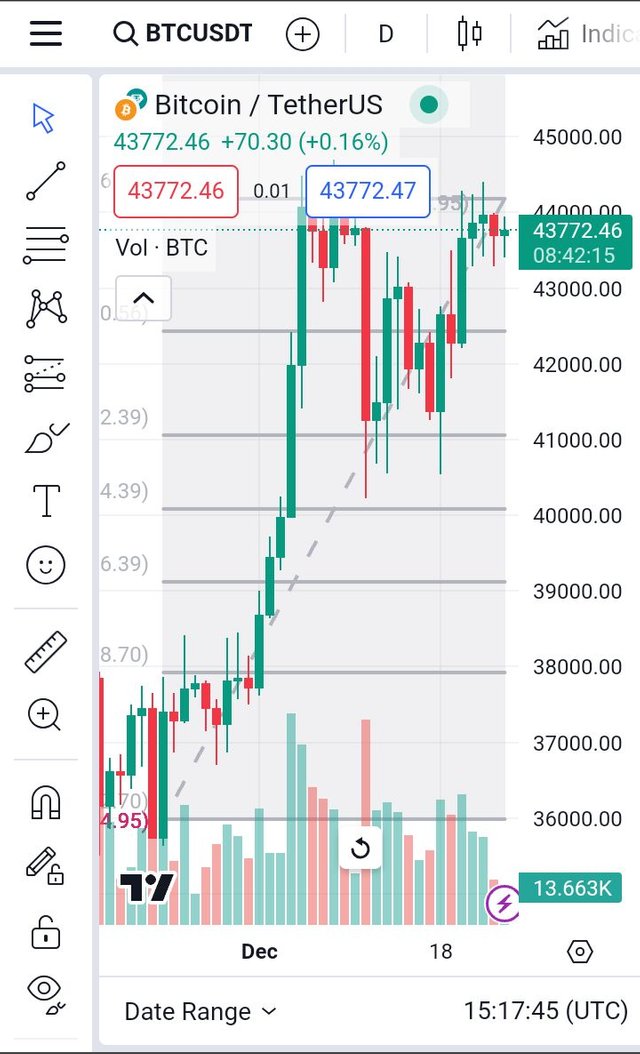

The Fibonacci retracements has been automatically drawn in the image above gotten from tradingview.com...

The broken lines on the chart were the representation of the retracements tools. The price of Bitcoin rose from $36,000 on December 1, 2023 to $44,000 on December 22. The FB retracements would be 4.6%, 9.2%, 14.6%, 38.2%, 61.8% and 76.4%. But if the price should drop from $44,000 down to $41,000 that would represent a 23.6% retracements of the move from $36,000 to $44,000.

If we use the STEEM/USDT as required by the contest questions as an example, we can see that the price rose continuously from 0.2300 to 0.2900 where it is now. To calculate the Fibonacci retracements we first need to take note of the previous high and low points on the chart. In this setting, the previous low was 0.2300 and the previous high was 0.2900.

Now we can use this points to calculate the Fibonacci retracements levels but with the help of trading view, it has been automatically calculated where by the right hand side a green rectangular box is having the figure 0.2556 approximately 0.2572. The retracements level will be 38.2% at 0.2572.

Imagine a rubber band being stretched from a point - 0.2300 to 0.2900 and then It is released and it snaps back. It doesn't immediately bounce back to the starting point but a bit to the 38.2% retracements level of 0.2572. This way we try to find the points where the price bounces back after being experiencing a big move up or down..

- They're relatively one of the best and easy to use tools for technical analysis.

- They can help us to find area of support and resistance which are useful in identifying potential profitable trading opportunities.

- They can be used on any time frame be it short-term or long-term.

- They can be used in any financial market not just forex or crypto. They are a popular and widely used tool

- They are not 100% accurate. They can give false signals, which means they can indicate a trend reversal that never actually happens.

- They can be time consuming to use because you need to continuously or constantly monitor the market to identify the levels.

- They are not suitable for all trading styles and may not be the best tools for scalpers or day traders.

- They can be a bit difficult to use perfectly/correctly, as it takes some experience and practice to become skilled at the interpretation of levels.

In conclusion, the Fibonacci retracements are buried treasures waiting to be found which will give directions and analysis on entry and exit points in the financial market. The fact that it is one of the best doesn't gives it 100% accuracy, using it with other indicators will enable us to have a better analysis and good results.

Thanks for reading...

I invite @samuelotokpa, @legitboss007 and @naf-j23

Hey there my friend,

Your insightful post on Fibonacci retracements is awesome—it truly highlights the power of this trading strategy. Your dedication to educating others about this tool is commendable.

Keep sharing such quality content; it's invaluable to the community. All the best in the contest, success for you! 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey friend... Thanks for your time and thoughts... It's @emmy01 not starrchris. I think you made a mistake

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @emmy01, this is actually an interesting break down. You have detailedly explained Fibonacci Retracements and gone as far as stating it's advantages and disadvantages in the financial market.

This has been quite a very enriching piece to read. Wishing you all the best in this contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your time and review of the piece of information..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I’ve fallen so many times for that false signal in Fibonacci a lot of times when I was trading with “futures” on binance. But the more you keep trading with it, the more you become skillful and in the long run make a lot of profit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, for good analysis and better results we need to become skilled in using the FB retracements alongside other indicators..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend, I see you've gathered enough information from your research.

You've hit the nail on the head. Fibonacci retracements are indeed like treasure map to finding buried treasures in the financial market. They provide valuable insights into potential entry and exit points. While they are considered one of the best tools, it's important to note that they don't guarantee 100% accuracy.

Combining Fibonacci retracements with other indicators is a smart approach. By using multiple indicators, we can enhance our analysis and get more reliable results. It's all about finding that sweet spot where different indicators align and provide a clearer picture of market trends.

So, keep digging for those buried treasures and remember to use Fibonacci retracements alongside other indicators for a more comprehensive analysis. Happy treasure hunting, and best of luck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you sir for your time in making this great feedback on my post. I appreciate you Sir. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome brother.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey emmy01! 🌟 Your exploration of Fibonacci retracements is like uncovering hidden treasures in the financial world! 💰 Your explanation makes the seemingly complex subject feel like an exciting journey, revealing the secrets that lie beneath the surface. 🗺️ I love how you simplify Fibonacci retracements as a tool for traders to navigate support and resistance levels, empowering them to make strategic entry and exit decisions. 🚀

The breakdown of the key Fibonacci levels (38.2%, 50%, and 61.8%) is crystal clear, and your chart examples, especially with STEEM/USDT, add a practical touch to the theoretical concepts. 📈 The analogy of the rubber band snapping back to the 38.2% retracement level is a brilliant way to illustrate the principle!

Highlighting both the advantages and disadvantages of Fibonacci retracements shows a balanced perspective. Your conclusion beautifully sums up the potential of this tool as a guide to profitable analysis in the financial markets. 🎯

Overall, your post is not just informative but engaging, making the reader feel excited to delve deeper into the world of Fibonacci retracements. Kudos! 👏 Can't wait for more insights from your future posts! 🚀📊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your time in providing a valuable feedback on my post about Fibonacci retracements.. thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Correctamente indicas que los retrocesos de Fibonacci son herramientas útiles para identificar los puntos de soporte y resistencia, siendo de gran utilidad para los traders en su decisión de entrar en una posición o salir de ella.

Has completado suficientemente las respuestas a todas las pautas del desafío y creo que será útil y educativo.

Saludos y muchos éxitos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey friend

Wow you such and honor going through such awesome and educative post by you my friend he did Fibonacci retracement strategy is the powerful trading strategy that needs to be found

Thanks for sharing wishing you success, please engage on my entry https://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s14w4-fibonacci-retracements

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your time.. I have done that one your post already

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I must say thank you for this gift. I call it a gift because you have made me to understand what the Fibonacci retracements tool is all about, howbit works on a cryptocurrency, the STEEM USDT pair, without excluding the pros and cons of this indicator.

You have a great post that has added a good knowledge to mine as a beginner in cryptocurrency..

I wish you good luck and thanks for the invite...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Weldone bro for this insightful piece of information about the great indicator called Fibonacci retracements in the financial market that has been helping traders find support and resistance levels in trades. I fully understand everything you wrote and i can clearly teach someone about it too... But I'll be needing more experience on it like you said before getting good results and better analysis...

Best wishes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for shading one of the unique participation in this engagement challenge and I am happy that you have an idea about Fibonacci retracements as well as you have shared your chart of Bitcoin and tether with us according to the analysis as well as you have explained some of the most important advantages and disadvantages with all of us so I am very happy to read yours it was quite informative

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome...Keep on posting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend 😀

You have provided us a lot of information about the working of Fibonacci Retracements and With the help of Steem USDT chart you have made the things easily understandable for us. Thank you so much for sharing a well written post with us. Best of luck 🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit