”1. What Is the Importance Of the DeFi System?”

Defi fully pronounced Decentralized Finance is a public authority/controlled financial system working with smart contracts mechanism and cryptocurrencies.

Looking at the above definition, we can pick out four key words:

- Decentralized

- Finance

- System

- Mechanism

Decentralized: Decentralized means scattered amongst many, such that sole authority by one number isn’t possible. Centralized finance has been a system where a sole party or few group of people(parties) own the authority over others finances thereby most times making it work for them rather than those who actually own the finances. This way there are lower interest rates, far higher loan repayment rates, rigid financial categories for investment etc. All these finally making investing not really worthwhile.

Financial: This shows that Defi has to do with finance/money. Where cryptocurrencies, tokens, stable coins etc it could always be converted to our native currencies and used to purchase goods and services.

System: This means that Defi has an “input” and an “output”. And has to deal with people. So when you invest(input) your money in Defi, it becomes available to someone else as a loan(output).

Mechanism: Most people call Defi systems: Smart contract Algorithm, whereas they are actually Smart contract Mechanisms in that, algorithms are usually self/ or people centered having complex yet sentimental design intent. Mechanisms on the other hand are like machines which are blind to the individual and work as far as you have the necessary requirements which in this case are a “recognized wallet” and an “internet connection”. This way Defi systems stand for equality amongst participants.

From the above definitions we can say that the importance of Defi are:

- Shared Governance: Here Defi doesn’t rely on one central authority, with a shared power and a smart mechanism to detect sabotage, the Defi system removes the major flaw of centralized finance.

- A reliable System: As much as its complex mechanism, the Decentralized finance system is also very reliable allowing individuals to easily and safely transact with it.

- Easy to use Finances: Like mentioned earlier, the Decentralized financial system is very easy to use, one only has to have an internet connection and a recognized crypto wallet.

- Equality and transparency: The Decentralized financial system has brought about equality and transparency in transactions everyone can now participate equally without sentiment of social or financial status.

- Privacy: without the need of registration and facial verification, the decentralized financial system has made financial activities possible respecting privacy.

- Flexibility: Flexibility is another great angle of the Decentralized financial system, for individuals to be able to transact with ease and flexibility.

”2. Flaws in Centralized Finance. “

Flaws with Cefi:

Centralized Finance although haven being the conventional financial system, it has some intrinsic flaws which I will be pointing out below:

Limited Control Over Funds by Fund Owners

With Centralized finance fund constrained on what and what not they can do with their money, sometimes funds are even frozen without prior noticing account owners.

External Sentimental Authority over users funds

Authority over users finance can be irritating sometimes, once my steem coins where frozen on my binance wallet because they were undergoing an upgrade without prior informing me of the upcoming upgrade. I lost a good percentage of the value of my steem due to negative price fluctuation as I couldn’t count convert my steem to stable cryptocurrencies during the time.

Lack of Financial Privacy

Lastly with Centralized finance, there is the need for user registration and facial and residential address verification and even sometimes confirmation. This which makes no financial privacy inescapable.

”3 DeFi Products. (Explain any 2 Products in detail).”

Defi Products which range from stable coins, defi exchanges, and lending. I will be discussing on Stable coins and Lending.

Stable coins

Stable coins which are Dollar pegged cryptocurrencies aimed at tackling the always fluctuating conventional cryptocurrencies allows for investors to have a stable ground to wait when the crypto market seems uncertain before entering back at great entry positions. Example of a Stable coin is the Maker Dao Dai.

Dai

The Maker Daos Dai stable coin is a US Dollar pegged crypto currency under the Dao protocol.

Generated by smart contract where undividuals can deposit collateral asserts into the Dao system worth the amount of Dai they are hoping to generate.

With the idea of an assert backed stable coin, the Maker Dao’s Dai can now be traded on public exchanges such as Binance, Coinbase etc.

Lending

Borrowing has always been an attribute of man to help sustain and grow his business or livelihood. With conventional Centralized finance making lending really hard for the common man, and very sentimental to the richer folks, Decentralized finance has made lending really easy to access by everyone with relatively better rates. Below I will be explaining the Aave lending protocol.

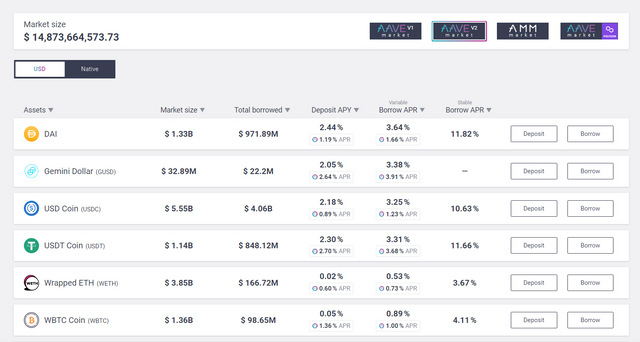

Aave Lend

Founded by Stani Kulechov, Aave protocol is a Defi lending dapp built with the intention of making investing and more loans on the Ethereum network super easy to use.

With over 17.8 million worth of liquidity pool, and an average loan interest rate of 10% APY with its flash borrowing for developers, the Aave loan is really a great Decentralized finance platform.

With its native currency being Aave, it is listed on coinmarket cap ranking number 26 with a market cap of $3.612 Billion dollars.

”4. Risk involved in DeFi.”

Criminal Activities

The major fear with cryptocurrency more amongst governments is its use with high profile criminals and terrorist profile organisations to carry out their activities. From transacting through decentralized wallets and the use of the Dark web for communication it becomes harder for governments to track these individuals and organisations.

Rug Pull

Rug pull is a fraud committed in the cryptocurrency decentralized finance industry by developers where they acquire funds through ICOs or listing them on a Decentralized exchange such that when investors put hard earned money in these currencies the developers withdraw all the currency from the liquidity pool and investors lose all their money.

Price Volatility Risk

Crypto currencies are best known for their very high price volatility, this doesn't exclude Defi tokens which have their prices varying 24/7. This posses as a risk to investors who may invest a token as at a given price for a given interest rate, but then when the time period is over the token price had dropped more than the interest rate inclusive. This becomes a net loss to the investor and more a waste of precious time.

”5. What is Yield Farming?”

Yield farming like the name suggests:

Farm: “allow someone to collect and keep the revenues from (a tax) on payment of a fee.”source

Farming involves giving someone some capital (land/money/human resource etc) to be able to give U back profit from the activities he uses it for.

Yield: yield is the revenue gotten from a given venture.

Yield farming now is the process of empowering someone to get a venture which yields profit with your intention of generating profit/revenues from it.

In the crypto context, yield farming is the process of lending your crypto currency especially ethereum to a liquidity pool with the intention of generating interest from the revenues gotten through fees paind by user.

”6. How does Yield Farming Work?”

With Yield farming basically being adding liquidity to a liquidity pool via cryptocurrency, the process of yield farming now involves 2 major parties:

- Liquidity Providers

- Liquidity Pools

Liquidity Providers

Like in a system, liquidity providers are the input, they fund the liquidity pool with cryptocurrencies for operations to work smoothly due to high volumes.

Liquidity providers earn interest from revenues gained from the liquidity pool.

Liquidity Pools

Liquidity pool is the work station of the system fueled by the liquidity providers. The liquidity pool provides platforms such as cryptocurrency swapping, loans, lottery, wallets, etc. from which it generates revenues through fees charged.

This revenues are now split between the pool developers and the liquidity providers.

With the explanation of the roles played by the major parties, we can see that the liquidity pool works in a smart contract mechanism using the Auto Maker Model.

”7. What Are the best Yield Farming Platforms and why they are best.”

The best platforms are usually known from trading volumes and popularity as statistics show.

Today I will be discussing on the biggest DEX platform (by Coinmarket cap rating) and another very popular one which both provide yield farming options.

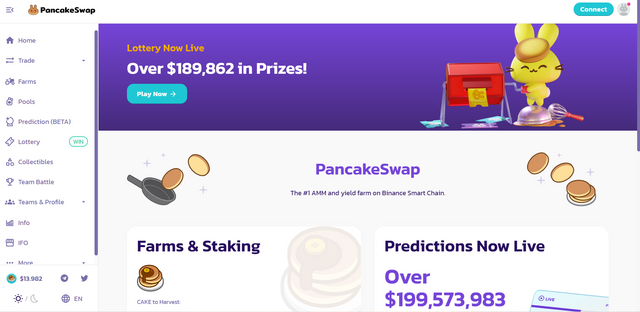

Pancake Swap:

Pancake swap is a major decentralized exchange like Uniswap, offering trading, farm, liquidity pools, prediction platform, lottery and collectibles.

Focusing on its farms as for this homework, pancake swap farms offer high APR for yield farming on its platform offering your either crypto currencies, BNB or Cake to its liquidity pool, Pancake swap allows everyone to easily earn from its liquidity pool from the comfort of their homes just through their wallet and an internet connection.

Aave:

The Aave decentralized liquidity protocol offers a liquidity pool where liquidity providers can come in staking their crypto currencies on their smart contract protocol hoping to make the expected APR%.

With the Aave one can quickly connect to his decentralized wallet and lend cryptocurrencies hoping to earn upto 21% APY.

"8. The Calculation method in Yield Farming Returns."

Investing in yield farming as we all know is for profit/Interest. Many of us know interest from high school to be calculated as:

I = (P * R * T) / 100Where P = Principal

R = Rate

T = Time.

In Cryptocurrency we have the APR and APY Interest methods, though sounding alike their calculations are very much different.

The APR is the Annual Percentage Returns. This which has a formula very close to the Simple Interest shown above, the calculation for APR is:

APR = (P * R * 1) / 100Now if I invest 300 dollars with a DEX yield farming giving 54% APR after one year, I get:

= $162

Therefor total gained after one year = $300 + $162 = $462

The APY is the Annual Percentage Yield. This which has a compounding factor formula is calculated as below:

APY = [(1 + (R/100) / T) ^ T - 1]Now if I invest same 300 dollars with a DEX yield farming giving same 54% APY after one year (365 days), I get:

P * [(1 + (54 / 100) / 365) ^ 365 – 1]= [300 * ((1 +(0.54 / 365)) ^ 365 – 1)]

= [ 300 * ((1.001479) ^ 365 – 1)]

= 214

Therefore total gained after one year = $300 + $214.59 = $514.59

"9. Advantages & Disadvantages Of Yield Farming."

Freedom

Unlike conventional bank interest rates, Yield farming rates give you more freedom of investment and with many and varying Defi platforms, one can choose to diversify his investment, creating a wonderful portfolio.

Higher Interest

Yield farming gives very good interest which makes it very lucrative to crypto enthusiasts. Unlike conventional banks giving about 5% to 8% ROI, crypto yield farming gives upto 50% APY on Liquidity provision.

Ease of Accessibility

One major edge crypto Defi has over regular banks are the need for only a recognized wallet and internet connection. This makes life very easy for crypto investors.

Crypto Price Volatility/Uncertainty:

Crypto Prices can be very volatile, this which causes Investors to be skeptical of long term investments, not wanting to get a net loss after investment.

Higher Gas Fees on some Platforms

The Ethereum platform has been known for its high gas fees, sending crypto for investments on platforms which use this network involves high gas fees which is not suitable especially when it now surpasses the expected interest.

Fraudulent Platforms

Some Crypto Defi Yield platforms are fully designed to defraud people with a plan to make it look as real as possible. This which cannot fully be controlled or curbed due to decentralization is an issue worth nothing in the crypto world.

"10. Conclusion on DeFi & Yield Farming."

Defi has made investing beautiful, diversification and inclusion having a faster growth rate in the financial sector. I no longer have to be subject to sentimental bank authorities and policies, my money is mine and I control it.

Yield farming is the new virtual farming, creating a great portfolio after a good research on platform to invest on makes investing more fun.

N/B:

Always do enough research before investing in any crypto platform, from company reputation to token value and acceptability.

Thanks.

CC: @stream4u

Hi @hadassah26

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit