( 1.) Describe the differences between Staking and Yield Farming.

The cryptocurrency which has come to stay has been of great help to a lot of people, which I am included. It is not news that Cryptocurrency works with Blockchain Technology. Blockchain technology which works on a decentralized system that is a great help. Blockchain technology came with the sole intention which is to remove the centralized system out from the market and to make the individual have full control over his funds.

They have been a lot of platforms that you can invest in the blockchain. The Blockchain is made of the Defi which is the Decentralized Finance. Decentralized Finance comprises applications and projects which are all based on blockchain technology. Some of the projects that work on Decentralized Finance are Yielding farming and stalking.

Today we are going to look at what made the stalking difference from the yielding farming.

Staking

In the proof of stake consensus mechanism, the validators stake a particular of assets to create a new block. Staking helps to verify transactions in the blockchain that uses the Proof of Stake consensus mechanism, while the participator stakes his money, they usually get rewarded.

When you put your crypto assets, to help the blockchain network to verify and confirm a particular transaction, this process is known as Staking. Knowing the fact that it is being used for a proof of stake consensus mechanism, which uses less energy compared to the proof of work consensus mechanism.

People use staking to generate passive income in the crypto space, this happens because some cryptocurrencies often give high-interest rates which are used for staking.

How does the staking works in crypto.

In the proof of stake consensus mechanism, staking of funds is the method that is being used to add a new transaction to the blockchain. The people which use this mechanism give their coins to the cryptocurrency protocol and the higher coin you give, the more your chances of being selected.

A new coin is made and distributed as a staking reward to the participant with the higher stakes anytime a new block is added to the blockchain. The majority of the time, your reward comes in the same coin you staked, but at times, different coins can be given as a reward.

Not all Cryptocurrency uses the proof of Stake Consensus mechanism, for you to be part of that competition of staking, you will need to own some coins already in the cryptocurrency coin.

Some Cryptocurrency that uses the proof of stake consensus mechanism

EThereum, Carando, Polkadot, Solana etc.

Yield Farming

Yield farming is synonymous to our normal farming, which after planting a seed in the soil, with time, you will reap the fruit of the seed you have planted. Yield Farming works like some banks that give you interest for saving money with them. Yield Farming which is also known as Liquidity harvesting, liquidity mining is one essential way investors makes money from the cryptocurrency space. It is lending cryptocurrency mechanism to the cryptocurrency blockchain, that yields interest with time.

You get rewards from the cryptocurrency holdings. Your cryptocurrencies is been locked up and you will begin to receive rewards.

It works in such a way that the Liquidity provider which is the user provides or add funds to the liquidity pools and the liquidity pool which has a Smart Contract. When the Liquidity provider provides liquidity, he gets rewarded by funds from fees which is generated by the Decentralized Financial platform and so many other platforms.

There are some situations where the reward can be gotten in multiple tokens, and the liquidity provider may also deposit the liquidity to other liquidity pools so that he can get rewarded from there also.

The yield farming is mostly done with ERC-20 tokens on the Ethereum platform and you get your reward in the ERC-20 token. Some platform that offers yield farming includes Swap, Pancake, Aave and Uniswap.

Difference between the staking and the yield farming

- Stake user usually gets a return of 5% & 12% while the yield farming return rate varies from 2.5% to 250% looking at the APY rates

- In staking your fund is being locked for some time but in the yield farming system, you have full access to your funds anytime and any day.

- In staking your fund is protected and it has very high stability, being that it is very hard for you to lose but in yield farming, you can lose your fund if there is a high gas fee, bad actors, or even a bearish market occurs.

- Staking has the sole aim of adding a new block to the blockchain while yield farming has its aim which is to generate income for its users by giving reward which comes in form of interest.

- The staking works well using the Proof of Stake consensus mechanism while the yield farming uses the Automated market maker which helps the liquidity provider to get interest.

( 2.) Enter Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Display screenshots.

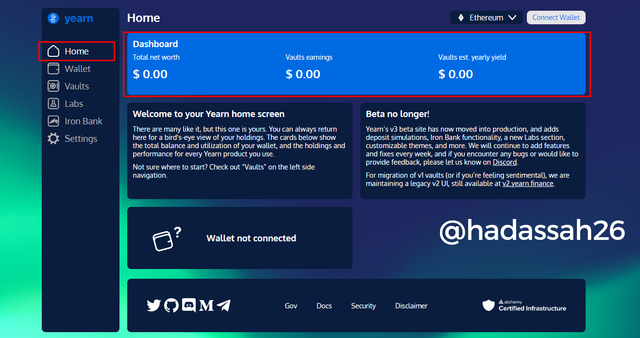

This is the homepage of the yearn using this particular website Yearn

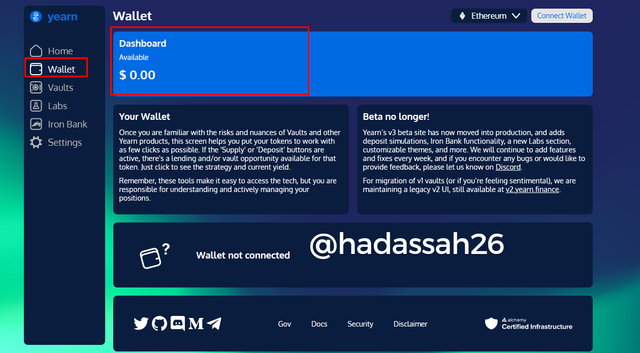

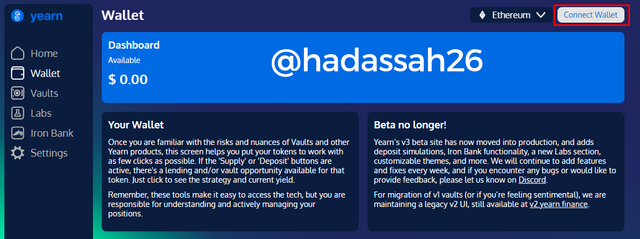

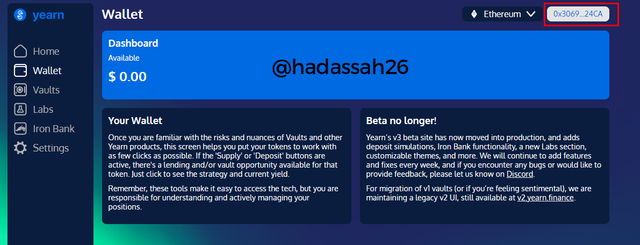

The next page show your wallet amount.

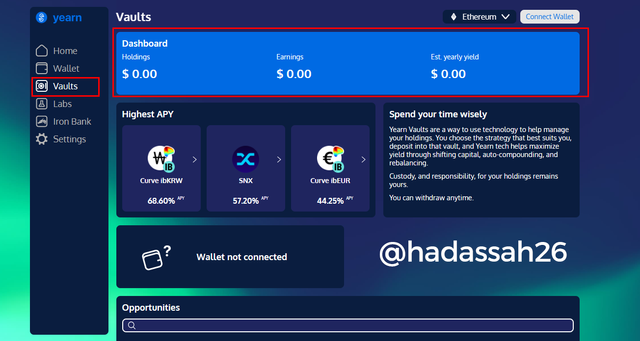

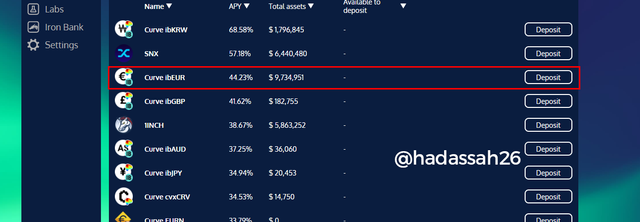

the vault page of the website

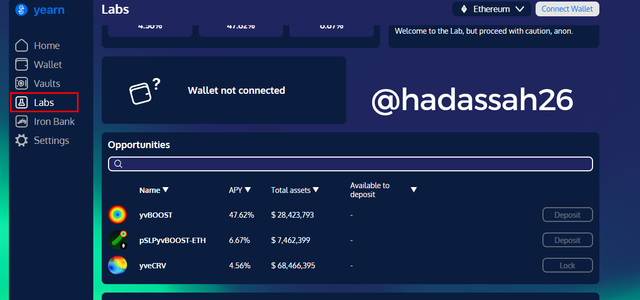

the next page option takes you to the lab page

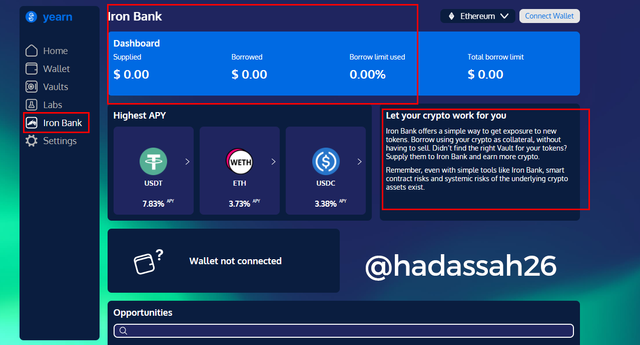

The iron bank page which shows you new ways to get exposure to new token

How to connect Wallet to Yearn Finance

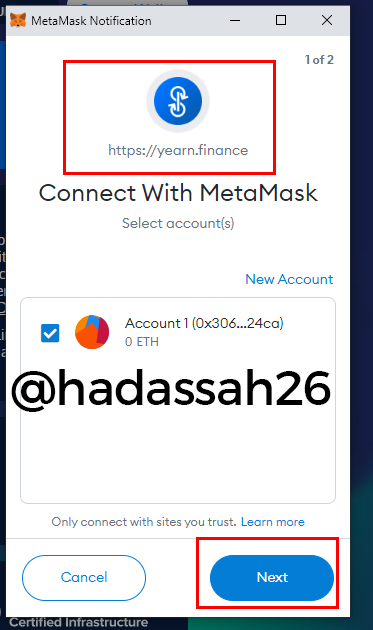

Quickly click the wallet and select connect wallet

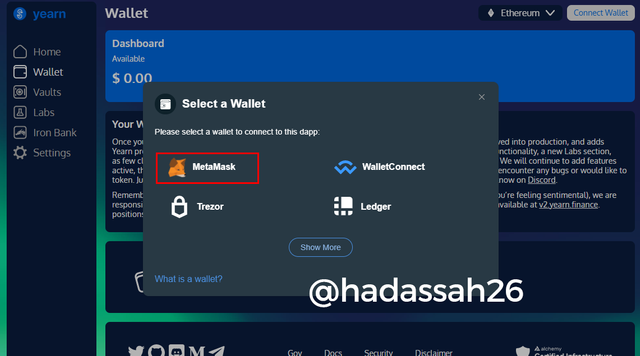

From the list of Wallet select MEtamask wallet

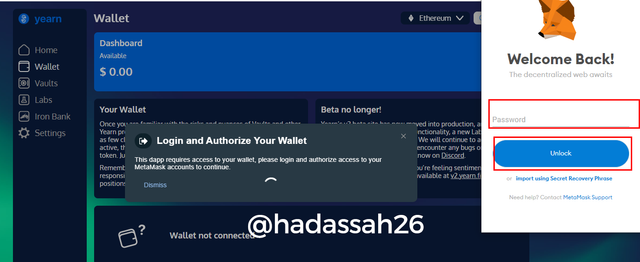

Then you can input your password and press continue

The Metamask will open and you will see that it has connected to the metamask

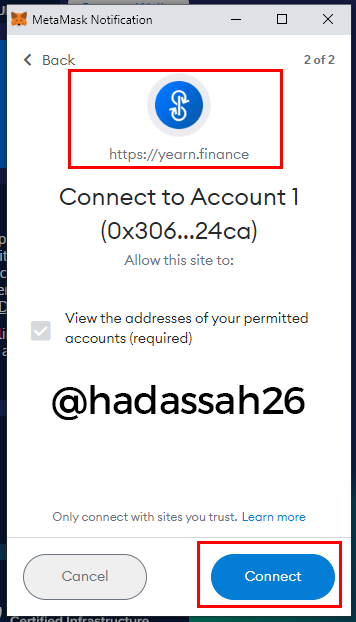

Then press connect to complete the process

You can now see that yearn finance is connected to the Metamask

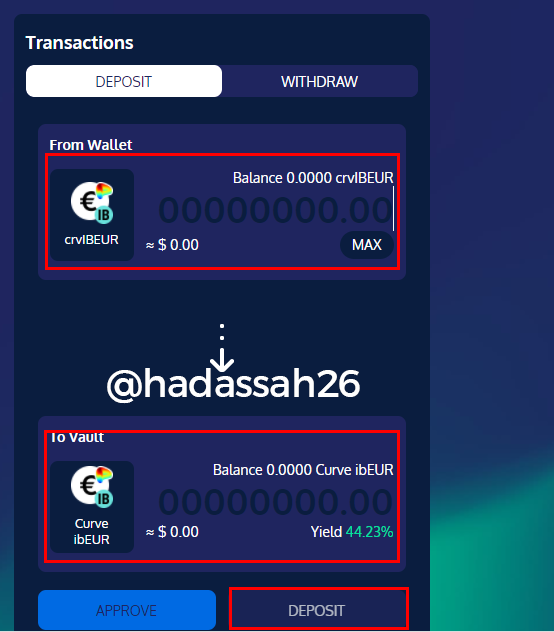

Select one of the opportunities, so you can deposit into it.

Input the amount that you want to deposit

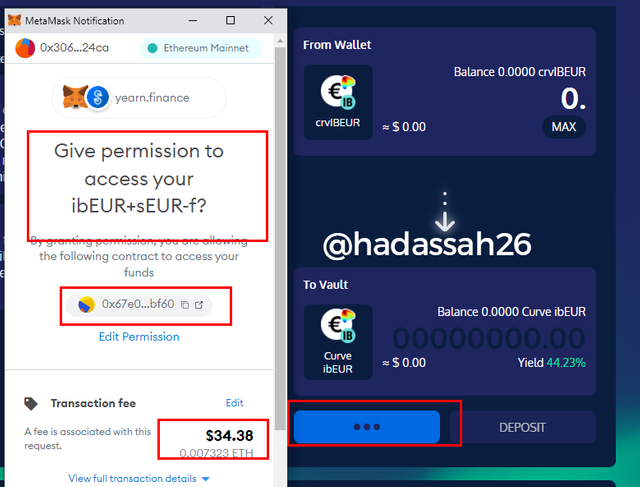

Automatically the Metamask windows will pop up showing that you have permission to it

( 3.) What is collateralization in Yield Farming? What is the function?

In a centralized system, when you want to obtain a loan from a bank, you usually come with a collateral in order for the loan to be given to you. A collateral is something you can exchange if you fail to pay the loan that you collected. Even in the Decentralized system, it is being used. But it provides assurance that you are a genuine individual. How important the collateral the loan is depends on the what protocol you are supply your funds to, but it is of high Importance you look at the collateral ratio very well.

As a borrower in the yield farming, you need to provide collateral for you to obtain the loan.

Also, the collateral is usually more than the amount that you are desiring to borrow, which aims to avoid liquidation. This concept is called Overcollateralization.

For instance, the lending protocol that you use, have a lending protocol which requires a collateralization ratio of 300%. for every $100 you put in. You can borrow $33.33. the collaterization in yield farming helps to reduce liquidation risk after you have borrowed a certain amount .

( 4.) At the time of writing your assignment, what is the TVL of the Defi ecosystem? What is the TVL of the Yearn Finance protocol? What is the ratio (ratio) of Market Capitalization / TVL of the YFI token? Display screenshots.

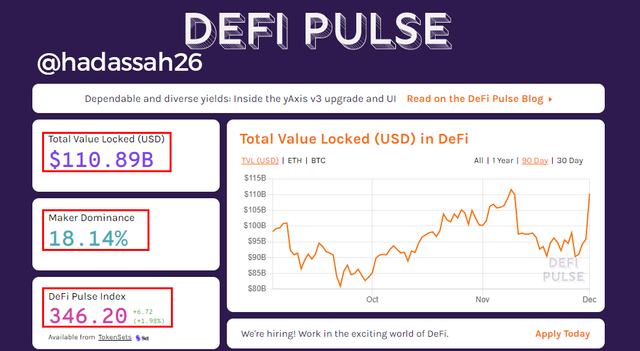

We can see TVL of the DeFi ecosystem from when I am writing this.

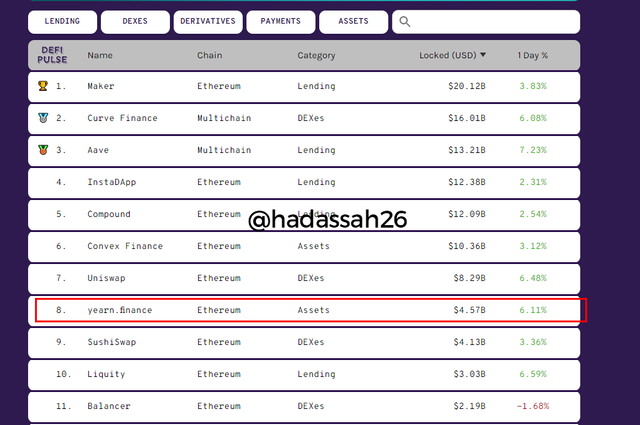

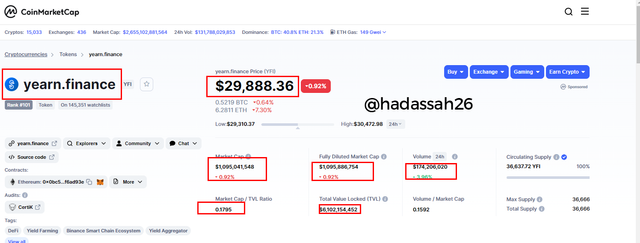

TVL of the Yearn Finance Potocol

Market Capitalization / TVL of the YFI token

0.1795

( 4.1.) Is the YFI token overvalued or undervalued? State the reasons.

For me the YFI token is undervalued. Because, having a market capitalization/TVL value of 0.1795 which is not even up to one. The Market Cap/TVL ratio is used to determine how valuable a coin or token is. Seeing the fact that it is less than one makes it undervalued.

Also, the YFI which is primarily used in yield farming, and liquidity providers normally use it to provide liquidity in a liquidity pool makes it more limited as compared to another token that is used as means of payment and other services make the YFI more Undervalued.

( 5.) If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment today? Explain the reasons.

The chart below shows the Bitcoin/USD, I bought it with $500

The chart below shows the YFI, I bought it with $500

Yield from BTC = 44.11% of $500 = 500 X 44.11/100 = 220.55

$500 + 220.55 = $720.55

Yield from YFI = -6.39% of $500 = 500 X -6.39/100 = -31.95

$500 - 31.95 = $468.05

Addition of the both yield will give you

= $720.55 + $468.05 = $1188.6

The profit after the investment

= $1188.6 - $1000 = $188.6

Return on Investment

ROI = ($188.6/1000) X 100 = 18.86%

( 6.) In your personal opinion, what are the risks of Yield Farming? Reason your answer.

The risk involved in Yield farming includes:

- Yield farming is more complex than what majority of the people think. SO you will need to have good strategies to understand it properly, and only selected users that can use it. Those that have large capital to deploy. Failure to properly understand the rudiment of yield farming will make you lose a huge amount of funds.

- Conditions such as high gas fee, bad actors and bearish fall can make a liquidity provider to losee it fund or even lower its initial value.

- If the value of the collateral drops, the user tends to add more to the collateral so that the collateral will be higher than the loan, and this is more money.

- Bugs in the Smart Contract can attack the Yield farming, sometime causing huge losses to the project.

We have seen the different between the yield farming and staking. We now know that the yield farming is an investment platform for traders where you can provide liquidity to a liquid pool and thereby in returns get rewarded. It is of high importance that you properly study yield farming because of it complex nature. Also do not forget to note the risk before you indugle in it.

It was a wonderful class again.

Cc: @imagen

Hello professor @imagen, seems your grading comment did not reflect, kindly recomment so I can get curated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit