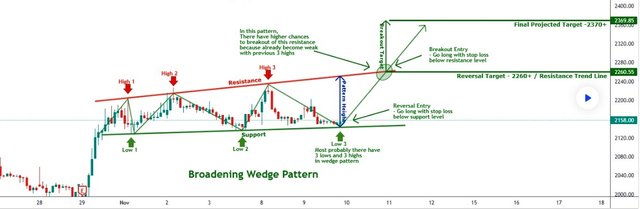

In 30 minutes time frame,

INDIGO shows a consolidation zone and creates a broadening wedge pattern in the following chart. At this time it's trading at the support level. So it may happen that reversal from this support level. There have 2 possible entries in this:

Reversal Entry:-

Possible it will face a resistance level near 2260(nearly 100+ points).

This trade can place a stop loss below the support level.Breakout Entry:-

Once this stock reached its resistance level there have chances of a breakout.

Once this gives breakout can go buy for a target of 2370+ with a stop loss of resistance level.

Disclaimer:

Consider this post as an eduucation reason. Prior to taking any exchange consistently talk with your monetary guide. All referenced examples and levels depend on likelihood and past history. Try not to consider it as a without a doubt. Continuously exchange with hazard the executives.