Hello all my friends where ever you are, I hope you all in good conditions..

Emotions in trading have a big influence on investor decisions. Therefore, we must really know how and when market cycles occur without ignoring discipline and basic rules in trading. As humans, wanting to get more profit is natural, but we must remain calm and not make mistakes when analyzing market movements because this is our valuable money. As the saying goes Trading is 1% Intelligence, 99% Emotional Trading Management.

Question 1: Identifying Emotional Triggers in Trading |

|---|

Emotions are feelings or psychological reactions experienced by humans in response to situations, experiences, or stimulation from the surrounding environment. Emotions can affect a person's thoughts, behavior, and physicality and this can happen anywhere and anytime.

In the world of trading this will still happen because we are ordinary humans who are greatly influenced by the surrounding conditions such as pressure and also happiness (when the market direction moves according to predictions then we will feel happy, while vice versa then we are disappointed). The most common thing experienced by traders is the feeling of FOMO and FUD. These are two very dangerous but very common emotional feelings.

In the Psychology of market cycles, it is assumed that traders' emotions are different when facing uptrends and downtrends, we should be alert and careful when we feel that "this is the time or maybe this time is different".

During an Uptrend;

when the trend is up, investors' emotions are usually very good and more positive, and they believe that there will be a market revival and the bullish phase will continue. It is very important to make yourself feel positive at the beginning of trading, this will raise your spirits and also reduce the feeling of continuing worry.

During a Downtrend;

When a downtrend occurs, investors will usually experience soaring emotions, and all decisions at that time are completely irrational because when the downtrend forms a bearish phase, fear, panic, despair, and frustration will dominate. This is when many investors "plunge" fall down.

Here is a chart showing the emotional stages of the market cycle by investors on the value of STEEMUSDT

Image source

Question 2: Overcoming Psychological Barriers |

|---|

Look at the example in the graph below;

Image source

Fear of missing out (FOMO) is a mental condition triggered by fear and experienced by traders when they do not participate in a long-lasting bull market rally (when they make a lot of profit). This mental condition is triggered by thoughts about what other participants are doing, namely this investor is busy thinking about the profits obtained by other investors from the price increase in yesterday's bull market rally so that his mind will form a pattern that "next I will also last longer and get as much profit as they get".

This is a late participation in yesterday's uptrend, so that when the asset price is high and the price increase is in sight, investors who experience FOMO actually invest because they believe that the market will move up and they will get multiple profits. In this case, FOMO has succeeded in making investors wrong in investing, while those who are not involved (usually already have good knowledge and experience in trading) will know that this is the wrong market movement so they immediately close their positions and exit.

For beginner traders, it would be better if we first learn some trading techniques and analysis before jumping in. In the world of trading, anything can happen even in the blink of an eye.

Question 3: Developing a Trading Routine |

|---|

Here is the trading routinedaily and weekly that includes psychological preparation, training will strengthen knowledge and physical, therefore it is very important to do something (warm up) routinely before doing something important like trading.

Daily Routine |

|---|

- Morning (10-15 minutes): Meditation and relaxation to prepare mentally (in a simple way is also possible)

- Market analysis (25-30 minutes): Review charts, news, and technical analysis (make it a habit to review something first)

- Trading planning (25-30 minutes): Set goals, loss limits, and strategies. (This is very important because this is the beginning of the emotional build-up phase)

- Make a trading journal: Record plans, results, and analysis (a record like a history/memory)

- Daily evaluation (10-15 minutes): Review results and identify areas of improvement. (don't be lazy to learn and learn again)

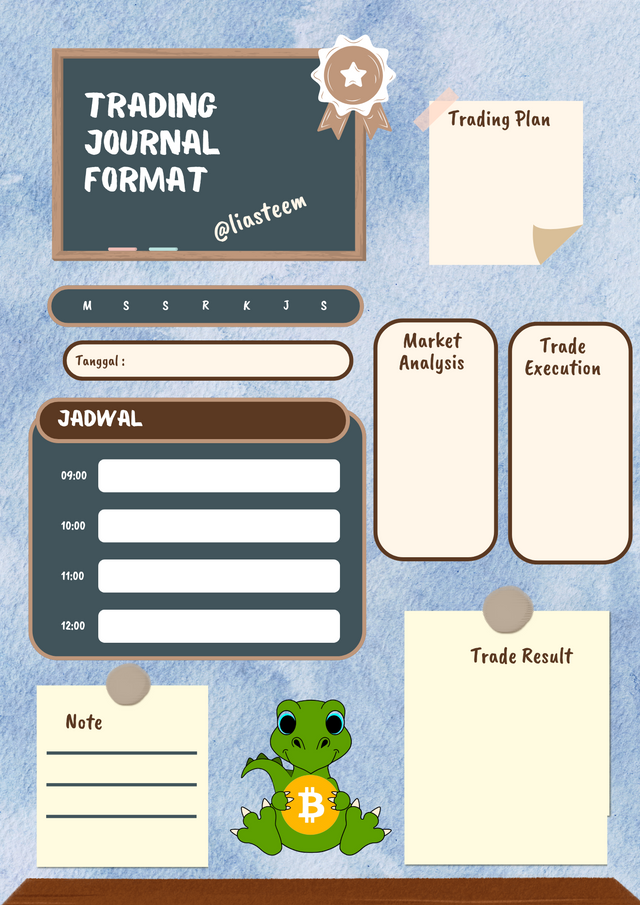

Or make a trading journal |

|---|

Here is an example of a journal format that we can make and will help us;

In addition, we also have mature and well-planned Psychological Preparation so that we are not shocked by the fact that suddenly the direction of market movement changes.

- We must set realistic and measurable goals.

- We just need to develop self-awareness through reflection and journaling.

- We can manage stress and emotions with relaxation techniques.

- Let's develop discipline and consistency.

- We also need to maintain a balance between trading and personal life so that we can "stop" when we need to stop.

Question 4: Case Study on Emotional Trading |

|---|

Here's how traders are affected by emotions and usually the beginning appears when a long red candlestick indicates that the stock is falling (bearish) or a long green candlestick indicates that the stock is rising (bullish). Investors will monitor the trading journey starting from the initial uncertain stock movement (unbelievable phase) and this is the beginning.

In the disbelief phase, investors just want this phase to end soon because they think "I will fail" and the trend will change soon. Then the trend increases, making investors' emotions change into Hope which will raise questions in investors "is it possible that this trend will increase further?".

Then the trend goes up again until investors who were previously in the disbelief and hope buying phase become "everyone buys now". And the trend continues to rise until investors become very happy and feel that I will get richer so that when the trend goes down ("complacent") investors become a little nervous, they still have egos hanging on "let's sail for a while".

Although it's not over, investors experience emotional turmoil again until the "denial" phase and say "I'm freaking out" but there is still hope in their hearts. Then it continues to the "Panic" phase where investors feel "I'm caught up". And when there is no significant market movement, then investors feel that they have misanalyzed the market movement, "Oh No.... No..." Which makes them "frustrated" and eventually lose. And this is over...

Question 5: Building Resilience in Volatile Markets |

|---|

Building mental resilience to handle a stressful trading environment will be very necessary and this can be achieved with lots of practice, action and experience. We must really develop a trading strategy and rules that ensure investment opportunities in the early stages of the market cycle (optimism and confidence) and form a disciplined habit of following the rules set in the trading world. Remember that we are human beings who have emotions and thoughts so emotions are the main element that is always present in us.

Therefore, we should not be too confident! It is better to enter with a 1:2 profit if it will burden your mind later. We should also try to take the time to analyze market rumors before making any trading transactions. And if we are not sure then it is better not to participate or postpone it. Also, do not panic when we see prices fluctuating. We can see how the market cycle affects investors.

In addition, we must also Always tryto be optimistic and win at least 3 times or try to get the first impression that we can win so that on the second occasion that feeling will help us. It is important not to be greedy, close when the position is according to the initial target. Don't forget to condition yourself physically and mentally in a calm, comfortable and good condition.

Until here, my participation in the Steemit Engagement Challenge S22W1 at SteemitCryptoAcademy.

I would like to invite my friends to participate in this Steemit Engagement Challenge, @drhira @ulfatulrahmah @goodybest @paholags @nancy0 @starrchris

greetings,

From your friend

❤

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 6/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Terima kasih banyak kakak lia atas undangan nya 🥰

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sama-sama sayang, yuk ikutan yuk... Ini bisa menambah wawasan kita tentang crypto... ☺

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ya ampun kak, saya tidak mengerti saya tidak terlalu faham tentang menjawab pertanyaan crypto 😁,.. Sukses selalu ya kk 🥰

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hehe aamiin...

Sukses juga buat ulfa... 🤗😘

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amin kk🥰

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

FOMO, dear and greed are the too much famous psychological terms we use in trading terminology. You have beautifully explained all these here. Thank you so much for your beautiful post it provides great knowledge to us about the concern topic.

Wish you best of luck my dear friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit