Hello Everyone and Have a Blessed day to all Crypto Students and Professors!!!

The past week of the Season 2 of Steemit Crypto Academy has been doing great and has been checked each post so far. We are now on the 2nd week of the 2nd Season and I'm really excited to do the tasks of each lesson as many as I can. This article will be my homework task entry for the lesson given by another new Professor, Prof. @fendit with the topic; Make your Cryptocurrencies Work for you. At the end of the lesson, the task given will ask the following:

Homework task:

1. Which is your risk aversion, which of these products you find the most appealing, and why?

2. Explain in your own words fixed and flexible savings, high-risk products, and launch pools.

3. Show and give detail on how to set the investment you chose in Binance. If you don't use Binance as your exchange, let us know which alternatives you have in your own exchange and simulate the process of investing in Binance.

Introduction

As we are already here in the crypto world, we've all know the benefits and risks we will get to it. We also need to determine some important aspects as we are doing some actions in his field as we don't really know what will happen next. Now, for this article, we will be going to discuss some important information as asked in the lesson being discussed by Prof. @fendit. This definitely based on my own experience with my journey here in the Crypto world.

What is my Risk Aversion and Why?

As discussed by Prof. @fendit, risk aversion is determined when we were comfortable with the uncertainty which I think means we will accept whatever may happen to our investment, either we will gain or lose we will immediately accept it. To determine what type of risk aversion I am, I will evaluate myself to what I am doing on my investment in the Binance Exchange.

Conservative Tolerance to Risk

I have determined myself as a Conservative Tolerance to Risk type of investor. I feel confident even there is the lowest volatility of return to my investment which will give me a guaranteed profit. I am not that really a good trader as I am just starting and do on my own based on what I have read from others that is why I am not that really a risk-taker type of investor. Base on my experience, I have bought some tokens then as I see an increase in price though it is not too big in return, I immediately took the gain for I am afraid if I will not get it the next day.

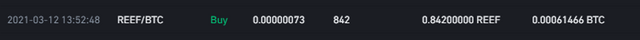

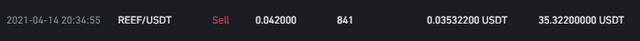

Here is my example;

I have bought some REEF tokens on Binance with a total amount of around 34 USDT that will get me a total of 842 REEF tokens.

I have bought the 842 REEF last March 12, 2021, and after how many days I didn't see a good price to sell it again until on

April 14, 2021, I finally see that the price is increasing then I have decided to sell it even there is a little gain of profit. After I sold it, I have gained a total of more than 35 USDT only.

For me as a beginning to Cryptocurrency Trading, this will be a good training ground for I have learned a lot from this experience. This might not be the very best type of aversion but this is really good for me.

Binance Earn - What are Fixed and Flexible savings, High-Risk Products, and Launch Pools?

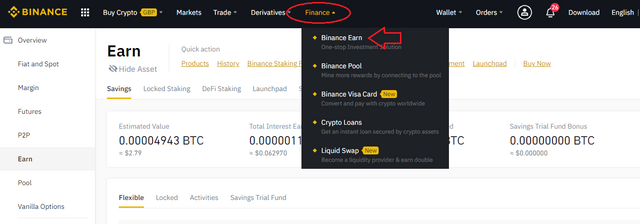

Binance Exchange has many options for each user to earn and based on what has been chosen. Now, we will then discuss further these options for us to earn. If you already have a Binance Account, go to the Finance option then choose Binance Earn.

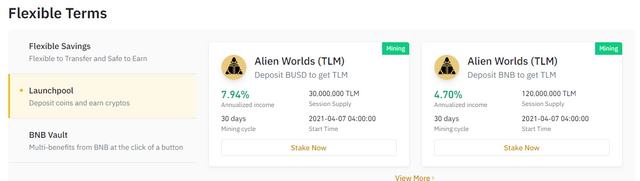

After you have chosen Binance Earn, you will now see the Products offered to earn more to the users in the Binance Exchange. The Products they've offered are Flexible Terms which has the Flexible Savings, Launchpool, and BNB Vault. The Fixed Terms which has the Fixed Savings and Staking services and lastly the High-Risk Products which includes the DeFi Staking, Dual Investment and Liquid Swap.

Flexible Terms

Let us start with Flexible Terms products offered by Binance Earn Services.

Flexible Savings

Flexible Savings came from its word itself flexible which means we can stake tokens or coins whatever we want. It is either you can set time on your own when to invest through staking and take it back by unstaking. This will get us also not fixed APY as it will not generating passive income as we decided to end our investment.

Launchpool

Other services under Flexible Savings is Launchpool who said to be Deposit and Earn Cryptos. There will be tokens or coins that will be listed on Binance Exchange but before they will be listed, Binance will add them to Lauchpool which all investors will stake their BNB tokens or BUSD Tokens then generate the offered Token or Coins daily with the number of days as set by the Tokens provider, usually it is 30 days. It is also flexible for we can decide immediately when to get back all our investment and expect to not generating income after doing it.

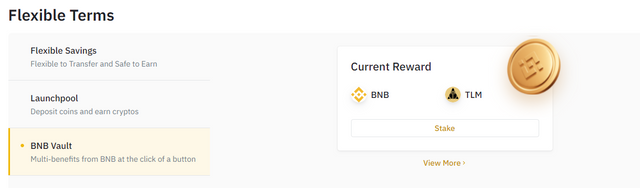

BNB Vault

This service is somewhat the same as Lauchpool but at this option, only BNB Coin is being offered to Stake. We can also decide when to get back all our investment.

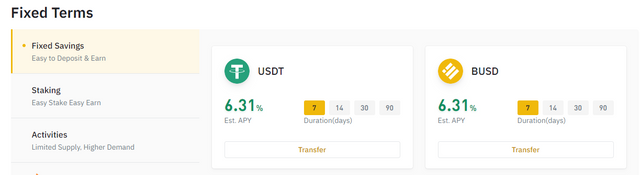

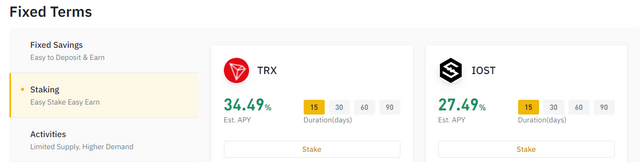

Fixed Terms

Now, here is the next products that offered on Binance Earn under Fixed Terms which all about Staking that have a bigger APY than flexible terms products.

Fixed Savings

From the word itself, fixed means there is a specific period of time we can get back our investment to generate passive income. We need to deposit or transfer funds and set a how many days from 7, 14, 30, or 90 days and after choosing how many days, we will generate income within the selected days until it ends then it will automatically deposit or transfer it back to our wallet with the generated income.

Staking

This is also somewhat the same as Fixed Savings but instead of depositing or transferring funds, we will then stake our selected tokens or coins to how many days we choose for it to generate passive income.

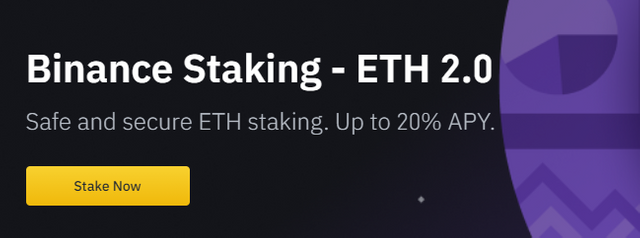

ETH 2.0 Staking

The other staking service they offered is this ETH 2.0 Staking or what they called Binance Staking - ETH 2.0 which offered up to 20% APY. This staking has 3 Phas, from ETH Stake, Rewards Distribution, and the Redeem ETH. We can redeem our Stake ETH after the 3 phases.

High-Risk Products

The product Binance Earn has is this High-Risks product which offers services that have a bigger APY but expect also a high-risk investment.

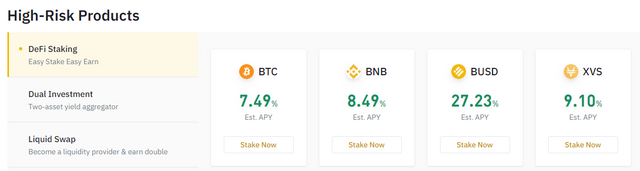

DeFi Staking

The first service offered is this DeFi Staking which has a high-risk warning by the Binance Exchange as though it has a big APY of investment it also has a bigger risk of losing investment. These are staking services offered by several DeFi projects that have already listed on Binance Exchange.

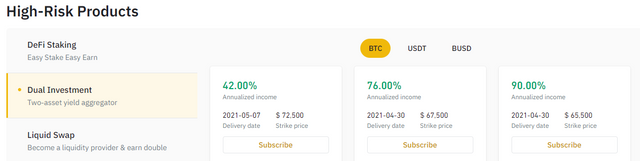

Dual Investment

Another service offered is this Dual Investment which allows each user to purchased as an investment from the currency and the final settlement takes place in either BTC or BUSD. it has a bigger APY than other staking services but a bigger risk also than others.

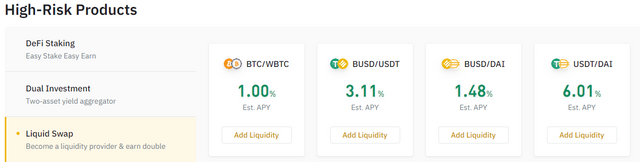

Liquid Swap

This service will allow each user to add liquidity to the mining pool and in return, a reward will also be received. But as a reminder, Adding liquidity into a liquid pool and becoming a liquidity provider is not risk-free. When the market price of tokens fluctuates greatly, the staking income may be lower than the income of ordinary holding of the tokens.

How to set Investment on Binance Exchange?

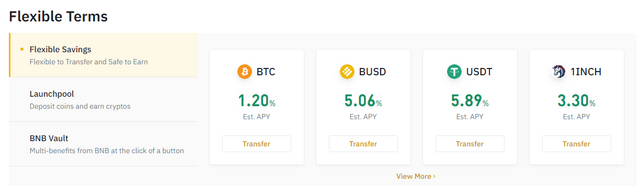

Here we can see how to set investment on Binance Exchange based on what I have chosen which is in Flexible Terms who have the Flexible Savings, Launchpool, and BNB Vault.

Flexible Savings

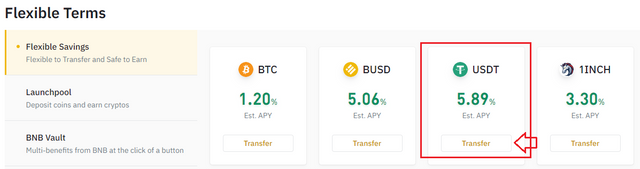

We will now set as an example the USDT Investment with the 5.89 % Est. APY.

Just click on the transfer button and you will be redirected to the other page.

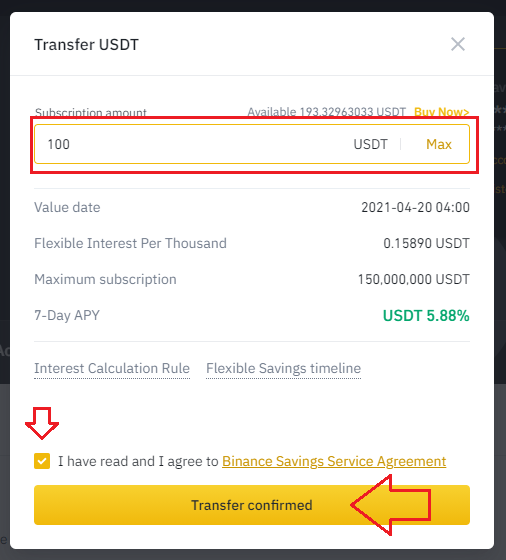

Now that you have already on the page where we can transact our investment just filled up the desired amount you want to invest at your own risks. Then read the details of the investment and then marked check the I have read and I agree so you can click the transfer confirmed button, then you have now successfully transferred and invested.

Launchpool

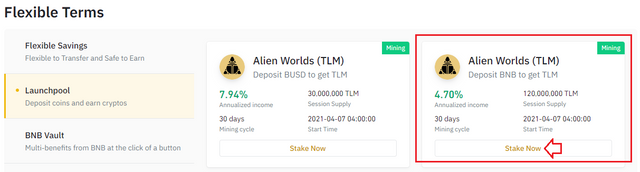

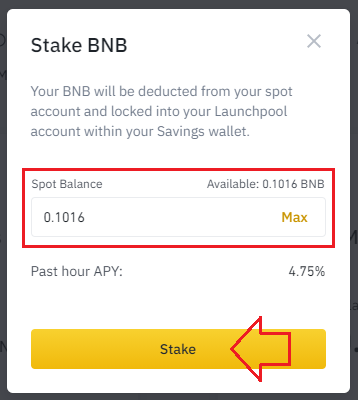

Here we will discuss how to stake on a Lauchpool and we will set as an example the option where we stake BNB to mine Alien World (TLM) Tokens. The first is to click on the stake button then we will be redirected to another page.

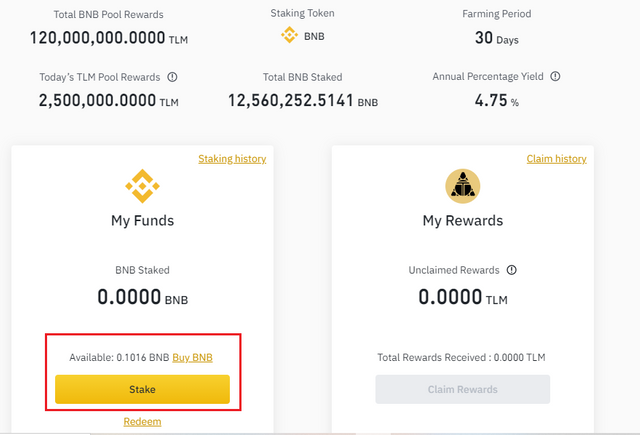

We will then see the details of the Lauchpool like the Total Pool Reward, Farming Period, and the APY. Then below, you will see the stake button to stake our BNB tokens.

Now, fill up the important details as shown as the amount of BNB then click Stake and everything will be done. You have successfully stake BNB and will generate income which is the Alien Worlds (TLM) Tokens.

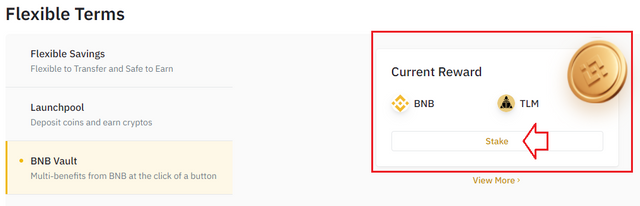

BNB Vault

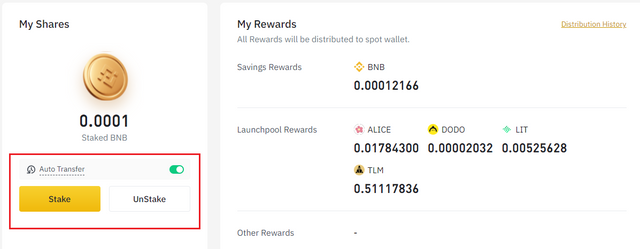

Lastly is this BNB Vault which is also a Proof of Stake service where only has BNB tokens options to stake. To stake just click on the Stake button and will also be redirected to another page to stake BNB.

The page will allow us to see the details on the current status of the Launchpool rewards and the option for us to stake BNB Tokens. The next step now is to click the stake button to start staking BNB Tokens and earn.

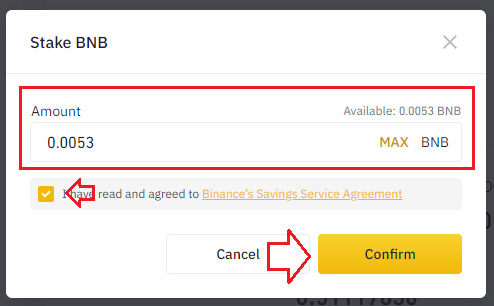

Now, just fill again the important field in the form like the amount, marked check the *I have read and agreed *, then click Confirm to successfully stake BNB Tokens. After doing everything right, then you have successfully stake and invested then will start to generate income which it is also the Alien Worlds (TLM) Tokens directly to Spot Wallet.

Conclusion

We are now in this Crypto World which allows us to earn passively through our own leanings and understanding unto it. But as we are in a dwelling with this, there is always a risk, and that we should always be risk-takers and accepts whatever will happen to our investment. Let us all have time to search and study the platform or project you have started right now for I do believe that our experience is our main weapon to be able to achieve and be successful in this industry.

This would be my homework task article to Prof. @fendit this 2nd Week of the Steemit Crypto Academy in its Season 2 and hopefully, everything is fine and be accepted. I've appreciate all the efforts and information I've got from the lesson and I'm looking forward to the next lesson next week.

Thank you also to all the Steem Team who initiated this new project and to all the Professors for doing such a great job so far here in the academy.

Note: All Screenshots are taken from my Binance Account.

That would be all, thank you and God Bless!!!

Your Steemit Crypto Academy Student;

Thank you for being part of my lecture and completing the task!

My comments on your work:

Overall, I didn't find any major issues, you certainly showed that every topic was understood and that's nice to see!

Still, you included some details on the first task that were not part of what was asked and missed to explain which of the products that Binance offers you would choose.

General comment:

Nice work!!

It was very well presented and written, you were very clear in your explanations and you gave your point of view, which I really appreciate!

Thank you for being part!!

Overall score:

7/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good read para maka intindi pa more kay cloudy pa gyud mind nako kay wala pa ko mo try ug focus.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Paturo kami ni rhaine sayo mag trade po. Hehe

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nakakahilo magbasa pero magandang topic ito dahil dito ako natoto mag trade trade

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit