On this occasion I will try to answer questions from the homework given by professor @yohan2on, as for this week's class related to Risk Management in Trading

Buy Stop

Buy stop is a strategy or action in placing orders when the market is experiencing a bullish trend from the initial price seen. so a buy order will occur when the price continues to experience a bullish phase and breaks the resistance level. so traders predict that if the price continues to increase and has broken through the resistance level then the asset price will continue to increase, this is the right time to enter the market and start buying the asset. let's look at the graph below.

If we look at the chart above, I have set the resistance level for the BNB/USDT pair at a price of $437, and the current price is $407 and when the asset continues to increase and has passed the set resistance level, then place a buy stop order. the right thing is to be slightly above the resistance level, this is all to anticipate the reversal of the bullish to bearish phase. so that these assets continue to increase. by utilizing the right type of buy stop order the possibility of the asset experiencing an increase is very large.

Sell Stop

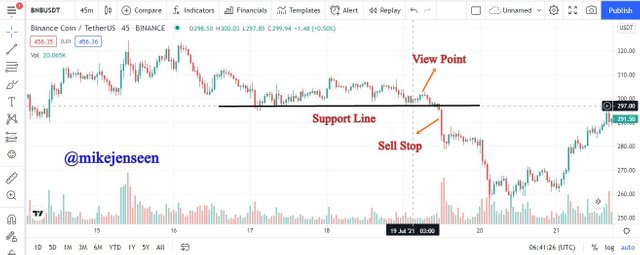

Sell Stop is a strategy or action in placing orders when the market is experiencing a bearish trend from the initial price when viewed. so a proper sell order can be placed when the price of an asset has penetrated the predefined support level from the current price. so traders estimate that if the price of an asset remains in a bearish phase from the initial price seen and penetrates the support level, the asset is expected to continue to decline. let's look at the chart below

If we look at the chart above, I have set the support level for the BNB/USDT pair, which is $297 so when the price was first seen it was at $302 at that time the BStoprice was in a bearish phase in the market. after the BNB price passed the predefined support level, I waited slightly below the support level in anticipation of a price reversal in the market. so after passing the support level I immediately set a sell order to minimize losses, because the price would experience a very large decline in the asset.

Buy Limit

Buy Limit is a strategy of action for traders to be able to maximize profits because their buy limit is usually set at the support level with aim of a trend reversal from bearish to bullish. so traders wait for the price of an asset to touch the support level during a bearish phase. so when the price of an asset has touched the support level, then that is the right time to do a buy limit. let's look at the graph below.

if we look at the chart above, I have set the support level for hetheyA/USDT pair, which is $2.03, and when I saw the initial price the chart was in a bearish phase. after reaching the support level it is the right time to do a buy limit because when the support level occurs it is the lowest price if the phase turns into a bullish phase so as to maximize profits for traders.

Sell Limit

Sell limit is a strategy or trader's action when the price of an asset is in a bullish phase, the price is set at a resistance level with predictions that the asset will turn into a bearish phase so as to maximize the profits of traders. so traders when the chart is at the resistance level then this is the right time to do a sell limit order, by doing a sell limit order at the resistance level, the pre trader will oft the highest price so that the profits obtained will be mathematized. let's look at the graph below.

if we look at the chart above, I have set the resistance level of the TRX/USDT pair, which is $0.068, and when I saw the initial price the chart was in a bullish phase. after reaching the resistance level, it is the right time to sell the limit, because when the resistance level occurs it is the highest price if the phase turns into a bearish phase so you can sell assets at the highest price and can maximize profits for traders.

Trailing stop loss

Trailing stop loss is a strategy or action that can help traders to maximize profits and protect against losses. Traders set a trailing stop loss usually based on a 1:1 or 1:2 ratio by setting a trailing loss based on the ratio so traders will get a gradual profit.

so when the price follows the market trend according to the traders' predictions, the trailing stop will follow the trend with a predetermined distance, if the price is against the market trend that has been predicted by the traders, the stop loss will stop trading so this order is very helpful for traders. traders in maximizing profits and minimizing losses

Margin call

A margin call is a warning by the broker to traders, this warning is in the form of a call to be able to resolve margin problems. Margin is a collaboration between brokers and traders, so traders borrow funds that have been prepared by the broker to be able to trade in large quantities, in the hope of getting bigger profits.

so when a trader fails in his trade then he will experience a loss, it is at this time that the broker makes a margin call to warn the trader to be able to deposit into a trading account to cover the loss, so a margin call can be said to be a call to warn traders.

Risk Management in Trading

for a trader before trading, of course, he already knows the risks he will face because in trading certainly look not be separated from profits and losses. As we all know, cryptocurrencies experience, very large price fluctuations at any time so that the opportunities for profit will be even greater and vice versa, the opportunities for losses will also be very large.

So traders must be able to overcome these problems to be able to minimize the risk in trading. Good risk management is very necessary for trading. For an experienced trader, of course, he has his own strategy to avoid the risk of loss.

for a trader the most important thing to be able to overcome losses is to manage portfolio management in trading, in trading to be able to overcome losses in trading, good portfolio management is needed such as choosing several cryptocurrencies to be traded not only focusing on one cryptocurrency, by choosing several cryptocurrencies that have been analyzed properly, such as if one of the cryptocurrencies suffers a loss, the cryptocurrency that gains profit can cover the loss.

a trader also has to set a profit and loss ratio, usually, a trader wants to get a big profit but when he does not have consideration then the opposite will happen he will experience a loss because of his greed, and vice versa if he does not have considered when the as, set value drops and cannot take decisions then a trader will also get a big loss. So using ratios like 1:2 and the 1:1 is very necessary so that a trader can make a decision when he should stop their trading.

Another strategy to be able to overcome risk management in trading is to set take profit and stop loss. This is also related to the use of the ratio above, a trader must be able to determine when he should take profits and when asset prices decline, traders must also be able to determine when he should stop based so that a large loss can be minimized.

Moving Average Trading Strategy (BNB/USDT)

OK, I will try to use the BNB/USDT pair chart with the 50 EMA line and the 200 EMA line, as shown below.

So from the chart above, we can see that there has been a golden cross, which occurred because the 200 EMA line crossed with the 50 EMA line. This indicates that losses reversal will occur margins bearish to bullish. with information like this is the right time for me to make a buy entry.

the details are

Purchase Price: $365.60

Stop Loss : $332.01

Take Profit : $433.85

Risk = Buy Price - Stop Loss = $365.60 - $332.01 = $33.59

Reward = Take Profit - Purchase Price = $433.85 - $365.60 = $68.25

Risk : Reward = $33.59 : $68.25 = 1:2

So based on the calculation data above, I try to set the risk and reward ratio to 1:2, it can be said that the profit is 2 times greater than the loss. using the moving average method really helped me in setting stop loss and take profit because it provides very important information before the phase, a reversal from bearish to bullish which is often called the golden cross. By setting this ratio, traders can make decisions without hesitation in their trades.

Conclusion

Risk management in trading is needed in order to overcome losses and maximize profits. so a trader must be able losses a strategy to be able to overcome these problems such as making good portfolio management and being able to determine the reward and risk ratio. Therefore, careful planning is needed before trading

thanks to professor @yohan2on for giving a very good lecture this week. Hopefully my understanding and other readers about crypto will increase even more. That is all from me.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good work. Well done with your study on Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit