INTRODUCTION.

Let me begin by commending your work professor @awesononso. I appreciated how simply and straight to point the lecture was. Thank you once again.

If it will not mean diverting from the task questions, permit me to briefly hint some points that will help me build my post. In this post I will like to focus on meaning rather than lengthy comments.

writing style

This work will not go too technical. It is written with consideration to newbies.

use of images

Images are my personal works, others are drawn from my personal binance app template.

1•

Properly explain the Bid-Ask Spread.

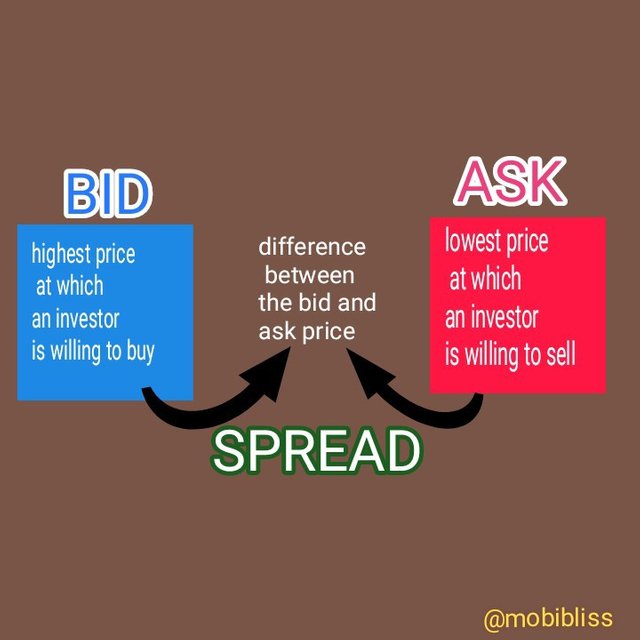

BID ASK SPREAD

Trading involves buying and selling and also pricing. The concept of buying low and selling high is what determines profit in business. In the stock and crypto market, it is just the same. To help us understand "bid ask spread", let us first and foremost understand current price and "what influences it" , "bid" , and "ask."

CURRENT PRICE.

This is the price at which an asset is traded. If we are asked to get the current price of steem for example, we will simply surf the internet and a record of the price listing will appear.

The current price of an asset is determined by

1: Demand and supply. When the demand of a coin goes high, sellers will want to increase the price. Conversely, when there are more people willing to sell a particular coin (more supply), the buyers will want to price the asset lower.

2: Last successful transaction. When an agreement is reached between a buyer and a seller and the transaction is completed successfully, the amount at which that asset was traded (sold or bought) becomes the current price.

The current price is the price at which the last transaction was completed and it is recorded.

The influencers are the "buyer" , "seller" , and "exchangers."

"BID" AND "ASK"

Usually, when we want to sell an item, we want to sell it higher at the best possible price. Conversely, when we intend to buy, we hope to get it as cheap as possible. If we have sold an item and hope to buy it back from the person we sold it to, we have to buy it at the price the individual is willing to sell to us. We are aware that he may need to add his profit. That is the concept of most trades and also the global market.

Bid refers to the highest amount a buyer is willing to pay for a tradable asset and in this case, a coin or token.

Take as a case study: Adamu, a new crypto currency investor want to acquire 10 unit of crypto A coin. Crypto A is currently selling at 50 cent per unit. 10 unit will equal $5. Adamu is not comfortable with the price and wish to acquire the coin at 40 cent per unit, so he places a *"buy limit order."( Buy limit order is an order placed below the current price so that once the price gets to the intended target it is automatically executed).

Price went in favour of Adamu and crypto A hit 40 cent per unit. Adamu's order is executed for 10 unit at $4.10 instead of $4. Adamu thought it was an error. He later realised that what he based his calculation on was just the current value price of crypto A.

What happened in the case study? Adamu was willing to buy at 40 cent per unit coin. That was the highest price he was willing to pay. When the price hit Adamu's intended buy price The exchanger had to add his profit so as to sell to Adamu. Why did Adamu feel that an error has occurred? He forgot that the exchanger is on business and needed to make profit. He did not put the exchanger into consideration.

Ask represents the lowest price a seller wishes to sell. A seller want to keep the price as high as possible.

When we are buying a coin in crypto market, we buy it at the "ask" price. The ask price is the price a seller is hoping to sell to us. It is always higher than the current price value. This is because the investor who bought at the current market value of an asset hopes to make profit. This is his purpose for doing business.

Conversely, when we intend to sell our crypto, we will be selling at the current price value.

Just like the above example, if Adamu became angry at the transaction and decides to sell back his crypto A coin, and if the value remains the same, he will sell it at the market price which is $4 for the 10 unit of steem.

BID ASK SPREAD.

Bid ask spread refers to the difference between the ask price and the bid price.

Just like in the above example, the difference between what Adamu bought and what he sold was $0.10.

Spread = ask - bid

In the case of Adamu, $ 4.10 - 4 = 0.10.

Bottom line.

Current price is the market value of a tradable asset at a particular point in time.

Bid is the amount an investor is willing to pay.

When we want to buy a security, we are asking. The price is slightly higher than the current price.

Ask is the lowest amount an investor wishes to sell an instrument.

When selling a security, we sell at the current price value.

2

Why is the Bid-Ask Spread important in a market?

An exchange platform or broker platform makes profit when an asset is bought or sold. They buy low from people and sell higher. The bid ask spread represent the profit they make. If they are not making profit, then they will not be in business and we may not have a more trusted and secure place to buy or sell our crypto.

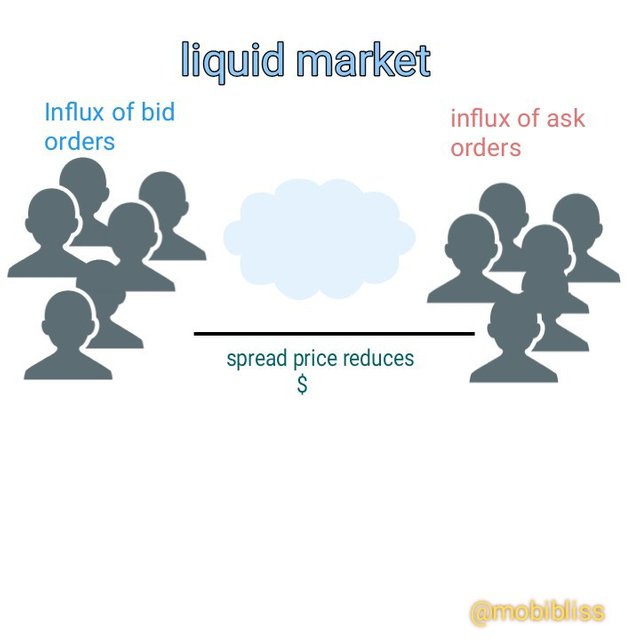

When a trading volume of an asset is high, the exchangers will take little profit to sell that asset. Take for instance, if a lot of people are buying and selling crypto A, that means that there are lots of money pumped into the crypto asset; the trading volume is high and we say that the crypto A market is liquid. The Exchangers makes money from many buying and selling and therefore will reduce the amount added to sell that coin to intended buyers.

Meanwhile, when the opposite is the case, the money added to sell that cryptocurrency increases.

See the two images below. Observe the difference.

Fig 1. Binance. liquid market.

Fig 2. Binance Illiquid market.

How to determine Liquid market

- High trading volume.

- gap between buy/sell orders are closer.

- Low percentage of ask bid spread.

3•

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Spread = ask price - bid price.

%Spread = (Spread÷Ask Price) x 100

Therefore,

Crypto x spread= $ 5.20 - 5 = 0.20

Crypto x spread = $ 0.20

B

Crypto x %spread = $ 0.20/5.20 × 100 =3.846153846153846

Approximately 3.8.

Crypto x %spread = 3.8%

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Using above formula,

Crypto Y spread = $ 8.80 - 8.40 = 0.4

Crypto Y spread = $ 0.4.

B

Crypto Y %spread = 0.4/8.80 × 100

=4.761904761904761

In approximation crypto Y = 4.8%

4.

In one statement, which of the assets above has the higher liquidity and why?

In the above examples, Crypto X has the higher liquidity, that is why the bid ask spread percentage is lower.

5.

Explain Slippage.

Fluctuations of prices in the global markets gives rise to what we know as slippage. Slippage explains why when we place an order, what we get may be different from what was quoted in the order book. There may occur a slip in price from the current value of the crypto asset. The difference in price that occured between when an order was placed and when it is finally executed is known as slippage.

Cryptocurrencies are highly volatile market. When a user places an order, within the seconds or minutes that the order may take to complete a change in price can occur. These changes can work in our favour and we call it positive slippage. At other times it works against us and we call it negative slippage.

Explain Positive Slippage and Negative slippage with price illustrations for each.

POSITIVE SLIPPAGE.

Using the case study with which we started, let's say Adamu placed a market order to get 10 units of crypto A at the current price value of 40 cent per unit and within the seconds the order took to complete, price dropped with a cent and therefore was executed at 39 cent per unit. Adamu has gained 10 cents positive market buy order slippage for the 10 units bought.

Example 2.

Suppose as we noted in the above case study, Adamu decided to resale his crypto "A" coin at 40 cent which is the current value per coin and he initiated a market sell order for the 10 units at 40 cent each and before the sale could be completed the price appreciated with a cent.He then got $4.10 for the 10 units instead of $4.

In the above instance, Adamu got more than what he hoped to gain from the sell. This is known as a positive slippage for market sell order.

NEGATIVE SLIPPAGE.

Negative slippage occurs as the opposite of the positive. It is when the slippage works against us.

In the above instances, if Adamu placed a market buy order at 40 cent per unit and the order jumped a little bit with a cent and the order was finally executed at 41 cent per unit, Adamu has a deficit of 1 cent for the price of crypto A. This is a negative slippage for the buy order.

In the second example, if Adamu placed a market order at 40 cent per unit coin and before the order could be completed, the price dropped to 39 cent per unit, Adamu has ran a deficit of 1 sent per unit. This is a negative slippage for sell order.

Among the things that makes slippage possible is scalability; when a network is slow in processing transactions, it may take longer to execute a bid or ask and anything can happen within that delay.

Another thing is if we are processing high volume of transactions at the same time, this may take too long for the transaction to complete.

Some persons suggest splitting transaction into smaller units as a solution to stop slippage. While that may work, let us not forget that transactions incur charges, Ethereum chain for example require high gas fees and splitting transaction may mean spending more in charges.

The key may lie in considering liquidity. The highly liquid markets are prone to fluctuations. At the same time highly liquid markets has more profit chances than others.

Slippage therefore may not have much solution at the moment.

CONCLUSION.

Bid ask spread refers to the difference between the bid and ask price, it represents the profit of a broker or Exchangers.

This is important because without the profits, the exchangers will not like to do business and without them being on business, it affects the global markets adversely.

Therefore, when we hope to buy a crypto from an exchange, we will hope to buy at a price slightly higher than the current price value.

The difference between the ask price of an asset and another asset is determined by the liquidity of the asset in question.

Prices of crypto fluctuations due to demand and supply and a huge change can happen in seconds. Slippage refers to the difference in price between when a transaction is initiated and when it is completed.

Thank you once again professor @awesononso

Hello @mobibliss,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Your explanation in the first question was not very clear.

There are also a number of points still missing.

You should present your images better.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit