Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Advanced Technical Analysis with Divergence Trading. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

.png)

Question 1: Explain the Concept of Divergence in Trading

Describe what divergence is and the types of divergences (eg, regular and hidden). Discuss the significance of each type and how they relate to potential reversals or trend continuations.

Crypto market is always unpredictable and sometimes we get some solid points about the market sentiments based on the historical movements. But sometimes divergence happens when the price action and the indicator do not align in the movement of the market. This suggests change in the momentum. It indicates the potential reversals or the continuations of the trend. We can use some indicators to detect divergence in the market. These indicators includes:

Relative Strength Index (RSI): It is an oscillator that measures the speed and the change in the price. It has the measurement value between 0 to 100.

Moving Average Convergence Divergence (MACD): This is another useful indicator. It measures the short term and long term price momentum. It uses two moving averages. It often uses 12 and 26 periods and it provides signals through the MACD line, signal line and histogram.

Stochastic Oscillator: This indicator is used to compare a particular closing price to a range of prices over time. It represents the market momentum, overbought and oversold levels in the market. It uses the range of 0 to 100.

Types of Divergence

There are main two types of divergence based on the price movement of the market. These are given below:

- Regular Divergence

- Hidden Divergence

Regular Divergence

Regular divergence is formed when the price and the indicators move in the opposite direction. It represents the weakening of the momentum. This weakening momentum suggests potential trend reversal.

Types of Regular Divergence

There are different types of the regular divergence which are given below:

- Bullish Regular Divergence

- Bearish Regular Divergence

Bullish Regular Divergence

It occurs when the price makes a lower but the indicators makes a higher low. It indicates that the selling pressure in decreasing and now the bullish reversal will lead the market. If we see it according to the different indicators then:

RSI: Price makes a lower low but the RSI makes a higher low. This suggests that while price is pushing lower selling momentum is decreasing. It hints a bullish reversal.

MACD: Price makes a lower low but the MACD line or histogram creates a higher low. This shows that the momentum of the downtrend is weakening.

Stochastic Oscillator: Price makes a lower low but the Stochastic line forms a higher low. It indicates that the asset may be oversold. And now the reversal in the price will occur.

Bearish Regular Divergence

It occurs when the price makes higher high but the indicators forms a lower high. This indicates that the buying momentum is weakening. This weakening momentum leads the market to a bearish reversal. If we see it according to the different indicators then:

RSI: Price makes a higher high but RSI forms a lower high. This suggests that whether the price is pushing higher but on the other hand the buying momentum is declining. It will lead to a bearish reversal.

MACD: Price makes a higher high but the MACD line or histogram shows a lower high. It indicates a fading upward momentum.

Stochastic Oscillator: Price makes a higher high but the stochastic oscillator forms a lower high. It signals overbought conditions and potential trend reversal.

Significance of Regular Divergence

Regular divergence is significant for the traders because it suggests a potential reversal in the current trend of the market. In other words:

Bullish Regular Divergence: It indicates a change from the downtrend to an uptrend. It suggests a potential reversal from a downtrend to an uptrend. It is specifically important when we pair it with oversold signals on RSI or Stochastic.

Bearish Regular Divergence: It indicates the potential reversal from an uptrend to a downtrend. It is often strongest when use it with overbought readings.

Regular divergence helps the traders to identify moments when momentum is fading. It is irrespective of the continuous price movement in the direction of the trend. This can be a good signal to take profits or to prepare yourself for the reversals.

Hidden Divergence

Hidden divergence indicates the trend continuation. It suggests that the current trend has strength. It occurs when the price and the indicators show divergence in a way that supports the continuation of the trend.

Types of Hidden Divergence

There are further two types of hidden divergence:

- Bullish Hidden Divergence

- Bearish Hidden Divergence

Bullish Hidden Divergence

This happens when the price makes a higher low but the indicator shows a lower low. It suggests that the asset will continue its uptrend. If we see it according to some indicators then:

RSI: Price makes a higher low but RSI forms a lower low. This suggests that the price pullback has less selling pressure. It supports the continuation of the uptrend.

MACD: Price makes a higher low but the MACD line or histogram forms a lower low. It indicates that the pullback is losing bearish momentum.

Stochastic Oscillator: Price makes a higher low while the stochastic oscillator forms a lower low. It confirms that the uptrend still has strength.

Bearish Hidden Divergence

It occurs when the price makes a lower high but the indicator forms a higher high. This suggests a continuation of the trend in the downward direction. According to the indicators we define it in this way:

RSI: Price makes a lower high but RSI forms a higher high. This shows that the upward correction within a downtrend is loosing its strength. It supports the continuation of the downtrend.

MACD: Price makes a lower high while the MACD line or histogram makes a higher high. It suggests that the rally is temporary and the bearish momentum will start.

Stochastic Oscillator: Price makes a lower high but the stochastic oscillator forms a higher high. It suggests that the trend will follow the downtrend.

Significance of Hidden Divergence

Hidden divergence is useful for the trend following strategies. It supports the continuation of an existing trend. In other words:

Bullish Hidden Divergence: It suggests that it is possible the trend will continue. It becomes very useful for the trend following strategies in the bull market.

Bearish Hidden Divergence: It indicates potential continuation of a downtrend. It indicates bearish sentiment and supports the downtrend in the bearish market.

Hidden divergence is valuable for traders who prefer to trade with the trend. It confirms that the momentum is along with the direction. It provides confidence in the continutaion of the trend.

Practical Application

We can practically implement divergence on the market by using RSI, MACD and Stochastic Oscillator.

Regular Divergence: The traders can identify the potential trend reversals before their start. When we combine regular divergence with the oversold and overbought levels such as RSI below 30 or above 70 respectively it increases confidence in the reversal signals.

Hidden Divergence: It helps to confirm the strength of a current trend. It also supports the strategies to follow the current trend. It is useful in the trending markets. In these markets the traders can use hidden divergence to identify the best points for the entry by following the direction of the trend.

So by applying different indicators to identify the regular and the hidden divergence the traders can get good opportunities in the market.

Question 2: Identifying Divergence with the RSI or MACD

Using a historical chart of Steem/USDT , identify and explain an example of bullish or bearish divergence using the RSI or MACD. Discuss how this divergence could have informed trading decisions.

We can identify the bullish and bearish patterns using the bullish or bearish divergence with other indicators such as RSI or MACD.

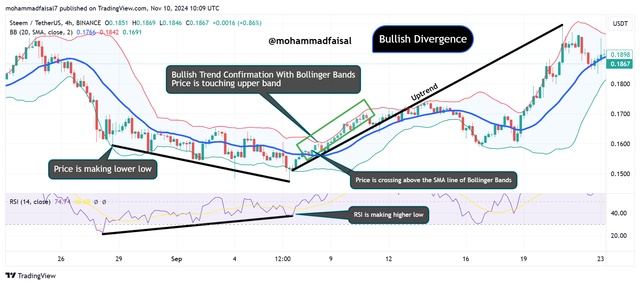

I have selected the STEEM/USDT trading pair in the tradingview. I have set 4 hour time frame for the chart for the better understanding and to get the solid signals.

If we see the historical chart of STEEM/USDT from 28 August 2024 we can identify a bullish divergence. The price was at the lower level at $0.1593. And the price continued to move towards the lower low after the trend. It is indicating a strong selling pressure. And it touch around $0.1474 which is lower than the previous low.

On the other hand if we see the RSI indicator it is making higher low while moving gradually in the upward direction. At the start the value of the RSI is around 22 and it moved upward by making higher low to 38.

We can see that the price is moving gradually downward but on the other hand the RSI is moving in the upward direction by making higher low. This behaviour shows and confirms the bullish divergence in the STEEM/USDT market.

Trading Decision

Potential Reversal Signal:

This bullish divergence indicates that the selling pressure is decreasing and the market is absorbing the selling pressure. The bearish momentum is also changing. It shows the possible reversal from the previous downtrend. The traders can consider this opportunity to take a long entry to make profit.

The traders can use this signal to prepare themselves for the potential buying opportunity. They can take buying opportunity especially when the RSI is rising from an oversold zone which can be below 30.

Entry and Exit Strategies:

Entry: As mentioned earlier the trader can enter a long position when RSI starts rising and it crosses above the 30 line. Moreover watch the candles as well to confirm the bullish pattern.

Stop Loss: Risk management is really very important. Traders can set a stop loss below the recent low. Because if the price breaks below the recent low then it can move in the downtrend by diverging the trend.

Take Profit: When the price rises it is important to take profit at the specific price level. The traders can use the recent resistance level to take profit. Moreover for the confirmation we can use Fibonacci retracement levels to set the targets for the profit.

On the whole if we see the output of the bullish divergence it lead the price to move in the significant upward direction while moving from $0.1508 to around $0.20. So by using RSI divergence the traders can spot the best timing to enter and exit in the market. And the traders spot the potential reversals in the trend by managing the risk of the trade.

Question 3: Combining Divergence with Other Indicators

Explains how divergence can be combined with other technical indicators (e.g. moving averages, Bollinger Bands) for more robust analysis. Provides an example involving the Steem token.

When we combine divergence with other indicators such as Moving Averages or Bollinger Bands it can improve the robustness of the trading signals. They help to confirm the potential reversals or the continuation in the trend. By adding these indicators with divergence the traders can get extra insights for the strength of the trend, volatility and the market conditions. It makes it easy to decide the entry as well as exit points.

Divergence with Moving Averages

The moving averages help to smooth out the price data. They show the overall trend direction. When we combine the divergence with the moving averages then the traders can confirm the validity of a potential reversal or the continuation of the trend. I will continue using the previous example where we have already detected a bullish divergence. I will show how we can confirm the trend reversal in the market with the help of the 50 day moving average.

We can see that the price is moving in the downward trend and the price is making lower low. At the same time if we see the RSI is not making lower low but it is making higher low. This is indicating a bullish divergence. It is suggesting that the downward momentum is weakening.

Moving Average Confirmation

Now we will see the role of the moving average to confirm the reversal in the trend along with bullish divergence. If we see carefully the implementation of the Simple Moving Average on the chart it is suggesting the confirmation of the trend.

I have set SMA to 50 day trading period for the strong and long term analysis. The SMA is being represented by the blue line. Before the 8 September, 2024 the price was moving below the 50 day SMA and the price was making lower low and the RSI was making higher low representing bullish divergence. But yet the trend was not confirmed. In order to confirm the trend I have applied SMA on the chart.

After the slight movement in the price the price started moving above the SMA 50. When the price crossed the blue line in the upward direction it confirmed the bullish divergence of STEEM/USDT. It confirms the strong breakout of the price in the upward direction.

Divergence with Bollinger Bands

Bollinger Bands consist of a moving average, upper band and lower band. They are useful to identify the oversold and overbought conditions. When the divergence touches or break the upper or lower bands of the Bollinger Band then it suggest the high probability of the trend reversal.

If the divergence touch or break the upper band then it confirms that the price will move in the upward direction. Similarly if the divergence touches or breaks down the lower band then it conforms that the price will move in the downward direction.

The price is making a lower low and the RSI is making a higher low. It is suggesting the bullish divergence and the reversal in the trend. But we can confirm this breakout with the help of the Bollinger Bands.

Bollinger Band Confirmation

We can observe that the price is initially moving in the downtrend and when the divergence started the price touch the lower band and then it crossed below the lower band. It represented oversold condition. But after this the price started moving against the previous trend.

When the price touch the SMA line of the bollinger band in the upward direction it further confirmed the bullish breakout. Moreover when the price touch the upper band it further confirmed the upward trend in the market. The SMA used in this bollinger bands indicator is of 20 days. If we see carefully and with keen observation then we can observe that on 8 September, 2024 and 00:00 the price crossed the blue line SMA of the bollinger band which confirmed the initial uptrend. And similarly on 9 September, 2024 the price touch the upper band to give a strong buy signal and the reversal of the trend in the upward direction.

Moreover the size of the bollinger bands is representing the volatility in the market. The size of the bollinger bands at this point of bullish divergence is compact so the volatility in the market is less.

The touch of the price with the upper band confirmed the bullish divergence and this confirmation of the bullish divergence led the price to move in the upward direction.

Advantages of Combining Indicators with Divergence

Moving averages and bollinger bands help to confirm the initial divergence signal. It helps to reduce the chances of acting on a false signal.

Indicators provide additional insights on when a reversal of the trend is going to happen. It also helps to spot the continuation of the previous trend.

Bollinger bands help to identify the volatility in the market and the moving averages work to identify the general trend of the market.

The use of the multi indicators with the divergence help to confirm the divergence and the breakout of the price. It enhances the overall reliability of the divergence as a trading tool.

Question 4: Developing a Divergence-Based Trading Strategy

Create a trading strategy that utilizes divergence as a primary signal for entry and exit points. Discuss your criteria for confirming divergence signals and potential filters to reduce false signals.

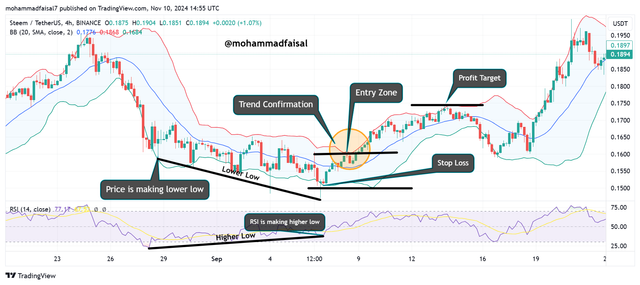

In order to build the complete trading strategy I will use these things in the strategy:

For the detection of the primary signal I will notice divergence between the price and the momentum indicators such as RSI.

In order to confirm the signals or the trend I will use moving averages or Bollinger Bands.

I will use 4 hour time graph for the development of the trading strategy.

I will develop a trading strategy for the long entry. So first of all there is the need to look for the bullish divergence. Bullish divergence happens when the price makes lower low but the RSI indicator makes the higher low.

For the long trading strategy I have identified a bullish divergence on the STEEM/USDT chart. You can see that the price is making lower low but the RSI indicator is making the higher low so it is the bullish divergence between the price and the RSI indicator. This bullish divergence appeared after the downtrend which happened right after the end of the uptrend.

We can see that STEEM has been in a downtrend and made a lower low of around $0.1470 and the RSI indicator is making the higher low starting from around 22.

For the perfect trading strategy I have used moving averages indicator. For the confirmation of the trend I analyzed the price movement around the SMA line. The price crossed above the SMA 50 day period. It confirmed the bullish trend. Now we will consider to take an entry.

We could take an entry after the bullish divergence but we should always wait for the confirmation of the trend by combining it with any momentum indicator. I have used moving averages. When the price crosses above the SMA 50 line then it represents the confirmation of the uptrend. And it is the entry point at the significant price level of $0.16.

Risk management is really very important while developing a trading strategy. So after taking entry it is necessary to determine the stop loss. According to this strategy put stop loss at the recent lower low. In this chart the recent low is at the price level of $0.15. So this is the stop loss level. And if the price dips below this recent low it can reverse the bullish trend and to avoid the potential loss the trade will be cut automatically here.

In order to confirm and set the take profit zone I have analyzed the chart keenly. I have set the take profit zone at the resistance zone. It is the key area to exit from the market with profit. After the local resistance we can see the price took a downward movement. So it is the best zone to exit the market.

Here in order to check all the points for the trading strategy such as the confirmation of the trend, entry point, stop loss and the exit points I have implemented Bollinger Bands as well. It is the set of the upper band, center line (SMA) and the lower band. We can see that after the divergence the price has crossed below the lower band. It is an oversold condition which represents the trend reversal. Moreover if we see the circular highlighted area of the candles the price is crossing above the blue line which is moving average.

So the trend has been confirmed here. After that the price has touch the upper band which represents the entry zone as it confirms the further that the price will drive in the upward direction. And according to Bollinger Bands when the price is touching the recent lower band then it is the stop loss point. And the local resistance in the bollinger band is representing the exit point.

So in this way we can develop a complete trading strategy with the help of the divergence and by using other indicators such as RSI and Bollinger bands.

Question 5: Limitations and Best Practices of Divergence Trading

Discuss the limitations of divergence trading and how traders can avoid common pitfalls. Include best practices for using divergence as part of a comprehensive trading plan.

Limitations of Divergence Trading

There are different limitations of the divergence trading. Some of them are given below:

False Signals in Sideways Markets:

- Divergence can produce unreliable signals in range-bound or choppy markets where price fluctuations lack clear directional momentum. In these cases, divergence may incorrectly suggest a reversal when the market is simply moving sideways.

Lagging Nature:

- Divergence relies on momentum indicators like RSI, MACD, and Stochastic that react to past price changes. This lag can delay signals, meaning a significant part of a price movement may have already occurred by the time the divergence is recognized, potentially reducing profit potential.

Doesn’t Predict Trend Strength:

- Divergence only signals a potential reversal or trend continuation; it does not indicate the strength of the upcoming movement. This can lead to situations where traders expect a strong reversal, but the price barely changes or reverses only briefly.

Frequent Occurrence of Minor Divergences:

- Minor divergences are common and can clutter the analysis, leading to unnecessary or premature trades. Differentiating between meaningful and insignificant divergences can be challenging, especially for novice traders.

Divergence Fails in Strong Trends:

- In strong trends, divergence signals are often invalid because the underlying momentum may persist despite a divergence forming. This means bearish divergence in a strong uptrend or bullish divergence in a strong downtrend may lead to incorrect trade entries, as the dominant trend overpowers the divergence signal.

Best Practices for Using Divergence in Trading

Combine Divergence with Other Indicators for Confirmation:

- Moving Averages: Use moving averages (e.g., 50-period, 200-period) to identify the prevailing trend. Enter a divergence-based trade only when it aligns with the trend or shows a clear reversal at a critical level.

- Volume Analysis: Confirm divergence with volume patterns, where increasing volume in the direction of the potential reversal strengthens the divergence signal.

Check Key Support and Resistance Levels:

- Use divergence near significant support and resistance zones for higher accuracy. Bullish divergence near a strong support level or bearish divergence near resistance can indicate higher probabilities of a reversal.

Focus on Higher Time Frames:

- Higher time frames (e.g., 4-hour, daily) tend to produce more reliable divergence signals than shorter time frames, which often generate noise and false signals due to market fluctuations.

Use Candlestick Patterns as Confirmation:

- Confirm divergence with candlestick patterns like bullish engulfing or hammer for bullish divergence and bearish engulfing or shooting star for bearish divergence. This provides added confidence that price action aligns with the anticipated reversal.

Filter Out Weak Divergences:

- Focus on strong divergences where price is making significant higher highs or lower lows while the indicator shows a clear opposite pattern. Avoid weak divergences that don’t show clear momentum or occur in low-volatility markets.

Set Stop-Loss and Profit Targets:

- Use tight stop-loss levels just beyond recent highs or lows to limit losses if the divergence fails. Set realistic profit targets by identifying key resistance or support levels, trend lines, or Bollinger Bands, ensuring that reward justifies risk.

Develop a Comprehensive Trading Plan:

- Divergence should be only one element of a broader strategy. Plan entries, exits, risk management, and conditions for trade invalidation. This disciplined approach reduces the impact of occasional false signals.

Regularly Backtest and Refine the Strategy:

- Test divergence setups with different indicators and filters to see which combinations work best under varying market conditions. Backtesting on historical data helps refine the strategy for more consistent performance.

Conclusion

Divergence trading offers valuable insights into potential reversals or trend continuations but must be used carefully to avoid common pitfalls. By combining divergence with trend analysis, volume, and additional confirmation indicators, traders can improve the quality of their divergence signals. Following best practices, managing risk, and integrating divergence into a structured trading plan can enhance overall trading performance and reduce vulnerability to false signals.

Disclaimer: All the chart screenshots for the explanation have been taken from TradingView otherwise stated.