Definition Of Technical Analysis

Specialized investigation is a methods for analyzing and foreseeing value developments in the monetary business sectors, by utilizing verifiable value graphs and market measurements. It depends on the possibility that if a dealer can distinguish past market designs, they can shape a genuinely precise forecast of future value directions.

It is one of the two significant schools of market investigation, the other being key examination. While key investigation centers around a resource's 'actual worth', with the importance of outer elements and inherent worth both considered, specialized examination depends absolutely on the value diagrams of a resource. It is exclusively the ID of examples on a graph that is utilized to foresee future developments.

Examples

Specialized investigators have a wide scope of instruments that they can use to discover patterns and examples on graphs. These incorporate moving midpoints, backing and obstruction levels, Bollinger groups, and then some. The entirety of the apparatuses have a similar reason: to make understanding diagram developments and recognizing patterns simpler for specialized merchants.

Pros

Having the option to distinguish the signs for value patterns in a market is a critical part of any exchanging procedure. All merchants require to work out a philosophy for finding the best section and leave focuses in a market, and utilizing specialized investigation apparatuses is an extremely famous method of doing as such.

Indeed, specialized examination apparatuses are so usually utilized, that many accept they have made unavoidable exchanging rules: As an ever increasing number of merchants utilize similar markers to discover backing and obstruction levels, there will be more purchasers and venders congregated around a similar cost focuses, and the examples will definitely be rehashed.

Cons

There will consistently be a component of market conduct that is unusual. There is no complete assurance that any type of examination – specialized or major – will be 100% precise. Albeit verifiable value designs give us a knowledge into a resource's probably value direction, that is no guarantee of achievement.

Brokers should utilize a scope of markers and investigation instruments to get the most elevated level of affirmation conceivable, and have a danger the executives procedure set up to ensure against unfavorable developments.

Technical chart

Charts are graphical showcases of value data of protections over the long run. Regularly, such graphs likewise show volume. Other than permitting the specialized expert to handily spot examples and patterns, the principle advantages of outlines are the brief introduction of cost and volume data over a length, which can be utilized by fundamentalists to concentrate how the market has responded to explicit occasions. Market unpredictability can likewise be effortlessly gathered from diagrams. Charts likewise assist specialized investigators with settling on passageway and leave focuses, and at what costs to put stops to diminish hazard.

Role Of Chart

Charts are graphical showcases of value data of protections over the long run and are the most key parts of specialized examination. While specialized investigation utilizes a wide assortment of graphs that show cost over the long haul. Charts play an important role in the trading. As i have told that they show the price of the specific item. They show the fluctuation in the price with time to time. One can check whole time record of the item with the help of the charts. So charts are very important in the trading. So their importance can not be denied.

Some Types Of Chart

There are many types of charts and all of those have their own properties and work to do.

The principle chart types utilized by specialized examiners are the line Chart, bar chart, candle chart, and point-and-figure chart. Charts can likewise be shown on a number-crunching or logarithmic scale. The kinds of charts and the scale utilized relies upon what data the specialized investigator considers to be generally significant, and which charts and which scale best shows that data.

Why Technical knowledge is important?

Technical knowledge is significant for various reasons. It can help you work all the more proficiently, support your certainty and make you a more important possibility for employers.Candidates who have a technical knowledge are frequently more sure when applying to specific businesses than the individuals who don't.

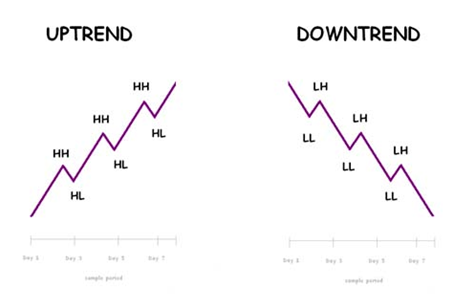

Uptrend or downtrend

Image-Reference

Uptrends and downtrends are really basic. Here's the definition for each:

Uptrend: This portrays when the cost of a stock is moving upward or getting higher. An upswing is portrayed by the diagram's pinnacles and box arriving at new highs as the pattern advances.

Along these lines, in the event that you take a gander at the outline after some time, it very well might be crisscrossing, yet it's by and large going up.

Downtrend: As you likely previously speculated, a downtrend is something contrary to an upturn. It's the point at which a stock cost is moving descending or getting lower.

The downtrend is described comparably to an uptrend— yet the other way. The pinnacles and box in the graph keep on dropping as the pattern goes on. Over the long haul the outline may crisscross, much the same as the upturn, however its overall heading is down.

Uptrend Stocks versus Downtrend Stocks

Beside the self-evident, what's the genuine distinction among uptrends and downtrends? Here are some central issues:

Uptrends offer brokers the chance to purchase low, sell high, and ideally keep on benefitting until the pattern turns around. Ordinarily, brokers sell the stock when the pinnacles and box presently don't break new highs.

Downtrends will not prompt benefits on the off chance that you like to go long, yet they can be a short merchant's fantasy. The interaction includes short selling by getting then rapidly selling shares. The thought is that you can repurchase the offers at a lower rate as the value keeps on jumping, netting the distinction as a benefit.

It doesn't make any difference whether you exchange an upswing or a downtrend. What makes a difference the most is the order with which you are exchanging. There isn't any standard or law that recommends exchanging upturn is more productive than exchanging downtrend, or the other way around. I generally exchange with the pattern followed by a severe stoploss (SL).

At the point when I work out a portfolio containing not many technique, I generally really like to see that my all out long exchanges and short exchanges of the portfolio are close to rise to or with exceptionally little contrast. The intention is to procure well on the two sides of the market. It is seen that exchanges give more benefit and extremely quick then the long exchanges. My portfolio contains,long-short,long just and short just methodologies. Some time on the off chance that the portfolio is one side one-sided, at that point I add some different systems to offset the portfolio with similar long and short exchanges.

These are my reviews about trading in the Uptrend and Downtrend . So It may be better in both the ways but technical analysis are necessary to watch out the market trend more closely.

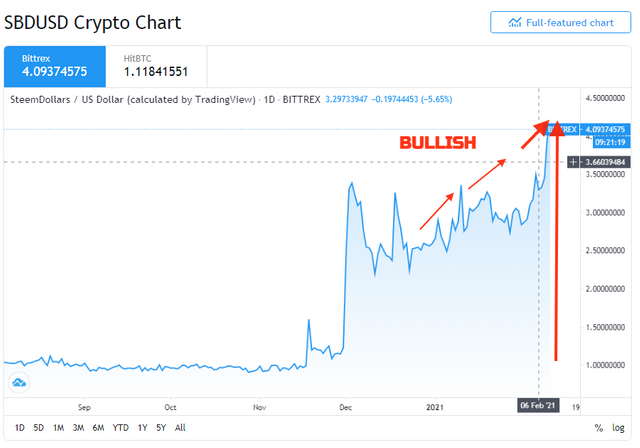

SBD/USD Chart

I have selected the chart of the Steem Dollar. From chart i have learnt that right now steem dollar going up and we say it bullish. I have seen that this chart is from 6 February to the present time and it is going up fastly. We can see that the price of the steem dollar is fluctuating around the 2.500000000 . From this price value sometimes it go up and sometimes it come down to it. But firstly it was pumped from 1.00000000 to almost 1.500000000 . And then it was pumped from here to the 3.38624257. It was its all time high of the steem dollar in the pastbut now it is more pumped from this to new value of 4.07778651.

I have learnt this from this chart and i have tried my best to explain it. As i am newcomer in the trading analysis and crypto but i am learning many things from the professors of the steemit in the crypto-academy.

Hello dear @stream4u , my teacher and the professor of the steemit crypto-academy. I hope you will be fine and good. It is my homework which i have tried my best to do and i hope you will like it and i hope in the next lecture i will perform more good work here.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post has been upvoted by @dsc-r2cornell, which is the curating account for @R2cornell's Discord Community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @mohammadfaisal,

The Question was simple, Uptrend or downtrend, which one is good for buy a coin, explain why?, In this, you can simply explain with the take a screenshot of any coin wherein you can see the uptrend and good for the buyers, in this we can understand that the students are now can see/find the upside in the chart.

However, you have explained higher high and lower low formation which is the extremely next level.

But overall, good to see your interest in this topic, made a good post and explored it very well.

Thank You For Showing Your Intrest to learn Crypto Trading Technical knowledge.

You have completed the homework task and made a good post, explained very nicely about why Technical knowledge is important in Trading and How to read and understand Trading charts?

Remark: Homework Task Completed.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#india #affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit