Richard Wyckoff

Richard Wyckoff (1873-1934) is one of the technical analysis legends. The Wyckoff Method is based on his theory about the stock market’s movements.

But first things first, let’s find out more about who this great man was.

Who Was Richard Wyckoff?

The start of his career was at the age of 15 when he started working as a stock runner for a brokerage in New York City. When he was in his 20’s he was the head of his firm. He also founded the magazine of Wall Street and even wrote and edited for two decades as well. In the 1930’s he founded the Stock Market Institute to teach others about smart money and how the big players operate in the stock market. He studied the legendary stock operators of his time like Livermore and JP Morgan and made laws and principles based on them.

Using Wyckoff’s Method

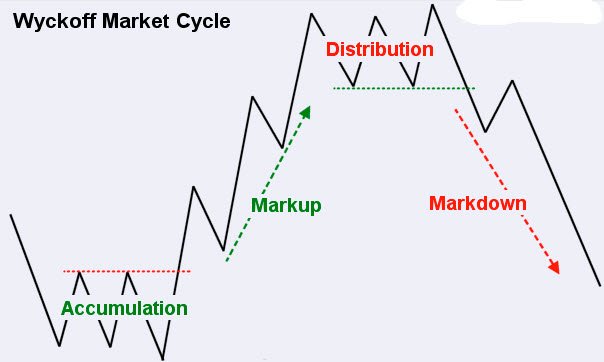

1. Find out if the market is in the accumulation phase or is it trending:

This is important because by determining the market trend you will get a grip of what will the future be like and can choose whether you should go long or short.

2. Your target should be in amplified harmony with the trend:

If the market is in an uptrend, the price of the stock you are trading or investing in, should increase more than the market and have smaller pullbacks than the rest of the market.

If you are trading in a downtrend, pick the stock that falls harder than the rest of the market. To put it simply, pick the stocks that not only are in harmony with the market and are moving in its direction, but it’s rather an amplified harmony.

If you are in a bullish trend and the market goes +10%, your stock should go up +20% (less or more, don’t take it literally). And vice versa. If you are in a bearish trend and the market goes -5%, your stock should drop 15% (again, not literally).

3. Is the price ready to move?

Note: doing this step requires doing the “nine tests”, we will talk about that after covering this part.

After doing the nine tests in an uptrend, do the results suggest the smart money has been successfully entered and absorbed? and vice versa, in a downtrend, do the nine test results suggest that a large supply is coming to the market?

4. Watch for a turn in overall (total) market index:

roughly 80% of individual stocks move the same as the overall market index. For example, you can say that roughly 80% of coins in crypto move in harmony with the TOTAL index. Using Wyckoff’s Laws can help you anticipate the turn in the near future. If your anticipation was correct, the overall market index is now on your side.