image created by me on picsart

1).Explain the following stating its advantages and disadvantages :

-Spot trading

-Margin trading

-Futures trading

2a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed).

3a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

4).Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy / sell position on any crypto asset. The following are expected.

i) Why you chose the crypto asset

ii) Why you chose the indicator and how it suits your trading style.

iii) Indicate the exit orders. (Screenshots required).

1).Explain the following stating its advantages and disadvantages :

-Spot trading

-Margin trading

-Futures trading

Spot trading:-

spot trading as the name implies is the basic trading usually utilize by the beginner's traders, this type of trading here in Nigeria are popularly understood has "buy and keep trading".

This trading involve a trader getting a crypto wallet and buying his preferred asset of choice at a certain amount into it with fiat money or cryptocurrency, when it rises massively or passes the amount he brought, he then sell and make profit.

It the most common and utilize trading in Nigeria by the novice traders.

Generally, in this type of trading the traders own,buy and sell their coin at a spot price.

Advantages of spot trading

- in sport trading a trader can determine to withdraw or deposit the crypto asset anyday and anytime the want to and also take full ownership of their asset.

- During the process of buying and selling there is always an opportunity for negotiations between the buyer and seller and after the price has been accepted by both parties, transfer will be made immediately and easily without delay and because it contains two party it makes it transparent and secure giving no room for easy hacking.

Disadvantages of spot trading

This type of trading requires to setup a crypto wallet in an online platform and exchange this process might be tough for the new traders.

cause of the volatility of cryptocurrency some traders with less knowledge of trading end up buying asset at a current state of high price which might end up not rising above the price the trader bought it, with this the trader will be vulnerable to losses.

Margin trading:-

Let me make a little illustration on how margin trading work.

This process is like wanting to bet with high stake but your cash is a little bit less, so your friend offers to borrow you some cash like $70

To be payed back, if you win the bet you will pay him back with much gain still remaining for you, but if you loss your bet you lose everything and will still owe you friend.

This margin trading is a type of trading strategy that allows borrowing of funds from exchange or other trader to enable trading asset against your current funds to make high profit. It requires leveraging their current asset by borrowing from third party to increase buying power.

Advantage of margin trading

By allowing traders to open more trading positions through borrowing of funds from third party, this will enable traders to stake or trade big by this have access to huge returns and capital.

Disadvantage of margin trading

Cause of the volatile nature of cryptocurrency, margin trading is highly risky, by this it requires traders with much understanding and experience to trade.

Traders stands a chance of losing huge funds if the lose the trade.

Future trading:-

In future trading, trader makes profit from the uptrend and downtrend of the price movement were the study the price of an asset which will help them predict the asset future price movement.

After analysing the market price and seeing a possible increase in the price movement the traders will proceed to buy. Same goes to selling when a trader see the will be a possibe decrease in price of his asset he quickly sell them off.

In this future trading, two parties which are the buyer and the seller agrees on the price of an asset in the present market and also fix price which are to be exchanged in future.

Advantage of future trading

- Future trading are know for high liquidity cause of the high rate of trade executed daily, the more buying and selling activity in the future market makes the market order placed quickily which will help the price not to fluctuate rapidly and badly.

- A trader are tend to make quick and huge profits in future cause of leverage offer to them,this will make them trade 10× as much as their current asset. Lastly market price moves faster than in spot market.

Disadvantages of future trading

- In future trading, if the future price is too low it will lead to losses

- because of the high leverage position traders are vulnerable to huge asset losses..

- In future trading, traders donot buy the underlying asset unlike the spot trading.

2a) Explain the different types of orders in trading.

In trading we have different type of order which are use in the trading market there are the

Market order and the pending order let simply look at them.

Market order:-

The market order is an order place in a trading market place, to buy and sell an asset at a current market's best available price.

This market order ensures a quick and easier execution of order.

Generally, the market order takes place when a trader think the asset price is at it best price,when the trader is sure he wants to fill his order and lastly when a trader want a fast and immediate execution which is the primary goal of market order.

Pending order:-

Through the word pending here,we should gain a fore knowledge of what a pending order his.

A pending order is an unexecuted order place in a market place to buy and sell asset, it enable trader to execute their trade when the market price get to a certain level.

This pending order consist of different types which I will briefly look into them.

There are:-

limit order

Stop-limit order

Oco order

limit order:-

limit order is an order were traders wish to buy or sell an asset at a certain price. When a trader place this limit order the also need to place a specific price for buying or selling.

Using the limit order in the case of buying or selling, your order will be executed below or at the price you specified while placing the other.

For example,assuming you want to buy 10TRX which the TRX is trading at $2, you then proceed to place a limit order of $1.5, when the asset values come to $1.5 your order will be executed.Stop limit order:-

In this type of pending order while entering the order 2 types of price are required to set, there are the stop price and the limit order price with this two price input the order cannot be executed.

This stop limit order happens when asset reaches a stop price then the limit order will be placed by the trader to buy and sell asset at limit price or better.

For example, placing a stop limit order to buy 10TRX at a rate of $4.50 when the price reach $4.

Here the $4 is the stop price which trigger a limit order of $4.50.OCO order:-

Oco is an abbreviation for 'one cancel the other'

This is an order that stipulate that when one order is executed then the other order is automatically cancelled. This order combines stop limit order and limit order at the same time and provides a way to sell an asset at high price or place a stop limit to sell asset if it fall below a certain price.

For example, if an asset is trading on a range price of $8 and $10 a trader can place an oco order with a buy stop just above $10 and a sell stop of below $8 then when a price break above a resistance and below a support a trade will be executed and stop order will automatically be canceled.

b) How can a trader manage risk using an OCO order? (technical example needed)

This order on it own is a risk management tool it a pending order that is to mitigate risk, looking at the way it operates, an Oco order usually combine a stop limit order with a limit order.

Like i said before when either stop limit order or limit order is reach and executed the other order

Will be automatically cancelled. This trade automation always bring about success in the trading market and mitigate risk.

To manage risk and minimize loses an experienced trader usually setup stop loss once the price do not go on their favour.

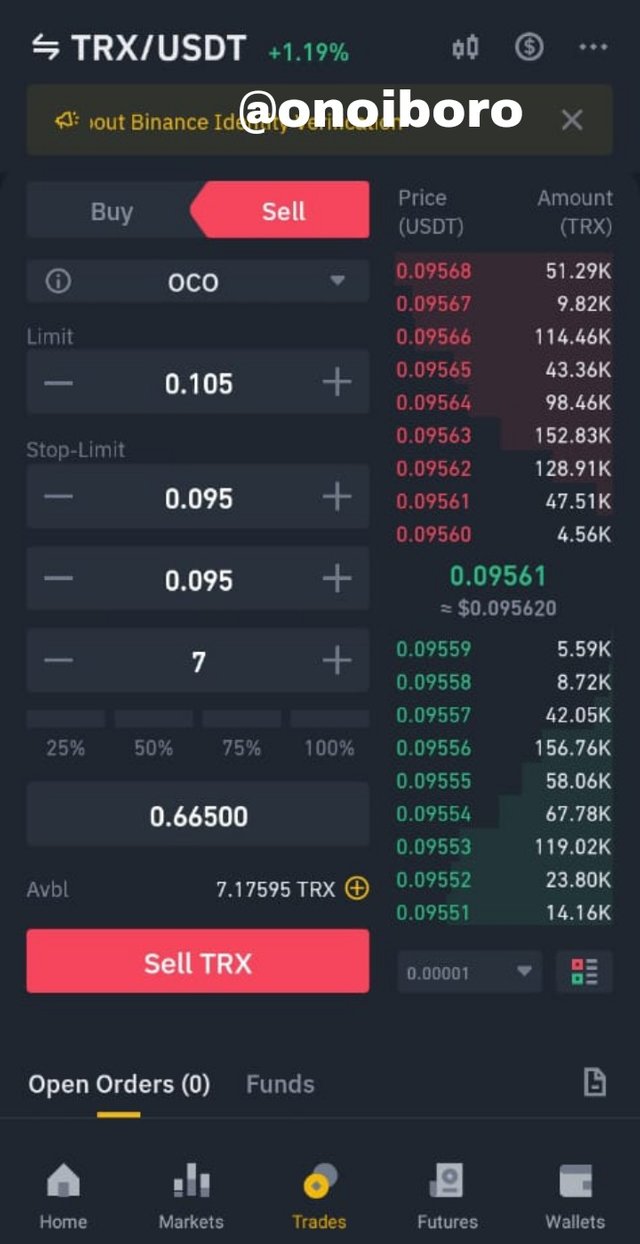

Above, is an oco order I open on binance exchange. Looking at the image you can see the limit order which I place to sell TRX at the price of $0.105 and also the stop- limit order to sell TRX at $0.095 when the price hit $0.095.

Before I proceed let briefly look at the two Exit order

Exit order

stoploss order:- it a kind of order that a trader enters to exit their trading position that the holds if the price of their investment go beyond a certain level which interpret a certain amount of loss in the trade.

This order helps traders to reduce losses and risk exposure when market is going contrary to their will.

Take profit order:- this is also a kind of order that traders enters to exist their trading position if the price reaches a certain profit level.

This order is normal place by a trader specifying a certain price beyond the purchase price, during trading if a price of an asset reaches the placed limit it will automatically exit trade and take profit.

Note- Both can be placed along side market order and pending orders.

3a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

Step1

Firstly, I will log on to my binance app, immediately it open I will proceed to clicking on market at the bottom side of the app. As indicated below.

step2

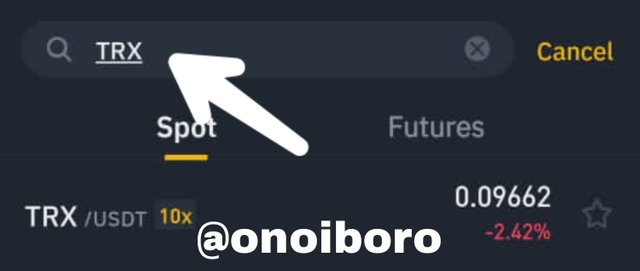

After clicking on trade a search box will pop up were you can input the name of the asset you need. Since am about using TRX/USDT

I will input TRX then a list of TRX couple with other asset will show up, I then proceed by clicking TRX/USDT.

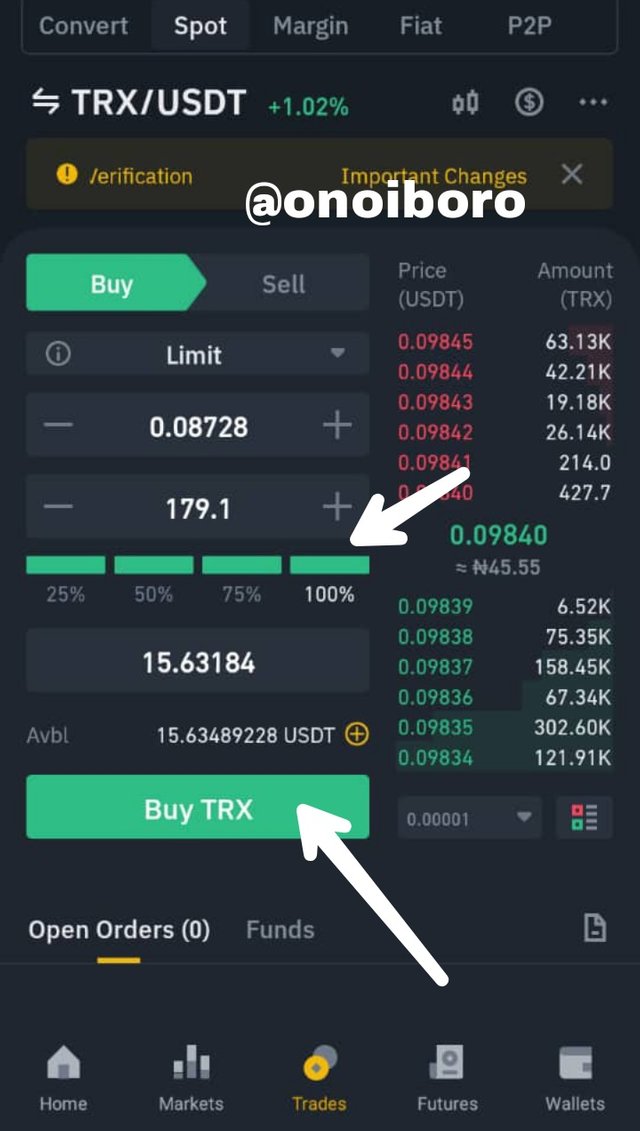

step3

After clicking on TRX/USDT, a page showing trading information of TRX/USDT will open. then i place a limit order of 0.08728 which is less compared to the market price of 0.09840 with $15.63184.

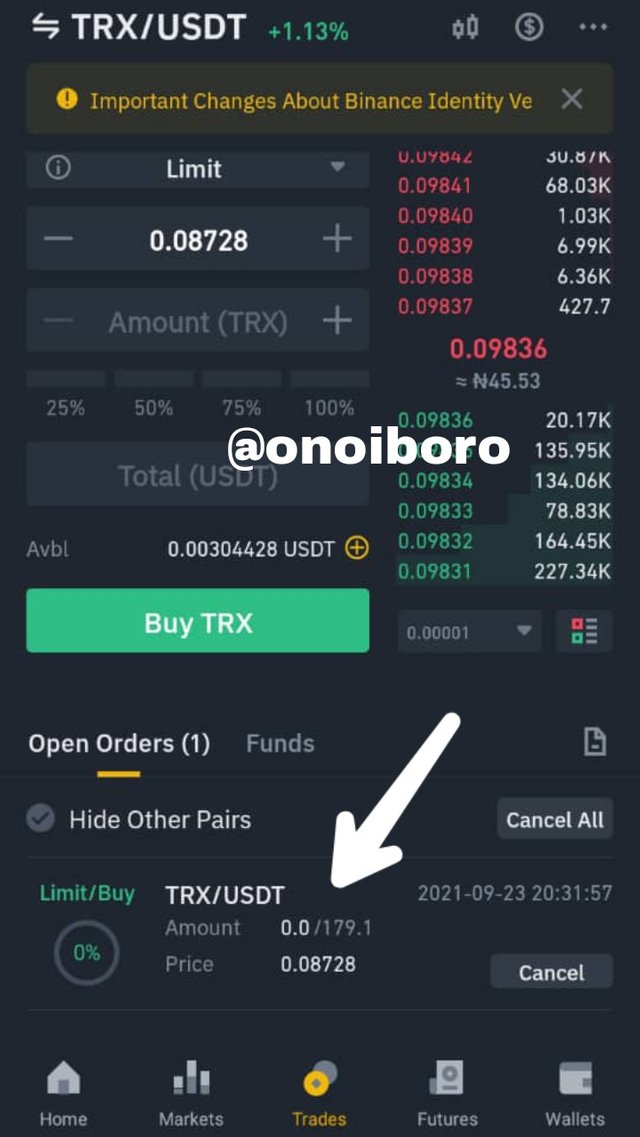

Step4

It will take some time for transaction to filled because it was less than the market price.

4).Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy / sell position on any crypto asset. The following are expected.

i) Why you chose the crypto asset

ii) Why you chose the indicator and how it suits your trading style.

iii) Indicate the exit orders. (Screenshots required).

I) I chose bitcoin cause am more familiar with the coin and also because of the current state of it market value, though it demand and value is at it increasing side.

According to research bitcoin as low transaction fee and seed transaction process and it is far more liquid and has much volume than every other coin.

II) in my technical analysis below i chose to use bollinger bands cause when conducting my trade i can easily look for strong breakout which are based on the volatility signaled and also i can determine the overbrought and oversold conditions.

It suit my trading style cause it determine the entry and exit point of my trade.

III) To finally complete this tasks i use my demo trading app called forex and stock practices as seen below

Here is the result of my trade

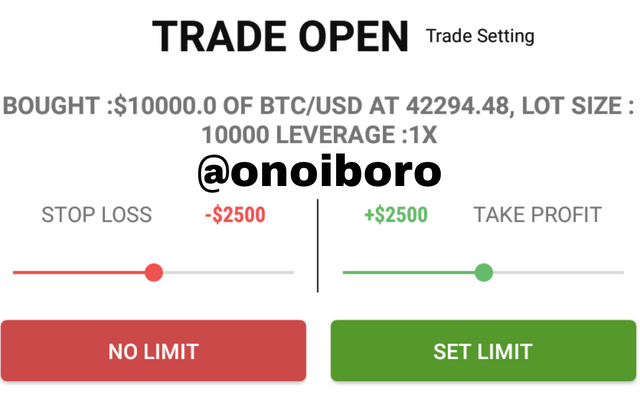

From the image above you can see the result of my trade using the bollinger bands i was able to buy $10000 of BTC at 42294 and set my stoploss and take profit at $2500.

And finally my trade was successful, as i made profit of $329090.63

Conclusion..

Trading is the buying and selling of cryptocurrency to make profit, it a kind of way a trader invest is cryptocurrency to make profit.

But then traders are also bound to loss if the trade does not go on their favour.

There are different ways and styles of trading which are utilized by certain level of traders to trade, there are spot trading,margin trading and future trading all this type of trading has their own style of trading with the aim of making profit but before this trade is executed it requires an agreement to buy and sell asset at a specific price or specify price range(order) which are always set by the trader before executing the order.

Once again thank you prof.@reminiscence01 for the well explanatory and clarity lecture post.

Hello @onoiboro , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit