Hello,

I salute all colleagues and professors in the Cryptoacademy.

I am opportune to learn again from professor @imagen, and I am going to answer my assignment bellow

Question

1.) Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion. (Binace is not allowed)

Staking cryptocurrency is the process of storing or freezing digital assets in your wallet or on a specific account with a third-party provider in order to receive passive income in the form of interest based on the amount staked. Blockchain networks using the Proof of Stake protocol (PoS), and also a copy of this algorithm like Delegated Proof-of-Stake do provide this service.

Use a Trustworthy Crypto Staking Platform. Select a reputable crypto staking platform.

Consider your ability to go without your crypto assets for an extended period of time before opting to engage in staking.

Before staking, think about the interest rate for your crypto staking site. Because you're staking to make money, the platform interest rate plays a big role in determining your earnings.

KuCoin Exchange is a cryptocurrency exchange.

Staking is available for the first time on KuCoin. In 2019, the Singapore Exchange platform launched a soft staking facility.

Users can currently stake a variety of coins on KuCoin, including those that aren't available on other credible platforms.

KuCoin Exchange was founded in 2013. PIVX, EOS, ATOM, TRX, NEBL, IOST, ONION, NRG, TOMO, NULS, LOOM, EOSC, WAN, VSYS, X'T, IOTX, LOKI, ELA can all be stacked. Depending on the cryptocurrency, yields range from 0.5 to 15%.Kraken Exchange is a cryptocurrency exchange situated in San Francisco. Kraken is one of the market's most well-known digital asset exchanges. For nearly a decade, the trading platform has been a popular alternative for both retail and commercial traders, offering a variety of top cryptocurrencies.

Kraken entered the exchange staking business in 2019 by introducing a Tezos staking service (XTZ).

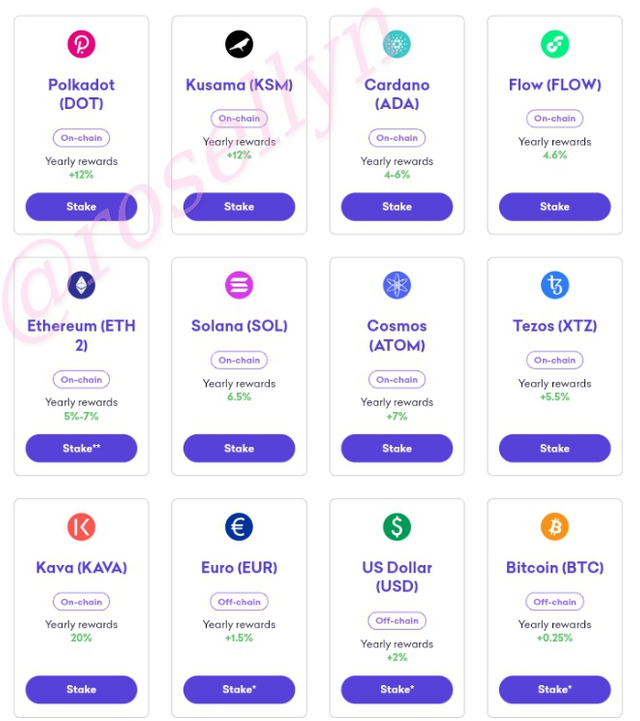

Kraken Exchange is a cryptocurrency exchange that allows you to stake On the Kraken platform, you can stake assets such as ETHEREUM, TEZOS, KAVA, CARDANO, FLOW, COSMOS, BTC EURO, and USD.

Kraken interest rate

Staking on KuCoin is quite easy. Deposit one of the coin that their staking service supported, and you are good, but on Kraken, you'll have to follow a proceedure before it will be agreed that you stake

On Kucoin, there is no bonding period, once you wallet is credited before snapshot, you will recieve your reward, but on Kraken certain assets have a bonding period, which may delay rewards until asset is staked for a certain period.

When you need your staked funds on kukoin, all you have to do is to go and use your assets for transactions, but on kraken, you will have to go and unstake your staked funds before you can access the funds.

Staking fee on kucoin is 5% -10%, But staking fee on kraken is

15%Kukoin doesnt offer off-chain staking, but Kraken offers off-chain staking for eligible accounts

According to your opinion: Kucoin Exchange from my observation is more profitable and beneficial for staking more than Kraken Exchange

Question

2.) What is Impermanent Loss?

A transitory loss of funds experienced by liquidity providers from decentralized sites is known as impermanent loss or non-permanent loss. The truth is that the price of a crypto asset on a decentralized and centralized platform frequently differs. BTC may be purchased for around $ 30,000 on UniSwap and $ 30,500 on Binance. Let's look at a real-life example of such a loss.

Let's imagine you paid $30,000 for an apartment in a remote location in 2015. Bitcoin reached a high of $313 in the same year. In theory, $30,000 could buy 958 bitcoins, and the price of bitcoin is expected to rise to 7,100 by 2020. If Bitcoin had been purchased at that time, your total would have turn $6,801,800. It turns out that non-permanent losses totaled $6,771,800 in this case you actually didn't make any money, but you also didn't lose any.

However, because this situation is not permanent, i.e. the price of an item will never become irrelevant, it is referred to as volatile loss. The price will be updated sooner or later, but circumstances vary, and if the market maker withdraws his funds at this time, he will lose money.

Centralized exchanges have a greater trade volume than decentralized exchanges at this level of development. In this sense, traditional exchanges have a higher ratio of buyers to sellers, resulting in significantly rapid price adjustments. Because there are more users on the exchange, there is more money on it, then the price is more significant than on decentralized platforms.

These explanations are superficial, but if we delve a bit deeper, we will discover the next moment. The operation of decentralized exchanges is automated and not under management regulations, as previously stated. The protocols used at these platforms to carry out all operations are based on a mathematical algorithm. This algorithm equalizes the coin ratio in the liquidity pool to 50:50, revealing the pool's true worth.

Define parameters and ensure liquidity for only well-known assets.

If possible, choose a pair using stablecoin as the quoted asset. Stablecoins have price volatility too but moderate, therefore, they are sometimes preferable.

Begin with a little fund and work your way up. If you're not familiar with the pair in a liquidity pool, it's best to avoid it.

Question

3.) What is Delegated Proof of Stake (DPoS)?

In 2014, developer Daniel Larimer invented the Delegated Proof of Stake (DPoS) consensus technique. DPoS is used in the following notable projects: EOS Ark Steemit Lisk BitShares.

The staking process concept is similar to that of PoS and is implemented in a consensus technique called Delegated Proof-of-Stake (DPoS). Investors or holders that stake their tokens in Delegated Proof of Stake are not directly involved in the validation or production of blocks on the blockchain network. Once their delegated coins or Proof of Stake tokens have been staked or locked on the network, they will be able to assign authority or shares to delegates (witnesses) or block producers, who will participate in the actual generationtion and validation of blocks on their behalf.

DPos token will also have its own reward system, block periods, minimum wagering conditions, and maybe a withdrawal delay that will be used for non-delegation. Because the agreed DPos protocol requires staking.

Stakeholders and investors vote for block producers or delegates (Witness) in DPoS, which is similar to a representative system.

Delegated Proof of Stake ensures a more fair distribution of coins and network influence, as well as a higher level of decentralization.

Each wallet with coins on the balance in a DPoS blockchain can vote for Delegates, Block Producers, or Validators (the representatives who have the right to generate a block and receive a reward on behalf of voters, and share part of this rewards to voters).

A corrupt minority will not be able to attack DPoS. If voted delegates do damage to the network or appear to be ineffective, network members re-elect and appoint new delegates until the percentage of honest block producers returns to normal.

The authority of the delegates is to establish the network's core rules.

The delegates ensure the blockchain's stability and generate blocks. They profit from transaction fees.

Any network member can become a delegate, but only for a limited time.

The network compensates the delegate for generating, and they share part of it with those who they are representing.

Conclusion

While staking can be an effective way to produce income from your digital asset holdings, it is still a dangerous undertaking because to the volatility of the underlying digital asset values. As a result, I recommend that investors conduct study and make the best selections possible.

Inpermanent loss is one of the key words that many DeFi investors and liquidity providers have lately been acquainted with. Decentralized projects are focused on the services given to clients, but pay little or no consideration to the potential losses that market participants may face. As a result, anyone interested in becoming a DeFi investor should conduct thorough study.

The Delegated Proof of Stake consensus method has been prospering, and its benefits have led to its adoption by many projects on the blockchain network. I won't be surprised if this protocol drives few mechanisms far away.

Thanks

Hi @rosellyn. Thank you for participating in Season 3 of the Steemit Crypto Academy.

You did a good job and demonstrated mastery of the topics requested in the assignment, however, you failed to consider the rates of return in your comparative analysis.

I look forward to continuing to proofread your next assignments.

Rating: 8.0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit