QUESTION 1

Say in your words what you understand about the price action and the engulfing candle pattern, describing each step to execute it

Price Action and Engulfing Candle Pattern

The price action and engulfing pattern is a strategy which is solely based on the candlestick movement and the market structure.

We all know the market structure to be one the main strategies that is highely profitable when followed closely since its movement is based on the actions of whales and financial institution.

The price action and the engulfing pattern is known to be a great strategy with much efficiency when followed and carried out properly as its execution is based on smaller time frames such as the 30 minuits, the 15 minuits and the 5 minuits. But for this exercise, I will be using the 15 and the 5 minuites timeframes.

steps to execute the price action and the engulfing candle pattern

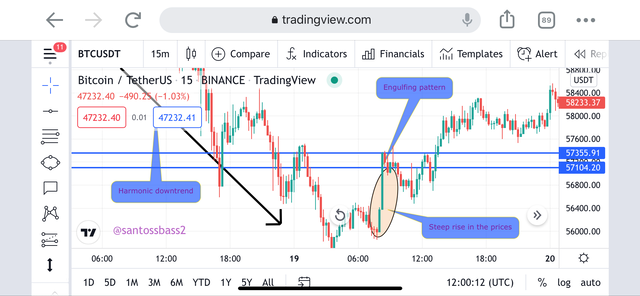

a) Finding charts with clear harmonic trend.

The first aspect here is to find charts with clear harmonic trends, which is particular preferable to be in the 15 timeframe. With this, what we will be identifying in the harmonic trend is the formation of higher highs and higher lows in the case of bullish trend and in the case of bearish trend we will be having lower lows and lower highs formations. With this formations we can say we have a clear harmoinic trend.

b) Finding a Strong opposing the previous direction

Now, what we have to look for closely is the formation of a strong movement which will oppose the movement of the prevent direction. This strong opposing movement is seen with the likely formation of 3 consegative same candlestick type. This formation is often noted to occur after the formation of lower high in the case of an uptrend turning to a downtrend or the formation of higher low in the case of a downtrend turning to an uptrend.

c) Finding a break in price and engulping pattern

The next strategy is the formation of a break and later an engulfing pattern. This means that this is the place where the scenario of the engulfing pattern comes into play. The break is seen after the strong movement in the prices and then we have a break and little opposite movement which is then couple with the formation of an engulfing pattern as seen in the formation below.

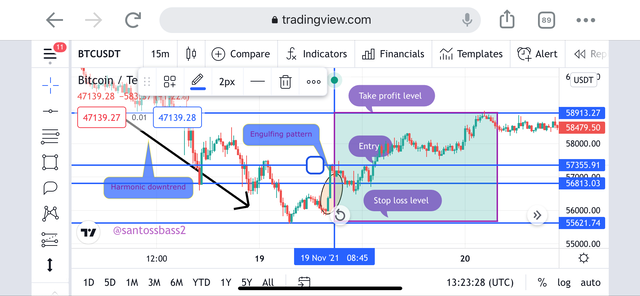

d) changing chart from 15 to 5 minute timeframe.

The next step here is finding the entry position which is to be done using the 5 minute timeframe. This means I will be changing the 15 to 5 minutes timeframe. The entry is seen as we have the break in the prices in the channel level level drawn in step 3 above. This is actually the bullish engulping patten and if the prive break already after changing, we will need to find another break and enter on the formation of the next candle.

QUESTION 2

Explain in your words the interpretation to be given to a large strong movement in the market, what doess the price tell us when it happens.

Interpretation of Large Strong Movement

Large strong movement in the market is caused by the following factors as listed below;

- Injection of liquidity by financial institutions

- Actions of whales

- Major news events

Beginning with the action of financial institutions, we have notice financial institutions and brokers in the market to be have great influence in the market through the injection of volume. The financial institutions are seen to inject high volume in the market on liquidity zones to take out the stop losses of many retail traders.

Also, we see the actions of whales which at times is so high in volumes such that it it causes the action of gaps on the candlestick. The whales come with high trading capital that when a position is made the prices turn to skyrocket.

And finally the last but not the least is the action of new events. This are actually major news events which has great impact on assets such as the tweet from Elon Musk earlier this year on April about the environmental concerns leverage on the mining on bitcoin causing a drastic fall in the prices.

QUESTION 3

Explain trade entry and exit criteria for the buy/sell using price action and engulfing pattern

Trade entry and Exit for buy order

Trade Entry

For the trade entry in a buy scenario, what we will be looking at closely is for the 4 aforementioned points to come into reality. Therefore,

- We will make sure we have clear harmonic trend which is a downtrend since we are looking for a buy entry. In this regards, the trend will be coupled with lower lows and lower highs.

- The next thing we will be looking at is a strong bullish move which will be coupled with candlesticks of the same type. In this case it will be a bullish candle.

- The next thing to be looked at here is the engulfing pattern which is made by a price break after the formation of the strong bullish movement

- The fourth which will be the finding of the entry level is marked by changing the timeframe to 5 minute and finding a break in the channel marked by the engulfing pattern in the 15 time frame.

Trade Exit

The stop loss level will be just a few pips below the start of the movement of the bearish candle while the take profit will be at the last resistance level.

Trade entry and Exit for sell order

Trade Entry

For the trade entry, what we will be looking at closely is for the 4 afformentioned points to come into reality. Therefore,

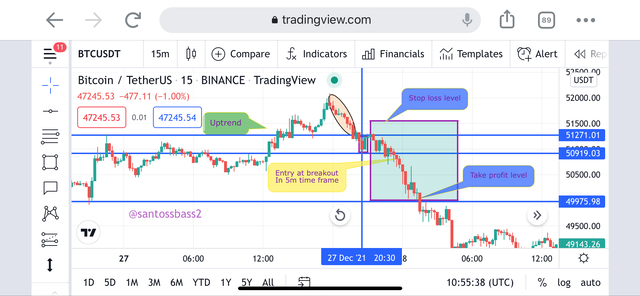

- We will make sure we have clear harmonic trend which is an uptrend since we are looking for a sell entry. In this regards, the trend will be coupled with higher highs and higher lows.

- The next thing we will be looking at is a strong bearish move which will be coupled with candlesticks of the same type. In this case it will be a bearish candle.

- The next thing to be looked at here is the engulfing pattern which is made by a price break after the formation of the strong bearish movement

- The fourth which will be the finding of the entry level is marked by changing the timeframe to 5 minute and finding a break in the channel marked by the engulfing pattern in the 15 time frame.

Trade Exit

The stop loss level will be just a few pips above the start of the movement of the bearish candle while the take profit will be at the last support level.

Trade entry and Exit for sell order

Trade Entry

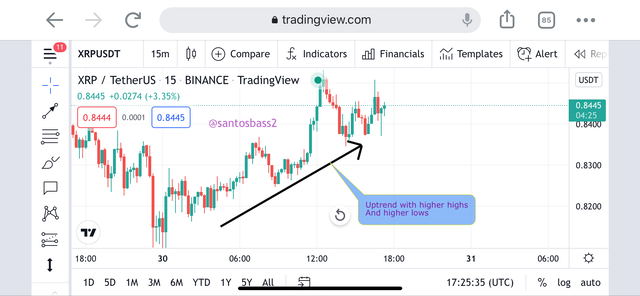

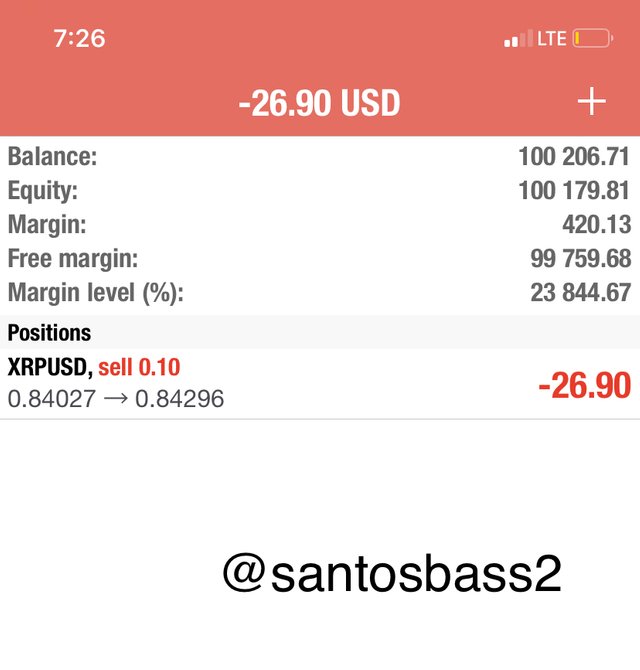

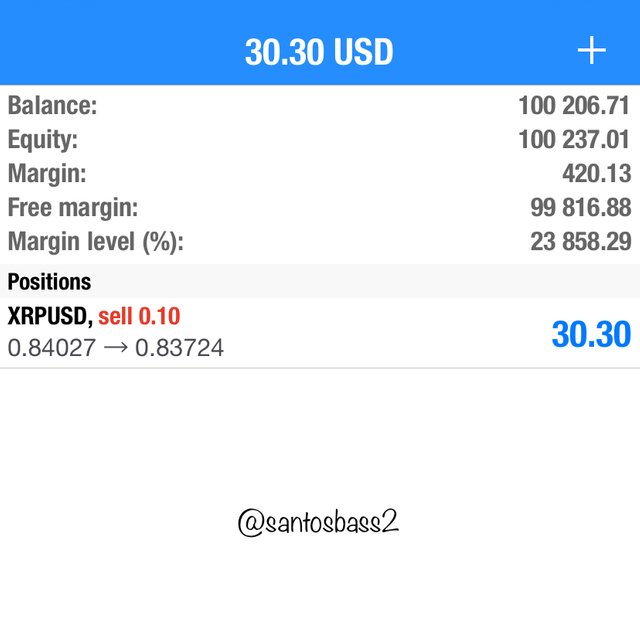

For the trade entry with the xrp/usdt, what i will be looking at closely is for the 4 afformentioned points to come into reality.

- We will make sure we have clear harmonic trend which is an uptrend since we are looking for a sell entry. In this regards, the trend will be coupled with higher highs and higher lows.

- The next thing we will be looking at is a strong bearish move which will be coupled with candlesticks of the same type. In this case it will be a bearish candle.

- The next thing to be looked at here is the engulfing pattern which is made by a price break after the formation of the strong bearish movement

- The fourth which will be the finding of the entry level is marked by changing the timeframe to 5 minute and finding a break in the channel marked by the engulfing pattern in the 15 time frame.

Trade Exit

The stop loss level will be just a few pips above the start of the movement of the bearish candle while the take profit will be at the last support level.

Conclusion

I have explained the trading strategy with the price action and the engulfing pattern. The strategy actually stands out outstanding due its confluence nature. And multiple confirmation with different time frames.

With the practical approach on the signals. We can say the stately can be relied on.