The professor discussed the topic of risk management this week. A newcomer to trading, an unsuccessful trader, and a successful trader need to take a number of measures to reach better positions.

1- Define the following Trading terminologies;

There are some concepts that should be known in trade terminology. Now I will explain them in an understandable way.

Buy Stop

It is used to buy at a price well above the current market price of an asset. Although it may seem like a disadvantageous transaction at first glance, it is actually a very profitable operation. Because after the determined resistance level is broken, the asset price is expected to rise a lot.

Now let's examine this on the graph.

(tradingview TRX/USDT 4H chart)

In order to place a stop order, the asset price must be in an uptrend. Tron price is increasing. Trend direction is strong, indicators are giving signals in this direction. TRX has resistance at $0.096. I placed the buy stop order slightly above the resistance as we need to make sure that the resistance is broken.

Sell Stop

A sell stop is used to sell any asset traded in the market for even less than the current price. Although it seems like we will lose at first glance, we are likely to lose more if the support level is broken in strong sales. If the support level is not broken, our sell stop order will not be executed.

(tradingview DENT/USDT 4H chart)

Dent had a great rally a few days ago. It is now in a downtrend. Although this is considered a short-term delay, if the BTC price drops, the DENT price will also fall. You should not only focus on the Dent chart, but also consider other details. Dent price is currently $0.0074 and the price is falling. There is a very strong support level at $0.00584. If the DENT price drops below this level, it will sell very hard. We should put our sell stop price slightly below the resistance level.

Buy Limit

If the price of any asset is lower than its current price, it is called a buy order to execute the purchase. The purpose for traders to place this order is that the asset price first falls, and then the support price increases rapidly after the order is fulfilled.

If the price of any asset is lower than its current price, it is called a buy order to execute the purchase. The purpose for traders to place this order is that the asset price first falls, and then the support price increases rapidly after the order is fulfilled.

Now I'm going to show this graphically.

(Tradingview ONE/USDT 4H chart)

ONE price oscillated upwards after a very rapid rise. The RSI value was above 70 and a sell signal was formed. Meanwhile, a trader knew that the current price would drop. He did not buy at the current price, thinking that there will be a retest from the support zone. He set the buy limit price at $0.105 or $0.093. Because there is a support zone in this region. There is a possibility that the price will drop here. An increase in price can be expected after the buy limit is met.

Sell Limit

If the price of any asset is much higher than the current price, if a sales transaction is desired, the sales order to be given under these conditions is called a sales stop. Here, the trader thinks that the asset price will rise a little higher and then fall.

He may have thought that the current resistance level was too strong. If the volume is not too high and the strength of the trend is not enough, the trader thinks that the price will go up a little more and then go down.

In such cases, the trader can predict that the price will decrease after a certain increase.

(tradingview XLM/USDT 1D chart)

XLM is one of the cryptocurrencies that has risen a lot in recent days. There is a very strong resistance level at $0.496. Many traders will find that XLM has a hard time breaking this resistance level. Therefore, it is necessary to place a sell limit order slightly below the resistance level. If we place a sell limit order at full resistance, our trade may not be executed.

Trailing Stop Loss

Trailing Stop Loss

Trailing stop order functions to enable the trader to take profit and protect from loss. The aim here is to gradually increase the profit of the trader.

Traders place a pre-analyzed and determined order with a percentage difference from the market price when the market is volatile. In this type of order, if the current price does not move in the direction that the trader expects, losses are limited and gains are protected.

In cases where the price moves as desired by the trader, it moves with the specified percentage (for example, 5%). In this case, the trade remains open. If the trader makes a profit, he locks the profit provided. On the contrary, if the price is decreasing, when the price moves by a certain percentage, the trailing stop loss order will end the trading at the current price.

Margin Call

We can say that Margin Call is the call made by the brokerage house to the investor when certain conditions are met. Imagine a trader is trading with all his money and making a loss. In order for the trader to maintain his position and not to incur any further damage, he receives instructions from the brokerage house. In this case, the investor is called to complete the margin.

The brokerage house can make margin call by phone, message, e-mail or in other ways. In case of damage, you will be contacted. The purpose here is to protect the investor from loss. The investor has to fulfill the call requested by the brokerage house, if the investor does not fulfill it, the brokerage house has the right to trade. In some cases, even the investor is not notified. The brokerage house has the right to demand the transaction fee from the investor after fulfilling the necessary transactions.

2 - Practically demonstrate your understanding of Risk management in Trading.

What is Risk Management?

Traders should take precautions to eliminate the dangers they may face in trade and the threats that may arise. It is one of the foundations of trade. If the trader does not stick to the rules he has set, we cannot say that he has made a successful trade. How to manage risk to be successful in trading. I will explain this subject without further detail.

There is something we need to know not only in cryptocurrency trading, but also in other trades. "Don't trade with the money you need, big problems will await you if the trade doesn't go as you expect it to."

It is quite risky to take out loans, borrow money to do business. In addition, we should trade with a maximum of 10-15% of the money we have.

It would be more useful to divide the risk management strategy into 3 categories in general. These; It is possible to separate Position Sizing, Risk/Reward Ratio, Stop Loss and Take Profit.

a) Position Sizing /Portfolio Management

It is related to how many cryptocurrencies a trader will have in his portfolio. This can be called portfolio diversification. We know how risky it is to put all your eggs in one basket. We know that if we drop the basket, all the eggs will break. We should know that buying a single cryptocurrency with all our money poses a great risk. Because when the cryptocurrency experiences a hack attack, its price will either reset or drop by 99%. Do you want $100 to drop to $1? If you buy this cryptocurrency with $20 instead of $100, your loss will be less.

With the increase of other cryptocurrencies in the basket, you will have tolerated your loss. Therefore, when trading with cryptocurrencies, you should have at least 5 different cryptocurrencies in your portfolio.

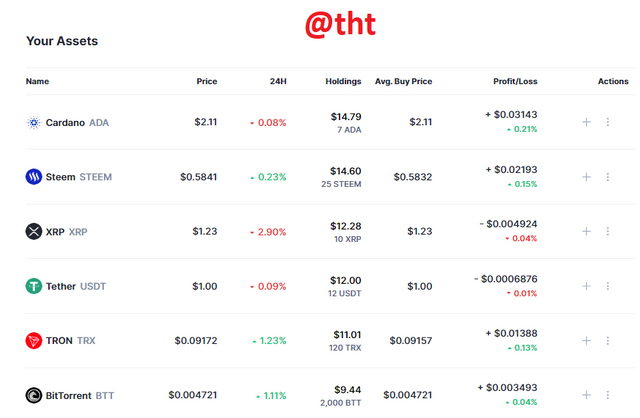

As you can see, I did not buy a single asset with all my money. I bought 6 assets in total. The price of these 5 assets can change constantly. I also bought some Tether. I will buy with Tether when there is a buying opportunity.

b) Risk /Reward Ratio

It is the rate of profit we will get in return for the risk we take after any trade. The most popular risk-reward ratios used are 1/2, 1/3, and 1/4.

Let's say we set the risk to reward ratio as 1/2. The asset price is also $10 for easy understanding. In this case, if we set the stop loss level to $8, our sell price should be $12. If the trade develops as we expect, we make a profit of $2, if the trade does not develop as we expect, we lose $2.

If we set the risk-reward ratio as 1/3. Again, if our stop loss level is $8, our sell price will be $14. If the trade develops as we expect, we make a profit of $4, if it does not develop as we expect, we lose $2.

c) Stopp Loss and Take Profit

One of the two important strategies that savvy traders use when trading is Stop Loss and Take Profit. In our trade, if the market progresses beyond our expectation, if there is a decrease in the asset price, the stop loss is activated to avoid further loss and our trade is closed. On the contrary, our trade proceeds as we expect, it is an order that is activated in case of an increase in the asset price.

The purpose of Stop Loss is not to make any more losses. In take profit, the profit we get is sufficient. Our positions are closed before the market turns against us.

(tradingview Steem/USDT 4H chart)

Short-term exponential moving average 50

Long-term exponential moving average 200

First of all, I want you to draw attention to one point. As of July 28, the event called Golden Croos took place on the chart. The 50 EMA line has now started to act as a very strong support. If you notice, the Steem price has not fallen below the 50 EMA line since July 28. (not counting the wicks on the candlestick)

Buy Price: $0.569

Stop Loss: $0.558

Take Profit: $0.600

Risk/R: ?

Buy Price- Stop Loss: 0.569-0.558: 0.011

Take Profit -Buy Price: 0.600-0.569: 0.031

Risk/Reward: 0.011/0.031

R/ R= ~ 1/3

I placed the buy price slightly above the support zone. I set the stop loss level below the support price. This is near the 50 EMA line. Because it's a pretty strong support level. I chose the Take Profit level just below the strong resistance level. In this case, the Risk / Reward ratio is approximately 1/3.

As you can see, it is possible to earn 1/3 return after conscious and strategically thought risk management.

Conclusion

Risk management is very important in trading. Trades made without risk management and strategy setting are not much different from gambling. In this lesson, we learned how to manage risk to be successful in trading.

Thanks to the professor for this useful lesson.

Twitter Sharing

https://twitter.com/Steemtht/status/1427360426153611268

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @tht

Thanks for participating in the Steemit Crypto Academy

Feedback

This is excellently done. Well done with such a practical study on Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit