There have been so many people who have had experience of the cryptocurrency market. These persons have used significant capital to begin trading but in some cases lose all their capital. It is therefore commendable that Prof. @lenonmc21 has used this lesson to educate us about how to develop and employ trading plan to safeguard our capital. This has been a great lesson. I will proceed now to the assignment questions.

Define and Explain in detail in your own words, what is a "Trading Plan"?

A plan as the name suggest can simply be described as a plan used in trading. A trading plan is an outline of all details and conditions that will be employed by a trader when conducting trading activities. The trading plan is made up of a comprehensive guide on what to do and want not to do when taking trades in the crytopcurrency market. With the trading plan, a trader has a breakdown of all aspects of trading including the capital, the expected profit and loss, trading strategies and other trading dynamics.

The making of a trading plan involves formulating a scheme of proposed actions and regulations that would be implemented while trading. It is structured in such as way as to provide direction towards the achievement of profitability.

There is nothing very new about a trading plan when compared to other plans. The most outstanding thing here is the fact that the said plan is targeted toward a trading activities. The trading plan still follows the same principles of planning on that here, focus and emphasis dwells on trading.

Question Two: Explain in your own words why it is essential in this profession to have a "Trading Plan"?

One reasons why the waves of the sea can toss an empty boat in all directions is that the boat has no one to stead it in any particular direction. In trading, the trader is the boat in the wide turbulent sea (the crytopcurrency market) who can either have a direction using a trading plan or gets to wander endesleses and aimlessly without a plan.

Therefore a trading plan has enormous benefits to the trader. The pressures in the cryptocurrency market can be overwhelming at times. It is thus, very necessary to have a trading plan which will help proper functioning. Some very vital reasons for having a trading plan include:

Facilitating Profit: A trading plan ensures that a trader does not experience more losses than wins. It specifies the ratio of risk to reward that should be used as well criteria for taking trades. This will boost the chances of profitability.

Guiding Trading Activities and Giving and sense of Direction: A trading plan helps to moderate the activities of a trader. It helps to guide the actions of a trader. It also enables a trader have a focus and know how to channel his efforts.

Quicker Decisions: To make decisions, a trader will easily make reference to the trading plan which already has some laid out steps. This will help him arrive at decisions much faster.

Guarding Emotions: Just as stated earlier, so many emotions can arise when operating in the market. However, a trading plan serve as a buffer and a tool to keep these emotions under control as a trader will know how to proceed in such situations.

Protecting Capital: The trading plan discourages recklessness of any kind and compels a trader to stick to certain rules. It also avoids acting out of excitement. A trader does not expose his capital to excessive risks. He will know when take profit and when to stop loss.

Instilling Control: Nothing could be worse for a trader than not knowing what to do next or being helpless. Trading plan puts a trader in control and gives him options in any eventuality.

Explain and define in detail each of the fundamental elements of a "Trading Plan"

There are things that are used to define certain concepts such that without these markers, the concept would lose its definition. These are things we could term as essentials.

There are those things that without them something cannot be said to be. For a trading plan therefore, there are those things that need to be included before such a plan can be qualified as a trading plan. The are the basic requirements and components of a trading plan. These essentials are:

Risk Management

This is the component of the trading plan that functions to regulate how much risk is acceptable by a trader. It determines what level of risk should be taken and what proportion of the trading capital that a trader is whilling to forgo per trade taken.

It gives specifications about how many trades should be taken with respect to how many are won and how many are lost. It helps to state a risk to reward ratio that will still allow for profit making. The most important thing for a trader is to ensure profitability. This can only be possible once his risk are less than his profit.

So, it requires a trader deciding maximum loss trades will be taken proportional to the number of win trades whick will sum up to profits.

Capital Management

Investments are made in prospect of profits. A trader puts in a trading capital so as to grow it with profit and without this capital he cannot trade. Thus, the last thing that a trade would wish for is to lose his trading capital.

Therefore, it is the duty of the trader to find ways to protect his capital while making a trading plan. A trader needs his equity to increase rather than decrease a s this can only be possible with a sustained capital.

Therefore, capital management involves stating the percentage of losses, percentage of profits and trading hours. With the amount of capital a trader has, he should decide what portion of it should be exposed per trade. What amount of profits he would love to make with respect to his capital and how much time he will be commiting to his trading enterprise.

Trading Psychology

The emotional and psychological disposition of a trader goes a long way to affecting if he will be successful or unsuccessful. The feelings we experience affect how we see things and what actions we take. Trading psychology is concerned with the emotions and feelings of a trader and how he controls these feelings so that they do not influence him negatively in the market.

Since a trader requires a good state of mind to be able to analyze the market adequately and be able to make informed decisions, trading psychology aims to promote a functional state of being. There is great tendency for a trader to follow his moods of happiness, desperation, anger, joy or orders to make trading decisions.

With the trading psychology, a trader gets to specify certain pattern of behaviors to stick to or avoid while trading in the market. It makes it possible for rational, logical and well-thought trading decisions to be taken following particular rules and regulations.

Control and Planning of Trading Account

When it comes to financial matters, there is always need for some calculations, estimations and forecasting. In crytopcurrency trading, to make more incomes and grow equity, a trader needs to have a sizeable capital. This can be gotten from consciou management of the trading account and periodic addition to the capital.

Control and planning of trading account implies creating a systematic strategy to operate the account from time to time. It involves taking record of the trading activities and outcomes and using a formula to calculate daily trading ratios and capital reinvestment.

In this component, a trader has to determine how much capital is sufficient to fund the account, how much losses will be allowed, how much profit is envisaged what portion of profit will be added to the capital how many trading hours will be used and so on.

Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

I will be setting up a trading plan to guide my trading activities. My plan is targeted to ensuring significant profitability. My trading capital will be $40 at the start. Components of the plan are given below.

Risk Management

The crytopcurrency market is very risky one. But not being ready to take these risks simply means not being ready to make profit. So, in my trading plan I will be putting in measures to manage the risk so that I can have more profits than losses. Everyday, will be making a maximum of either 4 win trades or 2 failed trades.

Thus, as I enter the market and take winning trades, if I have a total of four winning trades in a day, I will not take any more trades but close positions and leave. Also, if in a day I encounter 3 lossing trades, I will not take any further trades for that day.

Capital Management

I plan to keep having sufficient capital to trade with. Thus, I will be watchful to avoid loss of my capital. For my capital management, I will be having a loss to be 1% of my trading capital which equals $0.4 calculating from my $40 capital. It is advised that beginners like myself adopt this loss percent. This is the portion of my capital that I will be risking per trade.

I will be using a 2% profit margin. This is double it my loss percent and in this was, I will be able to make profit overall. I will try not to be greedy by pursuing larger percentage.

I want to take my trading very seriously as it is my only means of income. Thus, I will trading for the full five working days in a week. In one month, I would have traded for 20 days. This will give me ample time to attain to other needs. I would also have my weekends to myself so as to cool off some steam and revitalize myself.

Trading Psychology

It would be a really sorry situation if I were to lose my cool when in the market. With how tricky the market can be, I would be careful to keep my character and person in check and also maintain a very serene emotional state. This will enable me have a clear, focused mind carry out trading. I do not wish to let my emotions out of control or let it get in the way of my decisions and actions. Thus I will keep the following rules:

I will be committed and dedicated to my trading plan.

I would analyse the market for a minimum of 2 hours daily before placing a trade.

I will not trade when I am angry and will not also engage in revenge trading.

I would place 80% of my daily trades in the morning hours.

I will not combine trading and other activities at the same time.

I will not rush to close with a winning or losing trade earlier than my stipulated risk and capital management rules.

I will not trade with an empty stomach.

Planning and Control of our Trading Account

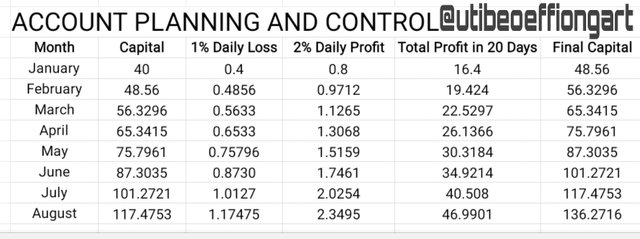

Using the details of the of my account and the other essential components. I will be drawing up a trading plan. My capital remains $40. I will trade on 5 week days. This constitutes 20 trading days in a month. My loss percent is 1% and profit target is 2%. I am making an 8 month trading plan.

At the end of the month I will use 40% of the profits to reinvest. I will use the remaining 60% to support myself and my family. I will also take part to appreciate myself for the success of the month. Of the 60%, 20% will be kept as reserve.

Summary of my account planning and control.

Ist Column: A breakdown of the trading months.

2nd Column: Trading capital at the beginning of every month.

3rd Column: Daily percent losses

4th Column: Daily percent profit.

5th Column: Total profit for the month.

6th Column: Shows the final capital for the month. The 40% of profit it added as reinvestment..

For one to be able to trade the crytopcurrency market, such a person needs to posses some amount of capital. After securing a trading account however, a trader will need to evolve measures to protect that his capital. This is where the idea of trading plan comes handy.

A trader needs a trading plan. There is nothing as disastrous as not having one since such a trader will be likely to take actions that may be completely against his profitability. In creating the plan, a trader needs to put all necessary components into consideration as these will go along way in protecting his capital while also ensuring that he enjoys all the benefits that a good trading plan offers.

Accordingly, developing and executing a trading plan is great way to proceed in any trading endeavor. A trader is more likely to succeed with a trading plan that he is without it. The trader should however devise an plan than will best suit his trading needs.

Learning about the trading plan is such a great lesson for me as I plan to become a very active and profitable trader. Well done Prof. @lenonmc21 for this cool lesson.

Hello Prof. @lenonmc21. This my assignment post is over 48hours old.

So I decided to bring it to your attention.

Thank you Prof. @lenonmc21

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit