Hey Steemian friends!

| 👉 Explain the concept of cross-asset correlation and its significance in portfolio management. How does understanding correlations between different cryptocurrency assets contribute to effective diversification strategies? |

|---|

Bitcoin is gearing up to reach its all-time high, and if you've noticed, the market is shining green like a forest. Why did this happen? Well, one can argue Bitcoin, being the big player with the largest market cap in the crypto market and it can influence the movement of other currencies.

So, does this imply a connection between Bitcoin's price and other ALT coins!

Apparently it does and tracking such relationship between two or more coins or financial assets is what we refers to “Cross-asset correlation”. To measure how closely these assets move together, we use a little math trick called a "correlation coefficient." It's a numerical number that swings between -1 and 1.

cross-asset correlation source

cross-asset correlation sourceHere's the breakdown of what these numbers mean:

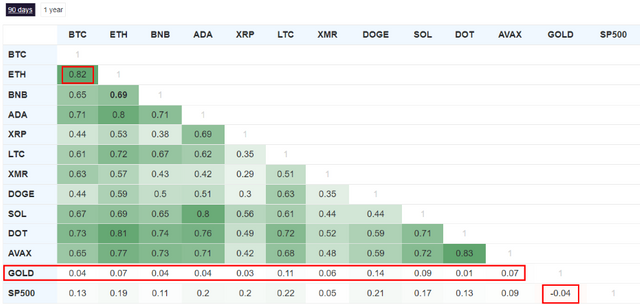

a. Positively correlated: If the number is close to 1, it means these currencies are strongly correlated, moving in the same direction. For example, BTC & ETH with a correlation coefficient of 0.82 implies a strong tendency to move together in the past 90 days.

b. Negatively correlated: If it's near -1, they're a bit like opposites, making moves in opposite directions. Take GOLD & SP500, for instance, with a correlation coefficient of -0.04, indicating they moved in opposite directions.

c. Uncorrelated: If it's around 0, they're more like strangers, not bothered by each other's moves. Consider GOLD vs. All other cryptocurrencies; figures close to 0 suggest that GOLD has little to no relationship with the price movements of cryptocurrencies.

Now, the big question is, why bother understanding these relationships?

Can it contribute to effective diversification strategies and portfolio management?

Absolutely. Imagine if your entire portfolio consists only of positively correlated assets during a market downturn ,all your assets would be at high risk getting rekt.

But if you strategically allocate assets with diverse correlations, it might help cushion the impact on your overall wealth during market volatility and even present opportunities during downtrends. So, understanding these relationships isn't just a market analysis thing but overall it's a smart move to protect and grow your investments in a highly volatile market.

| 👉 Explore how cross-asset correlations change during bullish and bearish market conditions. How can traders leverage this knowledge to adapt their portfolio strategies based on the overall market sentiment? |

|---|

- Bullish Market Conditions:

This is the best time to talk about it because aren’t we all having a good time with bullish market condition right now. As I said everything seems green, and what does green says psychology? 🟢 Go for it.

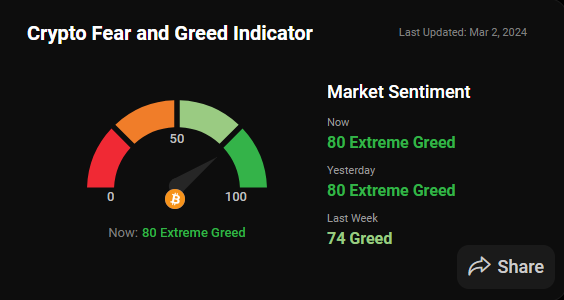

Market is at Extreme Greed now source

When the market sentiment overall positive, various assets tend to move in a more synchronized manner. This particular sentiment could attract more and more investors into market because of FOMO.

However, what advanced trader could do is, choose assets that are considered less risky or negatively correlated with the broader market and invest on them. In such case when the market make U turn, trader with this strategic move could mitigate losses because when some assets are losing value, others may be gaining or holding steady, acting as a buffer against the overall downturn.

- Bearish market conditions

In a bearish market if a trader notices a shift in market sentiment they might decide to reduce exposure to highly correlated assets like altcoins and increase holdings in stablecoins or precious metals (Gold, Silver), which could have lower correlations or even negative correlations with the broader market. Usually investors adopt a "flight to safety" mentality in these conditions.

By actively adjusting their portfolio allocations based on the prevailing market conditions and cross-asset correlations, traders can potentially optimize returns while managing risk more effectively. It's like having a flexible game plan that evolves with the changing dynamics of the market.

| 👉 Explain how understanding cross-asset correlations can be utilized for effective risk management and portfolio diversification. Provide examples of how allocating assets with low or negative correlations can help mitigate overall portfolio risk. |

|---|

Well in the previous answer I have explained how the market condition could influence cross-asset correlations to mitigate overall portfolio risk.

Now let’s take an example to further understand this concept.

Let’s assume that a trader interested in technology and collects stocks related to tech sector. Imagine with current innovations and positive sentiment in the AI market, these investments have performed exceptionally well. Now this is a scenario with positive correlations.

Imagine governments introduce regulatory changes affecting the use of AI, triggering a market downturn. Now that his entire portfolio is exposed to technology sector affect this badly.

With a grasp of cross-asset correlations, if the trader decides to diversify the portfolio by allocating a portion of funds to gold or Stablecoin he might have mitigating the overall impact on the portfolio.

If that happened even if the tech sector faces a downtrend, the negative correlation between gold and tech related cryptocurrencies could have act as a hedge and potentially increase the value of gold. Meanwhile, the stablecoins can act as a stabilizing force where its value remains relatively constant, providing a cushion against the overall portfolio's losses. This diversification strategy helps manage risk by not putting all the eggs in the highly volatile cryptocurrency basket but strategically spreading investments across assets with different correlations.

| 👉 Explore the historical correlation patterns between STEEM and other major cryptocurrencies, such as Bitcoin and Ethereum. How have these correlations evolved over time, and what insights can traders draw from STEEM's behavior in relation to the broader market? |

|---|

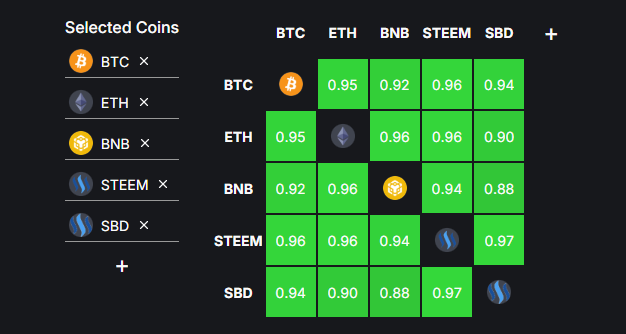

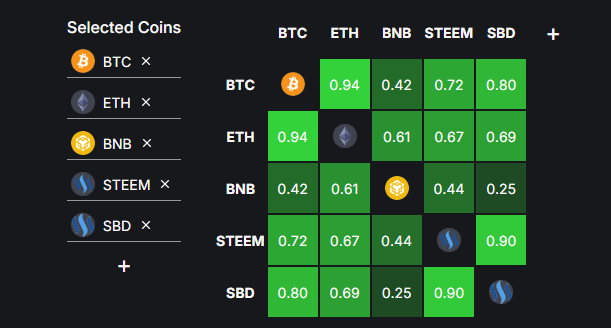

To further investigate into STEEM's performance compared to BTC, ETH, BNB, and SBD, I utilized the Correlations Matrix tool from defillama over various time frames.

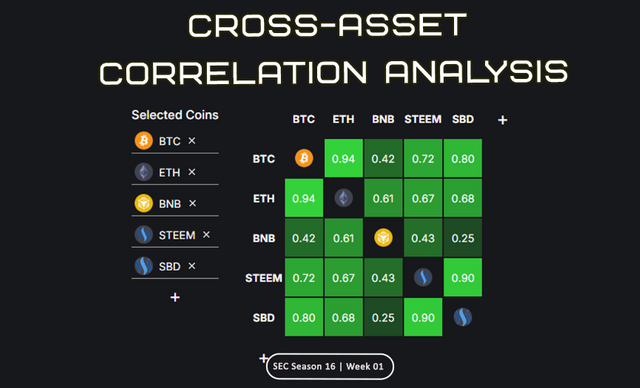

- Previous 07days

During this short period, all coins exhibit a strong correlation with Bitcoin, However, BNB showing a comparatively lesser reaction to the other mentioned currencies.

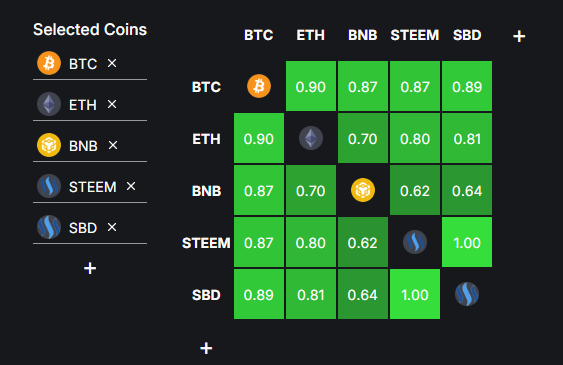

- Previous 30 days

The chart for the past 30 days showcases an impressive synchronicity, indicating that all currencies moved in tandem during this period.

- Previous 365 days

For a longer-term perspective, the matrix reveals that BTC/ETH and STEEM/SBD pairs follow each other closely. Interestingly, BNB shows less responsiveness to the market behavior of other currencies once again.

Now let's use TradeView Comparison method to see how the charts behave over a year period. I will use BTC | STEEM | BNB charts in a DAY mode for this comparison.

A - In this part of the chart we can see that BTC & STEEM prices move in nearly identical paths while BNB makes quite different waves.

B - Now for about good 06 months all the currencies are moving in tandem making almost alike wave patterns.

C - In this part of the chart BNB & BTC are making the same path while STEEM takes a different trajectory.

D - From the last week of January 2024, currencies once again move in the same direction, supporting a bullish market. However, STEEM lags behind the market at present.

In essence, we can see STEEM has tendency to follow BTC, but that doesn't imply that these movements are directly influencing each other. It is not set in stone that if the BTC has an uptrend Steem too follow the path and move upwards or vice versa. However, over the past year the correlation coefficient between these currencies is 0.72, suggesting a 72% chance of moving in the same direction. So we should know how to use this data with caution and proper risk management when we take financial decisions because this is simply not a crystal ball for predicting future movements.

Thank you for this interesting contest @crypto-academy. Looking forward to taking on the next week’s challenge. I would like to invite @chasad75, @yolvijrm & @senehasa to participate in this contest.

Thank you.

Peace to all 🙏

All the screenshots are sourced from various websites, and the appropriate references are provided.

I so love every knowledge i got from this platform each day by all participants.

You've indeed made it easy, very plain and interesting to readers and moreover like a pro.

I'm already thinking you're and expert in cryptocurrency.

Cross-Asset Correlation Analysis

Is indeed a very promising strategic analysis with what it has to offer to investors when it's put to effort and practice then getting a better result.

I'll always love to read more from you .

Good 👍 luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm always here to help and share more insights as per my knowledge and Thank you so much for your kind words! I'm thrilled to find these contest entries have such audience 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have written so post well best of luck for the participation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @shanza1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My knowledge of cryptocurrency is very limited, but after reading your post, I gained some understanding.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm happy to hear that! You're involved with digital currencies on Steemit, so it's quite useful to be familiar with this stuff 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your explanation of cross-asset correlation is clear and engaging providing a practical insight into how assets move together in the cryptocurrency market. The breakdown of correlation coefficients, along with real-world examples makes the concept accessible to readers.stay blessed dear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Understanding cross-asset correlation can indeed offer valuable insights into the dynamics of the cryptocurrency market. Even right now in the market we can see most of the coin sky rocketing with BTC.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your article clearly explains the importance of cross-asset correlation and portfolio management. You have given suitable examples to explain the importance of the correlation between different cryptocurrency assets. Your comments and suggestions are enriching. Advance Congratulations

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your thoughtful feedback! I'm glad you found the explanation clear and engaging.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You don't need to thanks dear it's my pleasure

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your participation in this engagement challenge and you have explained very well that due to a situation of FOMO which is fear of moving out most of the time investors get attractive due to this to market then there is a situation of positive correlation between different cryptocurrencies.

Good luck 🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your recognition of the explanation and Indeed, FOMO can significantly impact investor behavior, leading to increased market activity and positive correlations among different cryptocurrencies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello dear friend you did very well and I must say I appreciate your good job, it's really a neat and professional job and i must say keep it up.

Yes friend I must say you have really been observing the market so well and hopefully bitcoin new all time high we profit vus all especially steemians .

Thanks for going through, please help me drop a comment on my entry through the link below 👇https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All-time high! we might see it very soon friend! Everything going so positive I feel Steem is no where near it's real value. Let's hope for the best! 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unfortunately @virajherath, you are not eligible to participate in this competition, you must at least belong to club5050.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's sorted out now, Prof @kouba01. I missed my power up day. Would appreciate it if you could review it again. Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit