Trading is a highly risky venture but also highly rewarding when trades play out well in your favour. You may be asking yourself, is trading gambling? Yes, it is gambling when you trade without proper risk management. When you apply risk management on every trade, it ceases to be gambling, it’s then rather called speculation. The latter is trading professionally for consistently profitable trading.

What is Risk Management?

Risk management in trading refers to the processes employed in controlling losses at the same time maintaining a set risk to reward ratio.

In other words, there is a certain amount of money you are willing to lose to gain more money.

Risk management is another core aspect in trading that every beginner and Expert trader must have in addition to their trading strategy and market psychology. Therefore, without proper risk management, it does not matter how an expert trader you are using a great Trading strategy, you are liable to registering huge losses or even blowing up your account in the long run. Before you think of making any money, you have to first put in place measures to protect the initial capital on your account.

In trading not every trade will be profitable. The fact is that you win some and lose some. As a trader, you have to safeguard yourself from the negative human emotions that may throw you into panic and frustrations when it comes to losses. The idea behind risk management is staying in the business for a long time through managing the losses as you continue aiming to win more trades with your well-trusted Trading strategy.

Planning your Trades

Ensuring proper Planning of your trading is one of the processes that are pivotal in Risk management. As a common saying “you fail to plan, you plan to fail.” Without a systematic plan on when to enter and exit a trade will get you doomed to failure in your trading.

As a trader, you have to have a personal trading strategy that you have backtested, practised with on a demo account before applying it in your trading on a real account.

Applying both technical and fundamental analysis in your trading is also a good way to plan for your trading. This involves the use of several trading indicators on the trading charts that aid you in making a sound judgment on every trade. It also includes keeping updated about the different news surrounding that Crypto asset.

The 1% rule

Since not every trade will be profitable in trading. It’s therefore important to have a set amount of money you are willing to lose on every trade. Most traders are willing to lose 1% and others that are a bit risk-averse will opt for 2%. For example, according to the 1% rule, if you have $10,000 as your initial capital it implies that you are only willing to lose up to $100 on every trade and those that opt for 2%, are willing to lose $200 on every trade.

This is a rule in risk management which traders must strictly observe if they are to minimize the losses made on a few bad trades of the day. Otherwise, any compromise of this rule implies heavy losses on a few losing trades. Therefore to safeguard your account from registering heavy losses on a few bad trades, you have to carefully observe the 1% rule in your trading.

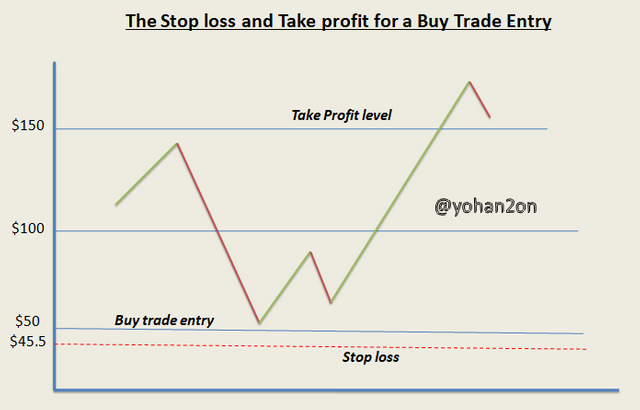

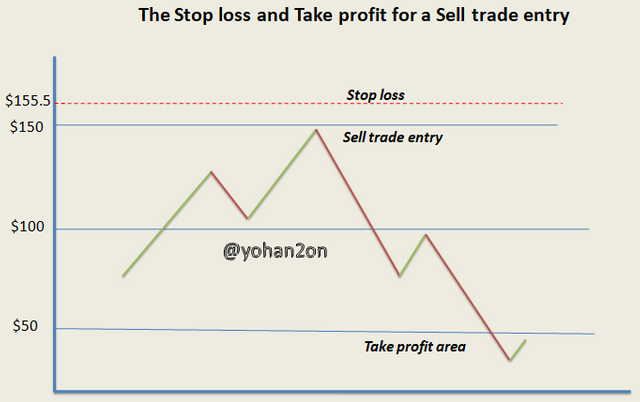

The Stop Loss and Take Profit

Setting up the Stop Loss and Take profit for every trade is another vital aspect involved in Risk management. Without a stop loss, you can lose a lot of money on a few bad trades and without a take profit, trades in profits can reverse back into losses in the absence of a profit target. As a trader, when you spot a trade entry/opportunity, the first thing you have to do is to set up the stop loss and take profit for your trade.

The Risk: Reward ratio is used in setting up the Stop loss and Take profit.

A good risk to reward ratio should be a 1:2 or 1:3. The 1:2 risk-reward ratio implies that you want doubled rewards and the 1:3 implies that you are looking for a Tripled reward for the money you have risked on a particular trade.

The Stop loss and take profit can be set using trading indicators like moving averages, Fibonacci retracement and so on.

How to effectively set the Stop loss

Many Traders make mistakes when it comes to setting the stop loss and in the due process, the markets take them out early then reverse in the speculated direction. Ideally, a stop loss ought to be set 5-10 pips above the recent swing high for a sell entry trade. For a buy entry trade, the stop loss should ideally be set 5 – 10pips below the recent swing low. The main idea behind that is to give enough room for the trade to play out. It is also some sort of breathing space that you provide to the trade and thereby, avoiding being taken out of that trade very early.

Avoid Break-even stops

Many times amateur traders prefer removing the risk from the trade as soon as it gets into profits. They do this by shifting the stop loss to a break-even point of the trade “at a 0 loss” just in case the trade eventually goes against their trade decision. This is not a good habit as it can end up yielding lots of unprofitable trades for the trader since price oftentimes makes retests of the already established support and resistance levels.

Use Moving averages, Fibonacci retracement levels or support and Resistance in spotting good areas to place your stop loss.

In Conclusion, though often underlooked, Risk management is a very important aspect in Trading that every trader must incorporate in their trading for professional and consistently profitable trading.

Homework task

1- Define the following Trading terminologies;

- Buy stop

- Sell stop

- Buy limit

- Sell limit

- Trailing stop loss

- Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

2 - Practically demonstrate your understanding of Risk management in Trading.

*Briefly talk about Risk management

*Be creative (I will expect some illustrations)

*Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

Rules and guidelines

- Post your homework article in the steemit Crypto Academy

- Only steemexclusive articles will be curated

- Do not reproduce the information I have provided in my course article. Expand your knowledge "Be original and Creative"

- Your article should range between 600– 1000words. (Be straight to the point)

- Use an exclusive tag #yohan2on-s3week8 and also tag me @yohan2on so that I can easily find your article.

- Clearly reference your work in case you have directly borrowed any content from other sources. Otherwise, be original and as creative as possible.

- Plagiarism and spinning off other users’ articles will not be tolerated in the homework task. Otherwise repeat offenders will be blacklisted and banned from the Crypto Academy.

- Use only copy-right free images and showcase their source.

- To participate in this task, you should have a minimum of 250SP and your reputation score should not be less than 55.

- This homework task runs till 21st/08/2021, Time: 11:59 pm UTC.

Will definitely try to submit this homework soon sir!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, I will be waiting for your work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sir plz check and give me marks

https://steemit.com/hive-108451/@ansardillewali/steemit-crypto-academy-season-3-week-7-how-to-create-an-account-on-trading-view-using-indicators-tools-trading-view-features

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry, you were late. The submission deadline for your work was Saturday at 11:59 pm UTC time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very sad to hear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much Professor @yohan2on. That is great homework we will love to share.

Thanks for your effort!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the appreciation. I am looking forward to your work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good job professor , I am glad to see this topic . This lesson is really very wonderful because I wanted to teach about it before this .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well explained Prof. Risk management is indeed the first thing a trader must understand, and put into consideration when trading. God bless you Prof.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the appreciation. I am looking forward to your work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor @yohan2on here is my assignment post

https://steemit.com/hive-108451/@vhenom/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear Professor, this is a course that will be very useful for us. Would it be a disadvantage for us to pass 1000 words while preparing homework?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it’s preferable to follow the rules as given

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You may exceed 1000 words by just 100 to 200words. The idea is to keep your content focused on what is required of you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The last two weeks assignment wasn't voted Sir

https://steemit.com/hive-108451/@opeyemioguns/steemit-cryptoacademy-or-season-3-week-6-or-cryptoscam-and-how-to-avoid-them-by-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Forwarded to the curators.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Sir

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please prof @yousafharoonkhan and @yohan2on my work hasn't been reviewed

https://steemit.com/hive-108451/@sadiqxylo/crypto-academy-season-3-week-7-homework-post-for-professor-yousafharoonkhan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Reviewed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks prof

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please @yohan2on, my post is 5 days and you have not reviewed.

https://steemit.com/hive-108451/@princesstj/risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor @yohan2on, this is the link to my assignment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

profesor: @yohan2on quisiera realizar su tarea sera que la puedo realizar.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hola profesor @yohan2on aquí le dejo mi tarea y gracias https://steemit.com/hive-108451/@mayrelisvasquez/steemit-crypto-academy-or-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My entry

https://steemit.com/hive-108451/@doctor23/steemit-crypto-academy-or-or-season-3-week-8-or-or-homework-post-for-professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Beautiful explanation of the lesson sir. You did justice you the topic.

Here is my homework post

Steemit Crypto Academy | Season 3 Week 8 - Risk Management in Trading | for Professor @yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Professor @yohan2on,

This is My Entry to homework post.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas tardes, profesor @yohan2on esta es mi tarea, espero que le guste

https://steemit.com/hive-108451/@flacura50/steemit-crypto-academy-or-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor, here is the lik to y assignent.

https://steemit.com/hive-108451/@harbysco/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading-by-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Professor @yuhan2on

https://steemit.com/hive-108451/@volkiceper/crypto-academy-season-3-week-8-homework-post-for-yohan2on-or-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear Prof @yohan2on,

Below is the link to my homework post

https://steemit.com/hive-108451/@msquaretwins/cryptoacademy-season-3-week-8-homework-post-for-professor-yohan2on-risk-management-in-trading

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings Professor @yohan2on

Here's my entry link;

https://steemit.com/hive-108451/@preshymukel/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola profesor un gran saludo a continuación le envió el link de mi tarea de esta semana.

https://steemit.com/hive-108451/@azucenita/steemit-crypto-academy-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio-por-azucenita

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor @yohan2on here is my entry sir Steemit Crypto Academy | Season 3 Week 8 - Risk Management in Trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here is my entry

https://steemit.com/hive-108451/@jasminemary/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas tarde profesor: @yohan2on aqui mi tarea espero verla realizado bien mil bendiciones...!! https://steemit.com/hive-108451/@makm/steemit-crypto-academy-season-3-week-8-gestion-de-riesgos-en-el-comercio

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your lecture, dear professor. Here is my homework post:

https://steemit.com/hive-108451/@princesstj/risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saludos profesor @yohan2on le realizo entrega de mi tarea para su evaluación y valoración.

https://steemit.com/hive-108451/@emmalucia/steemit-crypto-academy-or-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio-por-emmalucia

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear professor @yohan2on @yousafharoonkhan this is my hw link:

LINK: https://steemit.com/hive-108451/@shahab1998/steemit-crypto-academy-or-homework-for-yohan20n-risk-management-in-trading-by-shahab1998

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello teacher, here my homework.

https://steemit.com/hive-108451/@juanjo09/steemit-crypto-academy-or-season-3-week-8-or-homework-for-yohan2on-or-risk-management-in-trading-by-juanjo09

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas profesor un gran saludo en el link que le envio a continuación esta mi tarea de esta semana:

https://steemit.com/hive-108451/@felixrodriguez/steemit-crypto-academy-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio-por-felixrodriguez

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

aqui le dejo mi asignacion de la semana profesor! muchas gracias por tan educativa clase! https://steemit.com/hive-108451/@dexsyluz/crypto-academy-season-3-week-8-homework-post-for-yohan2on-risk-management-in-trading-by-dexsyluz

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here is my assignment entry Sir

https://steemit.com/hive-108451/@opeyemioguns/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading-or-coourse-by-youhan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @yohan2on professor, here is my entry

https://steemit.com/hive-108451/@kyara2/steemit-crypto-academy-season3-week8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas tardes profesor. Mi tarea de esta semana: https://steemit.com/hive-108451/@annwiswell/steemit-crypto-academy-or-or-temporada-3-semana-8-or-or-publicacion-de-tareas-para-el-profesor-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas tardes aquí mi tarea profesor muchas gracias por la ayuda brindada https://steemit.com/hive-108451/@yri02/steemit-crypto-academy-or-temporada-3-semana-8-gestion-de-riesgo-en-el-comercio

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor here is my home work.

https://steemit.com/hive-108451/@mustafaasif/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading-or-homework-post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi prof.@yohan2on, here is my post.

https://steemit.com/hive-108451/@gentles/steemit-crypto-academy-or-season-3-week-8-or-homework-post-for-pro-yohan2on-or-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Professor @yohan2on, here is Homework Post link:

https://steemit.com/hive-108451/@manuelgil64/steemit-crypto-academy-season-3-week-8-or-or-risk-management-in-trading-by-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas noches profesor @yohan2on aqui esta mi tarea de esta semana

https://steemit.com/hive-108451/@fresi18/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas Noche profesor aquí con mi tarea:

https://steemit.com/hive-108451/@josegregori/steemit-crypto-academy-or-temporada-3-semana-8-or-gestion-de-riesgos-en-el-comercio-or-tareas-del-profesor-yohan2on-por

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Profesor mi tarea https://steemit.com/hive-108451/@elio9604802/steemit-crypto-academy-or-publicacion-de-tarea-de-la-semana-8-de-la-temporada-3-para-el-profesor-yohan2on-gestion-de-riesgos-en

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor @yohan2on, this is my homework assignment. Thank You

https://steemit.com/hive-108451/@zology69/crypto-academy-or-season-3-week-8-risk-management-in-trading-for-professor-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor @yohan2on here is my assignment post

https://steemit.com/hive-108451/@azeem22/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor, This is my homework post.

https://steemit.com/hive-108451/@ibad4242/crypto-academy-season-3-week-8-homework-post-for-yohan2on-risk-management

Kindly evaluate it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello respected professor My home work entry post.

https://steemit.com/hive-108451/@ansardillewali/steemit-crypto-academy-or-or-season-3-week-8-or-or-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas noches profesor @yohan2on hago entrega de mi tarea https://steemit.com/hive-108451/@daanielaa/steemit-crypto-academy-or-publicacion-de-tarea-de-la-semana-8-de-la-temporada-3-para-el-profesor-yohan2on-gestion-de-riesgos-en

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professors, @yohan2on and @yousafharoonkhan

Please check my homework task that is not yet checked due to tag issue but this post is posted on time.

Thank you very much.

https://steemit.com/hive-108451/@azamrai/crypto-academy-season-3-week-8-homework-post-for-yohan2on-risk-management-in-trading-or-or-azamrai

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Professor, it is my homework;

https://steemit.com/hive-108451/@sinerjii/steemit-crypto-academy-season-3-week-8-homework-by-yohan2on-or-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Respected professor here is link of my homework task ;

https://steemit.com/hive-108451/@shahzadprincejee/crypto-academy-season-3-week-8-homework-submission-post-for-professor-yohan2on-risk-management-in-trading-by-shahzadprincejee

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here is my entry professor @yohan2on

CryptoAcademy Season 3 Week 8 / Homework Post for Professor |@yohan2on|... Risk Management in Trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Prof..here is my entry

https://steemit.com/hive-108451/@lhorgic/cryptoacademy-season-3-week-8-homework-post-for-professor-yohan2on-trading-risk-management

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, Prof. Please review my homework.

https://steemit.com/hive-108451/@princesstj/risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hai prof, this is my homework. it has been 2 days ago

https://steemit.com/hive-108451/@robbee/steemit-crypto-academy-intermediate-level-courses-season-3-week-8-homework-by-yohan2on-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear Professor @yohan2on,

https://steemit.com/hive-108451/@ghiasahmad/crypto-academy-season-3-week-8-or-homework-post-for-professor-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buena tarde profesor aquí le dejo mi tarea bendiciones https://steemit.com/hive-108451/@dulcem05/steemit-crypto-academy-or-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor. This is my homework link

https://steemit.com/hive-108451/@lordhojay/steemit-crypto-academy-or-risk-management-in-trading-or-homework-task

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola equipo, ya saliendo de vacaciones, muchas gracias por tanto aporte. Todo bien interesante. Por aquí dejo mi tarea:

https://steemit.com/hive-108451/@lisfabian/steemit-crypto-academy-or-s-3-w-8-or-gestion-de-riesgo-en-trading-or

¡Felices vacaciones!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola profesor @yohan2on. Acá le dejo mi tarea.

https://steemit.com/hive-108451/@perezzambrano/steemit-crypto-academy-or-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor thank you very much for this week's post very good explanation here is my homework.

https://steemit.com/hive-108451/@emimoron/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

my entry: https://steemit.com/hive-108451/@head1/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor. Here is my entry:

https://steemit.com/hive-108451/@dioximarandreina/cryptoacademy-season-3-week-8-homework-post-for-professor-yohan2on-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas noches profesor @yohan2on, muchas gracias por su clase de esta semana. Adjunto mi Tarea:

Steemit Crypto Academy | Season 3 - Week 8 | Risk Management in Trading | By @minikay

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello prof @yohan2on, here is my entry link

https://steemit.com/hive-108451/@meniya/steemit-crypto-academy-or-season-3-week-8-or-or-risk-management-in-trading-by-meniya

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

buenas noches profesor hago entrega de mi tarea https://steemit.com/hive-108451/@abigailaadap/steemit-crypto-academy-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio-por-abigailaadap

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi professor @yohan2on here is my entry https://steemit.com/hive-108451/@mccoy02/steemit-crypto-academy-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Buenas noches profesor, hago entrega de mi tarea:

https://steemit.com/hive-108451/@leomolina/crypto-academy-or-s3-w8-or-gestion-de-riesgos-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello proof here is my link

https://steemit.com/hive-108451/@chimezunem001/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Respected Prof. @yohan2on, here's the link to my homework task

https://steemit.com/hive-108451/@preye2/crypto-academy-season-3-week-8-homework-post-for-yohan2on-risk-management-in-trading-by-preye2

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @yohan2on Here is my submission

https://steemit.com/hive-108451/@chimzycash/steemit-crypto-academy-season-3-week-8-post-for-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

my assignment

https://steemit.com/hive-108451/@farooq2923/crypto-academy-season-3-week-8-i-homework-for-yohan2on-i-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Prof @yohan2on this is my entry for this weeks crypto academy :

Crypto Academy / Season 3 / Week 8 - Homework Post for [@yohan2on] - RISK MANAGEMENT

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good day sir, here's the link to my assignment post

Crytpo Academy Season 3 Week 8||Homework post for Prof. @yohan2on by @cinnymartins

Thank you sir

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

mi tarea profesor @yohan2on

https://steemit.com/hive-108451/@leonelb/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

#affable #venezuela

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-108451/@tejumola/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mi tarea Profesor @yohan2on :

https://steemit.com/hive-108451/@exqueila/steemit-crypto-academy-or-temporada-3-semana-8-or-curso-intermedio-gestion-de-riesgos-en-el-comercio-or-tareas-del-profesor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-108451/@alejandri/steemit-crypto-academy-or-publicacion-de-tarea-de-la-semana-8-de-la-temporada-3-para-el-profesor-yohan2on-gestion-de-riesgos-en

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Professor, it was a great lecture and I learnt a lot.

Pls here is my submission entry. It seems you skipped mine

https://steemit.com/hive-108451/@ononiwujoel/crypto-academy-season-3-week-8-homework-submission-post-for-professor-yohan2on-risk-management-in-trading-by-ononiwujoel

Cc: Professor @yohan2on

Cc: Professor @yousafharoonkhan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola profesor @yohan2on. Está es mi tarea de la semana.

https://steemit.com/hive-108451/@yelis/crypto-academy-season-3-week-8-homework-post-for-yohan2on-risk-management-in-trading-by-yelis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear Professor @yohan2on,

Please find my homework post here.

Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor @yohan2on, thank you for all the amazing lectures you've given throughout this season. I have learnt a lot and cannot wait to get on with practice. I have attached a link to my submission for the homework task below. Looking forward to reading your review.

https://steemit.com/hive-108451/@pangoli/steemit-crypto-academy-or-season-3-week-8-risk-management-in-trading-by-professor-yohan2on-homework-task-by-pangoli

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor@yohan2on,here is my homework post link

https://steemit.com/hive-108451/@ladyofpolicy/steemit-crypto-academy-or-or-season-3-week-8-or-or-homework-post-for-professor-yohan2on-by-ladyofpolicy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-108451/@kelechisamuel/steemit-crypto-academy-or-or-season-3-week-8-or-or-homework-post-for-professor-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @yohan2on please here is a link to my homework post.

https://steemit.com/hive-108451/@wonderbowy/crypto-academy-season-3-week-8-homework-post-by-wonderbowy-for-professor-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Professor @yohan2on, here is my homework task

https://steemit.com/hive-108451/@charis20/cryptoacademy-season-3-week-8-homework-post-for-professor-yohan2on-risk-management-in-trading

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @yohan2on This is my task post

https://steemit.com/hive-108451/@designieplay/crypto-academy-season-3-week-8-risk-management-in-trading-by-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola profesor @yohan2on. Quiero disculparme envié la tarea 2 minutos tarde porque tengo muchos problemas con el internet y la electricidad aquí en Venezuela. Espero no tener problemas por ello, me entienda y considere bastante.

Muchas gracias tenga un buen día.

https://steemit.com/hive-108451/@rodriguezz/academia-de-cifrado-or-temporada-3-semana-8-gestion-de-riesgos-en-el-comercio-para-el-profesor-yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good day sir, here's the link to my assignment post

https://steemit.com/hive-108451/@cinnymartins/crytpo-academy-season-3-week-8-or-or-homework-post-for-prof-yohan2on-by-cinnymartins

Thank you sir

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good day sir

The assignment you rated was mistakenly posted on your blog... Sir kindly rate this one I posted on the community so I can be curated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello Prof. @yohan2on, here is my post link

https://steemit.com/hive-108451/@evegrace/crypto-academy-season-3-week-8-homework-post-for-professor-yohan2on-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Prof. @yahan2on, pls there a mistake in the ground total. It is not accurate with the scores. I have proofread my post and also made corrections to my mistakes. Pls sir, help me to preview it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

sorry prof, you haven't checked my assignment 4 days ago

https://steemit.com/hive-108451/@robbee/steemit-crypto-academy-intermediate-level-courses-season-3-week-8-homework-by-yohan2on-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My homework post...https://steemit.com/hive-108451/@gboye1/steemit-crypto-academy-season-3-week-8-or-intermediate-course-or-homework-post-for-yohan2on-or-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit