Equalizing Access to Decentralized Finance

I was thinking about the financial significance of the lower cost credit facility JUST today and all the criticism about it being a MAKERDAO clone.

I was thinking about the financial significance of the lower cost credit facility JUST today and all the criticism about it being a MAKERDAO clone.

I asked myself these questions;

Do I think JUST just a clone of MakerDao?

Do I think JUST can be and will be some much more then an ETHEREUM credit facility clone?

Do I think JUST presents a WIN-WIN for proponents of decentralization and decentralized finance?

If we put our biases aside, I think we can see JUST in a different way then it has been portrayed. While there have been problems with functionality on JUST. But that’s why Cryptocurrency developers, bug finders, bug fixers and beta versions are all about. We should be honest that we live during the early days of Cryptocurrency development and imperfect beings make imperfect products.

So Justin Sun, the Tron Foundation launched Djed, a credit debt facility, on the Tron blockchain, and it is issuing collateralized loans. All initial reports said was a duplicate of the immensely successful MakerDAO credit debt facility based on the Ethereum Blockchain. The original name was Djed, which means Stability in the Egyptian language. The name was subsequently changed to JUST, indicating the project would be about justice and equality. I know that some people laughed and made fun of the name, but let’s revisit the name after a brief reviewing the White Paper.

First, after reading the White Paper and visiting the website I feel that the Djed platform is modeled after the opensource MakerDao platform on the Ethereum blockchain.

In terms of similarities;

The JUST is a credit facility, and a Collateralized debt lending platform,

JUST uses Collateralized Debt Positions (CDP).

Its users need to pay an interest rate called a Stability Fee on their loans, the amount of which is determined through by the Interim Risk Team.

The whole transaction is trustless using smart contracts.

So basically you deposit a specific cryptocurrency, transform it to a non-fungible version, pledge it as collateral for a loan, and receive a loan in the form of a stable coin.

Now you can exchange that stable coin for dollars and loan it out or use it to buy more cryptocurrency you want to stake!

Differences;

The CDF or credit debt facility doesNOT accept Ethereum deposits, it accepts only Tron Token.

There are no gas fees. All the other token names are different to reflect a new ecosystem.

This huge Financial News, but it isn’t readily apparent unless you actually go through the steps and expense of creating a CDP on the MakerDao. While everyone in theory has access to the MakerDao, when the price of admission is very high, the facility isn’t really open to all. For those of you who have never heard of the MakerDao I will review it here.

The MakerDAO is basically a credit facility that issues loans with a certain interest rate called the stability fee against a collateral called Ethereum. The loans are paid to borrowers in Dai. Each Dai is worth one dollar USD. The stability fee or interest rate is raised to reduce selling pressure on the Dai and help keep it pegged to the dollar and vice versa. The DAI stability fee or interest rates for borrowers was 1%, but later the stability fee increased from 1% to 3.5%. As you can see from the below headline, it is the most successful decentralized credit faculty in Decentralized Finance right now.

Why Collateralize your Ethereum?

As an investor your rate of return on Ethereum is variable, for example if the price for Ethereum increased 5% in one month your ROI was 5%. If you owned $100 worth of Ethereum your 5% ROI was worth $5 USD. But what if you owned 10 times as much Ethereum? $1000 worth of Ethereum at a 5% ROI would mean $50 USD. If you had 100 times as much Ethereum your 5% ROI would be worth $500 USD.nSo to make more money, you need to buy more Ethereum. But with collateralization you can buy more Ethereum without having more money. And as you can see by the transactional volume this is very popular.

Event Significance

The Tron Foundation adopted and modified the open source code for the MakerDao and is running it on a blockchain known for higher transactional volume capacity then the Ethereum blockchain. And a blockchain having millions of users. Investors who understand how a decentralized credit facility works and who do these transactions on the Ethereum Blockchain, see the advantages of running a clone on a blockchain with much greater transactional volume capacity. I think this is a situation where copying and modifying the code of the most successful credit facility in the decentralized space should be seen as a smart move. After all, this is the code for the most popular credit facility and the code has been bug tested by hundreds of developers. It’s open source and this is one of the main strengths of code libraries. It the reason there are so many Bitcoin clones, Dash clones and others.

The true beauty and utility of open source code is that it can be used as the base code for innovations. The Ethereum blockchain is considered the Legacy blockchain for smart contracts. The costs of transacting there include both Ethereum or Ether and Gas. There are other blockchains which use Smart Contracts and nonfungible tokens, similar to the Tokens used on the Ethereum blockchain for decentralized finance and other forms of Commerce. But the Ethereum blockchain is so famous, that the vast majority of decentralized finance runs on the Ethereum blockchain.

But there are two big problems:

Cost: Ethereum is $180.00 USD

Scalability; Ethereum frequently reaches its maximum transaction capacity and all transactions slow down and even smart contract function and execution starts malfunctioning, as did early in March and investors lose money.

Now enter Trans credit Facility.

Low cost Tron is around 0.15 USD or 15 cents

Tron blockchain has a much higher transactional capacity then Ethereum blockchain.

This is a significant difference because now those investors who can’t afford ETHEREUM at $160.00 USD per Token can still profit from this investment model using Tron tokens at 0.15 $ USD. In some ways this brings DeFi to the masses by making it affordable. Some smart investor with a good grasp of decentralized finance, but who was born in a poor country is barred from profiting off the MakerDao, but the price of entry is much lower on JUST. Lets be realistic. There are far fewer investors having $160.00 USD to invest in the MakerDao, then there are investors who can buy Tron at 15 cents. In terms of access a smart but dollar poor investor can succeed easier with Tron. Now when we look at the name change to JUST we stop laughing. If we are fair we admit that JUST, by using Tron tokens instead of Ethereum Tokens benefits Tron, but also smaller investors with less dollars. The promise of decentralized finance is access to markets and financial tools for all. When large amounts of money are required for access, then that promise is denied. JUST provides access and the promise of decentralized finance is fulfilled.

In today’s world we must be careful, sceptically, trust is earned and continued honesty must be continually verified. This trystless nature of the blockchain and unfettered access to the tools of financial success is why we are here. Keep your minds and eyes open. Trust, but learn how to verify. The blockchain is touted as being transparent. But only to the informed.

Stay informed my friends.

🤔👀

Written by Shortsegments. ✍🏼

Shortsegments is a blogger or writer on social media application or platforms, some of which are running on blockchains.

Please follow @shortsegments Twitter Feed Here

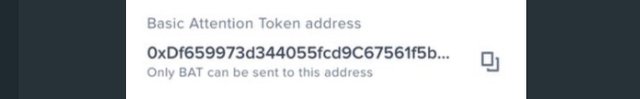

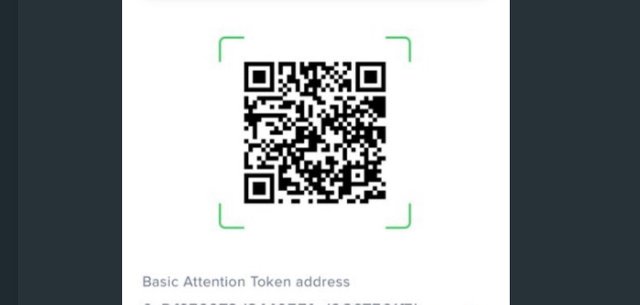

Please upvote, resteem and consider leaving me a tip in BAT to support my blog

Thank you

BAT Basic Attention Token

Send BAT tips to this BAT wallet:

Or use QR reader to scan this symbol to send me BAT via QR scanner equipped wallet.

Thank you for supporting my content.

Shortsegments

@shortsegments

Please check out these Communities:

Banking and Finance

Flowers Pictures

Steemit Explained

Title: Equalizing Access to Decentralized Finance

Tags: banking-finance decentralized-finance makerdao just

So if I understand you correctly. The MakerDao on the Ethereum Blockchain allows wealthy people to make money through their knowledge of credit, loans and leveraged investment. The rich deposit Ethereum, which is $180 a token in the MakerDao. They borrow money, using their Etheteum as collateral, then use that borrowed money to buy more Ethereum, then deposit that in the MakerDao, then borrow more money against that newly deposited Ethereum and borrow more money and do the same thing again. So by using credit and loans, along with a very expensive asset, the Ethereum they buy more Ethereum with loans, but no more of their capitol.

But only the wealthy can buy Ethereum. So only the wealthy can use this strategy. But the new credit facility, uses a cheaper asset Tron. So now people who can’t afford Ethereum, but can afford Tron, can use this vehicle to make increase their holdings of Tron. So the same way the Ethereum holders increase their Ethereum holdings and their subsequent profit on the increased value of their increased amount of Ethereum, less wealthy profit from increased value of Tron over time.

Title: Equalizing Access to Decentralized Finance

link

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes. You have correctly described the process and pointed out that a cheaper asset for the loans opens up the loan process to the less wealthy parts of society.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wish I knew what this article is about.

Your tags underneath will not work unless you use # before each word.

Happy day 💕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So if I understand you correctly. The MakerDao on the Ethereum Blockchain allows wealthy people to make money through their knowledge of credit, loans and leveraged investment. The rich deposit Ethereum, which is $180 a token in the MakerDao. They borrow money, using their Etheteum as collateral, then use that borrowed money to buy more Ethereum, then deposit that in the MakerDao, then borrow more money against that newly deposited Ethereum and borrow more money and do the same thing again. So by using credit and loans, along with a very expensive asset, the Ethereum they buy more Ethereum with loans, but no more of their capitol.

But only the wealthy can buy Ethereum. So only the wealthy can use this strategy. But the new credit facility, uses a cheaper asset Tron. So now people who can’t afford Ethereum, but can afford Tron, can use this vehicle to make increase their holdings of Tron. So the same way the Ethereum holders increase their Ethereum holdings and their subsequent profit on the increased value of their increased amount of Ethereum, less wealthy profit from increased value of Tron over time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @wakeupkitty

The MakerDao on the Ethereum Blockchain allows wealthy people to make money through their knowledge of credit, loans and leveraged investment. The rich deposit Ethereum, which is $180 a token in the MakerDao. They borrow money, using their Etheteum as collateral, then use that borrowed money to buy more Ethereum, then deposit that in the MakerDao, then borrow more money against that newly deposited Ethereum and borrow more money and do the same thing again. So by using credit and loans, along with a very expensive asset, the Ethereum they buy more Ethereum with loans, but no more of their capitol.

But only the wealthy can buy Ethereum. So only the wealthy can use this strategy. But the new credit facility, uses a cheaper asset Tron. So now people who can’t afford Ethereum, but can afford Tron, can use this vehicle to make increase their holdings of Tron. So the same way the Ethereum holders increase their Ethereum holdings and their subsequent profit on the increased value of their increased amount of Ethereum, less wealthy profit from increased value of Tron over time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Have you tried the method on both blockchains and what is your own conclusion?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a great post explaining the advantages of JUST and the important of DeFi.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit