If you’ve been watching the news, or if you’ve spent any time looking into the fall of FTX, you’ve probably heard Sam Bankman-Fried being referred to as a modern-day Bernie Madoff.

But for those in Gen Z or Gen Alpha, you may not be familiar with Bernie Madoff or the ways in which his scheme was similar to that which was perpetrated by Bankman-Fried. It’s time to clear up any confusion by diving in deep to both of these schemes and discussing how they are both similar and different.

Read on to learn all about Bernie Madoff and the scheme which shocked a nation.

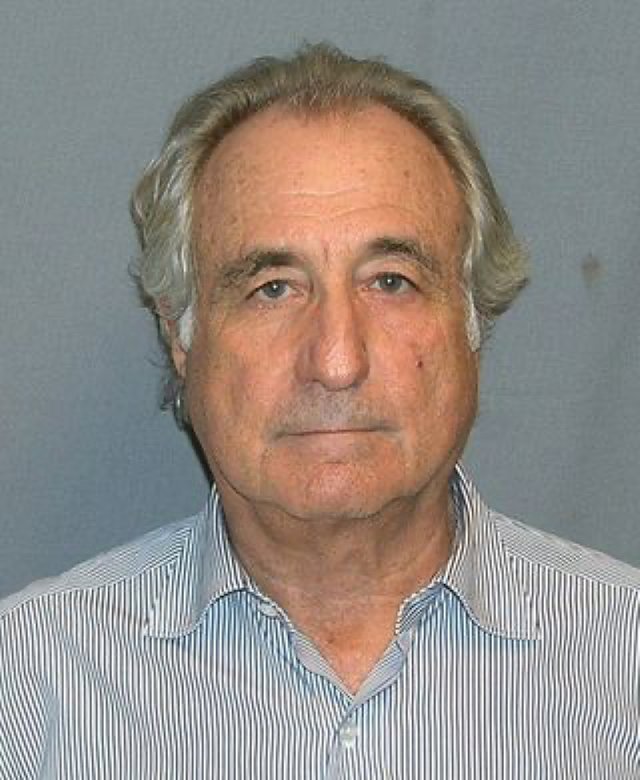

Who Was Bernie Madoff?

Bernard Madoff, while not the inventor of the Ponzi Scheme (that was Charles Ponzi of course), is known for perpetuating the longest running Ponzi scheme known to date. Starting in 1960, as a young adult, Bernie Madoff began taking money from family and friends and investing it in penny stocks.

Unfortunately, when the stock market crashed in the early 60s, Bernie lost all of the money friends and family had invested. It was estimated that at this time, 24 different people had invested a total of $30,000. Because he was so embarrassed at the loss of the money, Bernie asked his father-in-law, Saul Alpern for a $30,000 loan so he could pay back all 24 parties involved.

When he paid the money back, Bernie lied to the 24 people, telling them he hadn’t lost the money but rather had been lucky and ended up cashing out even. The people involved were so surprised (because almost all of their other investments were lost) so many began praising Bernie for his excellent investing skills and denied his refund. Instead, they asked Bernie to continue investing their money and even sent more of their savings. This boosted Bernie’s reputation as a trader.

Around this time, Bernie also founded a legal market making business in which he bought stocks from people who wanted to sell and sold them to others earning a few pennies on every transaction. While this business took off quickly and was very profitable, Bernie continued to take money beneath the table on the guise he was investing it privately.

While it isn’t clear why he didn’t invest this money, or register with the SEC, Bernie continued to take money from people under the table until he was caught in 2008. The money he accepted was either spent or used to pay previous investors as “returns.” This is the definition of a Ponzi scheme, which Bernie carried out for almost 50 years.

Related: What is a Ponzi Scheme?

How is FTX Like Bernie Madoff’s Scheme?

While FTX isn’t exactly like Bernie Madoff’s Ponzi scheme, it operated under a similar guise. Sam Bankman-Fried might have legally registered his company, but like Bernie Madoff he took investments that were made by users and used them to pay out other investors under the guise of a return.

Bernie Madoff’s Ponzi scheme was only able to last as long as it did because Bernie was respected in society. No one could conceive of the man they knew running such a large fraud. In the same way, Sam Bankman-Fried had lots of friends in high places who were rooting for him. None of them could conceive that such a thing could be perpetuated by such a nice young man—but it was.

In both cases, both men were caught when redemption requests outpaced the investments they had coming in from new clients. In Madoff’s case, this was perpetuated by the stock market crash in 2008 which left a lot of investors wondering where their money was. For Sam Bankman-Fried, a serious of collapses in the cryptocurrency world, combined by an investigation for a potential buy out, led to people wanting their funds back, which Bankman-Fried didn’t have on hand to give.

But while these cases of fraud are similar in nature, the scheme perpetuated by Bernie was worth over $64.8 billion dollars while the scheme perpetuated by SBF only amounted to about $5 billion dollars.

Related: Who is Sam Bankman-Fried?

Is Bitcoin a Ponzi Scheme?

Around the fall of FTX, many non-cryptocurrency owners began to hedge that Bitcoin itself was a Ponzi scheme. In reality, this couldn’t be further from the truth.

Bitcoin isn’t controlled by anyone, nor is it an investment which requires others to make decisions. The value of Bitcoin is only controlled by supply and demand, meaning as more people want to buy it, the price goes up, when less people want to buy it, the price goes down.

Because Bitcoin isn’t a government-controlled currency, many people allege that it has liquidity problems, similar to those which plagued Bernie Madoff and FTX before their Ponzi schemes collapsed. The truth is, technology is backing Bitcoin and as long as you have your private key, you will never have a problem accessing or selling your Bitcoin.

The problem comes only if you cannot find someone willing to buy your Bitcoin. While this may have been a serious problem shortly after the coin was launched in 2009, currently there are many market makers in the space, like Coinbase, Kraken, and Binance, who will always be willing to buy your Bitcoin from you for the purpose of selling it to someone else.

The only time this isn’t the case is if the US government or SEC were to make Bitcoin entirely illegal. Then, and only then, would you likely have trouble selling your Bitcoin to these market makers. But even in that case you can still sell to a private party as you please, it might just be more difficult to do so.

So, while the fall of FTX was similar to the Ponzi scheme perpetuated by Bernie Madoff, it’s important to know that the villain here is Sam Bankman-Fried, not Bitcoin. Plus, Bernie Madoff wasn’t even in operation when cryptocurrency was popular, and he still made off with millions.

Both of these men should be a lesson to investors, because it truly doesn’t matter what you invest in. Whether you are buying cryptocurrency, or fiat stocks, it’s important to vet any individual or service before you give them your money. Even if they are your friends. Otherwise, you may be left with nothing.

You May Also Like: The Fall of FTX

This article was brought to you by the Bitcoin Sports Casino on MintDice. Originally posted to MintDice.com.