Steemians you all welcome! Debt is a universal financial term that is commonly used among individuals and business organizations when there is insufficient financial resources to keep moving forward. At some point in our individual lives or business engagements, we may run short of needed finances to support our lives or our businesses engagements. When such situations emerges, going debt might become an option for us to take, though it carries negative connotations.

But come to think of it, is there anything wrong in going debt? For me, my answer is no because we can't have everything 100% the we want it. So we go debt to augment or make up the areas where we are insufficient financially.

Now since there is nothing wrong in going debt, why is there still problems on debt matters? This question and more would now lead me into the relevant questions being raised by the host, to elaborate more this DEBT.

Debt is a specified amount of money with or without interest clause, which is owed or borrowed by an individual or business entity. From this definition, debt could be looked at from two standpoints as follows:

Debt based on finance or business perspective. From this standpoint, debt is that certain sum of money together with interest that is owed by a business entity which is to be repaid at a specified period or time. Here, repayment terms are clearly spelt out with a collateral being put in place. Under this debt, a defaulting party pays a penalty.

Debt based on relationship perspective. Here, debt is that certain amount of money owed by a friend or close relatives which is to be paid back at some time in the future, which may not have interest , repayment terms and collateral backing up the borrowed sum.

It was in the year 2019, we needed a borehole in our house and embarked on the project. It required huge sums of money so I decided to go borrowing by reaching out to my bank. The repayment and interest terms were clearly set out and after going through it, I accepted the terms set out. The loan was approved and given to me. I used it for the sinking of the borehole and other things needed.

How I repaid the loan:

To pay off the loan, my monthly salary then, was used as a collateral by the bank. The bank had to make monthly deductions from my salary. 1/3 of my salary including the interest, was used to pay off my debt.

A friend of mine was seriously in need of money so he came to me for help to settle some of his bills. Due our closeness and friendliness, I agreed to lend him some money without interest with a gradual monthly repayment plan. I even gave him 3 months moratorium or grace before he starts making payments. The debt was expected to be paid in 6 months but he only paid 4 months and could not complete the remaining 2 months till date.

Pledging a collateral has been the best universal tool for debt retrieval or recovery. Here, the borrower is required to come up with an asset such as land, building, machines, or any other asset that could be easily converted to Cash. When a liquid asset is put in place by the borrower, the lender could easily lay hands on the asset or sell it to recover the debt if the borrower fails to pay off the debt.

Do you think problematic debt should be forfeited for the sake of peace?

This depends on those that are involved in the lending of and borrowing. Business debt are hardly forfeited because the money borrowed is been pooled together from different individuals and business organizations. So failure to pay back the debt attracts penalty like outright sale of the assets used as collateral to recover the debt. This is carried out by the legal team of the lender which every legal tool to make sure that the debt is paid off by the borrower. So in the business world, problematic debt can not be forfeited for the sake of peace.

On the other hands, when individuals like close relatives or friends engage in lending and borrowing, and along the line the debt becomes a problematic or bad debt, the lender might make some considerations to forgive or forfeit the debt based on the existing relationship.

Collateral is the universal tool for debt recovery especially in the business environment. Nothing is wrong in going debt but something is wrong if the debt could not be paid.

When deciding to go borrowing, whether from a close relatives or business entities like banks, always consider your capacity to pay back the debt.

I invite the following to join me to participate in this contest:

@caringmanaseh

@huraira50

@manuelhooks

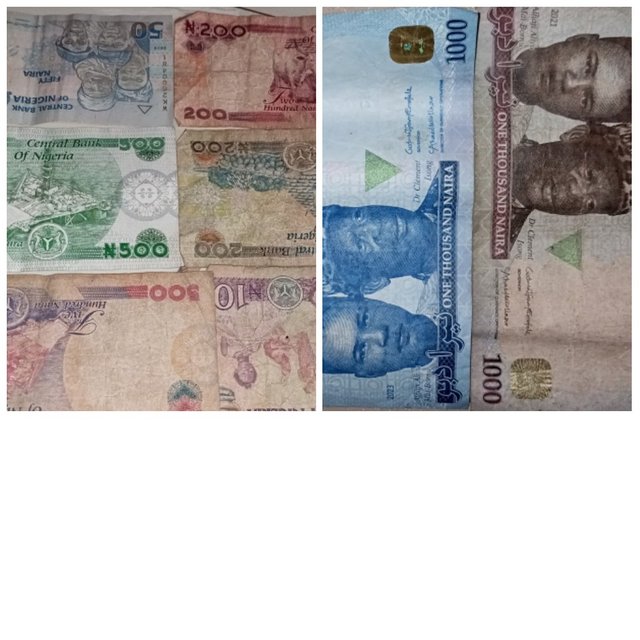

All images are legally owned by me!

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks my brother for mention me in your blog you share such a beautiful and amazing information with all of us. This shiw your passion and experience about this platform keep sharing like that fir achieve the Hing rank on this platform

Best wishes for Next

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola apreciado amigo. Lamento que ese amigo tuyo no haya honrado la deuda ya que tú le demostraste no solo que quería ayudarlo sino mucha confianza al momento de prestarle ese dinero y él como buena persona agradecida debió hacer el esfuerzo para regresarlo hasta el último centavo. Pero no te preocupes que la vida y Dios habrán retribuir ese favor que hiciste. Te deseo éxito y bendiciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit