(1).png)

Friends welcome to my post in the market we often see the main market and bear market and it plays an important role in the market fluctuations. We see this three-way change in the market due to liquidity changes. Today we will try to know some information about this bowl market and bear market. Below I am sharing the information with you. Let's start.

A cryptocurrency bull market is a general increase in the demand of cryptocurrencies over an extended period of time. This is the high optimism and vast level of excitement phase with good investor confidence in general. Investors — usually called ‘bulls’ feel like prices are on the rise, which makes them buy even more assets. That demand is likely to come in the form of higher prices.

Some of the factors that define a bull market are :

Trending vs Sustained Hikes usually, prices will trend (rise) over the long run until a new normal price change takes place and this is different from sustained increases where you see large percentage gains in increase streaks of maybe 10 days or more; normally at +20% total.

Frequent demand: Even the market has a very good response because lots of investors wish to trade within this marketplace.

Market Sentiment: There is not too much negative media and talks going around cryptocurrencies, which brings in more trust into investment.

Institutional Investment If we are seeing a significant increased participation from institutional investors, that means some of the brightest minds in Finance could believe it to be a bullish trend.

We saw these, for example the first half of 2017 was a kind of super bull market in cryptocurrencies and so on — but be experienced extremely high volatility because those markets are small compared to traditional financial markets. Gold prices can shoot up more than 40% in just a few days, for illustration.

.png)

Causes of Bull Markets

A variety of factors would form the building blocks for a bull market in cryptocurrencies.

Mainstream Adoption Demand: Currently only a small portion of merchants accept cryptocurrencies, and that extends to the number of consumers that actually use their crypto for online purchases.

Good News Events: Announcements like Institutional Investors buying in, Big Companies investing into Bitcoin or Regulatory & Legal clarity will bring confidence among investors.

Cultural Influence: Can be associated with a surge if supported by publicity from celebrities or media.

These can also fuel a bullish environment -- economic factors like low unemployment rates and good overall economy.

Understanding Bear Markets

On the flip side, a bear market for crypto is when prices are falling overall. This is as indicated by scepticism, whereby financial specialists feel that costs will keep on tumbling. Bears, however — investors who generally believe prices will decline (which is part of why there are so few around these days) — have been known to sell in order to avoid losses begetting bigger losses.

Some key attributes of a bear market:

Prolonged Price Decreases: Prices continually trend downward over the long-term and can be explained with a drop of 20% or more from recent highs.

Decreased Demand: With lesser interest from investors, many prefer to keep their assets as opposed purchasing more.

Raw Market Sentiment: Media mostly talks about the ugly side or scams in crypto space.

Increased selling pressure: prices can fall because people panic and sell out even more to cut their losses.

Causes of Bear Markets

There are a number of reasons why bear markets happen:

Bad News Events: Regulation implications or hacked security will lead to loss of confidence among the investors.

Economic Downturns: General economic concerns – all asset classes may share in the pessimism during recessions (i.e. stock, bond investments).

Market Corrections Entering into some market corrections is normal during bull runs as prices moderate down from extended bullish price action.

Bull Market Vs, Bear Markets

Here is a breakdown of how bull and bear markets compare in investor sentiment & price movement:

In a bull market the demand is in excess of the availability and thereby prices are mothered by rising price and investor confidence. Bear market supply is higher than demand and prices are going down, people feel uncertain.

Collectively, a good understanding of these dynamics helps investors to sail through this volatility in the area where they can make their fortune.

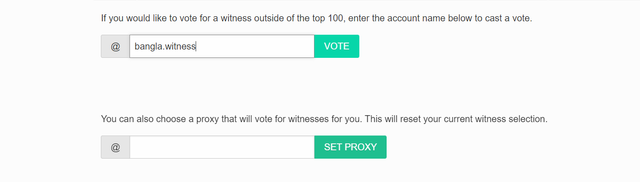

SET @rme as your proxy

X promotion link

https://x.com/mostofajaman55/status/1831696163734704612

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit