Hello, the recent Bitcoin halving event and its implications, along with updates on market trends related to Bitcoin and the other cryptocurrencies.

Bitcoin Halving and Market Updates

The recent Bitcoin halving and its implications along with updates on market trends related to Bitcoin and other cryptocurrencies.

Implications of the Bitcoin HalvingThe Bitcoin halving occurred as expected, reducing block rewards to 3,125 bitcoins per block.

Bitcoin's inflation rate fell significantly after the halving, becoming scarcer than gold.

The introduction of the Runes protocol for issuing tokens in Bitcoin caused an increase in network fees.

Network fees skyrocketed after halving, reaching over 40 bitcoins per block, affecting transaction costs.

Market trends and information ?

Miners' income after the halving reached $106 million, with a significant portion from transaction fees.

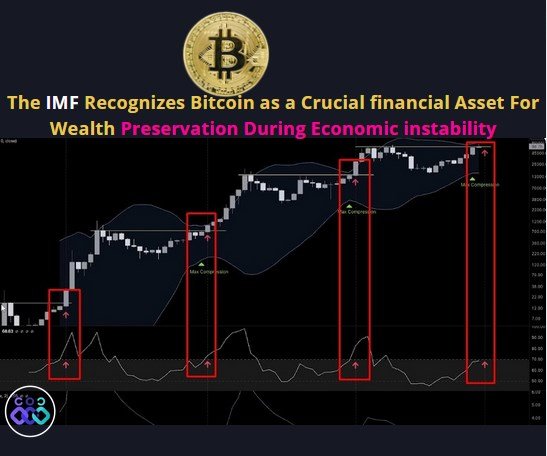

The IMF recognizes Bitcoin as a crucial financial asset for wealth preservation during economic instability.

ETF updates and market developments ?

Covers updates on Bitcoin-related ETFs and notable developments in the cryptocurrency market.

ETF TrendsRecently there has been a decrease in interest in both the entry and exit of Bitcoins through ETFs.

Grayscale proposes lower fees for its bitcoin mini Trust ETF compared to GBTC, which could influence market flows.

Cryptocurrency market developments?

Grayscale's announcement of reduced fees for the bitcoin mini Trust ETF may impact fund flows within the market.

The addition of Celo to USDT support aims to facilitate cross-border payments through the Telegram platform.

Earnings reports from tech giants?

About upcoming earnings reports from major tech companies like Tesla, Microsoft, Amazon, Meta (formerly Facebook), and Google. Earnings expectations

Key Market UpdatesI will provide you with updates on various companies and market trends, including Netflix, Boeing, Tesla, American, Super Micron, Nvidia and Taiwan Semiconductors.

Netflix PerformanceNetflix: experienced a 9% drop in share price due to concerns about not disclosing the number of future users.

Despite this drop, Deutch B Le raised the price target to $75.

Boeing's expansion plans?

Boeing: closed with an increase of 0.23% as it announced its intentions to enter the flying vehicle business in Asia by 2030.

Tesla's challenges?

Tesla faced a nearly 2% decline after recalling more than 3,000 Cyber Trucks for pedal defects.

The company also reduced prices in China and the United States to boost sales.

The growth of American Airlines?

- American Airlines saw an increase of more than 6% following positive results and maintaining guidance.

Market sentiment and upcoming events ?

Market sentiment indicators such as fear levels and upcoming events that will affect financial markets.

Market Sentiment AnalysisThe fear level of the traditional market is at 31, while the greed level of the cryptocurrency market is at 73.

Bitcoin's rebound may keep it within the greed zone without reaching neutrality.

Upcoming economic events?

Various global economic events are scheduled throughout the week.

Key developments include interest rate decisions in Japan and important data releases in the US.

Earnings reports and market trends ?

Information on upcoming earnings reports of major companies and their potential impact on the market along with current market trends.

Earnings Report Highlights

About 40% of S&P500 companies will publish earnings reports this week.

Notable companies reporting include Tesla, Visa, Meta, IBM, Microsoft, Google and Intel.

- Observations of market trends

Markets experienced significant declines driven by technology sell-offs.

Bitcoin Analysis and Altcoin Updates ?

In an analysis of the current situation of Bitcoin, analyzing possible price movements and key levels to watch. Additionally, updates on various altcoins are shared.

Bitcoin AnalysisBitcoin is showing signs of support at the lower end of the range without breaking it, indicating a possible short-term trend change.

E there is a possibility for Bitcoin to reach the upper range of 72,500 to 74,700 based on current indicators and market conditions.

Watching Ethereum's behavior can provide insight into possible Bitcoin moves as Ethereum has shown support at crucial levels and is moving up. Altcoin updates.

Immutable X is recovering after a major token unlock event, which could break its bearish structure towards $84 per token.

The governance proposal of the Injective Protocol (Inj 3.0) marks a substantial update in tokenomics and making it one of the most active assets. A break above 37 could indicate further bullish movement towards 52mil.

Net Mine experienced a sharp decline but is close to a major accumulation zone around $C. Tracking announcements from technology companies this week may affect their movement.

Market outlook: impact of inflation data ?

This moves on to broader market trends and focusing on inflation data in the United States and its potential effects on currencies such as the euro and dollar.

Impact of inflation dataIn anticipation of the release of US inflation data this week, if inflation continues to rise, it may strengthen the dollar against currencies such as the euro, possibly targeting higher levels around $108.

Short-term focus remains on key DXI levels at 106.70 and 107.70; Monitor last week's highs and lows for directional signals in trading strategies.

Commodity Market Update ?

Recent developments in the commodity markets, focusing on gold, silver and oil.

Commodity Market TrendsGold is seeing a notable rise followed by profit-taking and strategic entry points for medium-term positions are being evaluated amid strong volatility.

The dynamics of the oil market are influenced by statements by Iranian officials indicating that there are no immediate response plans.

Current geopolitical factors continue to shape global oil price movements.

Immediate attack by Israel and geopolitical pressure?

This revolves around the immediate impact of an attack by Israel which could signal the end of hostilities between countries. This could alleviate geopolitical pressure and its effects on oil prices.

Immediate impact analysisIsrael's recent attack may indicate a cessation of hostilities between nations.

The consequences could lead to a reduction in geopolitical tensions and oil price fluctuations.

Planned mitigation of liquidity problems after the event to stabilize economic conditions.

Expectations of a gradual improvement in market conditions following the results of technology companies and the release of PC data in the US.

✅ Vote @bangla.witness as lead witness please.

Thank you for reading me grateful.....

.gif)

Let's remember to comment on my publication, I will gladly answer you.

This article is written by @OscarDavid79 free of copyright

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for supporting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://twitter.com/oscardavidd79/status/1784333250502033550

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Note:- ✅

Regards,

@jueco

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit