A bearish trap is a trading pattern that occurs in a downtrend market, where prices initially continue to fall but then rapidly reverse direction, creating a trap for unsuspecting bearish traders.

In a bearish trap, traders who are betting on a continued downward trend are caught off guard as the prices start to rise unexpectedly. This often occurs when the market is oversold and due for a short-term bounce. As a result, traders who have shorted the market are forced to cover their positions and buy back their shorted shares, further driving prices up.

To identify a bearish trap, traders typically look for a downtrend market with decreasing volume and a sharp price reversal that is accompanied by an increase in volume. Technical analysis tools, such as candlestick charts and moving averages, can also help traders spot this pattern.

Once a bearish trap is identified, traders have several options. They can choose to hold onto their short positions, hoping that prices will drop once again, or they can choose to cover their positions and exit their trades. Some traders may also choose to go long and take advantage of the sudden price increase.

It's important to note that bearish traps can be dangerous for traders who are not prepared for the sudden change in market direction. For this reason, it's essential to have a well-defined trading strategy in place and to use proper risk management techniques.

In conclusion, bearish traps can be a challenging and potentially profitable pattern for traders to navigate. By understanding the characteristics of this pattern and incorporating it into their trading strategy, traders can increase their chances of success and minimize their potential losses. However, as with all forms of trading, it's essential to remain vigilant and to continue to monitor market conditions to ensure that the bearish trap doesn't become a bear trap.

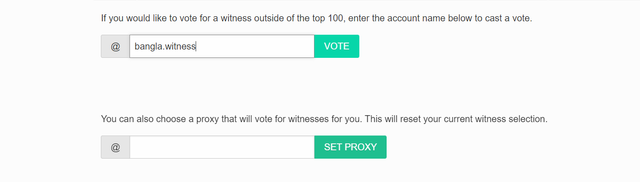

VOTE @bangla.witness as witness

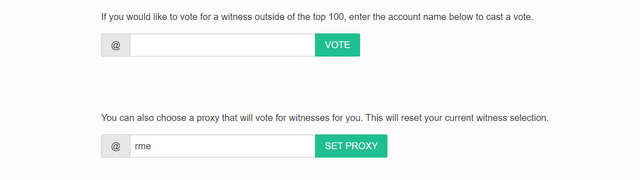

OR

Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit